The Indian Statistical Institute’s Ninety-Second Annual Report for the year 2023-2024 has several key findings. Financial statements were audited with a qualified opinion, noting exceptions in accounting practices and the management of fixed assets. Significant issues include unadjusted sale proceeds of fixed assets, lack of fixed asset registers for externally funded projects, and non-compliance with accounting standards regarding foreign currency transactions and employee benefits. Emphasis is placed on matters such as unreconciled GST input tax credits and unutilized endowment funds. The report indicates potential financial risks and areas needing improvement in accounting and asset management practices within the institute.

SOURCE PDF LINK :

Click to access Statement_of_Accounts_ISI_2023-24.pdf

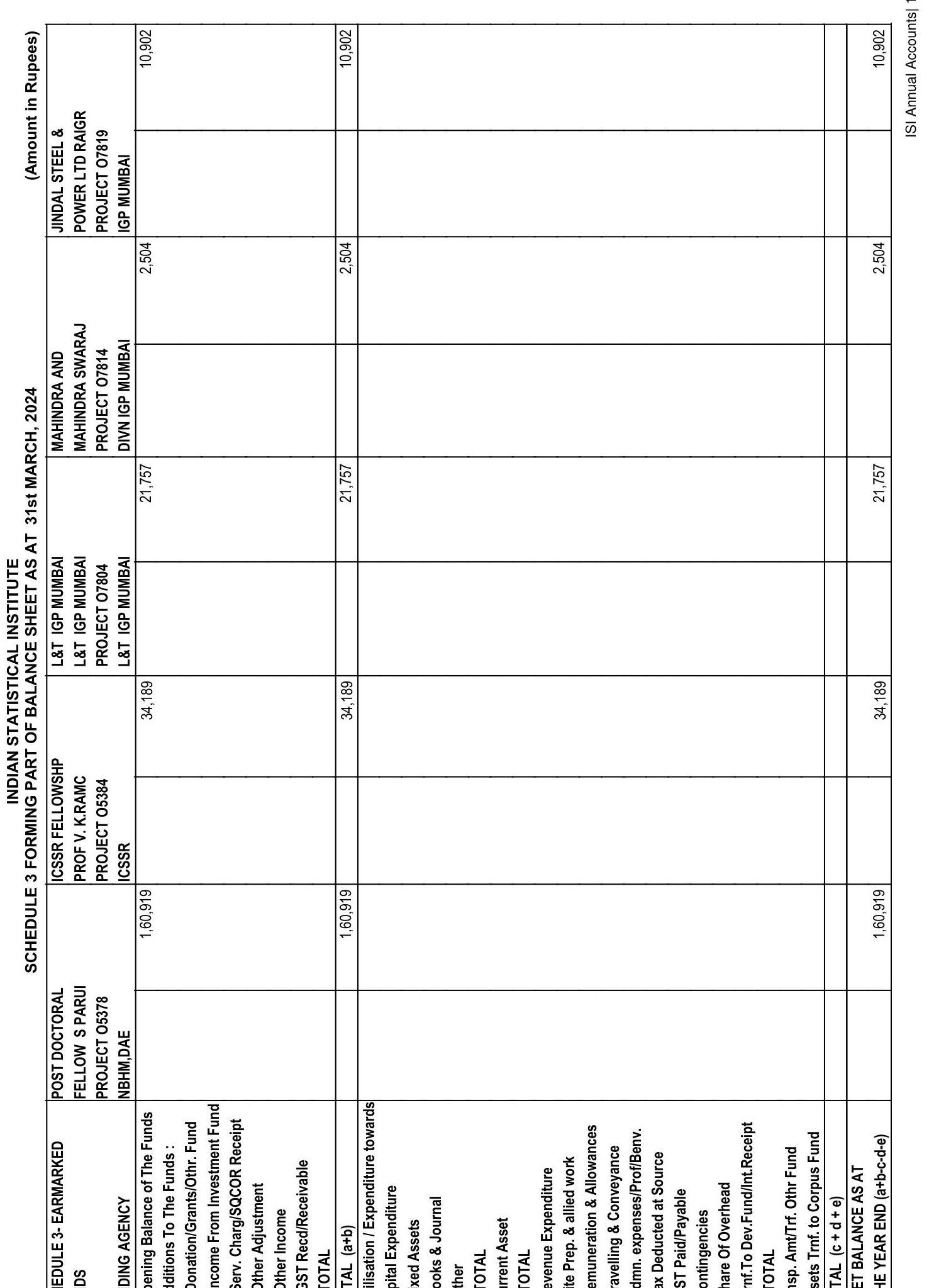

Click to view full document content

INDIAN STATISTICAL INSTITUTE

NINETY-SECOND ANNUAL REPORT

Statement of Accounts and Auditor’s Report for the year 2023-2024

- Auditors’ Report ….. $1-6$

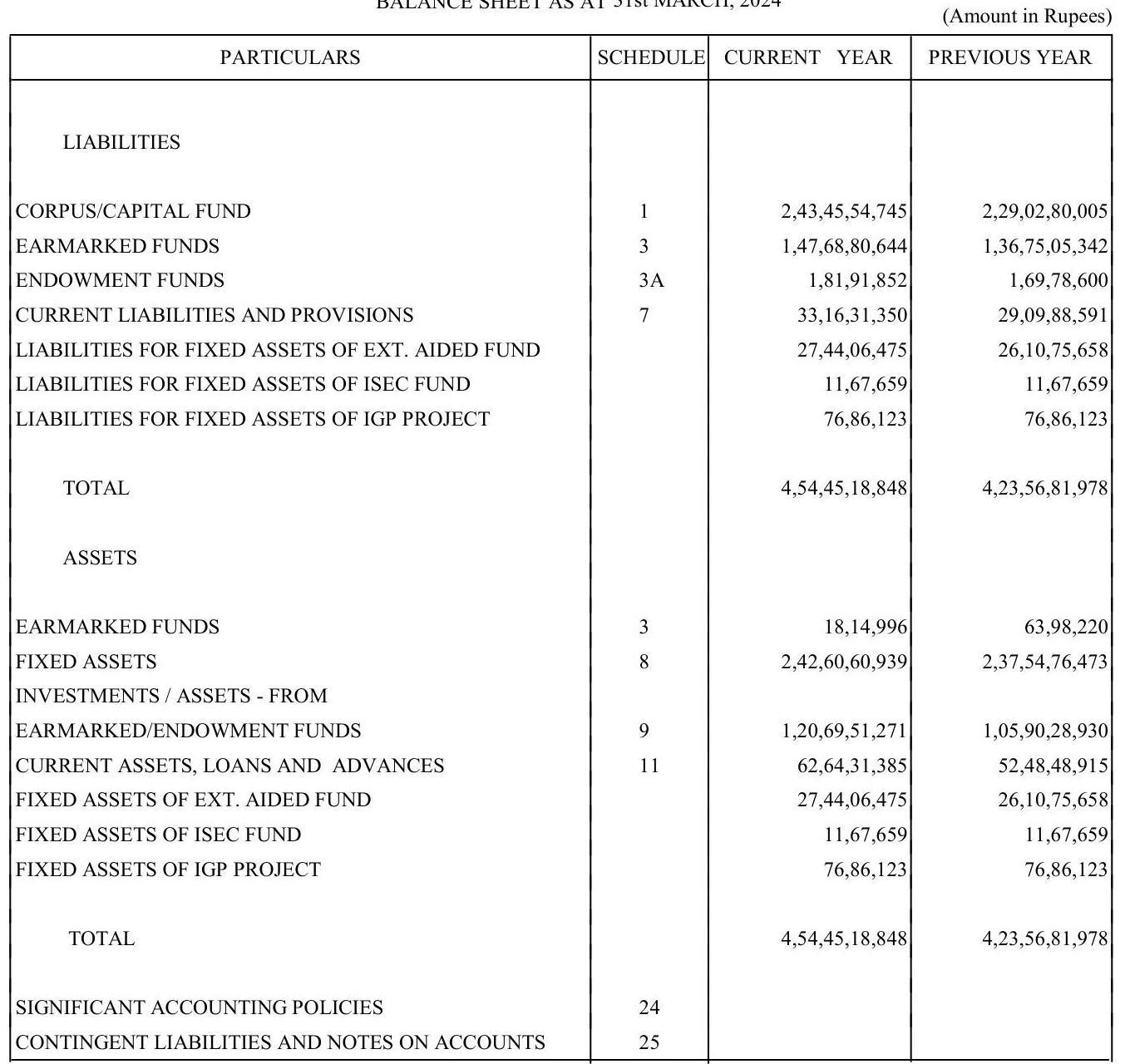

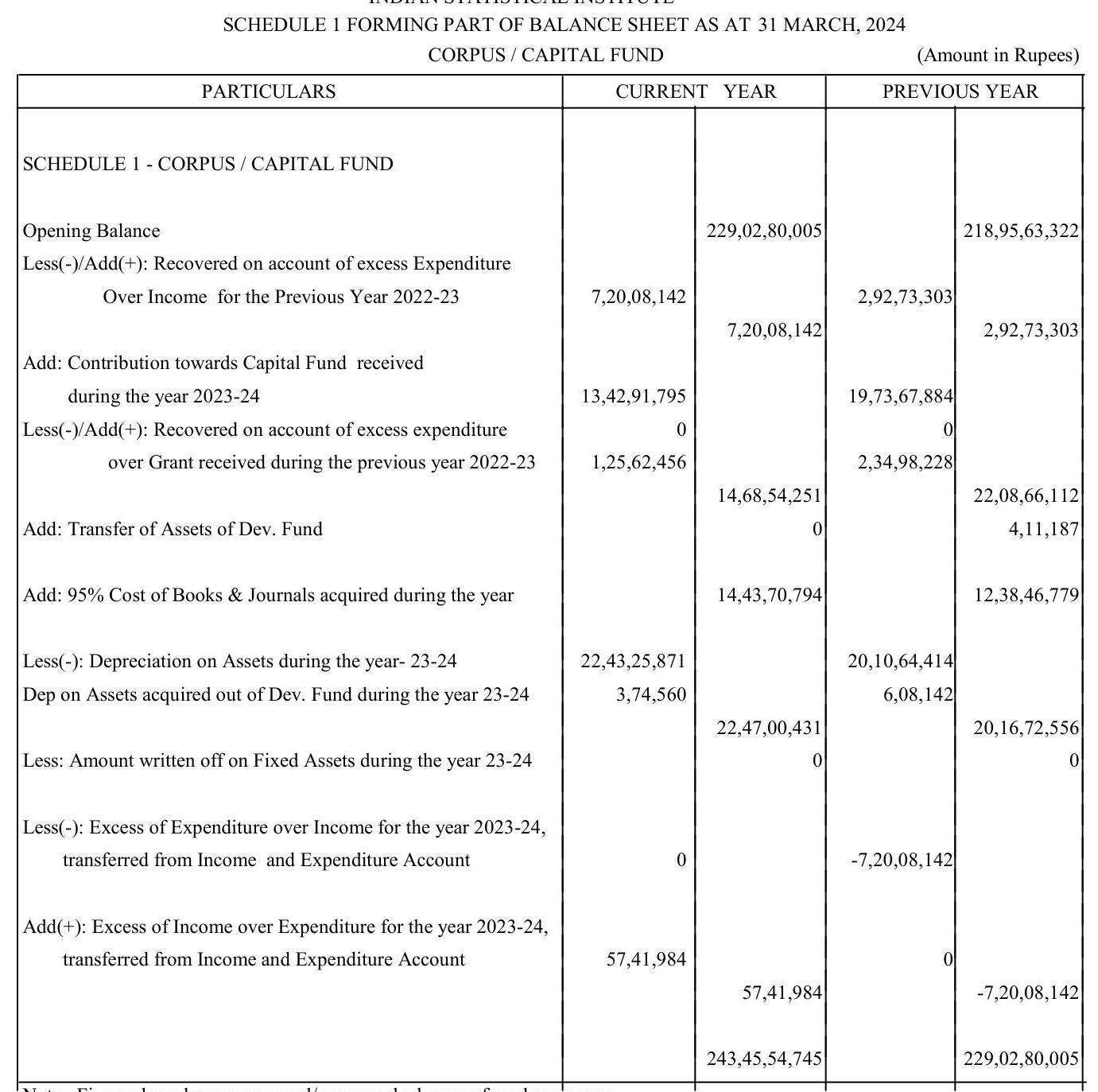

- Balance Sheet ….. 7

- Income \& Expenditure Account ….. 8

- Schedules Forming Part of Balance Sheet ….. $9-168$

- Schedules Forming Part of Income \& Expenditure ….. $169-172$ account

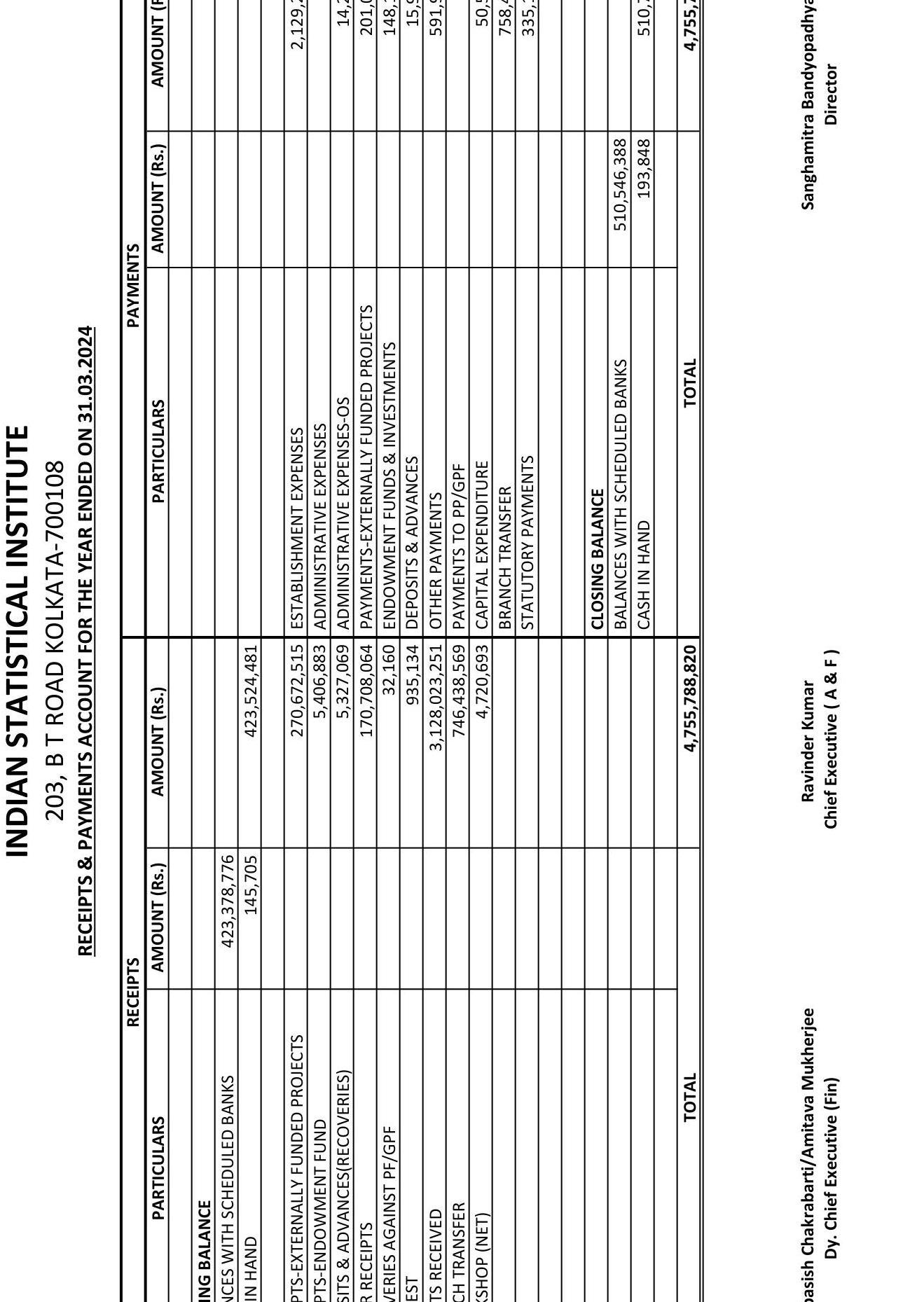

- Receipt \& Payment Accounts ….. 173

- Significant Accounting Policies ….. $174-176$

- Notes on Accounts ….. $177-181$

- Auditors’ Report, Balance Sheet and Income and Expenditure Account-Plan and Policy Research Fund ….. $182-186$

