This document details various training programs and the Post Graduate Diploma in Management (Financial Management) program offered by the National Institute of Financial Management (NIFM). Key training programs include the Senior Professional Course and Advanced Professional Course, both involving international attachments, and a specialized Training Program on Public Procurement. The PGDM(FM) program is a two-year full-time course approved by AICTE, accredited by NBA, and recognized as equivalent to an MBA. It covers a wide range of financial management and business subjects, with opportunities for international and domestic attachments and a project work component. The document outlines eligibility criteria, selection processes, course fees, and admission schedules for these programs, emphasizing NIFM’s role in capacity building for government and corporate professionals.

SOURCE PDF LINK :

Click to access NIFM-24052016.pdf

Click to view full document content

राष्ट्रीय वित्तीय प्रबन्धन संस्थान (वित्त मंत्रालय, भारत सरकार)

NATIONAL INSTITUTE OF FINANCIAL MANAGEMENT (Ministry of Finance, Government of India)

Harsh Kumar

Director

D.O.No.NIFM/DIR/ICPE/2016/

Dated: 18th April, 2016

Dear Shri Das,

Please recall your meeting with Shri Anand Asthana, Director General, ICPE, Ljubljana, Slovenia. I am giving below the dates and titles of the Management Development programmes (MDPs) being conducted by NIFM in FY 2016-17, which have a component of training overseas at ICPE Ljubljana, Slovenia.

| S.No. | Training Programme | Dates |

| — | — | — |

| 01. | Senior Professional Course | • 8th August to 26th August 2016

• 26th December to 13th January 2017 |

| 02. | Advanced Professional Course | • 27th June to 15th July 2016

• 10th October to 28th October 2016 |

| 03. | Budgeting, Accounting & Financial Management | • 9th May to 27th May 2016

• 22nd August to 9th September 2016

• 7th November to 25th November 2016 |

The details of these programmes and brochures are also enclosed on a pen-drive. It is requested that this may be got uploaded on DoPT portal.

I am also giving the details of AICTE approved two years Post Graduate Diploma in Management (Financial Management) [(PGDM(FM)) programme for serving officers/managers of Government, PSUs, Banks, Financial Institute and Corporate Sector. The Programme is also accredited by the National Board of Accreditation (NBA) and is recognized by the Association of Indian Universities (AIU) as equivalent to Master of Business Administration (MBA) degree of an Indian University. The course fee for the PGDM (FM) programme is covered under the Central Plan Scheme of Ministry of Finance for development to finance professionals, therefore sponsoring departments will not have to bear the course fee. It is requested that this may also be got uploaded on DoPT portal.

Yours Sincerely,

Shri Pramod Kumar Das, Joint Secretary (Trg.) Department of Personnel Training (DoPT), Block No.IV, Lod JNU Campus, New Delhi-67 Ph. No.011-26106314

(1314116 (Harsh Kumar)

Date: 2015/01/26 11:51:51 PM

M. S. S. D.

SENIOR PROFESSIONAL COURSE ADVANCED PROFESSIONAL COURSE

The National Institute of Financial Management (NIFM) is Centre of Excellence specializing in capacity building of professionals in the fields of Public Policy, Financial Management and other governance issues for promoting highest standards of professional competence and practice. NIFM is a premier resource center for the capacity building of senior, middle and entry level of management in Government of India. NIFM also caters to the training needs of State Governments, Defence establishments, Banks and other Financial Institutions. Training Programmes are customized and executed for the officials from other countries as well.

NIFM plays a pivotal role in governance and administrative reforms by providing a platform for interaction and exchange of ideas \& experiences among officers from different organized services, different state governments and between personnel of civil and defence establishments.

Apart from capacity building, NIFM is also engaged in serious research studies in the areas of accounting, audit, financial management, parliamentary financial control and other issues related to public policy and delivery systems. The outcomes of such research studies are published and disseminated through Research Papers, Journals and Books.

With above objective in mind, NIFM is organising a Senior Professional Course for officers of Accounts and Finance Services and officers working as Under Secretary/Deputy Secretary and Directors in IFD and Budget Divisions of Ministries/Departments/Autonomous Bodies, Advanced Professional Course for the officers of Accounts and Finance services and also officers working as Joint Secretaries/Financial Advisers and other senior officers working in Ministries/Departments/Autonomous Bodies etc. The first week of training will be at NIFM followed by two weeks of international attachment. Participants will then go back to their working place and work on the Project along with their regular duties. After working of four weeks they will return to NIFM for one week. During this week they will make project presentation. The project would be on area of their work wherein they plan to bring about a change.

In view of on going changes in governance practices, there is a strong case for having a common refresher course at middle management level for officers with 8 to 16 years of service, i.e. officers of the 2000 to 2008 batches and Advanced Professional Course at senior management level for the officers with 16 to 22 years of service i.e officers of the 1994 to 2000 batches. This will not only sharpen the professional skills of the officers but will also go a long way in shaping their careers.

Pedagogy

- The basic format of the training for both these four weeks’ courses is as under:-

- First week at NIFM and will include allotment of topics for projects;

- Two weeks international attachment at an institute of repute;

- Four weeks back to work and prepare the project paper; and

- One week at NIFM including project presentation of Public Expenditure Management in their respective office/Department/Ministry.

Indicative List of sessions to be engaged with ICPE, Slovenia

- 8 lectures on administrative, economic and financial management in the EU with a case study of 2 EU member states, Slovenia and Austria

- Visits/Meetings at the Institute of the European Union in Brussels viz.-(European parliament, European Commission, DG for Economic and Financial Affairs, European Economic and Social Committee)

- Visits/Meetings at the International and local organizations in Austria viz.-(United Nations and UNIDO, European Investment bank- Regional Office, Federal Ministry of Finance in Austria, parliament of Austria)

- Visits to the Centre of Excellence in Finance (Slovenia) and the Bank of Slovenia (Monetary Union)

- It would be possible for the participants to visit cities of immense political, economic, or historical importance within the European: Brussels (Belgium), Vienna (Austria), Ljubljana (Slovenia), Trieste and Venice (both Italy)

We have planned two programmes each for middle level and senior level officers during 2016-17:

Eligibility Criteria for

Senior and middle level officials working in various Ministries/Department/Autonomous Bodies, Members of Accounts/Finance Services of Gol, State Governments. Officials of the Public Sector Undertakings/Banks officials dealing with Government Budgeting and Public Expenditure Professionals and academicians in CTIs etc. Participants should have working knowledge of English.