- Observation of Auditor’s with our Replies. ….. $187-192$

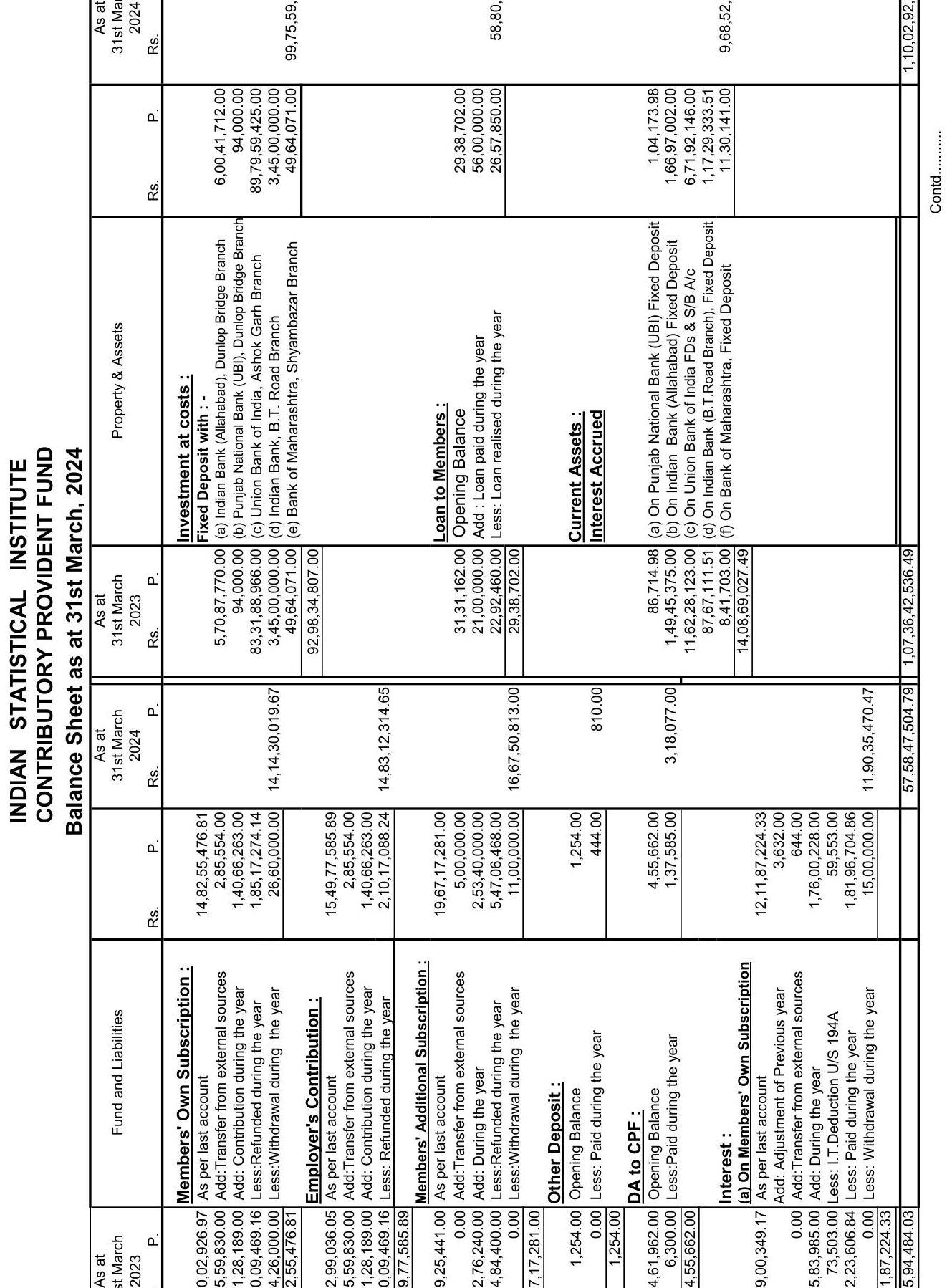

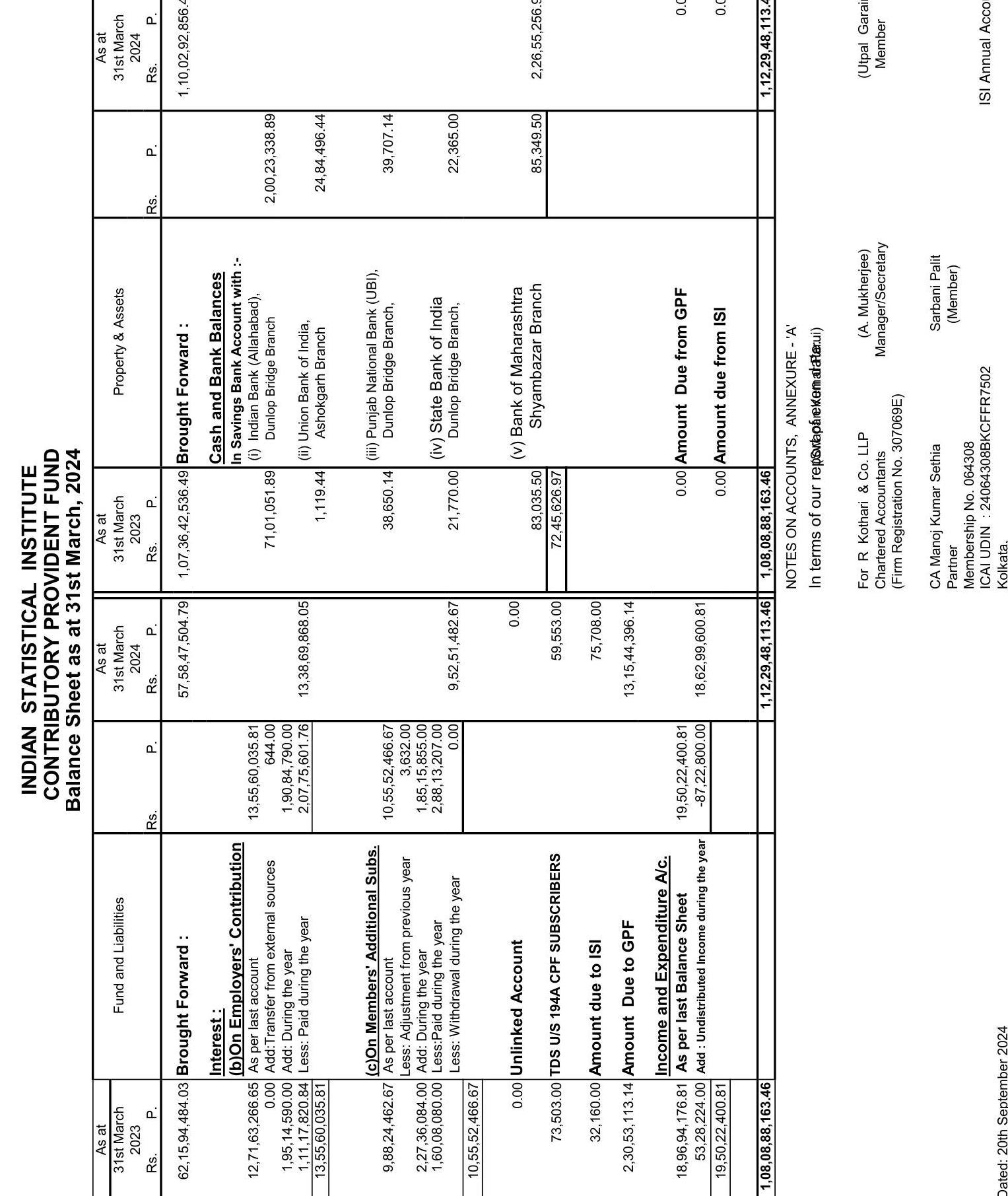

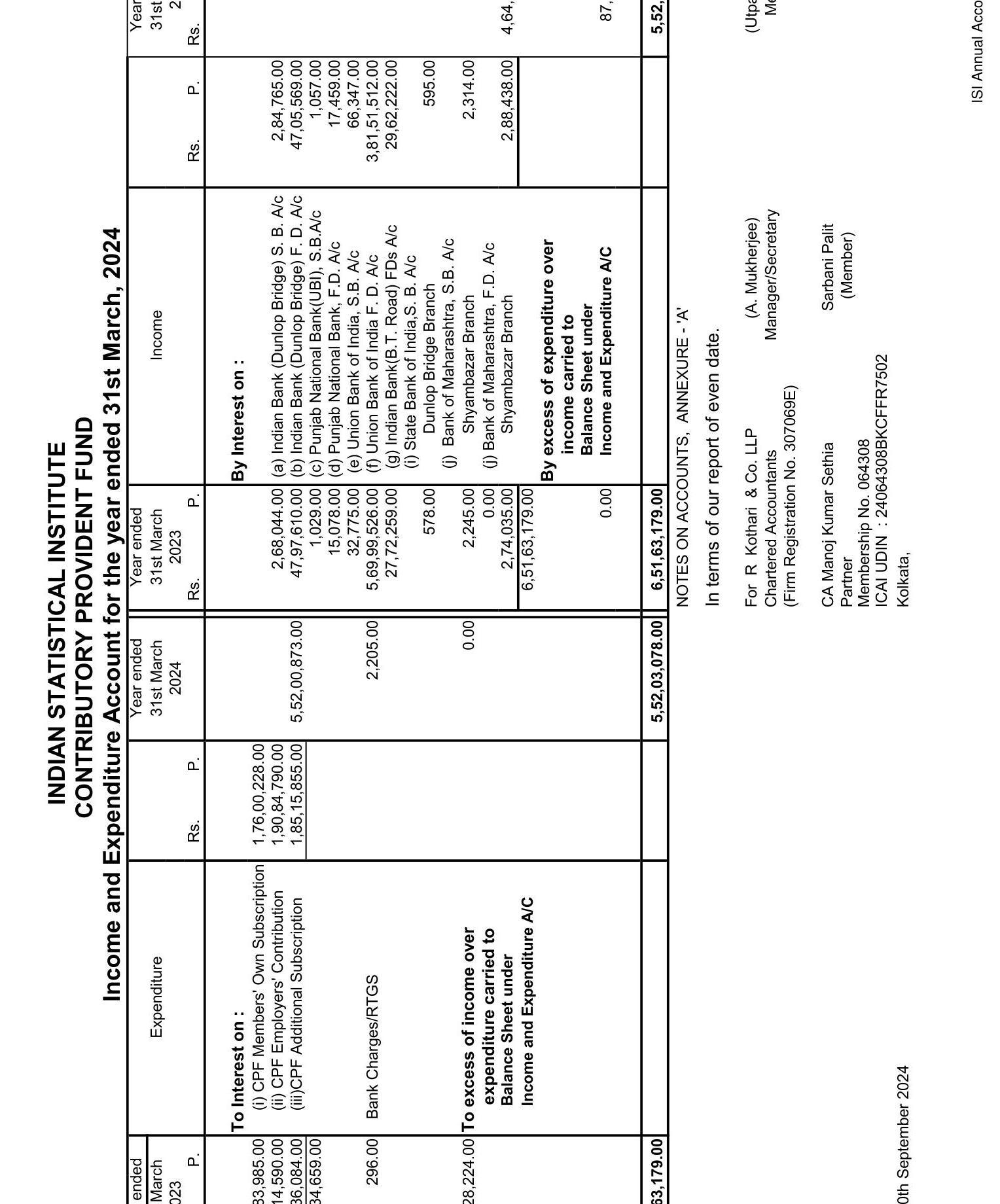

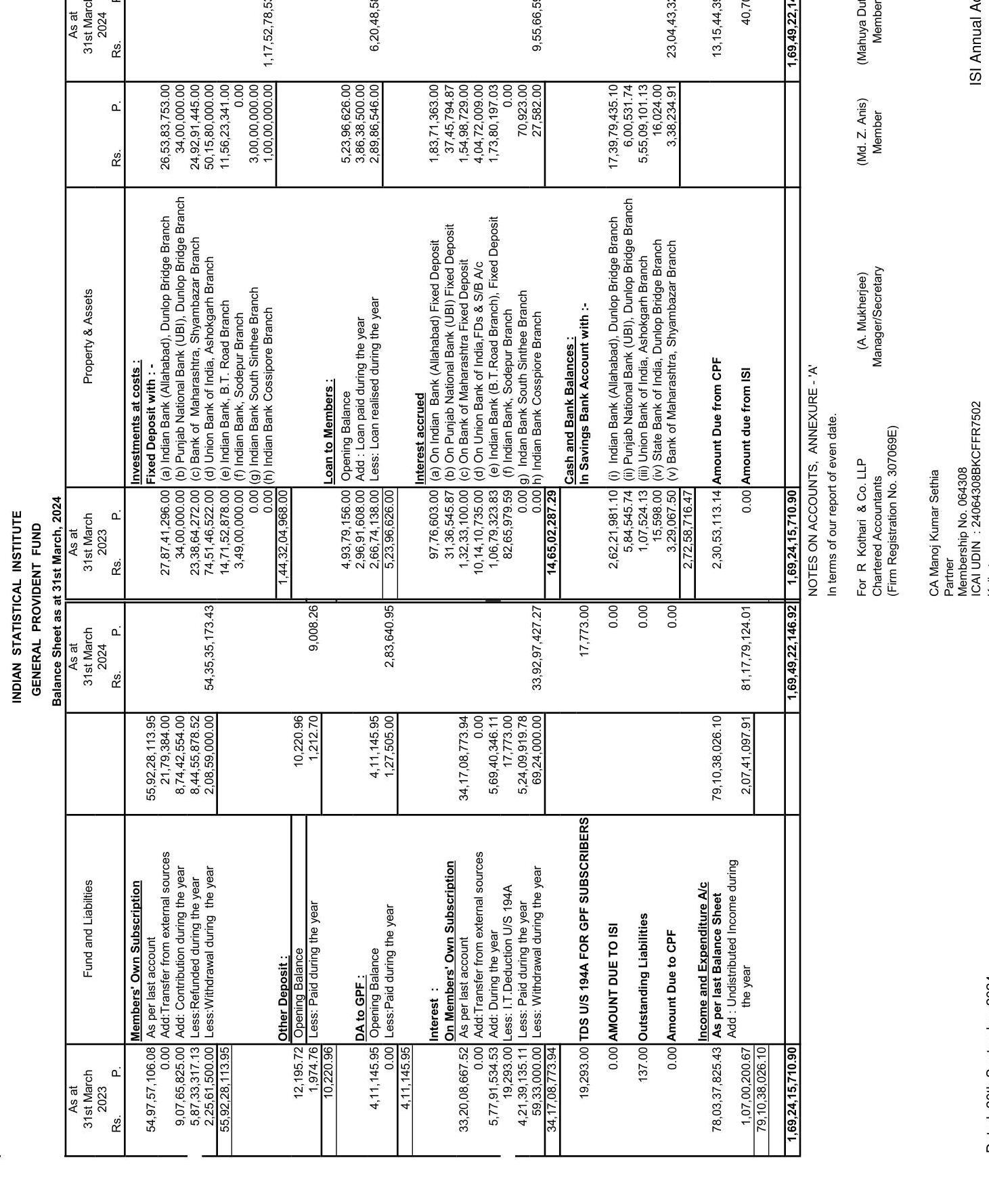

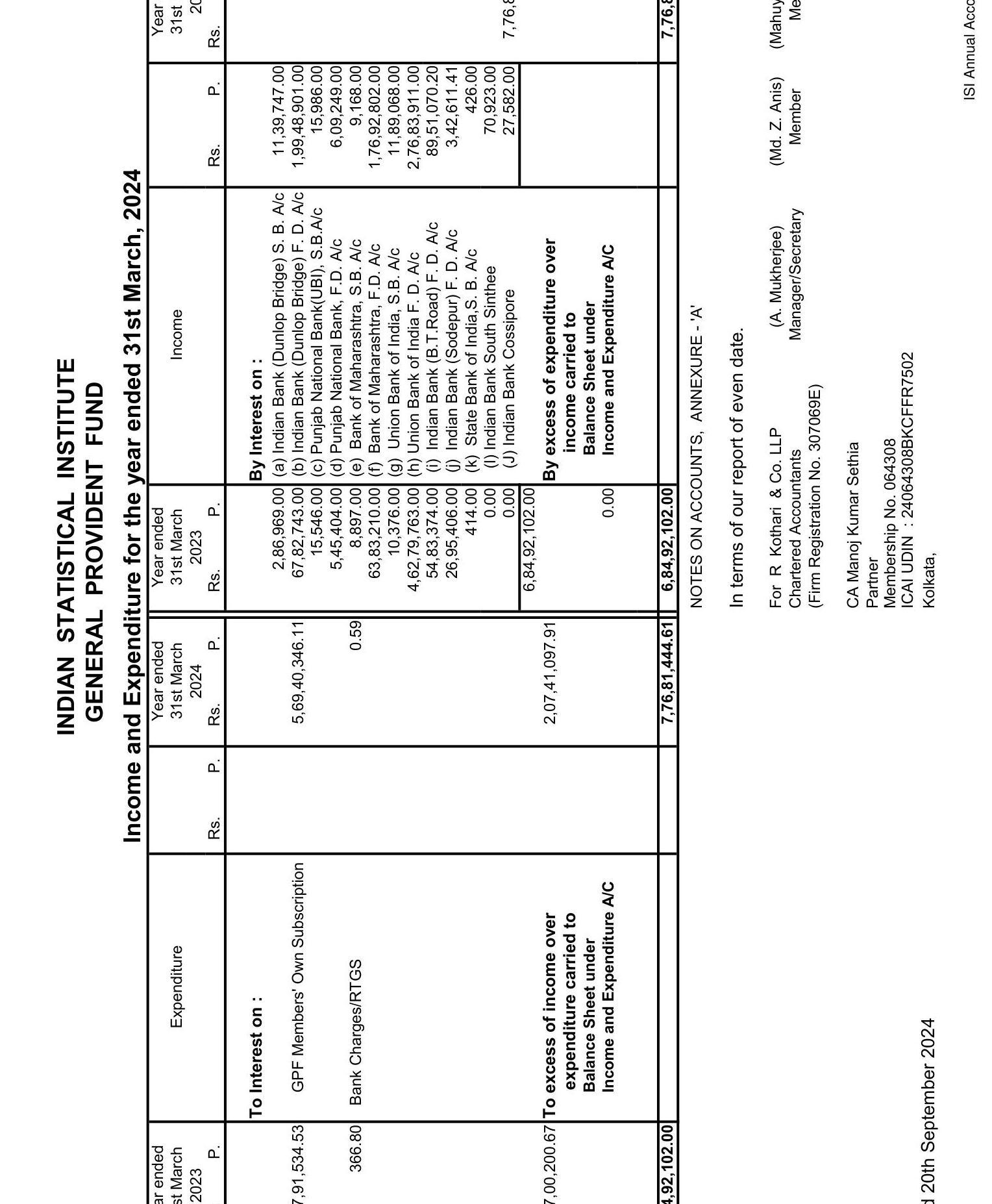

- Auditors’ Report, Balance Sheet of ISICPF, Income \& Expenditure a/c of ISICPF, Balance Sheet of ….. $193-201$ISIGPF and Income \& Expenditure a/c of ISIGPF,Notes on Accounts of ISICPF \& ISIGPF, Replies tothe Auditors’ Comments.

INDEPENDENT AUDITOR’S REPORT

Report on the Audit of Financial Statements

Qualified Opinion

We have audited the accompanying Financial Statements of INDIAN STATISTICAL INSTITUTE (hereinafter referred to as “the institute”), which comprise the Balance Sheet as at 31st March, 2024, the Income \& Expenditure Account and notes to the financial statements including a summary of significant accounting policies and other explanatory information.

In our opinion and to the best of our information and according to the explanations given to us, except for the effect of the matter described in the Basis for Qualified Opinion section of our report, the aforesaid financial statements give the information required in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in India, of the state of affairs of the Institute as at March 31, 2024, and Net Surplus for the year ended on that date.

Basis for Qualified Opinion

i. Attention is invited to Note no. 24(1) of Significant Accounting Policies regarding method of accounting followed. The institute follows the mercantile system of accounting and recognizes its incomes and expenditures on accrual basis; however, certain cases such as accounting of interest income on house building loans. adhoc bonus and dearness allowance, expenditure on disbursement of share of faculty members respectively has been accounted for on cash basis.

ii. Attention is invited to Note no. 24 (1) of Significant Accounting Policies regarding employee benefit expenses. Certain employee benefits including retirement benefits (including Gratuity) and D.A. are accounted for on cash basis which constitutes a departure from the Accounting Standard 15 (Revised) “Employee Benefits” issued by the Institute of Chartered Accountants of India.

iii. Attention is invited to Note no. 24 (1) of Prepaid Expenses are charged off in the year these are incurred other than Subscription of Journals and all transactions pertaining to earlier periods are accounted for as year’s transactions under the regular heads of account in the absence of the Head “Prior Period Adjustment Account”. In our opinion the requirements of the provisions of Accounting Standard-5, ‘Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies’ as issued by the Institute of Chartered Accountants of India are not complied with.

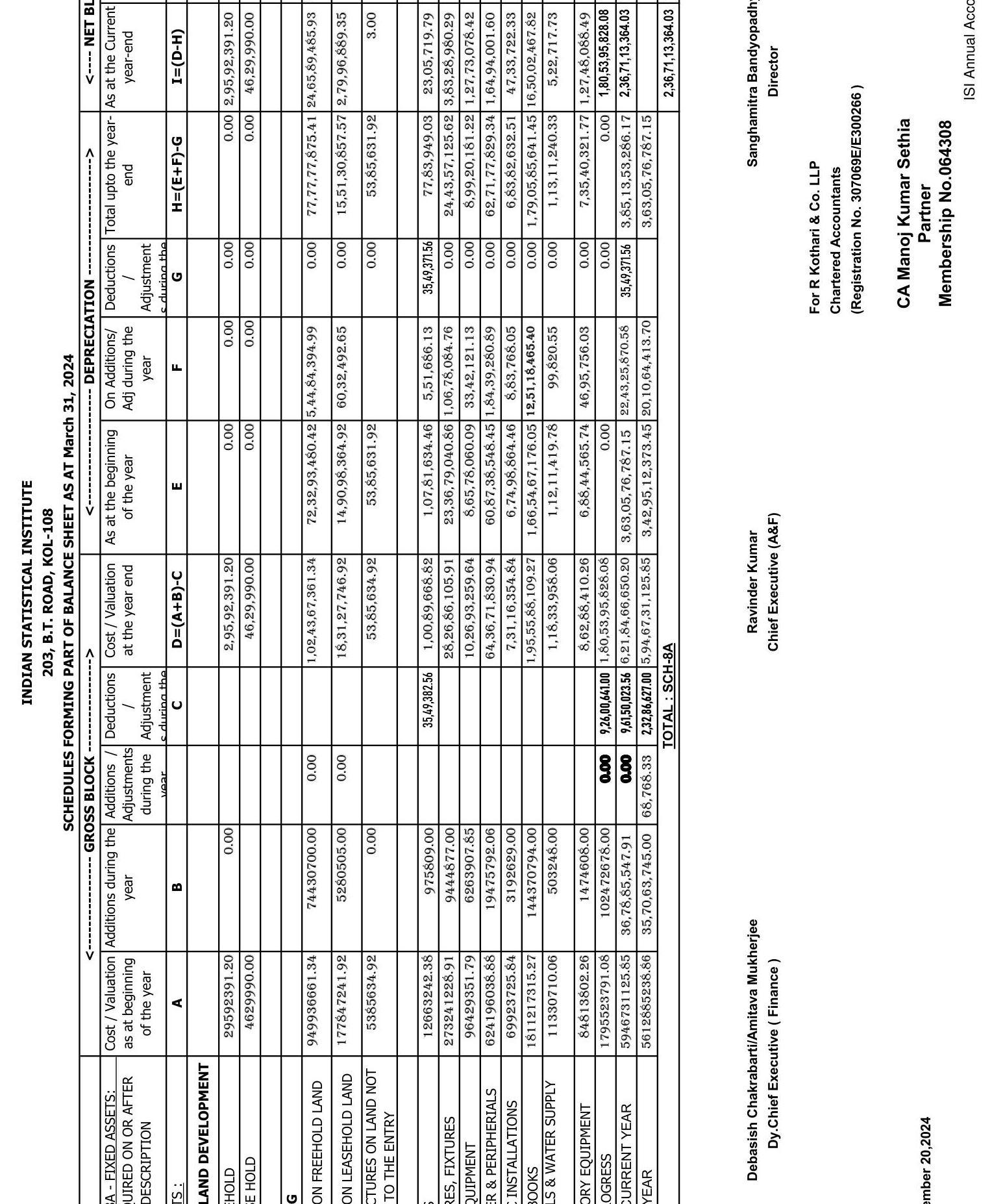

iv. Depreciation on fixed assets acquired up to accounting year 1985-86 have not been charged in the accounts from the financial year 1986-87 onwards as per Schedule 24(2.1) which is not in compliance with Accounting Standard-10, ‘Property, Plant \& Equipments’.

v. No adjustment had been made in respect of sale proceeds against fixed assets sold / disposed off cumulative value of Rs. 54,35,883/-( P.Y. Rs. 61,82,872/-) included in current liabilities under schedule 7 to the financial statements which is carry forward and unadjusted with respective fixed assets as disclosed in Schedule 25(1.6). In absence of the aforesaid adjustment, the value of fixed assets $\mathcal{E}$ current liabilities as on reporting date is overstated with consequential impact on Income $\mathcal{E}$ Expenditure / Corpus Fund in reported financial statements.

vi. Fixed assets under schedule 8A to the financial statement includes computer systems having book value of Rs 7,00,000/- approx as per Schedule 25(1.5) were stolen in year 1992-1993 and no adjustment has been made regarding such loss in financial statements.

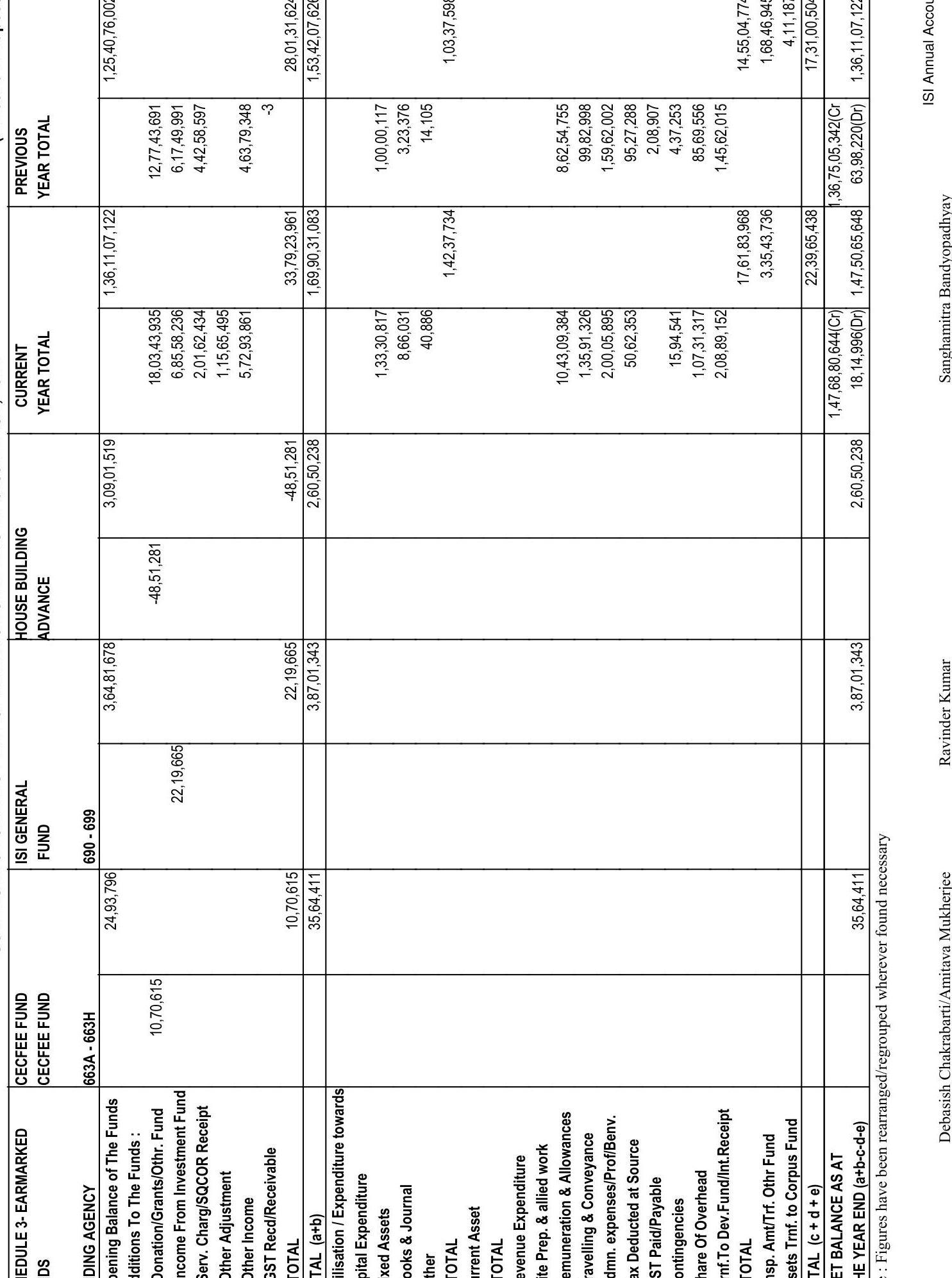

vii. In respect of assets acquired from Externally Funded Projects, fixed asset register is not maintained. Accordingly the physical existence of such asset could not be ensured. Physical verification of fixed assets including assets of other fund, assets of externally funded projects have not been carried out by the management during last five years; accordingly, obsolete, unserviceable or damaged items if any remain unascertained and not provided for.(Refer Schedule 25(1.3)).

viii. Transactions in foreign currencies are recorded at exchange rate prevailing at the time of initial recognition and exchange difference arising on settlement is not accounted for which is not in compliance with Accounting Standard-11,’Effect of Changes in Foreign Exchanges Rates’.

ix. With ref. to Schedule 25 (1.9) to the financial statement regarding capital expenditure of Rs. 11.02 crores (Capitalised under Building of Rs. 6.05 crores $\mathcal{E}$ Rs. 4.97 crores under CWIP) incurred at Chennai centre of the institute (ISI) in the state of Tamil Nadu as on 31.03.2024. A plot of land to the extent of eight acres was allotted to ISI by the Government of Tamil Nadu at free of cost. Due to the Public Interest Litigation (PIL) filed by an NGO, the High Court of Madras has ordered the Government of Tamil Nadu to cancel the land allotment to ISI. Also there is a mention in the order that ISI may approach the Government of Tamil Nadu for alternate allotment. As per the decision of the Council, ISI have approached the Government of Tamil Nadu for alternative land allotment and claimed for compensation of the expenditure incurred to the tune of Rs.11.02 Crores for the site development. Effect of the same on account of impairment of fixed assets $\mathcal{E}$ CWIP on reported financial for the year ended 31.03.2024 remain unascertained and not provided for.

We conducted our audit in accordance with the Standards on Auditing (SAs) issued by ICAI. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the entity in accordance with the ethical requirements that are relevant to our audit of the financial statements, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Emphasis of Matter

i. As referred to the Financial Statements, sundry debtors, security deposits given, sundry creditors, advance to / from parties, advances from customer, deposits taken, other liabilities, balance with Govt. authorities including, Professional Tax, Goods and Services Tax, etc includes balances remaining outstanding for a substantial periods. The balances are subject to confirmation/reconciliation. In the absence of above and other corroborative evidence, we are unable to comment on the extent to which such balances are recoverable. The reported Financial Statements might have consequential impact which remains unascertained.[Refer Schedule 25(8.6)]

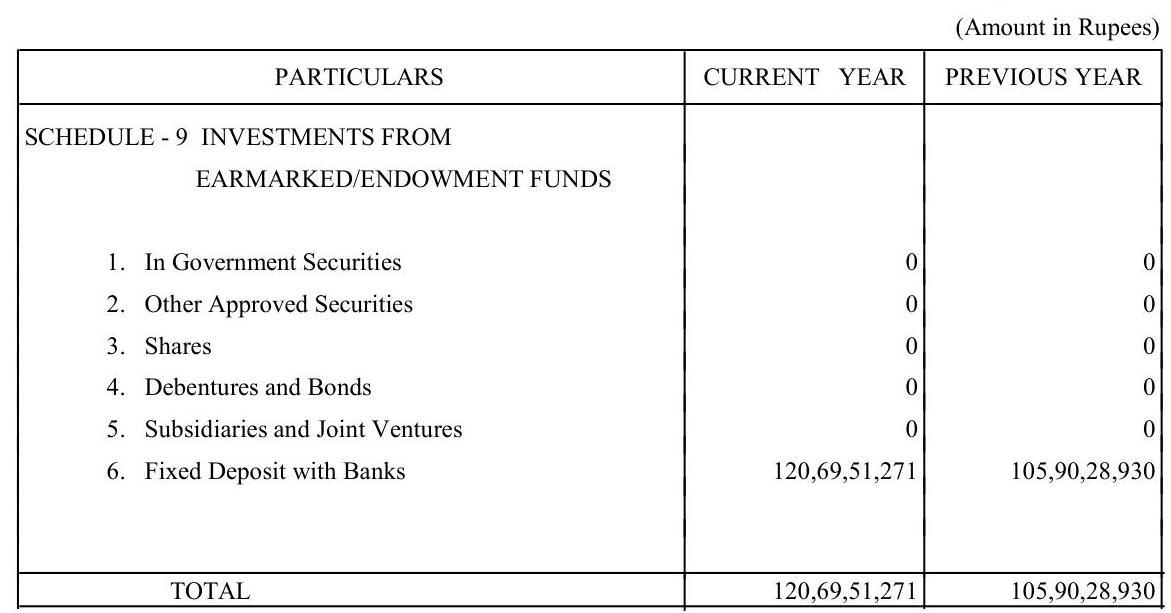

ii. Balance under Input Tax credit of GST of Rs. 74.17 lakhs (Other than Kolkata Facilities) as per schedule 11 to the financial statement remains unreconciled with periodical return under GST / balance appearing in GST Portal. Moreover, the Institute is providing exempted services specially for other facilities centre for which input tax credits are no longer eligible for utilization, but the same is carry forward and unadjusted in books.