Number of Seats

35 (Thirty Five in one batch)

Course Fee

Rs. 5,45,000/- (Rupees Five lakhs Forty Five Thousand only) per person. The fee includes training cost. Airfare in economy class, Visa Fee, Insurance for travelling abroad and lodging facility during international and domestic training. The fee is also inclusive of Service Tax.

Senior Professional Course (2016-17)

(for Middle Level Management)

| Year | Program | Part 1: 8th August 2016 to 30th August 2016 | Part 2: 25th September 2016 to 30th September 2016 |

|---|---|---|---|

| 2nd | |||

| 3rd | Program | Part 1: 26th December 2016 to 13th January 2017 | Part 2: 13th February 2017 to 17th February 2017 |

Advanced Professional Course (2016-17)

(for Senior Level Management)

| Year | Program | Part 1: 27th June 2016 to 15th July 2016 | Part 2: 15th August 2016 to 19th August 2016 |

|---|---|---|---|

| 2nd | |||

| 3rd | |||

| 4th | |||

| 5th | |||

| 6th | |||

| 7th | |||

| 8th | |||

| 9th | |||

| 10th | October 2016 to 28th October 2016 | Part 1: 28th November 2016 to 2nd December 2016 | Part 2: November 2016 to 2nd December 2016 |

Indicative list of topics for Senior Professional Course

(Ofticers having 16-16 years of Service)

- Internal Audit: International internal audit guidelines and standards; Risk based audit plans; IT based audit tools; Investigation of fraud and corruption; Audit reporting and communication;

- Cost benefit analysis

- User Charges

- National Health Program

- Pricing / Costing of Education / Health

- Pricing of Toll Charges

- Competition Commission

- Forecasting Method

- Infrastructure Policy

- Overview of Public Fiscal Management: Why is its reform important for development

- Accounting Standards

- Public Debt Management \& Dynamics

- Fiscal Decentralization: Principles and Key Issues

- Steps in Developing a Modern PFM System

- Integrated Financial Management Information System

- PSUs: Financial Analysis

- Strategic Budgeting

- Transparency in Public Sector Budgeting

Indicative list of topics for

Advanced Professional Course

(Ofticers having 16-22 years of Service)

Strategic management

- Introduction to strategy

- External environment and positioning

- Strategic tools

- Strategic issues in Govt. Organisations

- Strategy implementation

Policy directions towards enhancement of resources

- Disinvestment of Government holding in PSEs

- Auctions of Public resources

- Formations of SPVs and JVs

- ADR, GDR, venture financing, securitized finance

Subsidies and inclusive growth

- The policy imperatives of subsidies

- The economic fallouts of subsidies

- Imperatives of inclusive growth: specific policy initiatives

- Conditional cash transfer

- Indian experience and international outlook

Project Management and Evaluation

- Planning and scheduling of projects

- Appraisal: Financial and social cost benefit analysis

- Resourcing: Selection and allocation

- Implementation

- Project accounting and outcome assessment

Monitoring and evaluation

- Concept and framework

- Implementation needs

- Performance indicators

- Data collection and analysis

- Impact/output evaluation

- Cross country experiences

Public Private Partnership

- Social / economic case for PPP

- Organising and managing open competition

- Tender bid evaluations

- Contract and relationships management

- Cross country experiences in PPP

Accrual Accounting

- Perspectives

- Cross country experiences

- Issues and Challenges

Project Analysis and Financing technique

Nati

National Institute of Financial Management

an autonomous institution of Ministry of Finance, Government of India

International Training Programme on

Budgeting, Accounting \& Financial Management

About NIFM

The National Institute of Financial Management (NIFM) is a Centre of Excellence specializing in capacity building of professionals in the fields of Public Policy, Financial Management and other governance issues for promoting highest standards of professional competence and practice. NIFM is a premier resource center for the capacity building of senior, middle and entry level of management in Government of India . NIFM also caters to the training needs of State Governments, Defence establishments, Banks and other Financial Institutions. Training Programmes are customized and executed for the officials from other countries as well.

NIFM plays a pivotal role in governance and administrative reforms by providing a platform for interaction and exchange of ideas \& experiences among officers from different organized services, different state governments and between personnel of civil and defence establishments.

Apart from capacity building, NIFM is also engaged in serious research studies in the areas of accounting, audit, financial management, parliamentary financial control and other issues related to public policy and delivery systems. The outcomes of such research studies are published and disseminated through Research Papers, Journals and Books.

About this course

This International program aims at providing officers with a sound grounding on Public Financial management issues of Budget formulation, approval, execution and evaluation, the challenges of IFMIS in the context of Government Accounting, and the role of Audit in effective PFM. Apart from addressing the recent developments impacting PFM in India, the program would also provide hands on training on the latest analytics tools enabling managers to make better sense of Public finance data. The two week training at NIFM is followed by a 1 Week International attachment with ICPE, Slovenia where participants would be exposed to some of the relevant PFM practices in Slovenia and the European Union.

Public financial management (PFM) is universally recognised as an essential part of the development process. Sound PFM supports aggregate control, prioritization, accountability and efficiency in the management of public resources and delivery of services, which are critical to the achievement of public policy objectives. This program will provide the officers with a sound overview of PFM concepts along with an International exposure to related practices

Partner institution for this ITP: ICPE for International exposure to related practices in EU

ICPE is an inter-governmental international Center with its headquarters in Ljubljana, Slovenia. It traces

its origin to the International Center for Public Enterprises in Developing Countries set up on a UN initiative in 1974, which became a fully-fledged international Center in 1980 with more than 40 developing countries as its Member-States. After the independence of Slovenia, the new Republic of Slovenia became the host-country of the ICPE. Later in 1997 the formal name of the Center was changed to International Center for Promotion of Enterprises, by a Resolution of the ICPE Assembly. This gave the Center a more ‘inclusive’ and broad-based mandate in keeping with the changed economic and political priorities of Slovenia and many of the leading Member-States including India.

The ICPE is now mandated to pursue and promote international cooperation in areas related to entrepreneurship development, SME and infrastructure sectors, corporate governance, technology transfer, strategies for privatization, FDI, promotion of knowledge -based societal change through research, training, consultancy and information services in these fields.

Programme Outline

The program would cover the following:

Public Financial management

Financial Management in Government: An overview

Public Financial Management Framework including Public Expenditure and Financial Accountability (PEFA) framework

Fiscal Deficit, FRBM and related fiscal legislation

Trade-off between public expenditure control and development objectives

Budgeting

Budget Preparation and implementation process

Budgetary control, Performance budget, Outcome budgeting

Cash and Debt Management

Recent Developments impacting PFM in India

New initiatives in Direct \& Indirect Taxes GST

$14^{\text {th }}$ Finance Commission Award

Role of NITI Aayog

Digital India

Public Private Partnership

Government Accounting and IFMIS

Principles of Government Accounting

Basics of Commercial Accounting Understanding Financial Statements of Commercial Entities

Comparing Financial Statements of Government and Commercial Entities

Analysing Financial Statements

Accrual Accounting in Government – an overview

An exposure to International Public Sector Accounting Standards (IPSAS) \& IFRS

IFMIS in India – Union \& States

Public Sector Audit \& Accountability

Principles of Public Sector Auditing contemporary issues

International Standards of Public Sector Auditing (ISSAIs)

Tools \& Techniques in Internal Audit

Analytical tools \& techniques

Exploratory Data Analysis using new generation Anlaytics tools: Tableau / QlikView

Use of MS Excel for Financial Analysis \& Data Exploration

Concepts of Statistical Inference

Eligibility for this Programme

Middle level officials working in various Ministries/ Department/Autonomous Bodies, Members of Accounts/Finance Services of GoI, State Governments. Officials of the Public Sector Undertakings/Banks officials dealing with Government Budgeting and Public Expenditure Professionals and academicians in CTIs etc. Participants should have working knowledge of English.

Number of Seats-

30 (Thirty in one batch)

Course Fee

Rs. 4,00,000- (Rupees Four lakh only) per person. It includes tuition fee, course material, boarding and lodging at NIFM, Faridabad including service Tax for the NIFM component. It also includes the International attachment charges on tuition fee (payable to host Institute-ICPE), course material, Air travel (Economy class), Visa fee, Health insurance and accommodation during international attachment. DSA for the international component would be paid by the sponsoring authority as per admissibility. Duly filled nomination form(s) along with Demand Draft drawn in favour of ‘Accounts Officer, NIFM, Faridabad’ payable at Delhi/Faridabad may be sent in advance. You may also remit the fee through e-Payment, details for which is given in the nomination form.

Venue \& Duration

Total duration of the programme is 3 Weeks, out of which, first two weeks of the programme will be conducted at NIFM, Faridabad. The 3rd Week would be an international attachment at ICPE—Slovenia. The course is residential and accommodation would be provided by the Institutes.

We have planned three programmes during 2016-17:

1st Program: 9 May 2016-27 May 2016

2nd Program: 22 August 2016-9 September 2016

3rd Program: 7 November 2016-25 November 2016

National Institute of

Financial Management

an autonomous institution of Ministry of Finance, Government of India

National Institute of Financial Management An Autonomous Institution of Ministry of Finance, Govt. of India

ADMISSION OPEN

16th Batch of two years PGDM(FM) 2016-18

Approved by AICTE, Accredited by NBA Recognized as equivalent to MBA degree by AIU

Graduate Diploma in Management (Financial Management) 2016-18

Current Curriculum

First Trimester

- Accounting for Managers

- Managerial Economics

- ICT for Managers

- Management of Organization and People

- Business Mathematics

- Corporate Communication

- Public Financial Administration

Second Trimester

- Security Analysis and Portfolio Management

- Production and Operations Management

- Treasury and Risk Management

- International Financial Management

- Projects and Infrastructure Management: Financing, Implementation and Control

- One elective

Third Trimester

- Human Resource Management

- Marketing Management

- ICT for Finance

- Business Statistics

- Financial Management-II

- One elective

Sixth Trimester

- Project Work (16 weeks)

Training Attachments

- International – 2 weeks

- Domestic – 1 week

Newborns Work

- Newborn Death Rates and Short Listing by PNC

- 2016-17: 100% of the 100% of the 2016-17

- 2016-17: 100% of the 2016-17

- 2017: 100% of the 2017-18

- 2017: 100% of the 2017-18

- 2018: 100% of the 2018-19

- 2018: 100% of the 2018-19

- 2019: 100% of the 2019-20

- 2019: 100% of the 2019-20

Student Officers and Examinations

- Nominations Work

- 2016-17: 100% of the 100% of the 2016-17

- 2016-17: 100% of the 2016-17

- 2017: 100% of the 2017-18

- 2018: 100% of the 2018-19

- 2019: 100% of the 2019-20

For details please view Prospectus at: www.nifm.ac.in

National Institute of Financial Management, Sector-48, Pali Road, Faridabad-121001, Haryana, India

Contact: 0129-2418755 / 2465256, +91 9821181127; email: pgdmfm@nifm.ac.in

Programme Chair: Dr. S.S. Khanka

Course Director: Dr. Brajesh Kumar

Contact: 0129-2465208 / 2418755

Email: khanka@nifm.ac.in

Contact: 0129-2465228 / 2465209

Email: brajesh@nifm.ac.in

NATIONAL INSTITUTE OF FINANCIAL MANAGEMENT

A GOVERNMENT OF INDIA INSTITUTION

(DEPARTMENT OF EXPENDITURE, MINISTRY OF FINANCE)

Post Graduate Diploma In Management (Financial Management)

PGDM (FM) 2016-18

Approved by

All India Council for Technical Education (AICTE)

Recognised as

Equivalent to Master’s Degree by

Association of Indian Universities (AIU)

Accredited by

National Board of Accreditation (NBA)

Sector-48, Pali Road, Faridabad – 121001 (Haryana), INDIA

Website : http://www.nifm.ac.in

–

| Shri Arun Jaitley | Hon’ble Union Finance Minister | President |

|---|---|---|

| Shri Ratan P Watal | Secretary Expenditure, Gol Chairman Board of Governors | Member |

| Shri D S Dhesi | Chief Secretary, Government of Haryana | Member |

| Ms. Ajanta Dayalan | Deputy Comptroller \& Auditor General Of India | Member |

| Shri S Mookerjee | Financial Commissioner (Railways) | Member |

| Ms. Shobhana Joshi | Controller General of Defence Accounts | Member |

| Ms. Annie Moraes | Member (Finance), Deptt.of Telecom | Member |

| Shri M J Joseph | Controller General of Accounts | Member |

| Shri A K Singhal | Additional Chief Advisor (Cost), Min. of Finance | Member |

| Dr. S S Yadav | Professor, Dept. of Management Studies, IIT, Delhi | Member |

| Dr. J K Mitra | Professor, FMS, Delhi University, Delhi | Member |

| Dr. R Ravi Kumar | Professor, IIM, Bangalore | Member |

| Dr. Purushottam Sen | Professor, IIM, Kolkata | Member |

| Shri Harsh Kumar | Director, NIFM | Member Secretary |

BOARD OF GOVERNORS

Shri Ratan P Watal Ms. Ajanta Dayalan

Shri S Mookerjee

Ms. Shobhana Joshi

Ms. Annie Moraes

Shri M J Joseph

Shri A K Singhal

Dr. S S Yadav

Shri Harsh Kumar

Secretary Expenditure

Deputy Comptroller \& Auditor General Of India

Financial Commissioner (Railways)

Controller General of Defence Accounts

Member (Finance), Deptt.of Telecom

Controller General of Accounts, Min. of Fin.