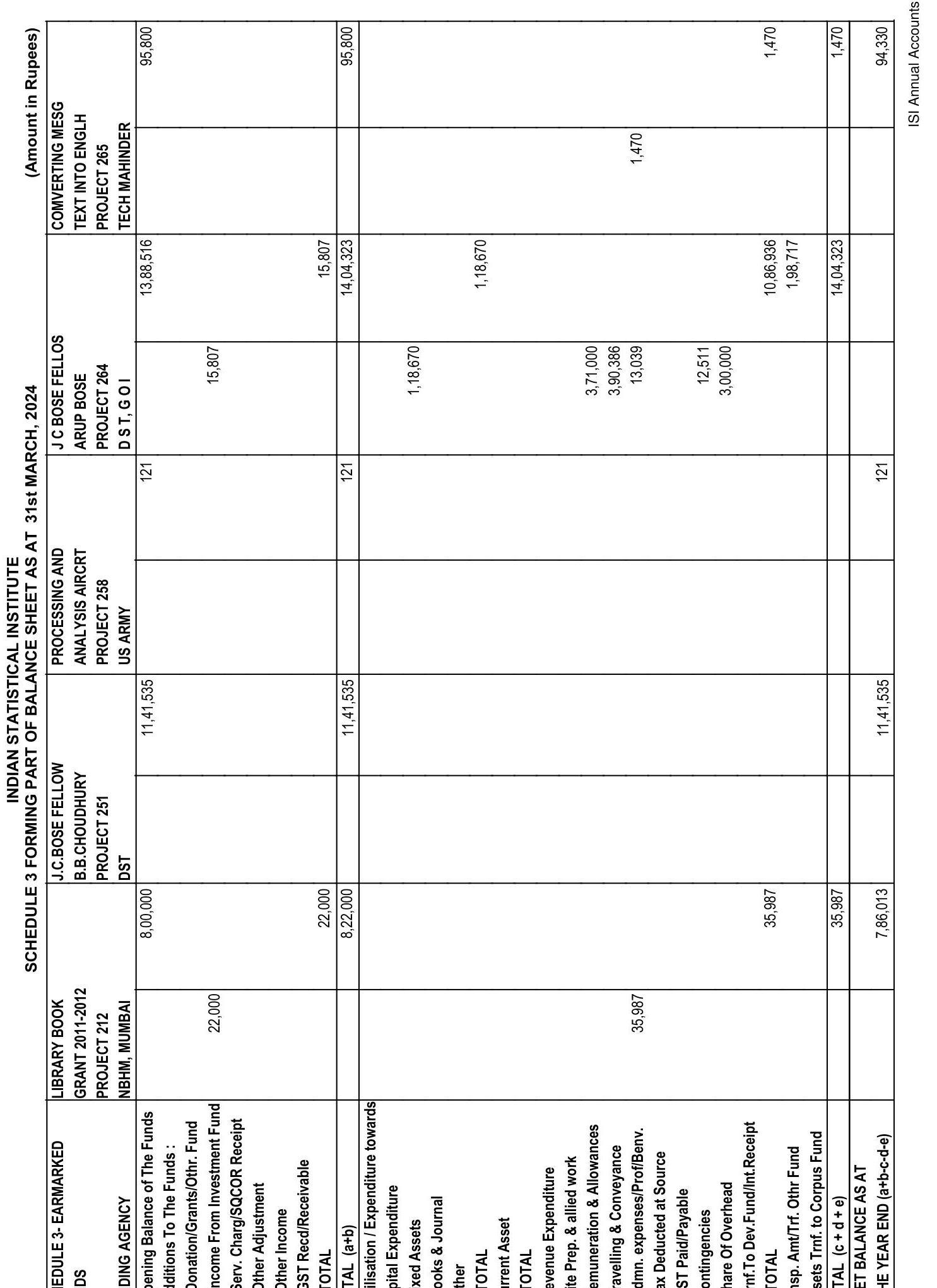

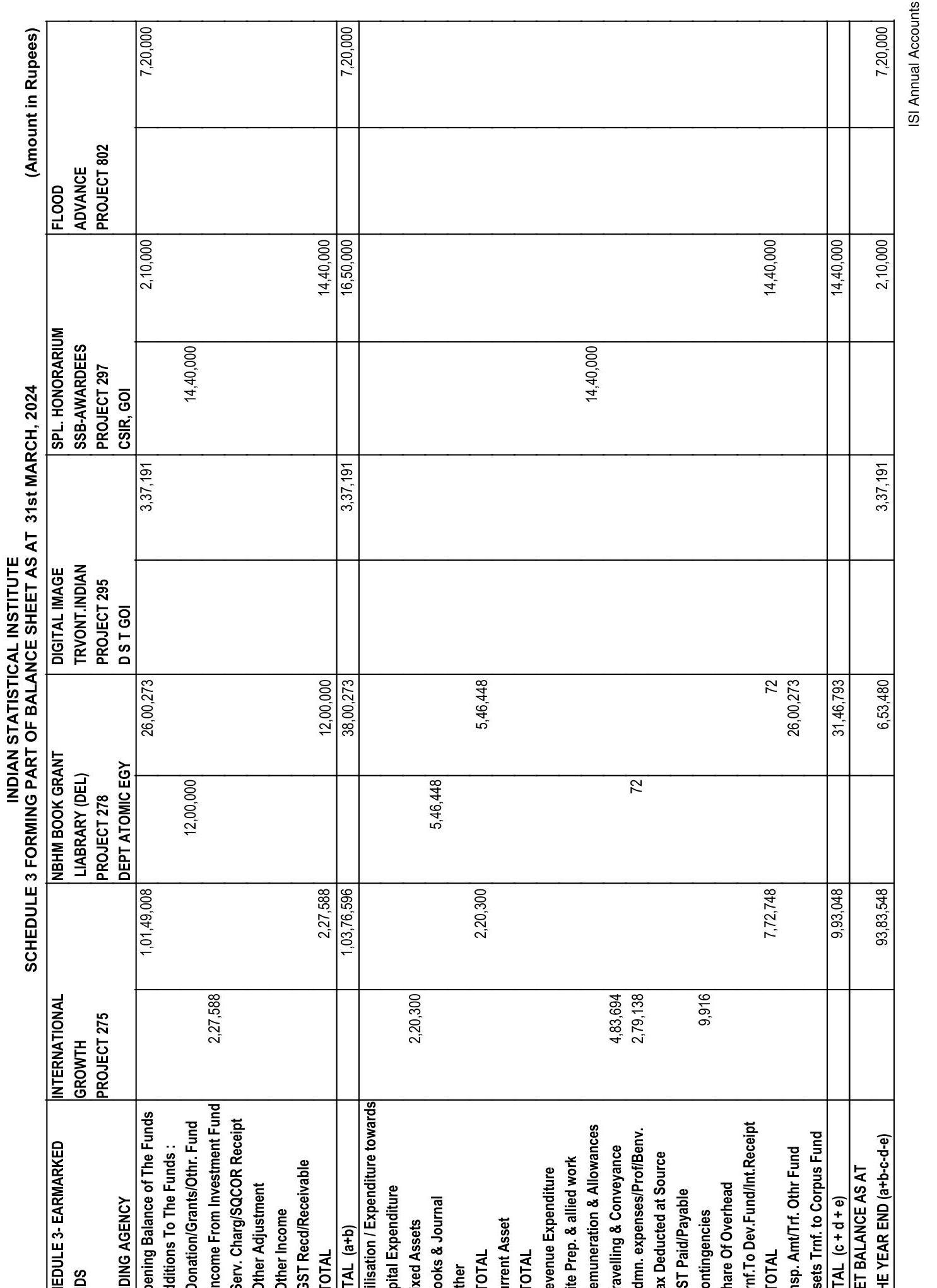

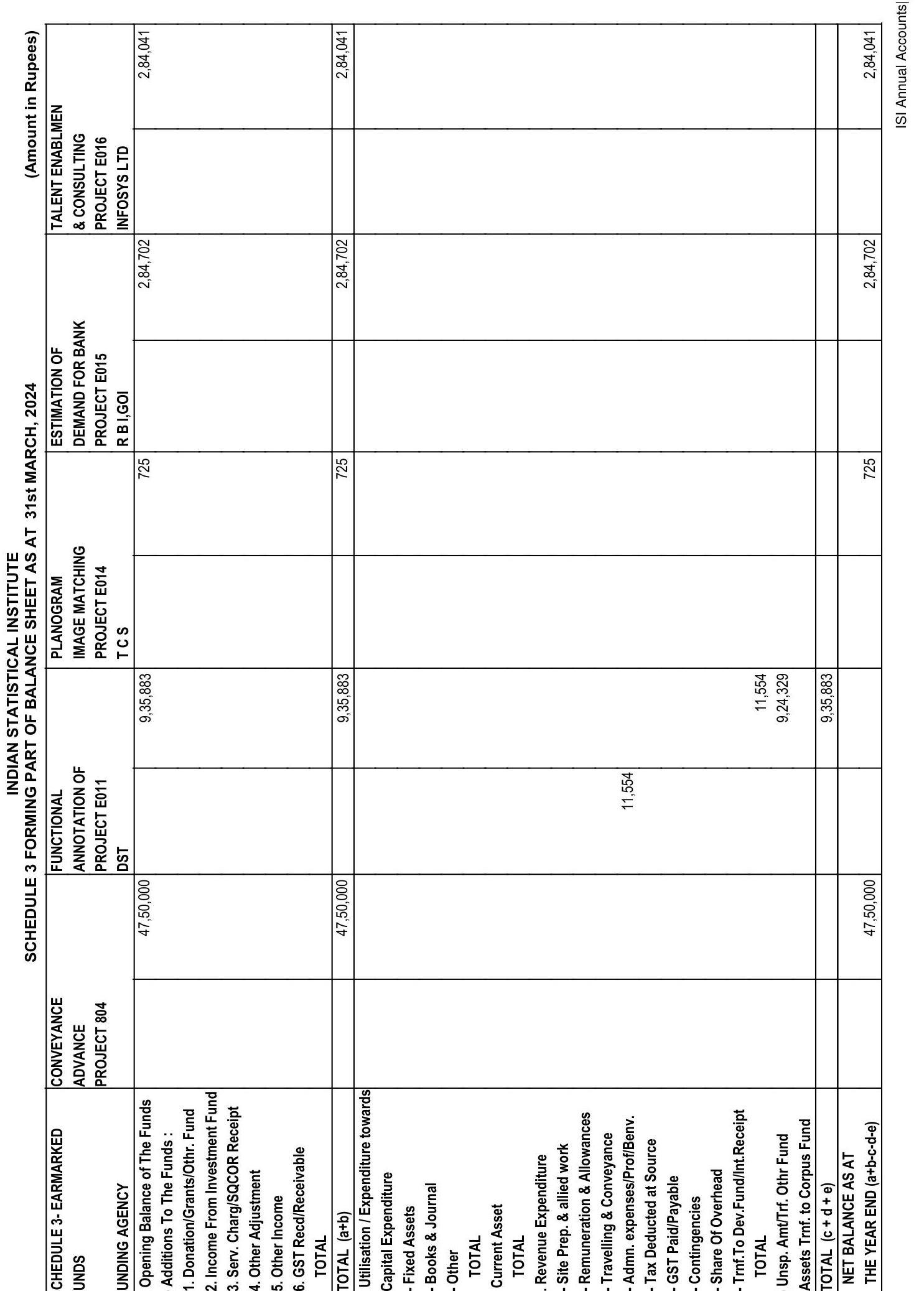

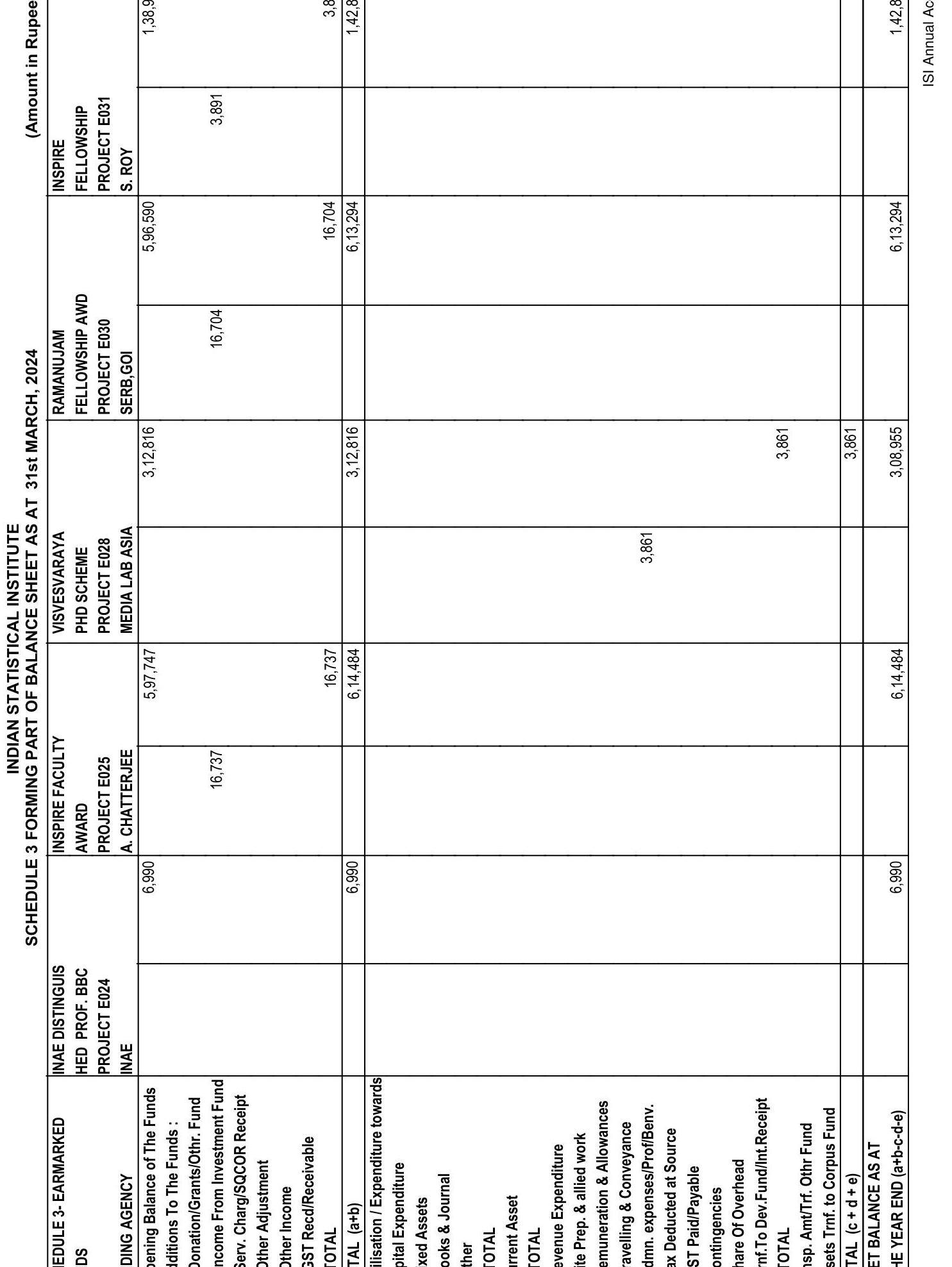

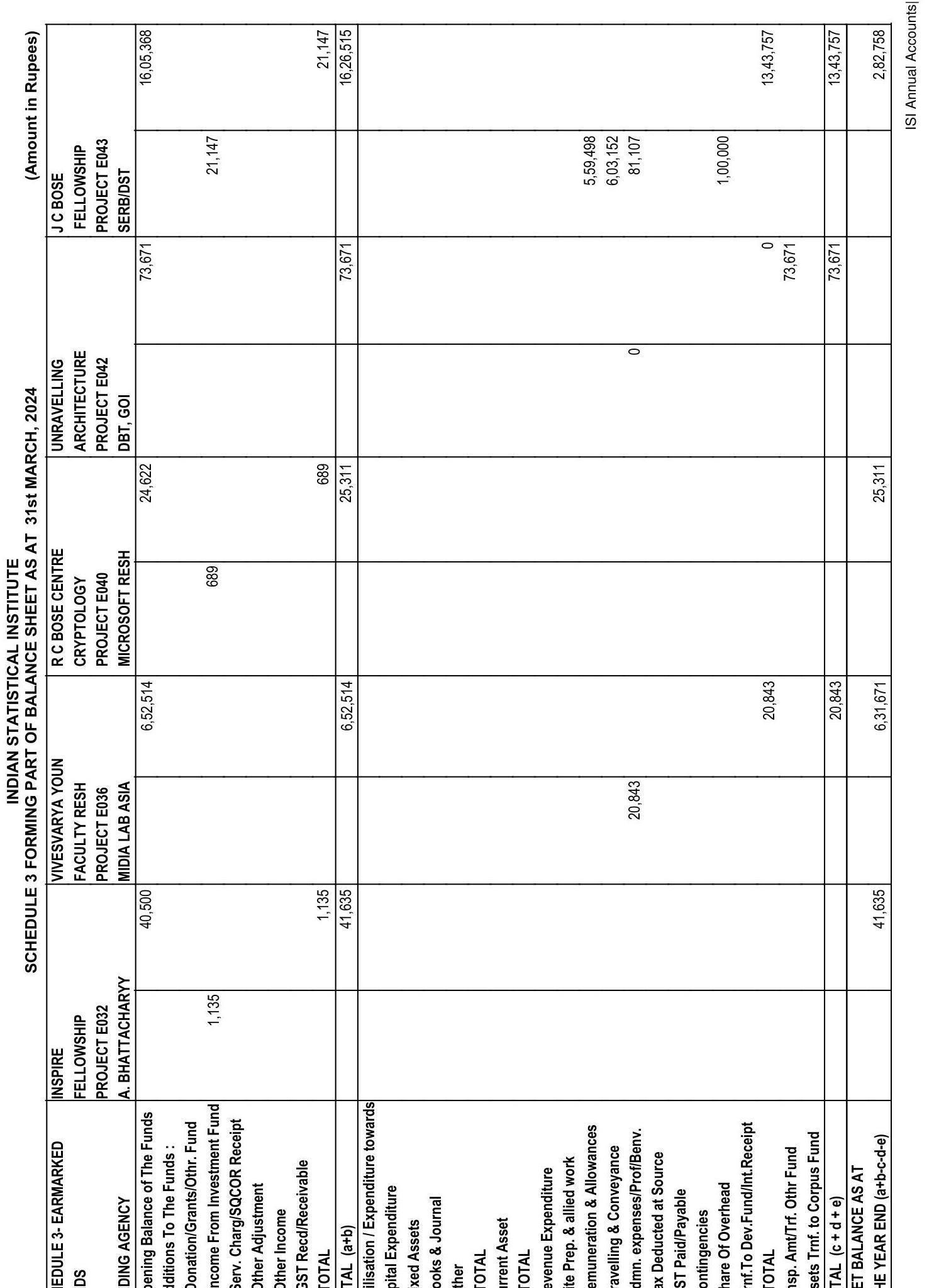

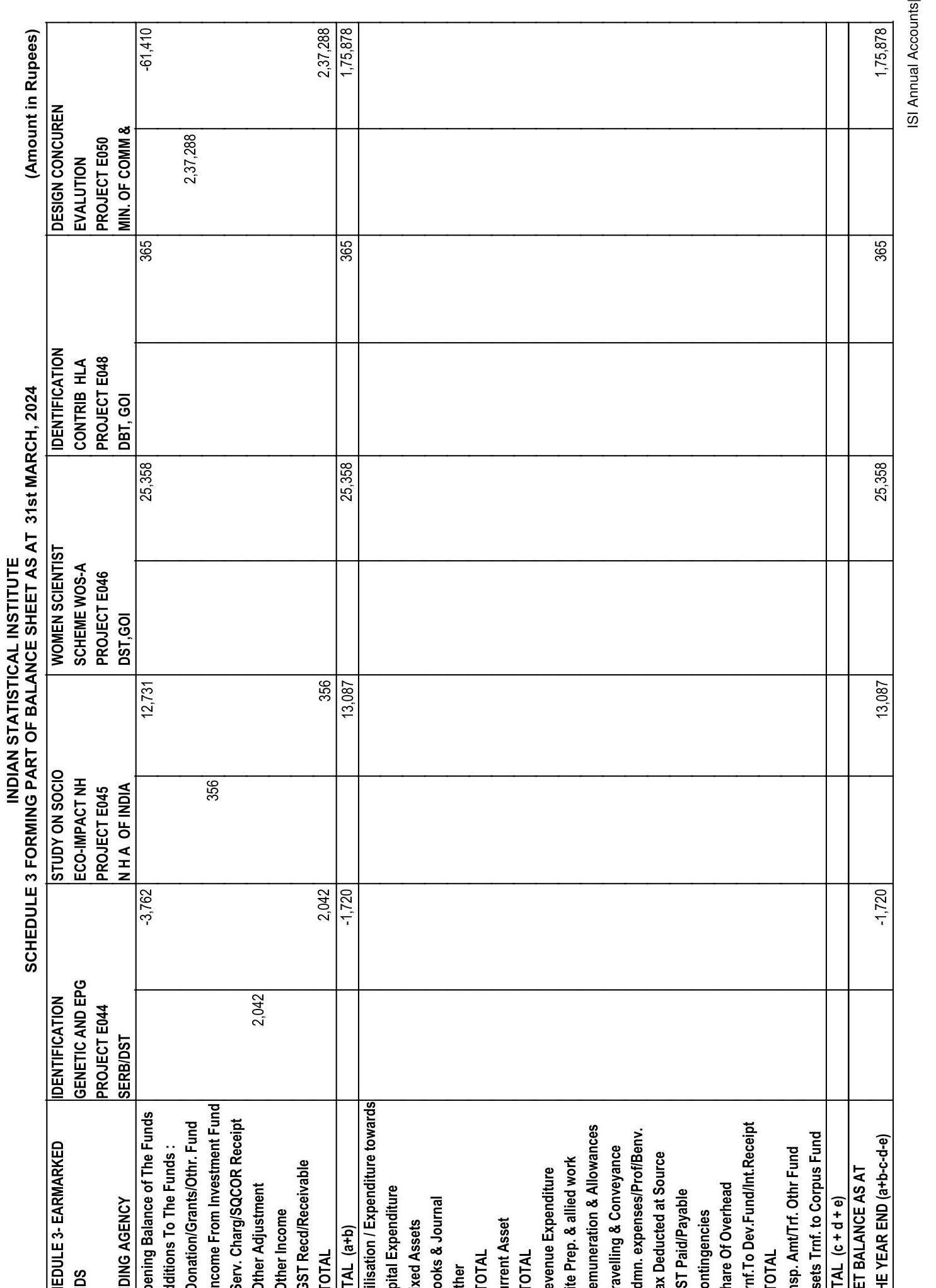