Additional Chief Advisor (Cost), Min. of Fin.

Professor, Dept. of Management Studies, IIT, Delhi

Director, NIFM

Chairman

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member Secretary

ACADEMIC ADVISORY COMMITTEE

Shri Harsh Kumar

AVM S M Subhani

Dr. P K Jain

Dr. A K Bhattacharya

Dr. Madhu Vij

Dr. R Ravi Kumar

Shri Harpreet Singh

Dr. Sanjiv Mittal

Dr. Javaid Akhter

Dr. P Alli Rani

Shri Yashwant Kumar

Director, NIFM

Indian Air Force, Air Hqrs., New Delhi

Professor, IIT, Delhi

Head, SPP\&P, IICA, Manesar, Gurgaon

Professor, FMS, DU, Delhi

Professor, IIM, Bangalore

Managing Director, CWC

Professor, GGS IP Univ., New Delhi

Professor, Aligarh Muslim Univ., Aligarh

Director (F) Container Corp.(I) Ltd.

Economic Advisor, Govt. of MP, Bhopal

All Professors, NIFM

Convener

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member

Members

DIRECTOR’S MESSAGE

The programme addresses key issues in Public Financial Management. It seeks to provide a platform for participants from different government and other organizations to take a regular break from work and opt for this programme to acquire knowledge and skills for a better and more informed decision making process. The programme broadens their horizons and gives them improved insights to be more effective in their work environment.

Keeping in mind the fast growing needs for shared responsibilities between Government and Corporate Sector, this programme has been suitably tailored to cater professional requirements of government officers and also of corporate sector executives in India and abroad.

This programme would help participants acquire skills for making informed decisions which would eventually ensure better delivery system. The ‘change management’ coupled with challenges thrown by the ‘New Public Management’ are best addressed by vision, professional skills, and one’s ability to translate the professional experience into effective policy making. This programme sensitizes the participants towards this facet of managerial challenge and offers an excellent opportunity to rejuvenate the participants by providing an academic as well as a research oriented perspective, and a professional template in an appropriate learning environment.

The earmarked design, depth and delivery of the programme is accomplished through regular monitoring of the programme by the Management Committee of the NIFM headed by the Director, and also by the Academic Advisory Committee of the institute. This committee consists of eminent academicians from premium institutions along with representation from the Public Sector and Civil Services.

NIFM has a network of academic collaborations with the institutions of repute in India and abroad. The2014-16 Batch of PGDM (FM) was deputed for two week to the University of California (Riverside), USA which gave them an opportunity to learn and understand the best business processes and practices across the world.

I welcome the participants joining this prestigious programme with an assurance that we will make all efforts to provide the best learning environment that will improve employability of the participants in more challenging assignments in the government as well as in the corporate sector.

The programme is residential for all the participants. Appropriate accommodation is provided to all participants of the programme NIFM has self-contained hostel facilities in two separate blocks viz. new hostel block and the old hostel block. Catering, laundry, house-keeping and maintenance services have been outsourced and are professionally organized. Mess is compulsory for all residents of NIFM hostels.

Subject to availability, allotment of family accommodation is also made to the participants desirous of staying with family. The family suites are allotted on first come first serve basis on payment regulated as per extant orders of NIFM.

THE PROGRAMME

The Programme titled “Post Graduate Diploma in Management (Financial Management)” is a two-year full time Programme for officials in government, executives in the public and the private sector corporations. The Programme is duly recognized by the All India Council for Technical Education (AICTE) duly accredited by National Board of Accreditation (NBA) and has also been recognized as equivalent to ‘Master’s Programme’ in Management (MBA) by the Association of Indian Universities (AIU).

The programme, designed under the guidance of Academic Advisory Committee, features the contents of similar programmes run by the best ‘Bschools’ of national and international repute. The programme has been cast with apt case to capture relevant issues that impact governance and the corresponding delivery by the public authorities. As the governments, at various levels, are becoming increasingly concerned about timely and quality delivery, the requisite managerial skills and capacity development issues pose constructive challenges. Accordingly, the programme design facilitates capacity building in the government as well as in the corporate sector with a view to meeting the emerging economic and social aspirations.

The programme aims to enhance managerial competence and self-development that are expected to translate each challenge into excellent opportunities, thereby improving promotional and career prospects for the participants of the programme.

The programme addresses the key issues in Corporate and Public Financial Management in an IT enabled scenario. The effective delivery of the programme rests on the premise of proper appreciation of ‘Applied Information Technology’ by the participants. The institute facilitates the participants in applying Information Technology in various papers by providing the best possible IT infrastructure.

The participants take Master’s level core subjects in business and management, including Management Accounting, Financial Management, Managerial Economics, Business \& Corporate Laws, Public Financial Administration, HRM, IT for Finance, Enterprise Management, Security Analysis and Portfolio Management, Treasury and Risk Management, Project and Infrastructure Management etc. The participants also choose elective papers from the given options such as Mergers \& Acquisitions, Micro finance and Insurance, IT Security, wealth and investment management, e-Commerce etc. As an integral part of the programme, the participants are provided training attachments, including a two week international placement with one of the partner institutions.

Towards the final stage of the programme, the participants spend their time with a competent supervisor on the project work.

COURSE CURRICULUM \& SYLLABUS

The Programme is covered in six trimesters. The programme duration of 24 months comprises of classroom teaching of approximately 20 months including domestic and international placements. The project work is of 04 months duration. The participants would be expected to remain available at NIFM throughout the duration of Programme. The broad structure of the curriculum is given below:

PROJECT WORK / DISSERTATION

During the sixth trimester of the Programme each participant is required to undertake a research project. A research problem of contemporary relevance (theoretical / action) is identified by the participants in consultation with NIFM faculty and / or senior level officers of their respective Department / organization. However, the final decision on the project work is taken by NIFM. The timing and duration of the project work is 16 weeks as per the curriculum.

NIFM faculty guides the participants in research, analysis, preparation and completion of the project. The participants are expected to remain in regular touch with their faculty guides for timely completion of the project work. The project work is required to be completed and submitted before completion of the programme.

CURRENT CURRICULUM

Course curriculum is modified and revised by the Academic Advisory Committee (ACC) of NIFM as per changing conditions in the public financial management.

FIRST YEAR

| FIRST TRIMESTER | |||

|---|---|---|---|

| Code | Title of the Paper | Credits | Sessions |

| 101 | Accounting for Managers | 3 | 40 |

| 102 | Managerial Economics | 3 | 40 |

| 103 | Information and Communication Technology for Managers | 3 | 40 |

| 104 | Management of Organization and People | 3 | 40 |

| 105 | Business Mathematics | $11 / 2$ | 30 |

| 106 | Corporate Communication | $11 / 2$ | 30 |

| 107 | Public Financial Administration | 3 | 40 |

| Total | 18 | 260 | |

| SECOND TRIMESTER | |||

| 201 | Management Accounting | 3 | 40 |

| 202 | Financial Markets and Institutions | 3 | 40 |

| 203 | Direct and indirect Taxes : Planning and Control | $11 / 2$ | 30 |

| 204 | Business and Corporate Laws | 3 | 40 |

| 205 | Financial Reporting Standards | $11 / 2$ | 30 |

| 206 | Financial Management – I | 3 | 40 |

| 207 | Business Data\& Network | 3 | 40 |

| Total | 18 | 260 | |

| THIRD TRIMESTER | |||

| 301 | Human Resource Management | 3 | 40 |

| 302 | Marketing Management | 3 | 40 |

| 303 | Information Technology (IT) for Finance | 3 | 40 |

| 304 | Business Statistics | $11 / 2$ | 30 |

| 305 | Research Methodology | $11 / 2$ | 30 |

| 306 | Financial Management – II | 3 | 40 |

| Electives | |||

| 307 (E) | Accounting in Government and Not for Profit Organizations | 3 | 40 |

| 308 (E) | Enterprise Management | ||

| Total | 18 | 260 |

SECOND YEAR

FOURTH TRIMESTER

| Code | Title of the Paper | Credits | Sessions |

|---|---|---|---|

| 401 | Security Analysis and Portfolio Management | 3 | 40 |

| 402 | Production and Operations Management | 3 | 40 |

| 403 | Treasury and Risk Management | 3 | 40 |

| 404 | International Financial Management | 3 | 40 |

| 405 | Projects and Infrastructure Management: Financing, Implementation and Control | 3 | 40 |

| Electives | |||

|---|---|---|---|

| 450 (E) | Mergers and Acquisitions (or) | 3 | 40 |

| Or | |||

|---|---|---|---|

| 451 (E) | Microfinance and Insurance | 3 | 40 |

| Or | |||

|---|---|---|---|

| 452 (E) | Strategic Management in Information Technology (IT) | 3 | 40 |

| Total | 18 | 240 |

FIFTH TRIMESTER

| Code | Title of the Paper | Credits | Sessions |

|---|---|---|---|

| 501 | Strategic Management | 3 | 40 |

| 502 | Financial Services | 1 ½ | 30 |

| 503 | Corporate Governance and Business Ethics | 1 ½ | 30 |

| Electives | |||

|---|---|---|---|

| 550 | Information Technology (IT) Security | 3 | 40 |

| 551 | E-Commerce | 3 | 40 |

|---|---|---|---|

| 552 | Management of Technology | 3 | 40 |

| 553 | Wealth and Investment Management | 3 | 40 |

|---|---|---|---|

TRAINING PLACEMENT

| Code | Title of the Paper | Credits | Sessions |

|---|---|---|---|

| a. | International Attachment | Two (02) Week | 03 |

| b. | Domestic Placement | One (01) Week | 40 |

| c. | Report Writing | One (01) Week | 03 |

| d. | Viva-voce | 40 |

| Total | 18 | 260 |

|---|---|---|

| Commencement of Project Work after the training placement | One (01) Month |

SIXTH TRIMESTER

| Code | Title of the Paper | Credits | Sessions |

|---|---|---|---|

| 601 | Project Work | Sixteen (16) Weeks | 09 |

Grand Total 99

TRAINING ATTACHMENTS

The participants may be taken, subject to necessary approvals from Government of India, for a two week international attachment in which an intensive coverage of international developmental perspective in critical areas of governance, financial management etc. is provided.

International attachment the participants about (a) the best practices of other economies/societies (b) problems and challenges facing other countries, and (c) feasible solutions that the other institutions come out for such problems.

The international placements for the year 2014-16 batch of PGDM(FM) participants were organized at University of California Riverside, California, USA. The participants were exposed to the best international practices in governance and financial management.

ELIGIBILITY CRITERIA

a. All participants must have completed Graduation or a degree equivalent thereto from an Indian/foreign university (institution) recognized by the Association of Indian Universities, Ministry of HRD, Government of India. Minimum percentage of marks at graduation level must be 50%. The upper age limit for all participants is 50 years on the last date of submission of the application form for programme.

b. Officers at middle/senior level working with the Central or State Governments, Public Enterprises/Autonomous Organizations belonging to State/Central Government. Other bodies of the Central/State Government and Corporate Sector.

c. Aspiring participants from the corporate sector must give their percentile score of CAT or any other test(s) approved by the AICTE, and ought to have work experience of minimum 03 years at a managerial position in a corporate entity.

d. Similar participants (b or c above) from foreign countries.

SELECTION PROCESS

Admission forms may be downloaded from NIFM website and submitted along with Bank Demand Draft for ₹ 500/- payable in favour of Accounts Officer, NIFM at Faridabad.

Applications, complete in all respects shall be submitted in NIFM by the due date mentioned in the ‘Date Schedule’ and in case of sponsored candidates the letter from the sponsoring organizations shall be received by the due date.

FOR GOVERNMENT EXECUTIVES (INDIA AND OVERSEAS)

Candidates may be shortlisted by the Institute and the shortlisted candidates and/or their sponsors would be intimated. The sponsors would be requested to depute their candidates well in time for attending the Group Discussion & Interviews.

FOR CORPORATE EXECUTIVES

Applicants are required to submit their percentile score of CAT or any other test(s) approved by the AICTE and they will be called for Group Discussion and Personal Interview.