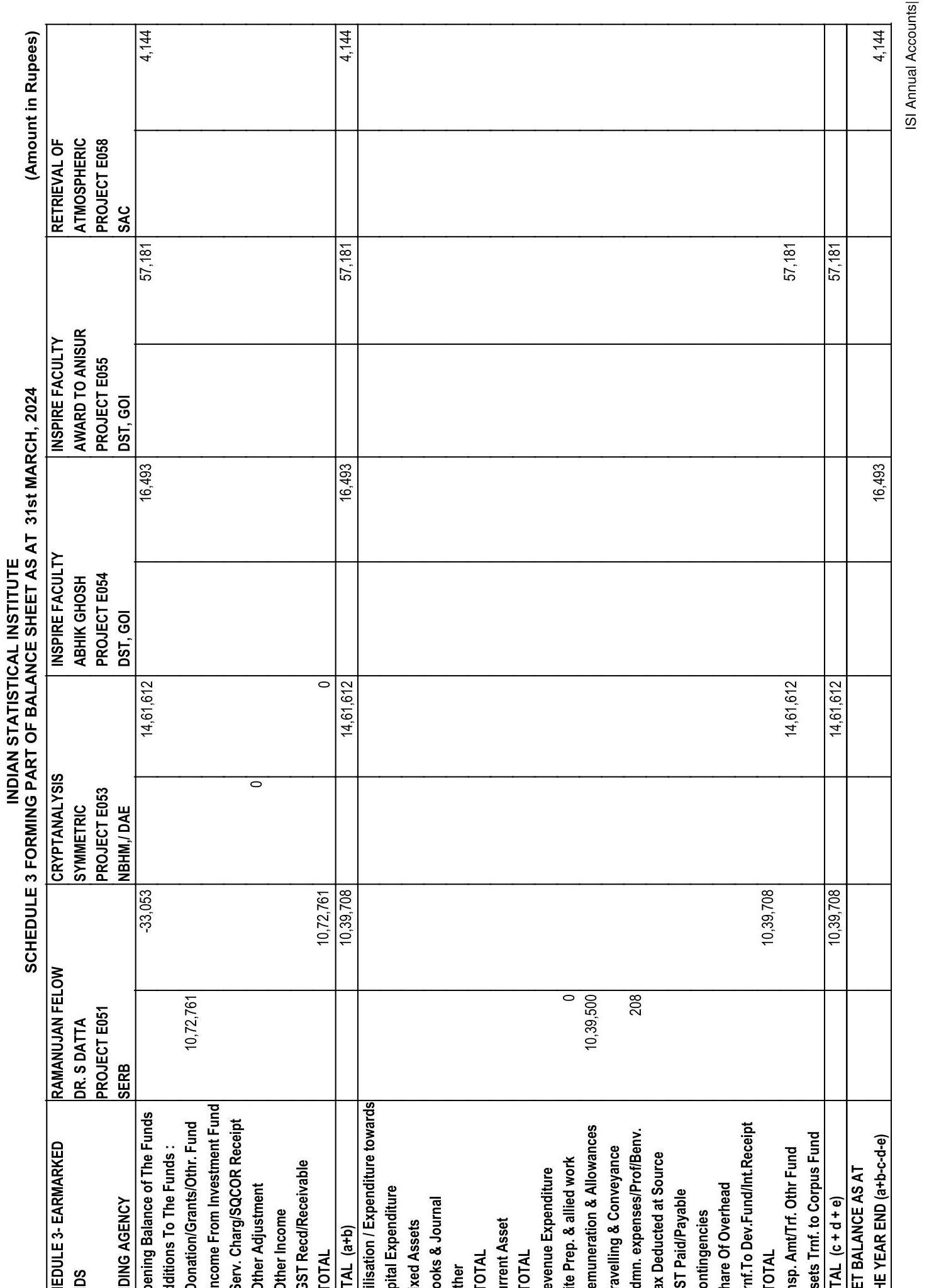

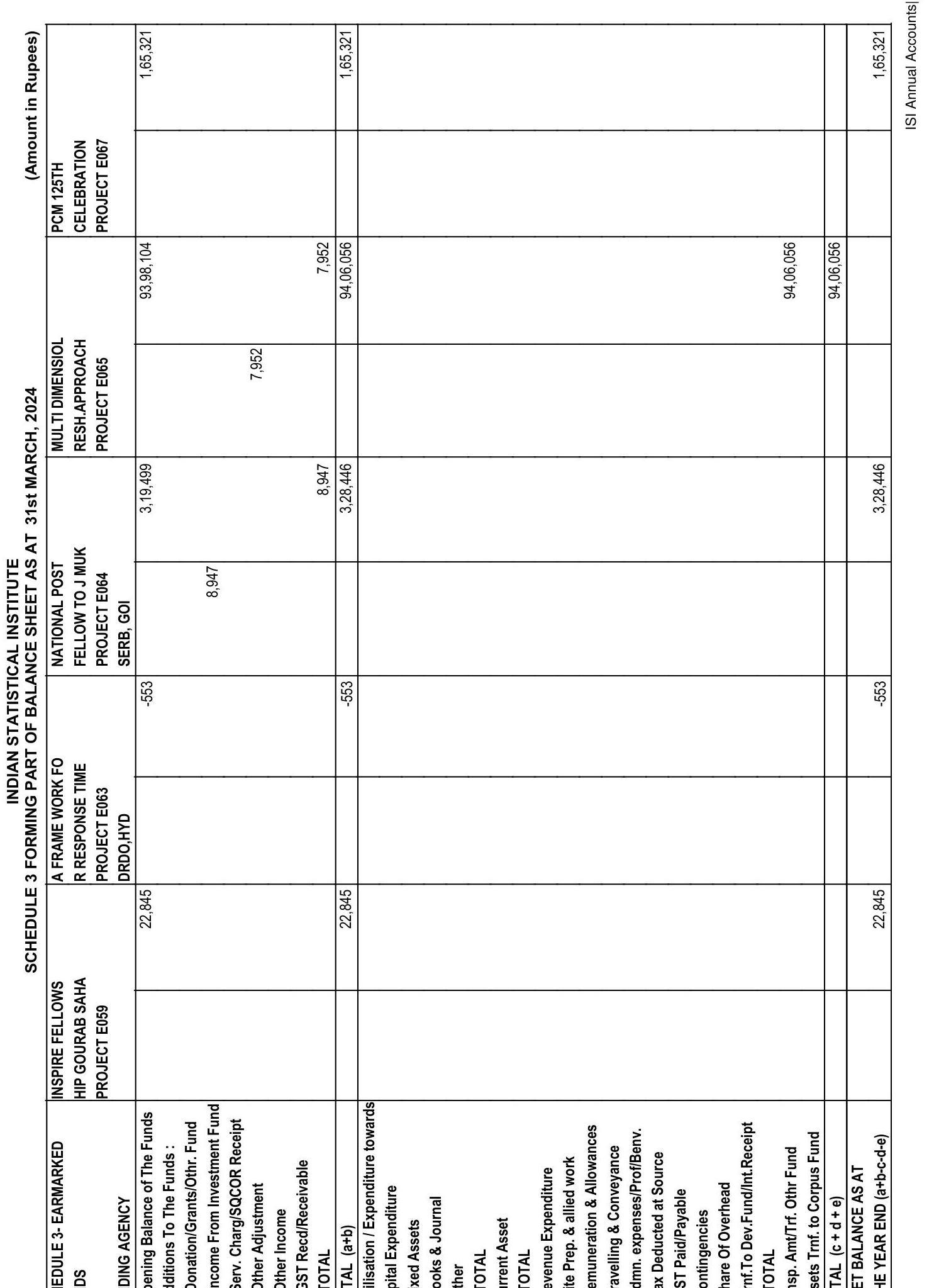

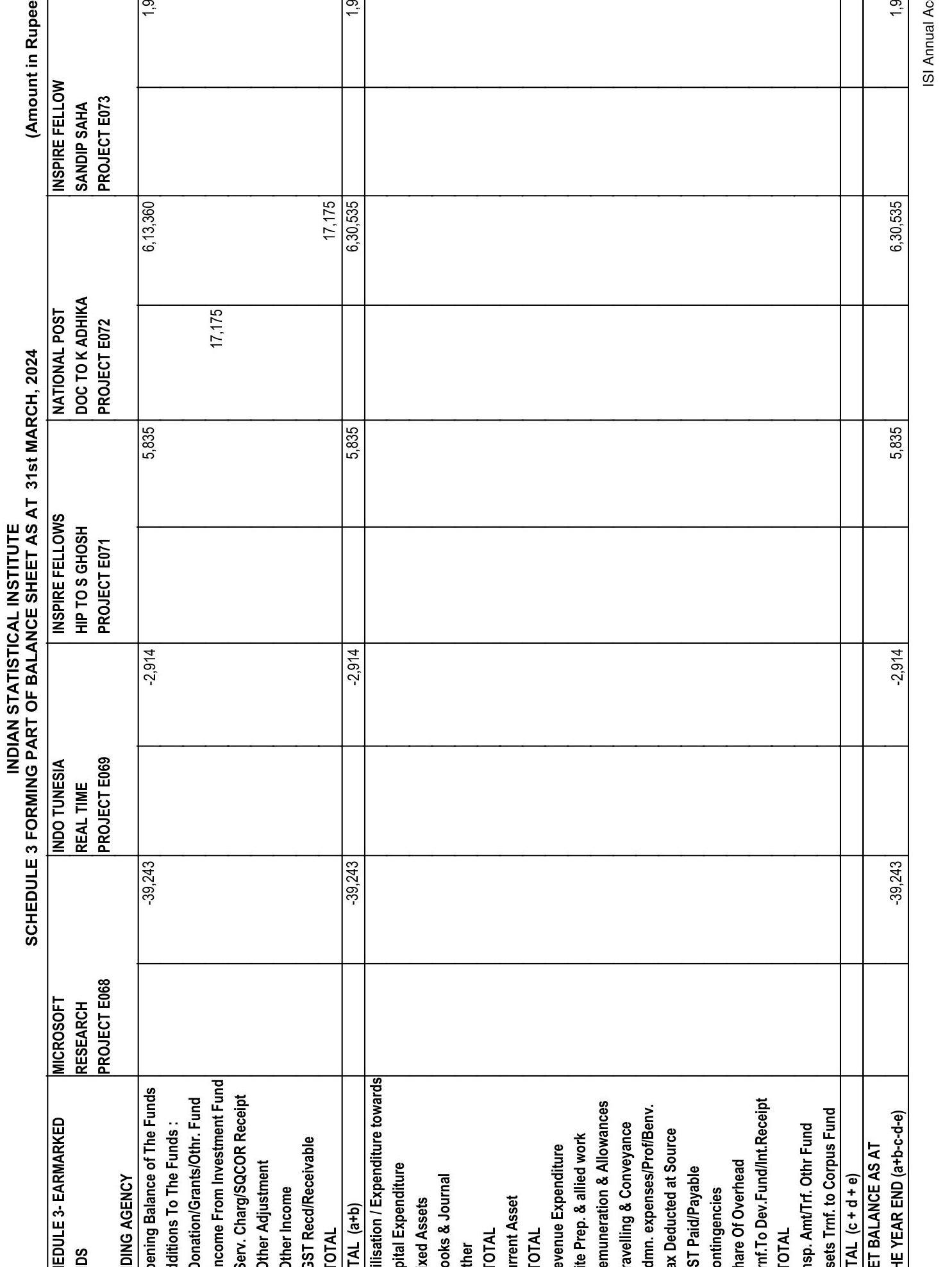

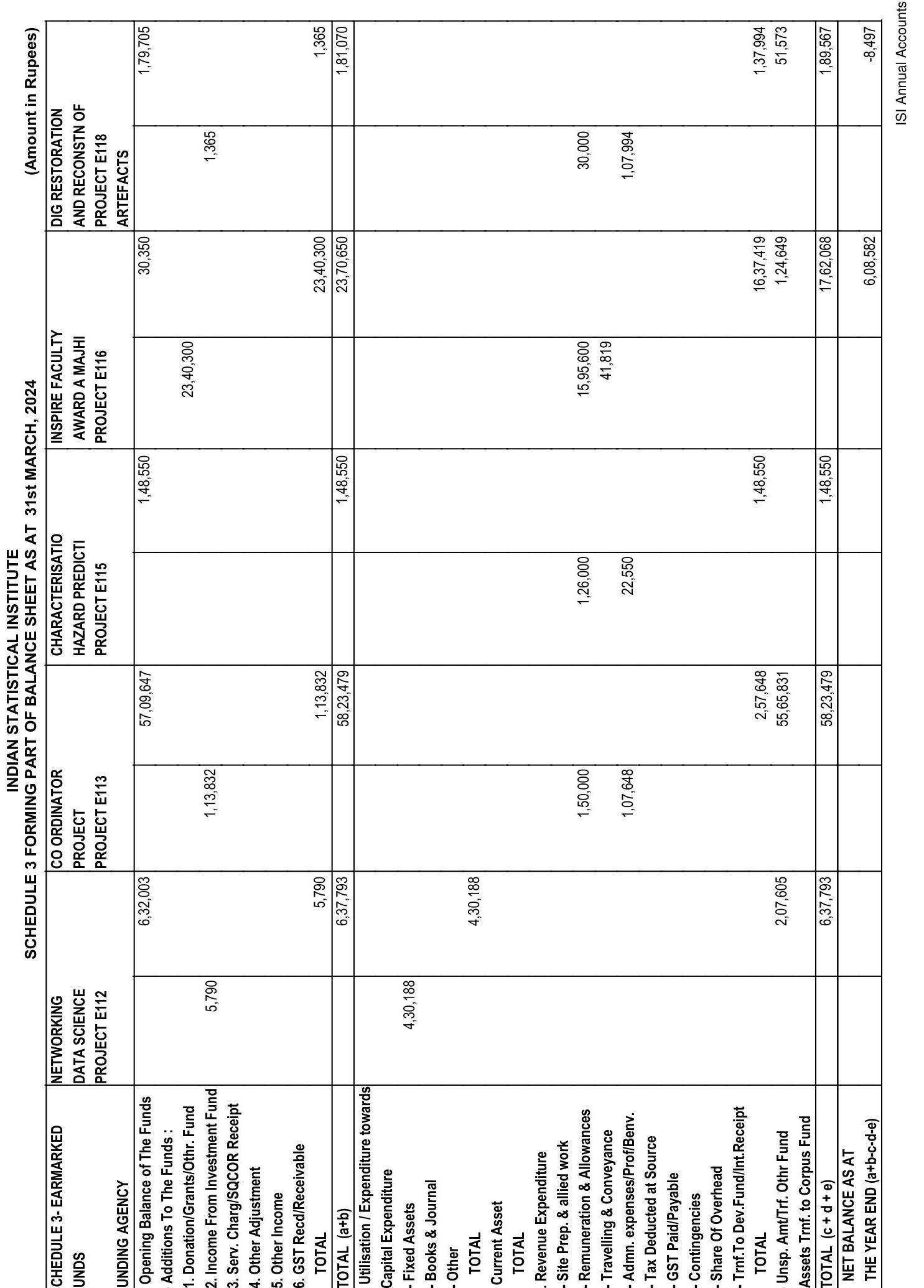

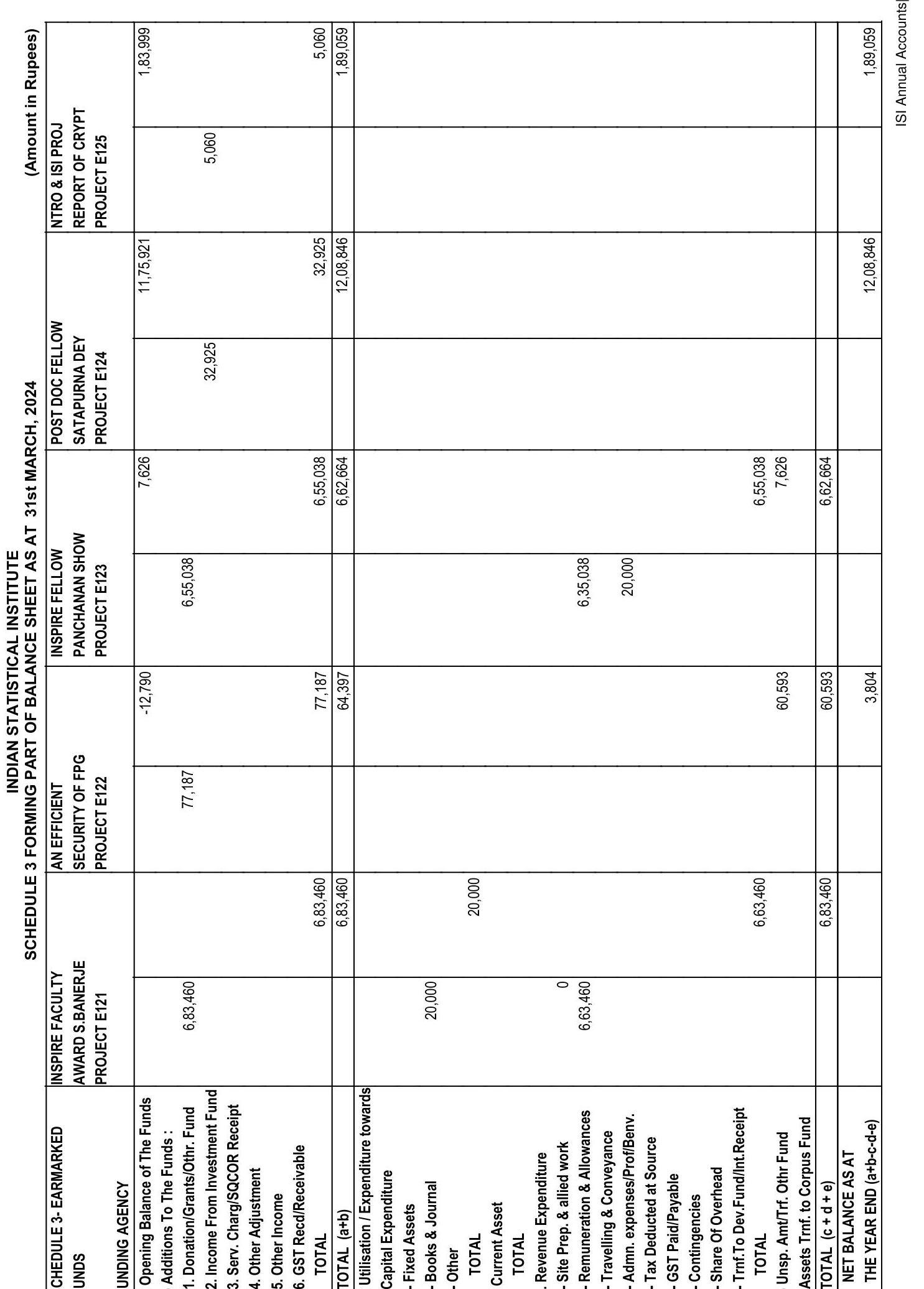