The weightage of different elements of screening would be as follows:

| Element of Screening | Weightage |

|---|---|

| Group Discussion | 50% |

| Personal Interview | 30% |

| Curriculum Vitae | 20% |

All supporting documents/testimonials (date of birth and letter from sponsoring organization) in original shall be required at the time of screening and/or final admission to the Programme. Mere fulfilling the minimum eligibility qualifications by the candidate shall not bind NIFM for offering admission to the candidate to the Programme. Selected Candidate shall be required to join the Programme or a day prior to starting of the course.

Decision of NIFM regarding admission of the candidates to the programme shall be final.

PROGRAMME FEE

PROGRAMME FEE

A. Sponsored Candidates from Central Government/StateGovernments/Union Territories/ PSUs and other bodies of the Central/State Government

B. Corporate Sector Executives

C. Overseas Participants

Fees is paid to NIFM by the Government of India under Central Plan Scheme of the Ministry of Finance

₹12 Lakh

US $\$ 20,000$

The Programme fee for the Corporate Sector Executives and Overseas Participants is to be paid through demand draft in favour of Accounts Officer, NIFM payable at Faridabad or through electronic transfer as per following schedule:

| Fee Payment Schedule | ||

|---|---|---|

| Instalment | Due Date | Amount |

| – First | Commencement Date | $50 \%$ |

| – Second | 6 months from date of commencement | $30 \%$ |

| – Third | 14 months from date of commencement | $20 \%$ |

The above fee includes tuition fee, cost towards study material, single-room accommodation in NIFM hostel, a laptop and institutional charges for various attachments including economy class air fare for international placement.

The fee doesn’t include DSA due on foreign attachment and D.A. and expenses on accommodation, travel and transportation for the domestic attachment etc. Such expenses shall be borne by the participants/their sponsor(s).

The expenses on food and power consumption in the hostel are to be borne by the participants. However, wherever applicable the participants may claim reimbursement from their sponsoring organizations.

DATE SCHEDULE

| Date for submission of the form/Nominations from their Sponsoring Organization |

$14^{\text {th }}$ May, 2016 |

|---|---|

| Group Discussion \& Interviews etc. | $16^{\text {th }}$ May 2016 from 10 a.m. onwards |

| Start of the programme | $06^{\text {th }}$ June, 2016 |

- The schedule will be displayed at NIFM website and notice board.

The Selected candidates shall report at the Institute a day prior to start of the course.

The names of successful candidates will be available on the official website of NIFM and they may also be informed by e-mail.

PROGRAMME CHIAR’S MESSAGE

The ever increasing changes posing challenges has relegated the relevance of the erstwhile generalization of Rule of Thumb in public financial management. It is against this backdrop, the Government of India set up the National Institute of Financial Management (NIFM), in 1993, to impart specialized education and training in the domain of public financial management. NIFM, over the period, has emerged as a premier institute and centre of excellence in public financial management in and outside India.

NIFM has been offering a two-year regular programme on Post-Graduate Diploma in Management (Financial Management) duly approved by the All India Council for Technical Education (AICTE) accreditated by National Board of Accreditation (NBA) and recognized equivalent to Master’s Degree by the Association of Indian Universities (AIU) for the officers working in the Government and the corporate sector. The programme has been designed and updated on regular basis by the Academic Advisory committee (AAC) consisting of members from academia and practitioners in the field of public financial management. That the Programme has been gaining increasing acceptability and relevancy is duly confirmed by the increasing number of participants batch after batch joining the Programme. To quote, the number of participants has almost doubled just within four years from 47 in Batch 2012-14 to 72 in Batch 2015-17.

With a view to make the programme more and more suitable by expanding the knowledge horizons, the participants of the programme join the international educational institutions of high academic repute for their international attachment for two week period. For example, the PGDM(FM) Batch 2014-16 was attached with the University of California, Riverside, USA for two week duration from October 5 to 16,2015 .

I, as the Programme Chair, extend an invitation to the esteemed organizations to nominate their officers for joining the programme to take its full advantage. It has been our earnest effort to impart the maximum value addition to the participants who join the Programme.

(S.S. Khanka)

Professor (HR) and Programme Chair

National Institute of Financial Management

(A Government of India Institution)

APPLICATION FORM

POST GRADUATE DIPLOMA IN MANAGEMENT (FINANCIAL MANAGEMENT) PGDM (FM) PROGRAMMEME 2016-18

Affix recent passport size photograph (self-attested)

TO BE FILLED IN BY THE APPLICANT

Name: ******************__

First ************_ Middle ***************** Last ***************___

Male: (Tick) ☐ Female: (Tick) ☐ Age in years ☐ Date of Birth ☐ ☐ ☐ ☐

Designation ************************************************___

Organization ******************************************______

| City | Phone (O) |

|---|---|

| Country | Mobile |

| Pin | Fax |

Educational Qualification (Graduation onwards)

| Sl.No. | Qualification | University | Year of Passing | Specialization | % Marks |

|---|---|---|---|---|---|

Work Experience: (Starting with your present position)

| Sl.No. | Post held | Organization | From | To | Job Profile |

|---|---|---|---|---|---|

I undertake to declare that upon mu admission to PGDM(FM) programme conducted by NIFM. I would abide by rules and regulations governing the conduct of the programme.

Signature of the Applicant

Continued….

TO BE FILLED IN BY THE SPONSOR (Only for sponsored Government Executives)

| Name of the Sponsor | |

|---|---|

| Designation | |

| Organization | |

| Address for communication | |

| City | |

| Country | |

| PIN | |

| Phone (O) | |

| Mobile Number | |

| Fax |

This organization undertakes to declare that upon admission of the candidate to PGDM (FM) programme conducted by NIFM the participant would abide by rules and regulations governing the conduct of the programme.

Signature of the Sponsor \& Stamp of the Organization

Please return the completed form to Prof. S. S. Khanka, Programme Chair, PGDM (FM)

For queries, please contact

LTP Cell at+91-129-2465256

Email: pgdmfm@nifm.ac.in

NATIONAL INSTITUTE OF FINANCIAL MANAGEMENT

Sector-48, Pali Road, Faridabad-121 001, Haryana (INDIA)

Telephones. (EPABX): 0129-2418857/75, Fax: 0129-2418867

Dial code 0129 from Delhi and other stations) Url:http://www.nifm.ac.in

National Institute of Financial Management (A Government of India Institution)

HALL TICKET

Post Graduate Diploma in Management (Financial Management) 2016-18

TO BE DETACHED BEFORE SUBMITTING THE APPLICATION FORM PLEASE BRING THE HALL TICKET AT THE TIME OF GROUP DISCUSSION

Name of Applicant

Date of Birth

Address for Correspondence

Application Form No.

Demand Draft/Pay Order No

[Only where the form has been download from NIFM website]

Signature of Applicant

National Institute of Financial Management

(A Government of India Institution)

Contact and Mailing Address

National Institute of Financial Management

Sector-48, Pali Road, Faridabad-121001

Haryana (INDIA)

Tel.: +91 129 2465256, +91 129 2465258, +91 1292418870

Fax : +91 1292418867

Website : http: www.nifm.ac.in

TRAINING PROGRAM ON PUBLIC PROCUREMENT

About NIFM

The National Institute of Financial Management (NIFM) is Centre of Excellence specializing in capacity building of professionals in the fields of Public Policy, Financial Management and other governance issues for promoting highest standards of professional competence and practice. NIFM is a premier resource center for the capacity building of senior, middle and entry level of management in Government of India . NIFM also caters to the training needs of State Governments, Defence establishments, Banks, Autonomous Bodies, Local Government, Public Sector Undertakings and other Financial Institutions. Training Programmes are customized and executed for the officials from other countries as well.

NIFM plays a pivotal role in governance and administrative reforms by providing a platform for interaction and exchange of ideas \& experiences among officers from different organized services, different state governments and personnel of civil and defence establishments.

Apart from capacity building, NIFM is also engaged in serious research studies in the areas of accounting, audit, financial management, parliamentary financial control and other issues related to public policy and delivery systems. The outcomes of such research studies are published and disseminated through Research Papers, Journals and Books.

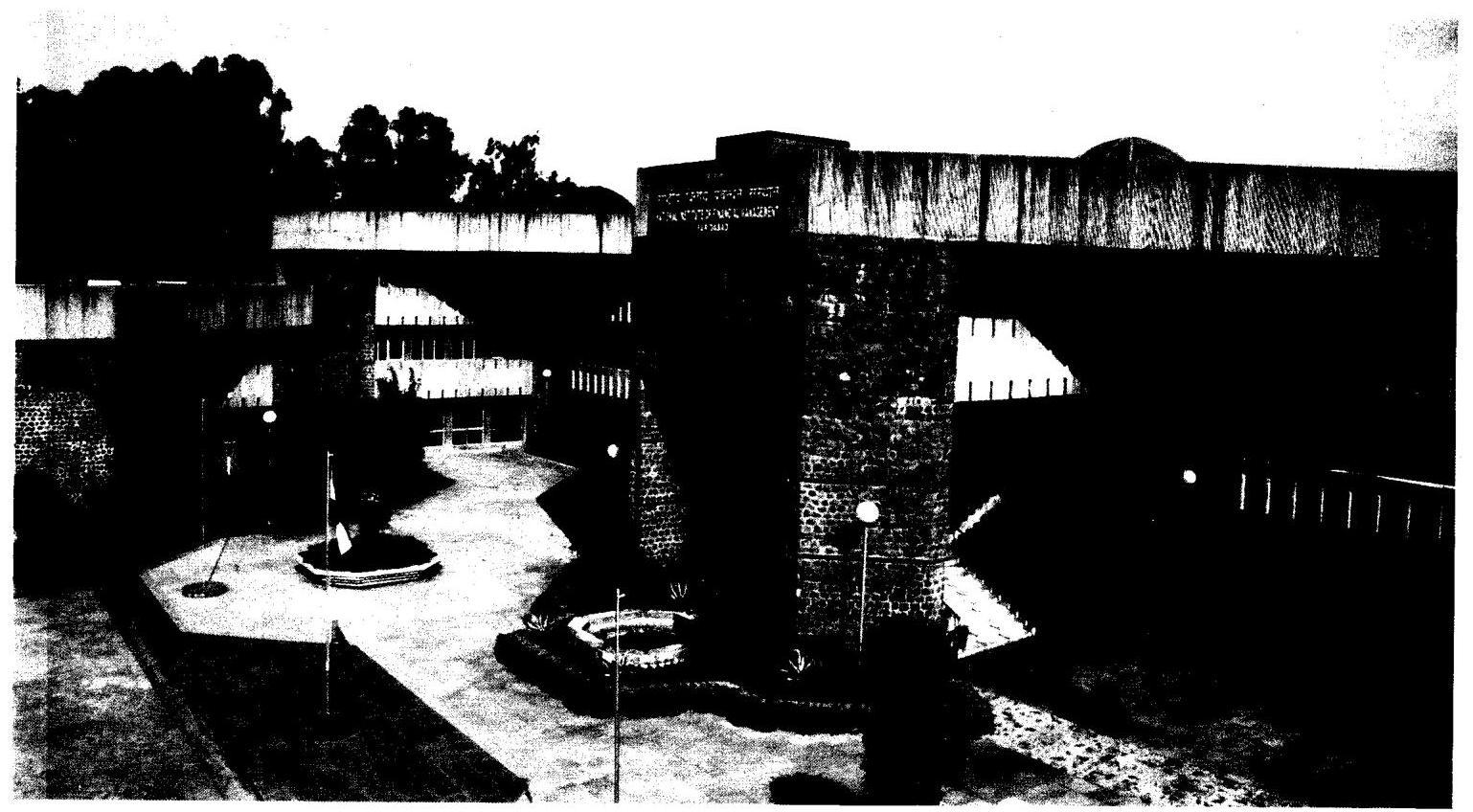

NIFM has a sprawling lush green campus of 42 acres situated in N.C.R. It has state-of-art training halls, computer Labs, hostels, indoor and outdoor sports complex and library having unique architectural design.

About this course

Large amount of public funds is being spent on public procurement for which special rules and procedures for procurement are applicable. It is therefore imperative that the executives/officers engaged in public procurement possess thorough knowledge of all the relevant rules, regulations and procedures of public procurement.

Ministry of Finance, Government of India identified NIFM as the nodal agency for conducting training programmes on this subject with a view to educating and familiarizing the concerned executives/officers with all the relevant rules and procedures of public procurement. NIFM receives active support from Public Procurement Division of Ministry of Finance, Government of India in this regard. NIFM has been conducting such training programmes periodically since 1996.

Procurement in an organisation involves around $35 \%$ of total budget in a year. Transparent, efficient and timely procurement is indispensable for successful achievement of objectives and reputation of any organisation.