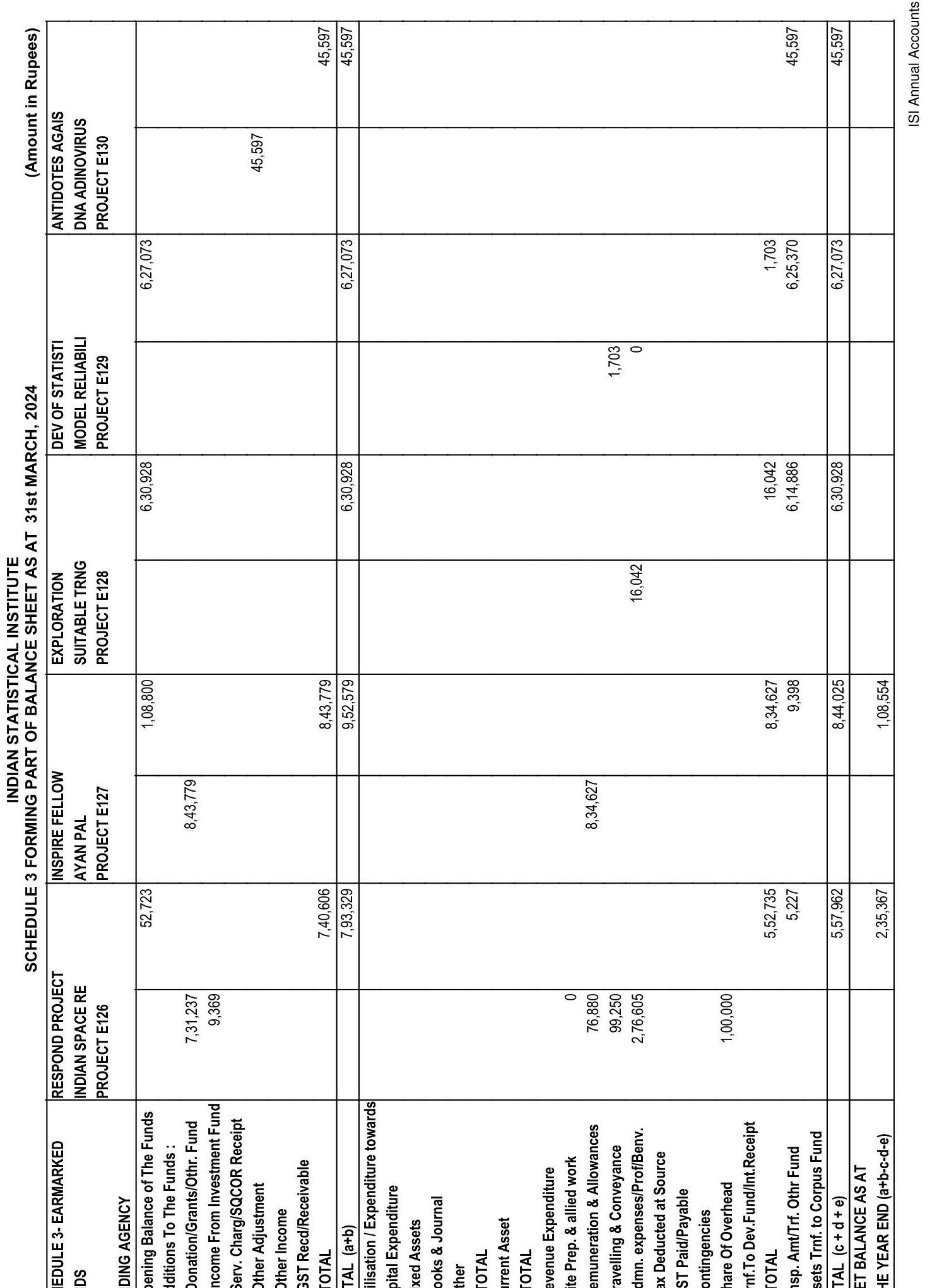

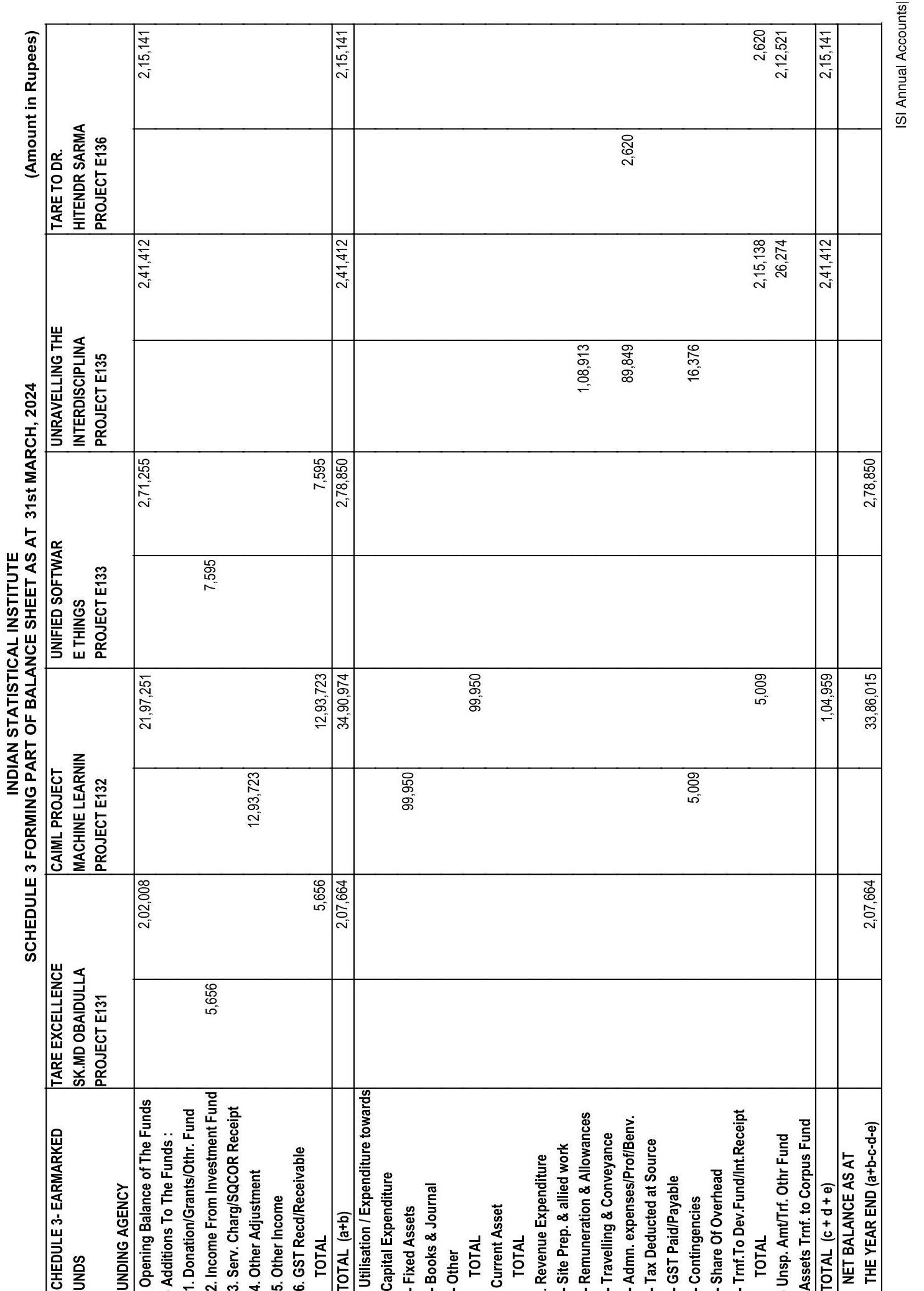

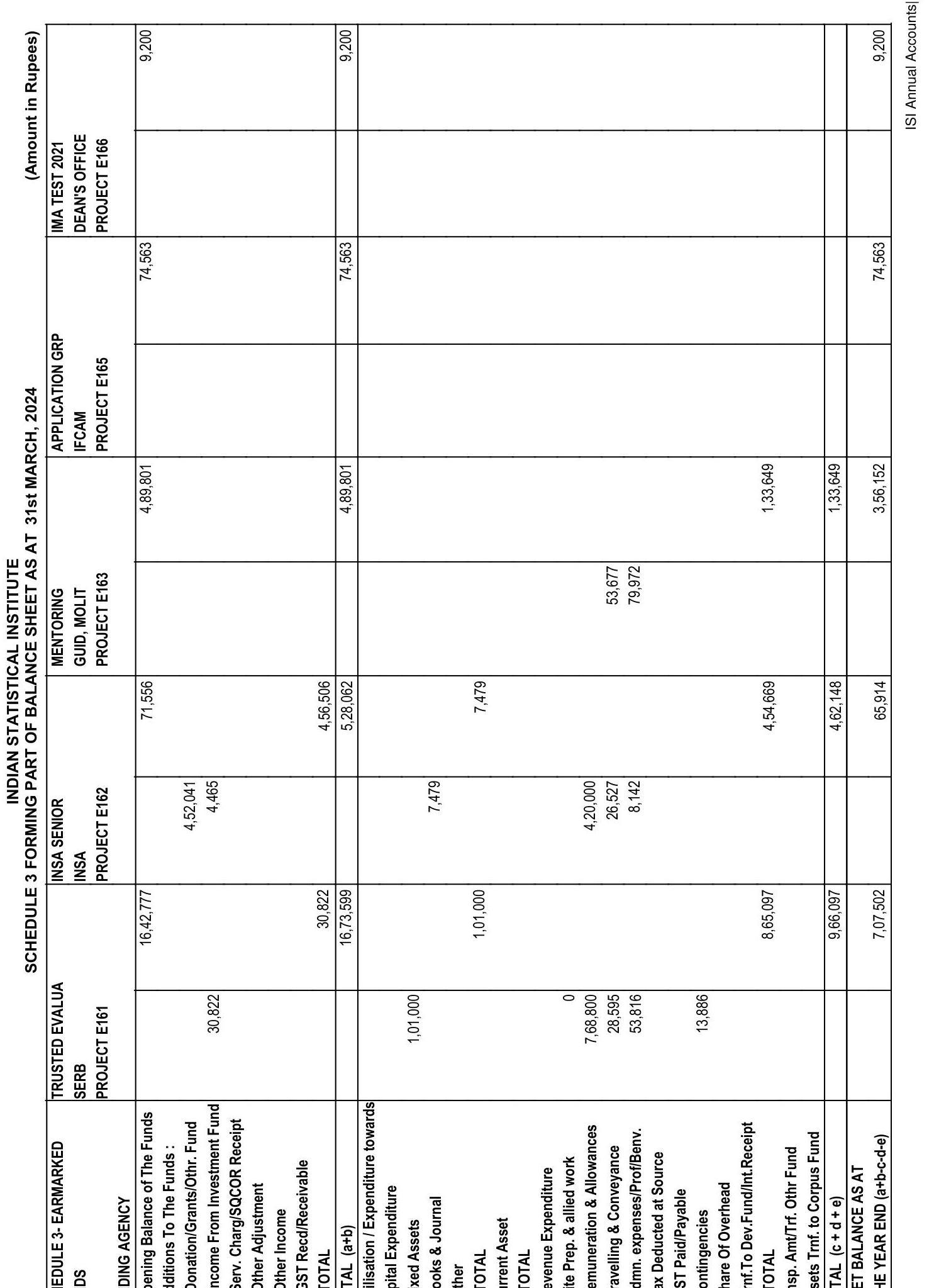

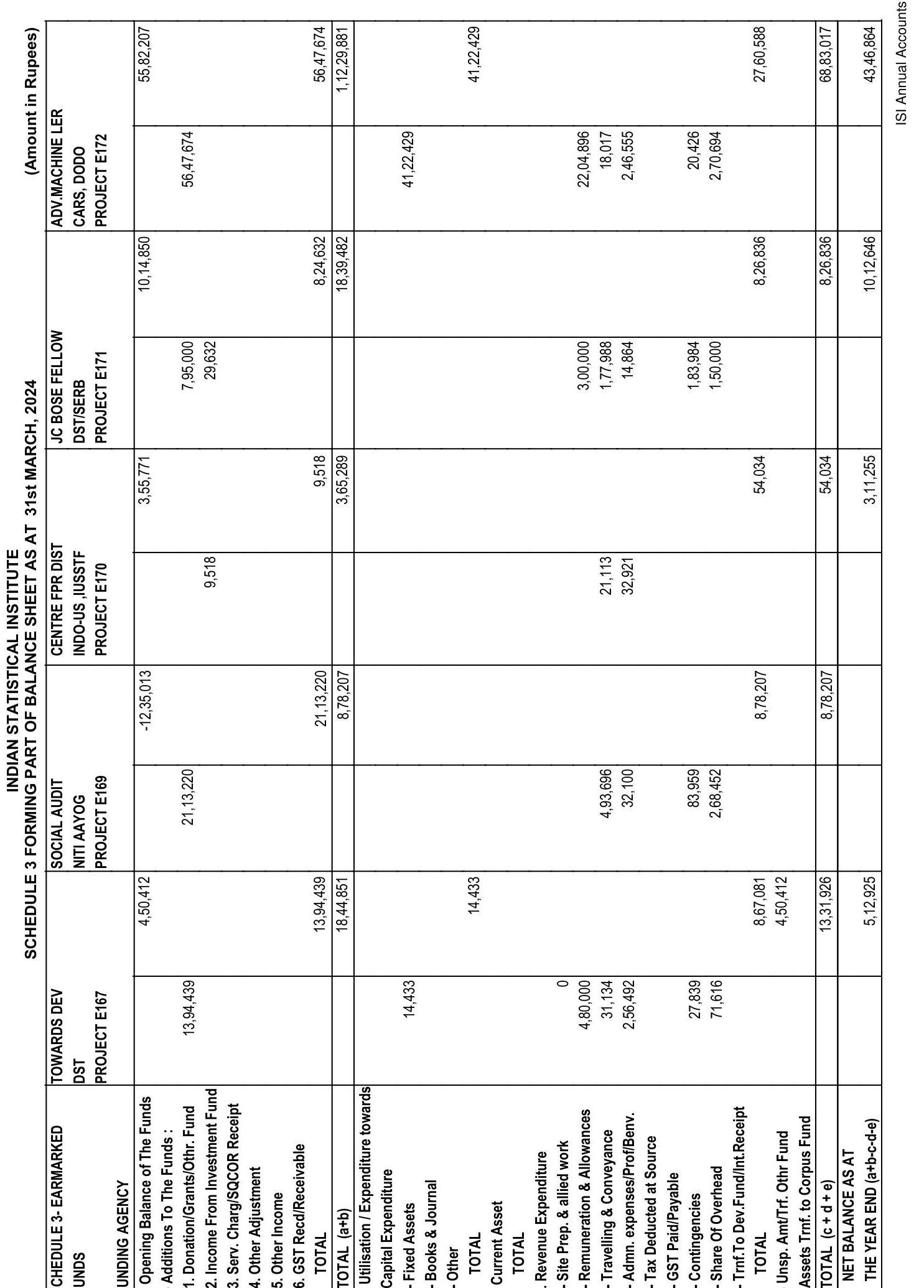

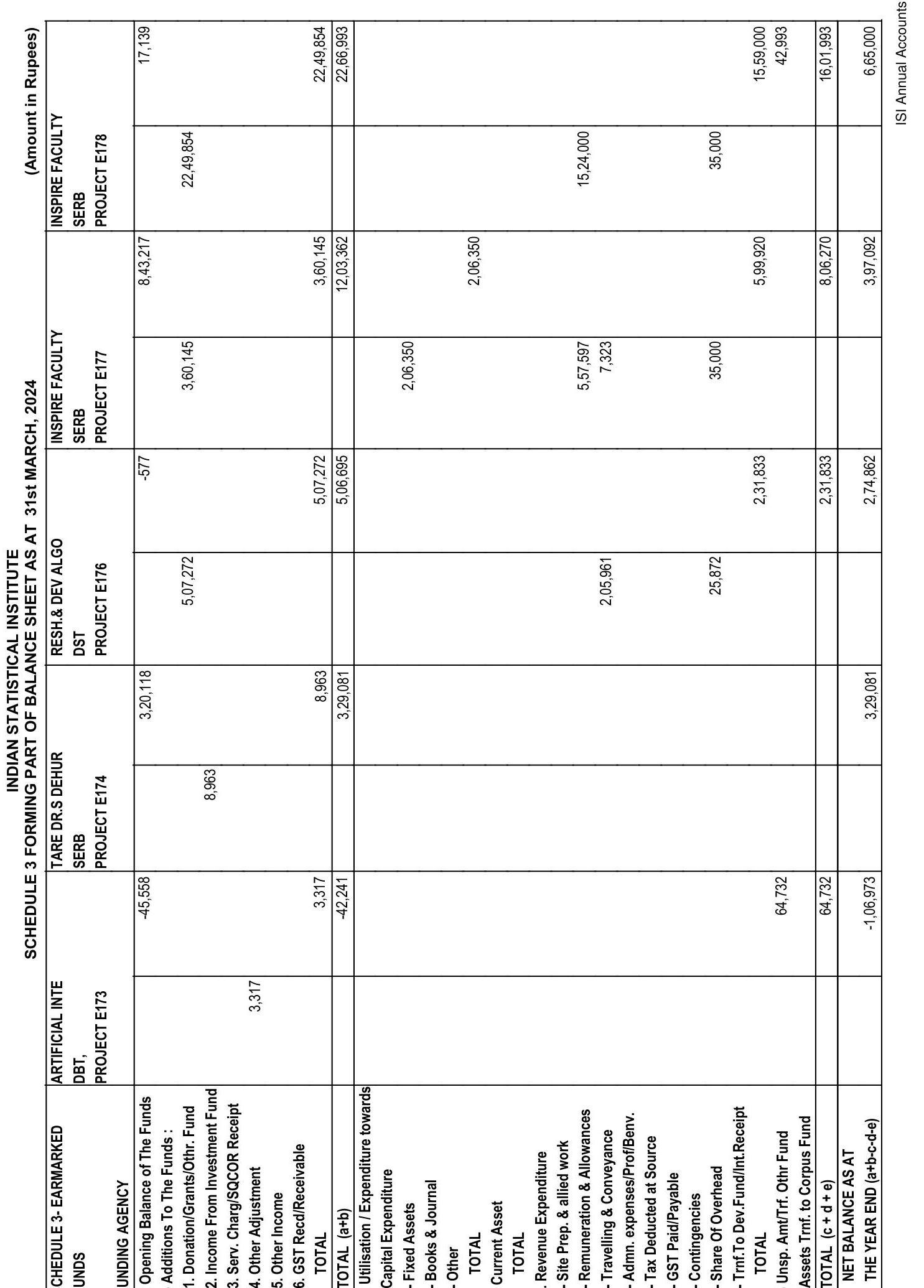

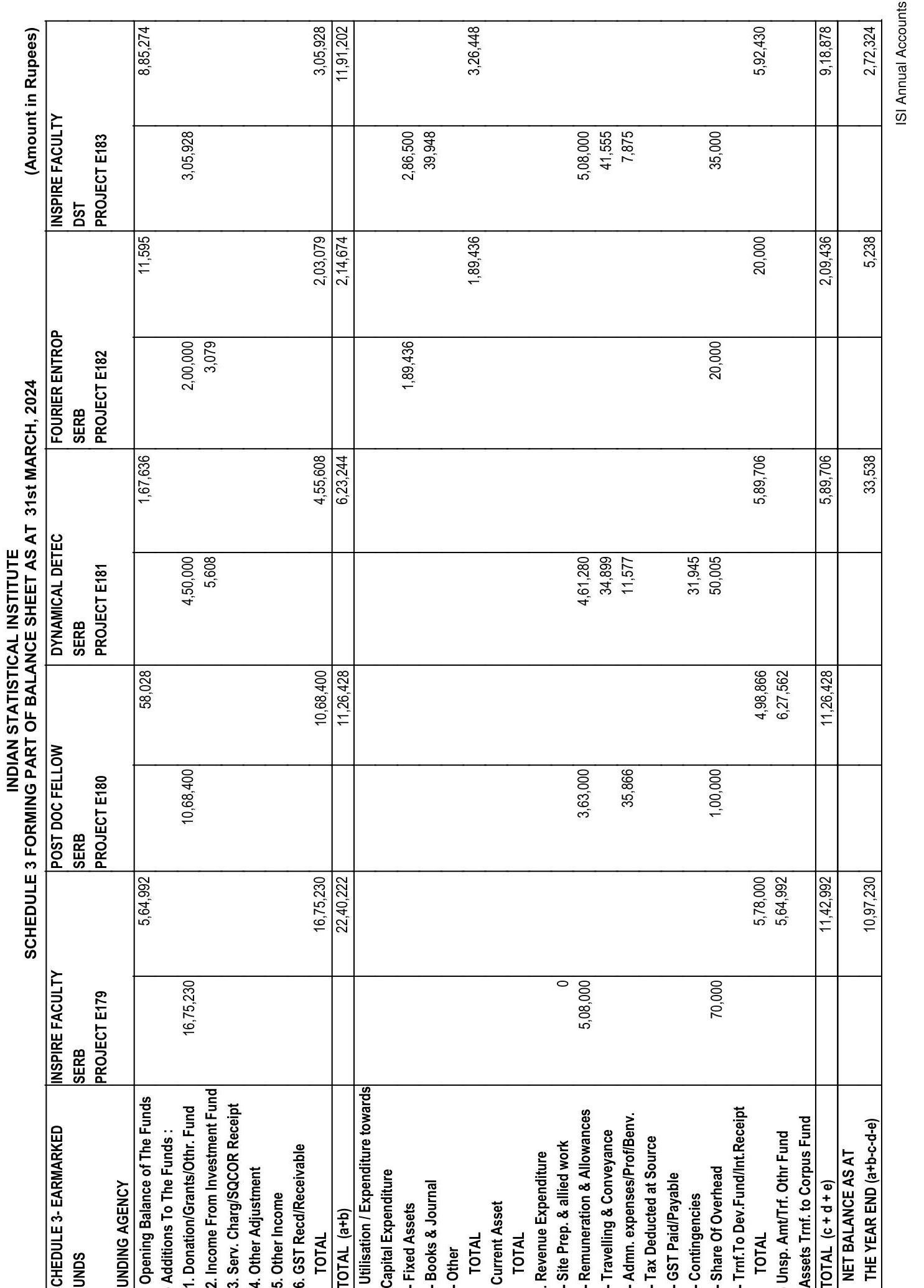