Pedagogy and Faculty

NIFM offers very high quality training solutions for all types of Public Procurement of Goods, Woks and Consulting Services. The Institute has vast intellectual resources to meet the ever increasing demand of building Public Procurement capacity. Training Modules and Session Plans have been carefully designed to cover both the theories and practices of Public Procurement with Case Studies of which NIFM has got a very large repertoire, Group Discussions etc. The faculty comprise academics of NIFM and leading experts who have about four decade’s experience in various areas of Public Procurement, including policy formulation and currently engaged as senior consultants/advisers/trainers in various organizations like the World Bank, Government departments, Consultancy MNCs etc.

For Whom and Duration

All officers/executives dealing or associated with public procurement of goods, works and services (from Procurement, Finance, Technical / user departments and Audit) should attend. This is a 6 days (Monday to Saturday) residential programme.

Programme Contents

- Principles of Public Procurement

- Introduction to Public Procurement

- Legal, Procedural and Regulatory Frame Work of Public Procurement

- General Financial Rules and Government of India Procedures of Procurement of Goods

- Introduction to Public Procurement Bill, 2012

- Central Vigilance Commission and its Guidelines

- Procurement of Goods with Government Fund

- Bidding Procedure

- Preparation of Technical Specifications

- Standard Bidding Documents

- Qualifying Criteria

- Bid Evaluation Criteria and Quantity Distribution Criteria

- Drafting of Bid Evaluation Report

- Award of Contract

- Procurement of Works with Government Fund

- General Financial Rules

- Manual of Procedure for Procurement of Works issued by the Government of India

- Works Manual of CPWD

- Types of Tenders and Contracts

- Structure of Bidding Documents and Standard Bidding Documents

- Pre-Qualification and Post-Qualification

- Bid Evaluation and award of Contract

- Payment Terms and Contract Price Adjustments

- Procurement of Consulting Services

- GFR and Government of India Guidelines

- Manual of Procedure for Procurement of Consultancy Services issued by the Government of India

- Model RFP Template issued by the Government of India

- Selection Methods

- Evaluation

- Negotiation

- Types of Contracts etc.

- Small Value Procurements

- Procurement of General items like Clothing items, Furniture, Paper, Stationery items etc

- Procurement of non-consulting services

6. Contract Management

- Inward Logistics

- Quality Assurance

- Payments

- Price Variation Clause

- Extension of Completion Period

- Audit of Public Procurement by C \& AG

- E-procurement

- Overview of Integrity related Procedures in manual/paper based process

- Security, Transparency Accountability

- Integrity issues in e-procurement

- Red Flags in e-procurement

- Electronic Requisition Management

- Quality Variation

- Liquidated Damages

- Force Majure

- Default \& Termination

- Warranty and AMC

- Contract Risk Management

- Electronic Tendering System – Organisational Administrative Requirements

- E-catalog of Supplier Organisation

- Sealed Bid: e-procurement / e-tendering

- Electronic Reverse Auction

- Electronic Forward Auction

Important Information

During 2015-16, forty programs had been planned and till the end of February 2016, thirty eight programs have been conducted and 1800 participants have attended. They came from various departments e.g. CPWD, ISRO, ICAR, CGWB, NIC, GSI, Income Tax, Department of Post, DoT, Department of Atomic Energy, Academic Institutes like IITs, AIIMS, Defence Services (Army, Air Force \& Navy), and Paramilitary organisations like BSF, CRPF, ITBP etc. and various Ministries of the Government of India. Another four programs have been scheduled up to the end of the present financial year i.e. 31.03.2016.

We have planned 40 programs in the year 2016-17 as under:

| Month | Duration | Schedule of training during 2016-17 | |||

|---|---|---|---|---|---|

| Month | Duration | Month | Duration | ||

| April’ 16 | 04 Apr – 09 Apr | August’ 16 | 01 Aug – 06 Aug | December, 16 | 05 Dec – 10 Dec |

| 25-Apr – 30 Apr | 08 Aug – 13 Aug | 19 Dec – 24 Dec | |||

| May’ 16 | 02 May – 07 May | 29 Aug – 03 Sep | 26 Dec – 31 Dec | ||

| 09 May – 14 May | September, 16 | 05 Sep – 10 Sep | January’ 17 | 02 Jan – 07 Jan | |

| 23 May – 28 May | 19 Sep – 24 Sep | 09 Jan-14 Jan | |||

| 30 May – 04 June | 26 Sep – 01 Oct | 16 Jan -21 Jan | |||

| June’ 16 | 06 June -11 June | October, 16 | 03 Oct – 08 Oct | 30 Jan – 04 Feb | |

| 13 June – 18 June | 17 Oct – 22 Oct | February’ 17 | 6 Feb – 11 Feb | ||

| 20 June – 25 June | 24 Oct – 29 Oct | 13 Feb – 18 Feb | |||

| 27 June – 02 July | 31 Oct – 05 Nov | 20 Feb – 25 Feb | |||

| July’ 16 | 11 July – 16 July | November, 16 | 07 Nov – 12 Nov | 27 Feb – 04 Mar | |

| 18 July – 23 July | 14 Nov – 19 Nov | March’ 17 | 06 Mar-11 Mar | ||

| 25 July – 30 July | 21 Nov – 26 Nov | 20 Mar – 25 Mar | |||

| 28 Nov – 03 Dec |

The Ministries, Departments and other organisations may plan their nominations well in advance and send that to NIFM for convenient planning and confirmation.

Course Fee

For Officers of Central Government Ministries, Departments, their attached and subordinate offices, Central Autonomous Bodies, Central Statutory and Regulatory Bodies – Fee for the course is being paid by Ministry of Finance, GOI.

PSUs and Other Indian participants – ₹35,000/- plus service tax @ $14.5 \%$ (Rupees Thirty five thousand plus service tax @ 14.5\%) per participant.

Foreign participants – 700 U.S. $\$$ per participant.

The course fee includes tuition fee, course materials, boarding, lodging, meals and local study trips (if any) during the programme. The course fee may be remitted before commencement of the program by way of Cheque/DD drawn in favor of ‘Accounts Officer, NIFM payable at Delhi/Faridabad or RTGS/NEFT, details for which are given behind the Nomination Form.

Please do write to us!

National Institute of Financial Management

An autonomous institution of Ministry of Finance, Government of India

-

- NIFM faculty profile is available on the official website of NIFM http://www.nifm.ac.in