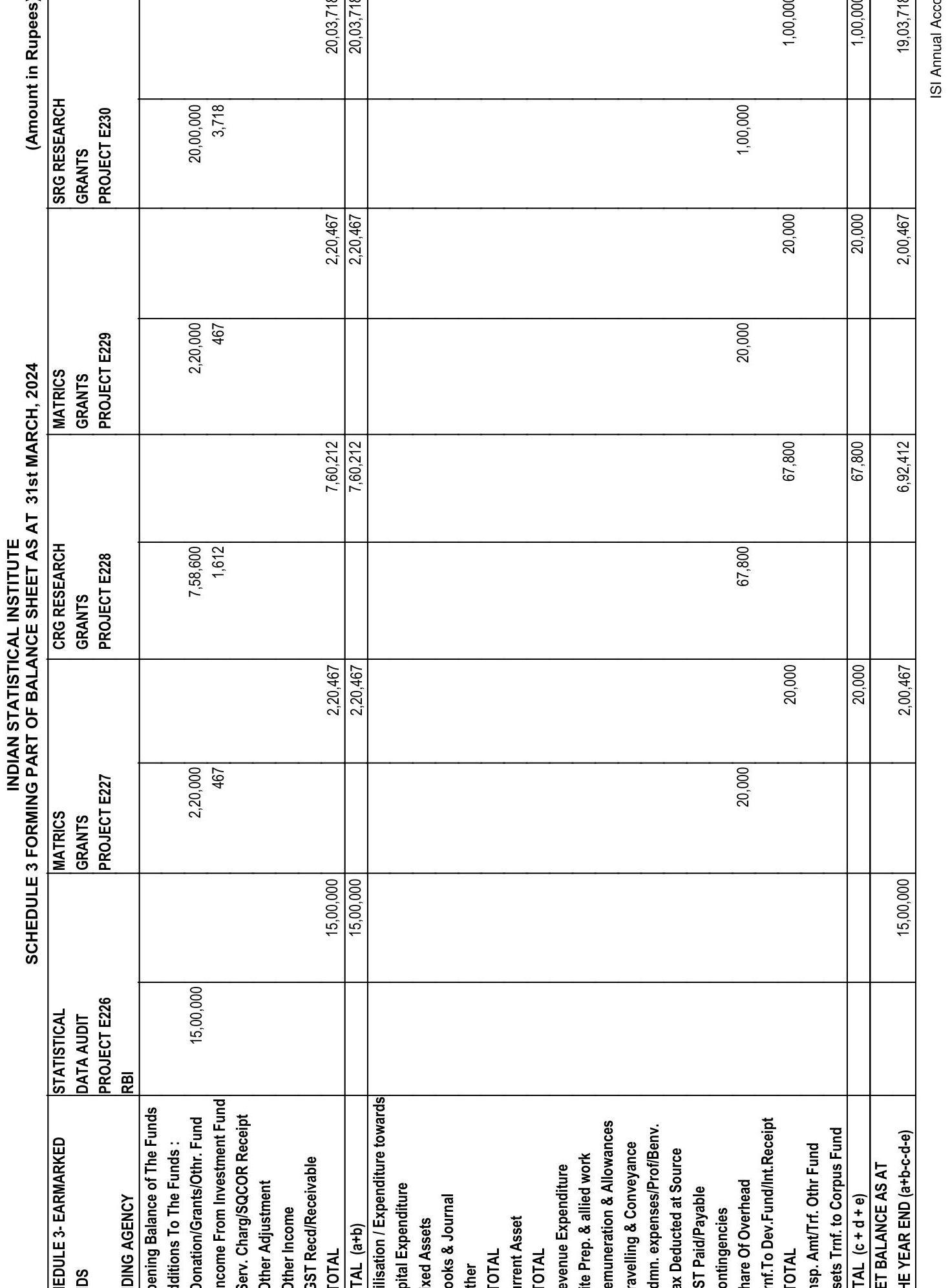

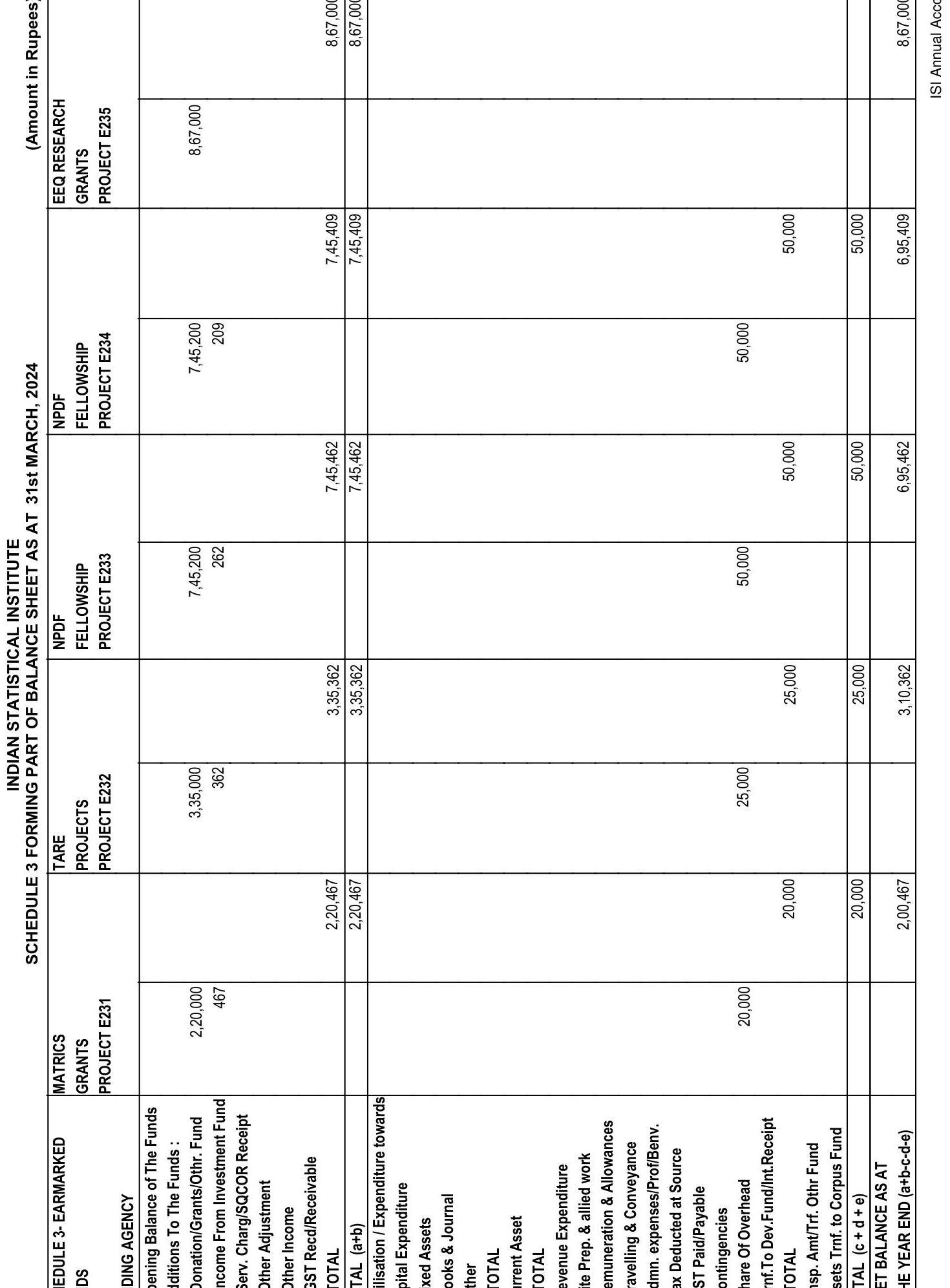

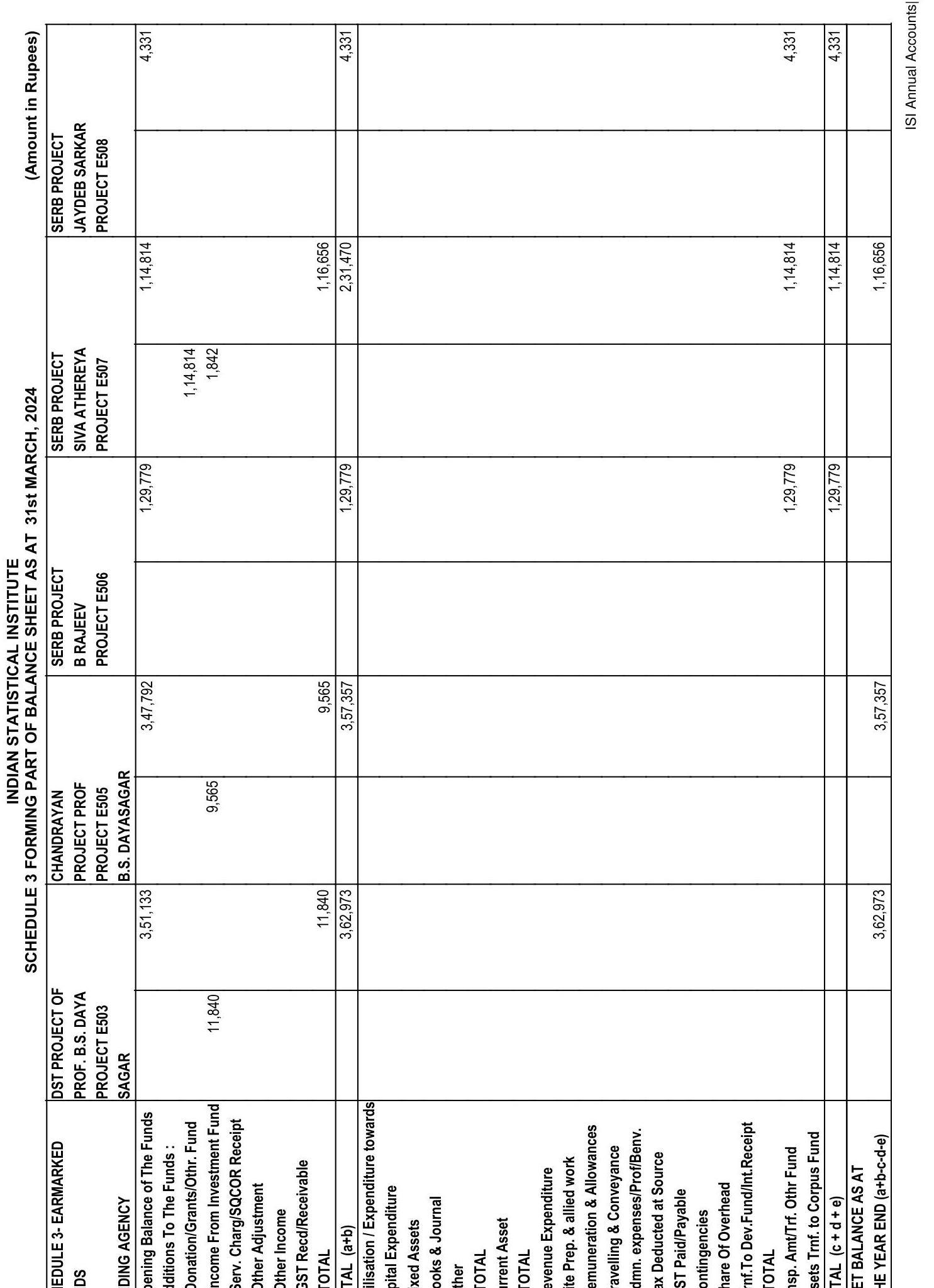

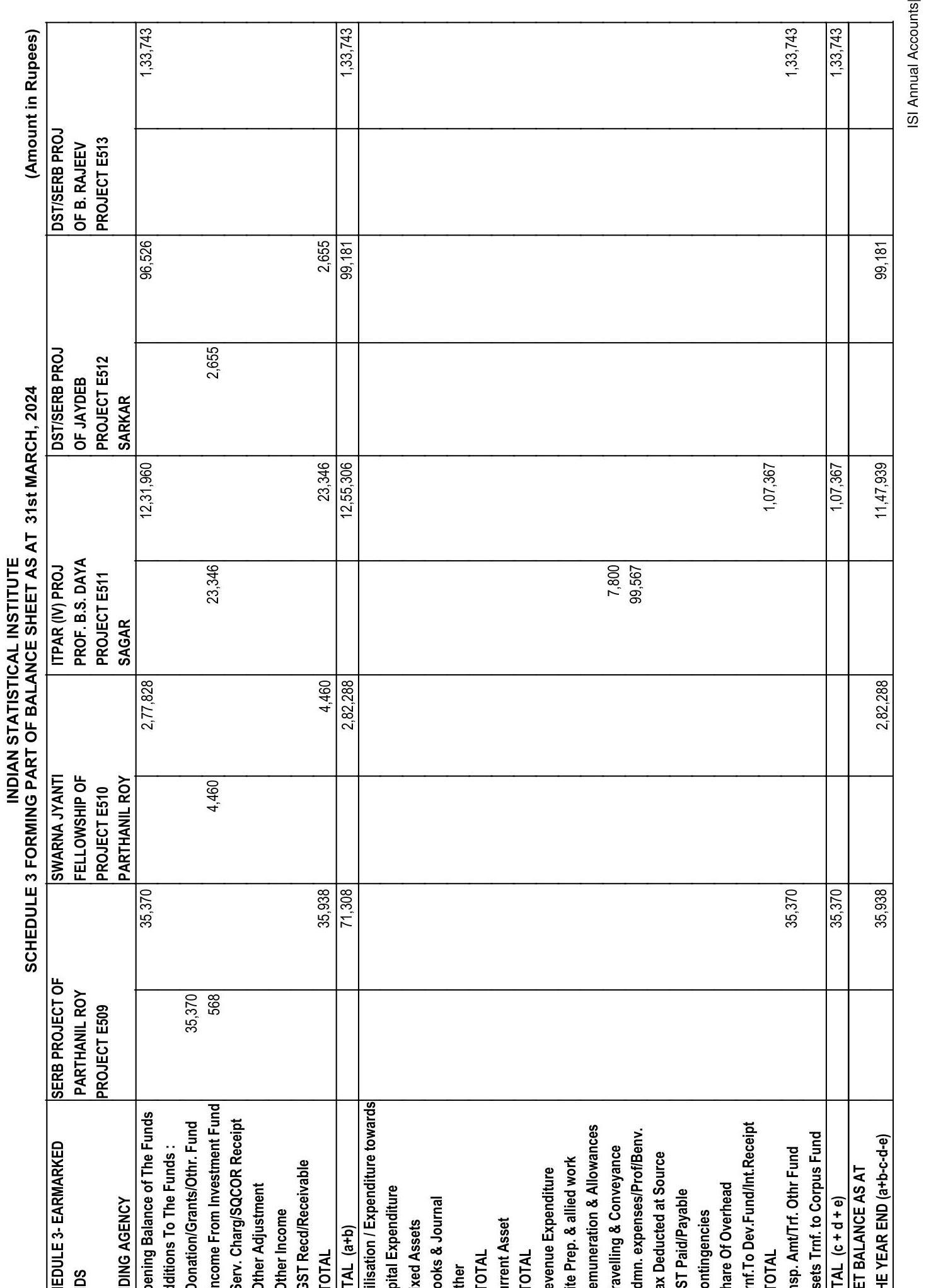

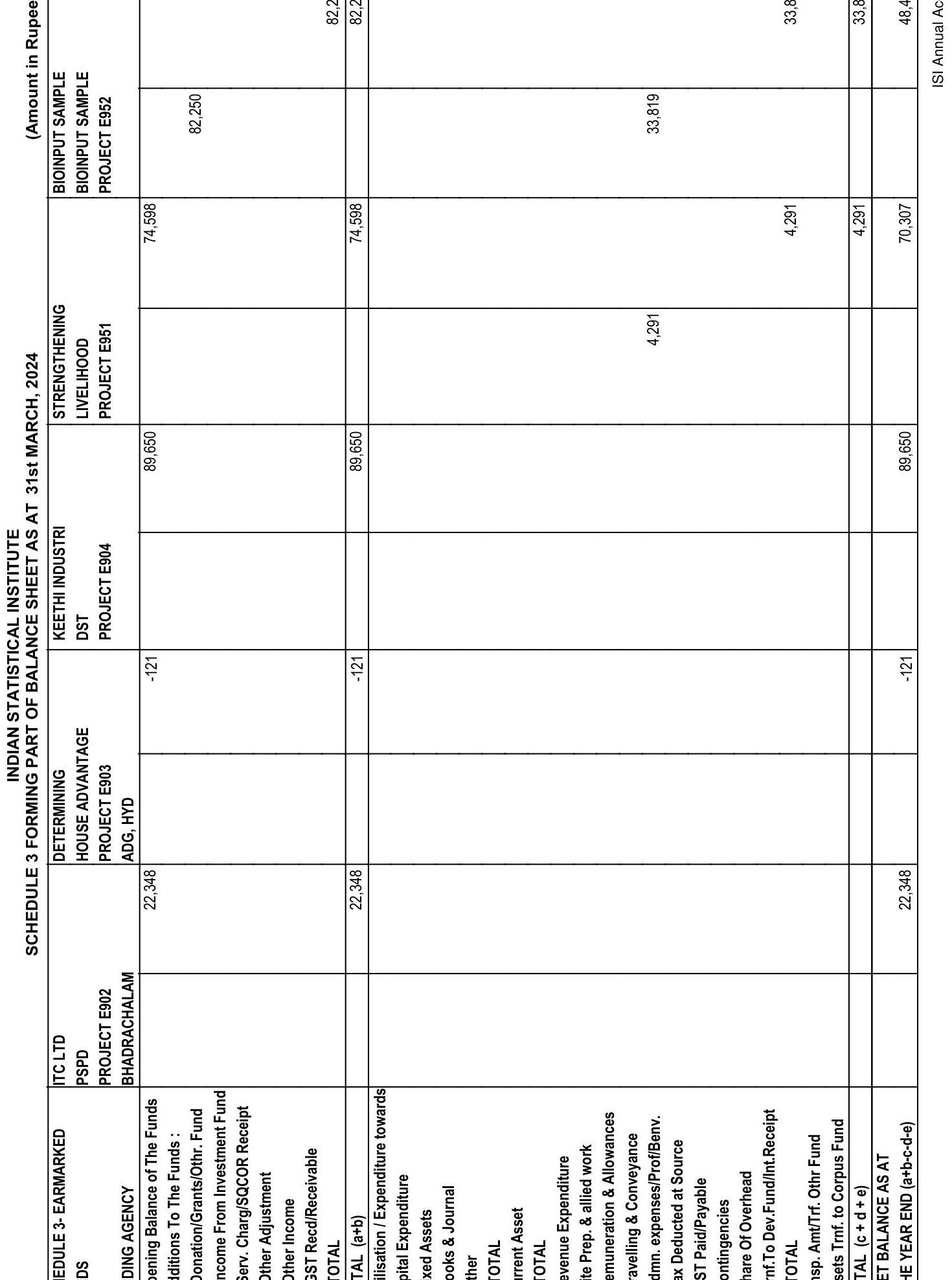

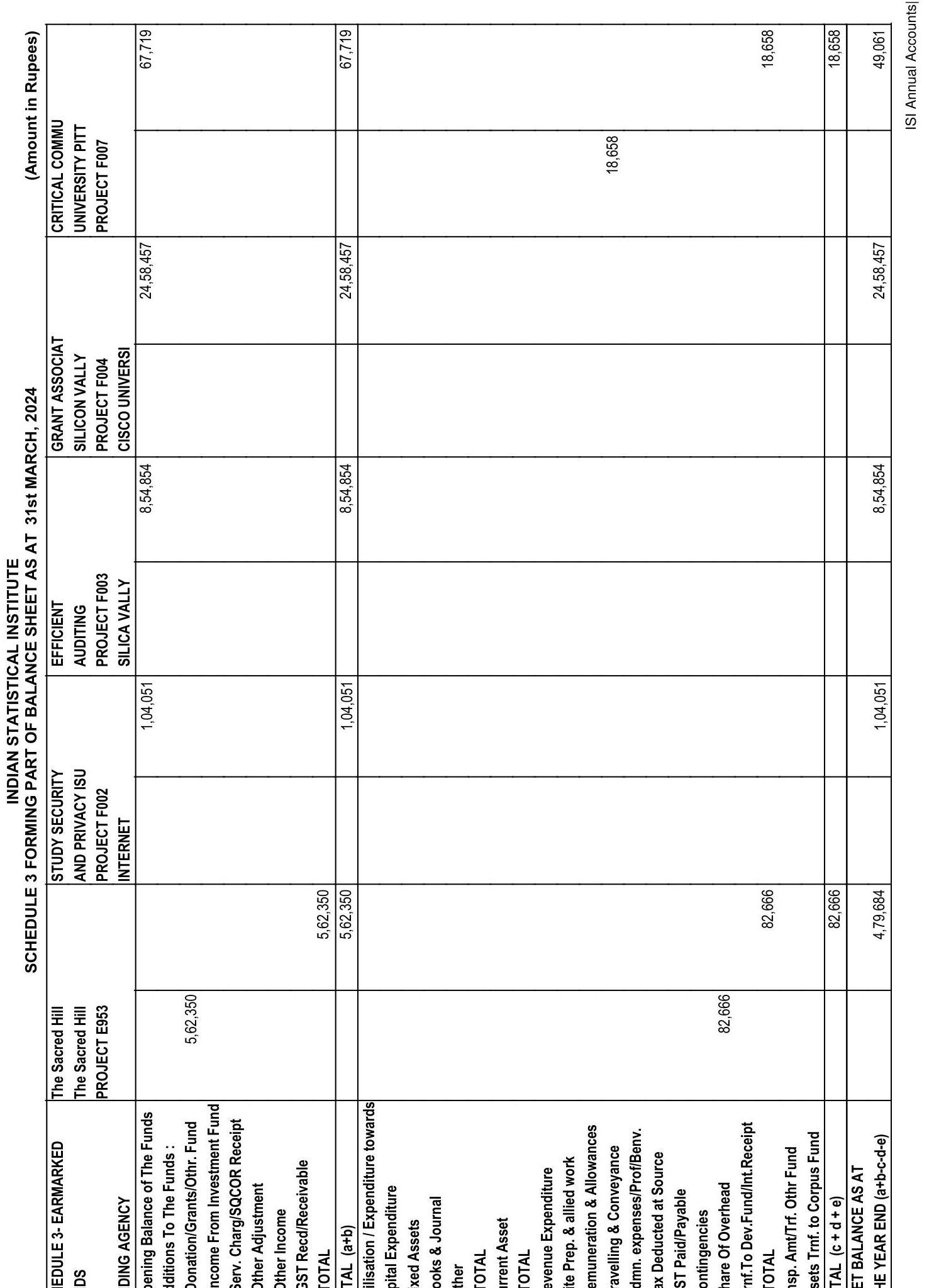

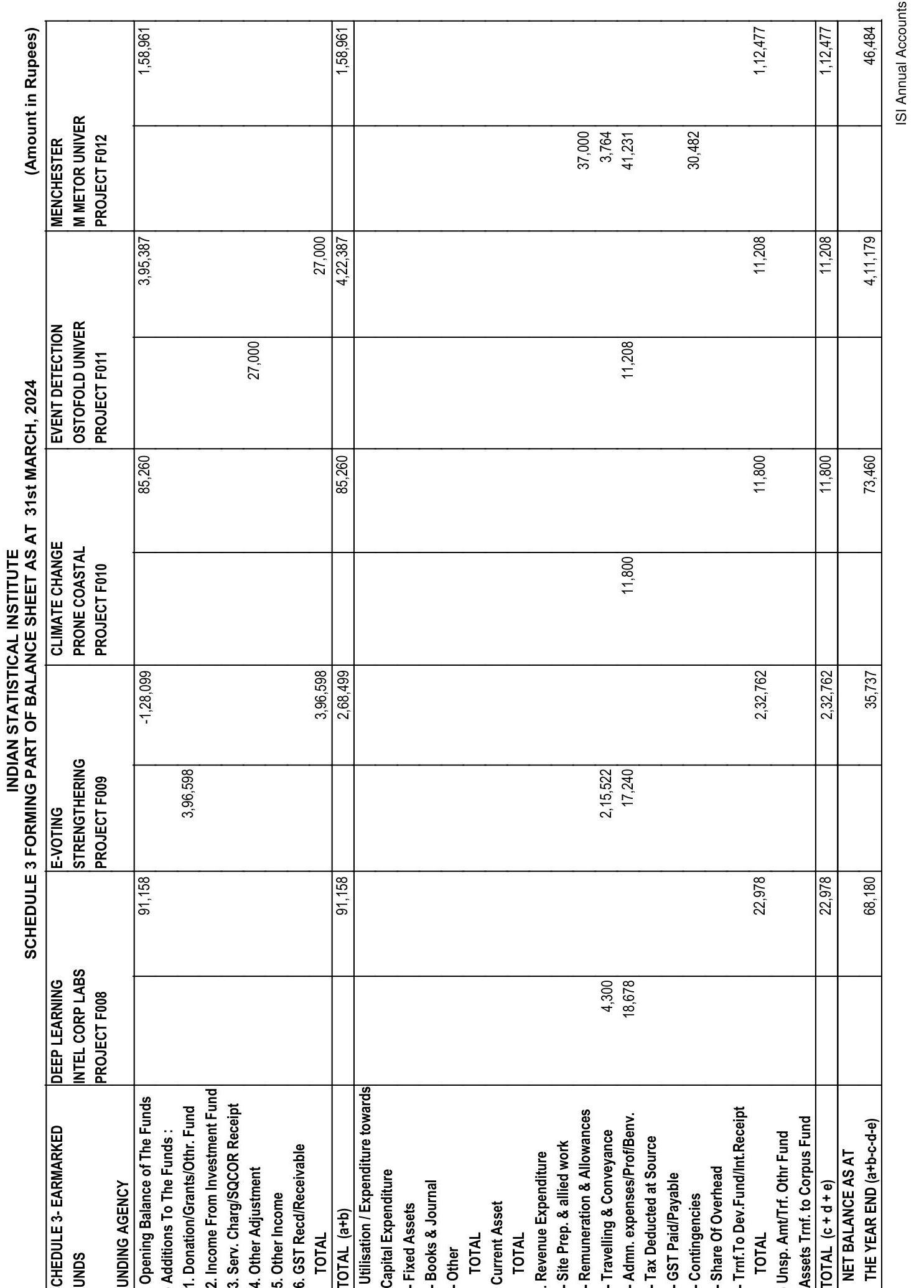

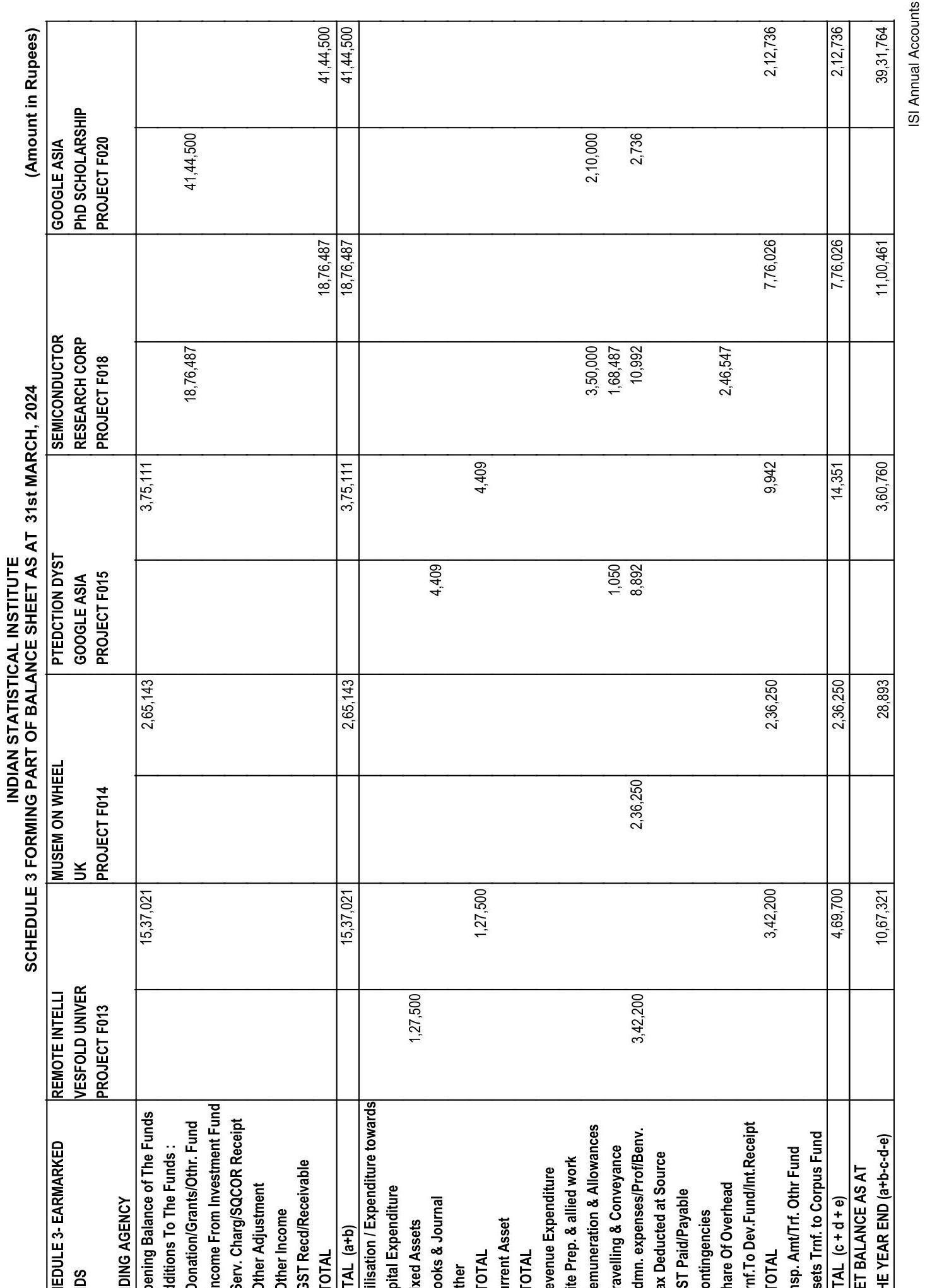

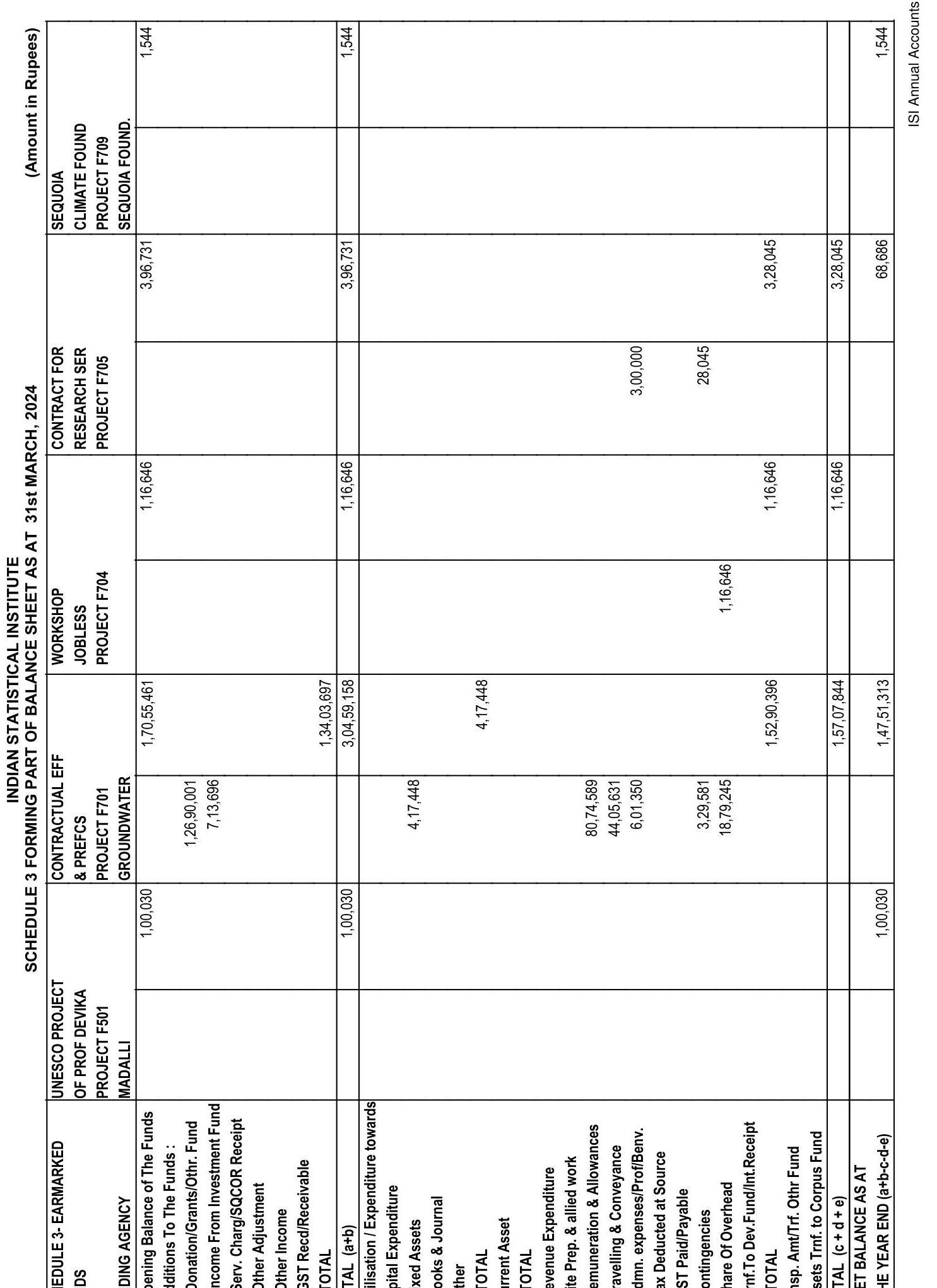

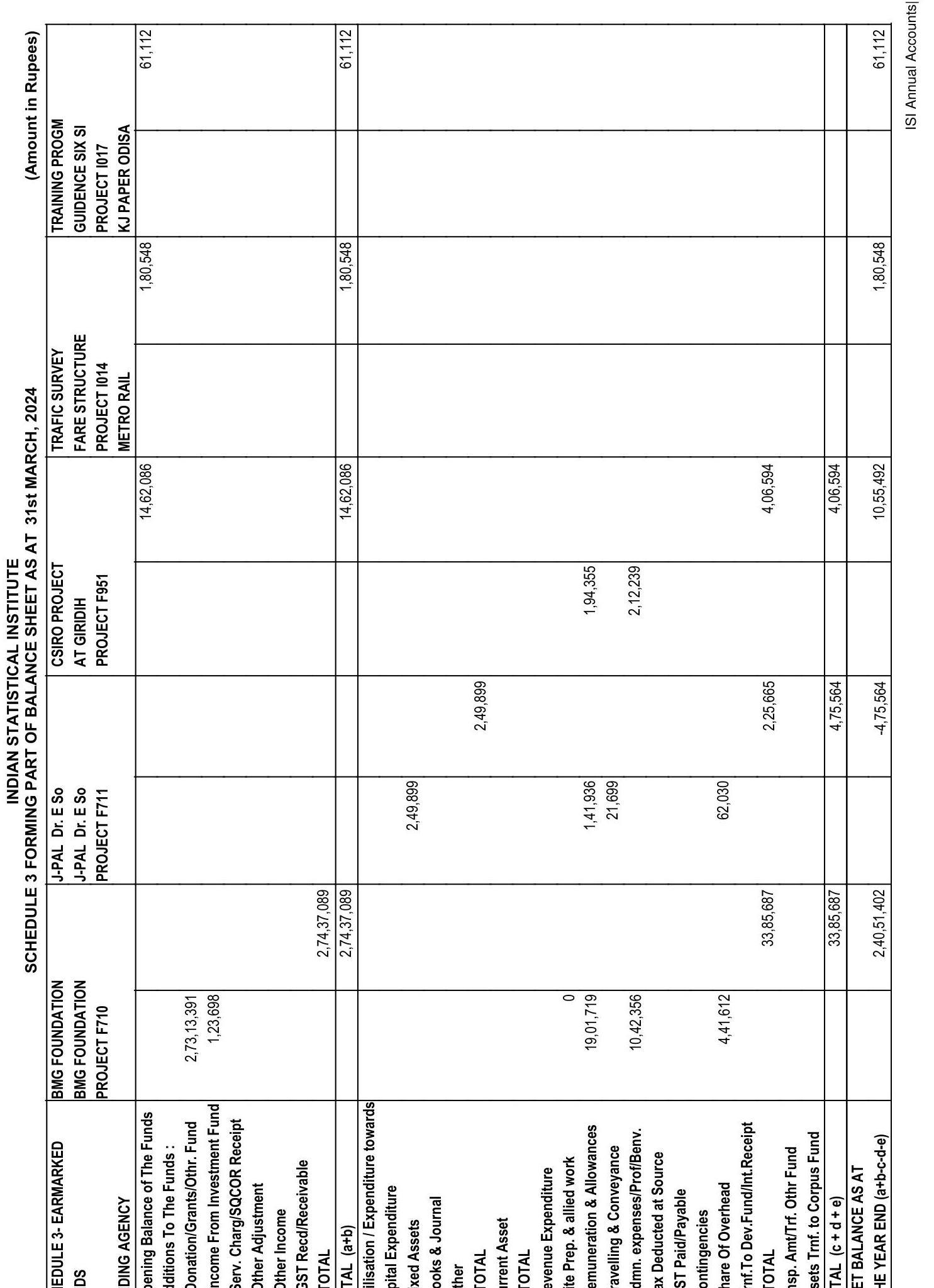

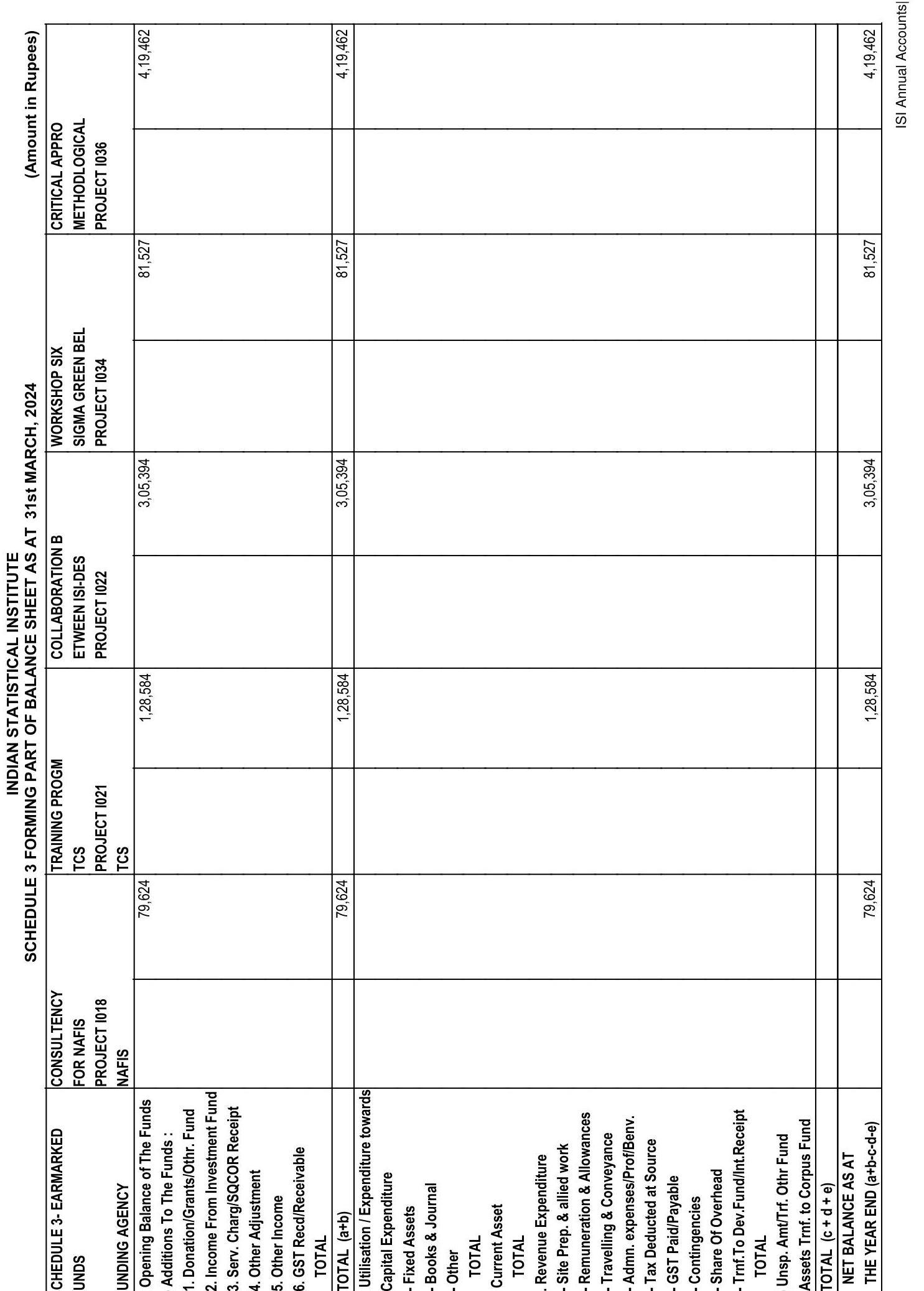

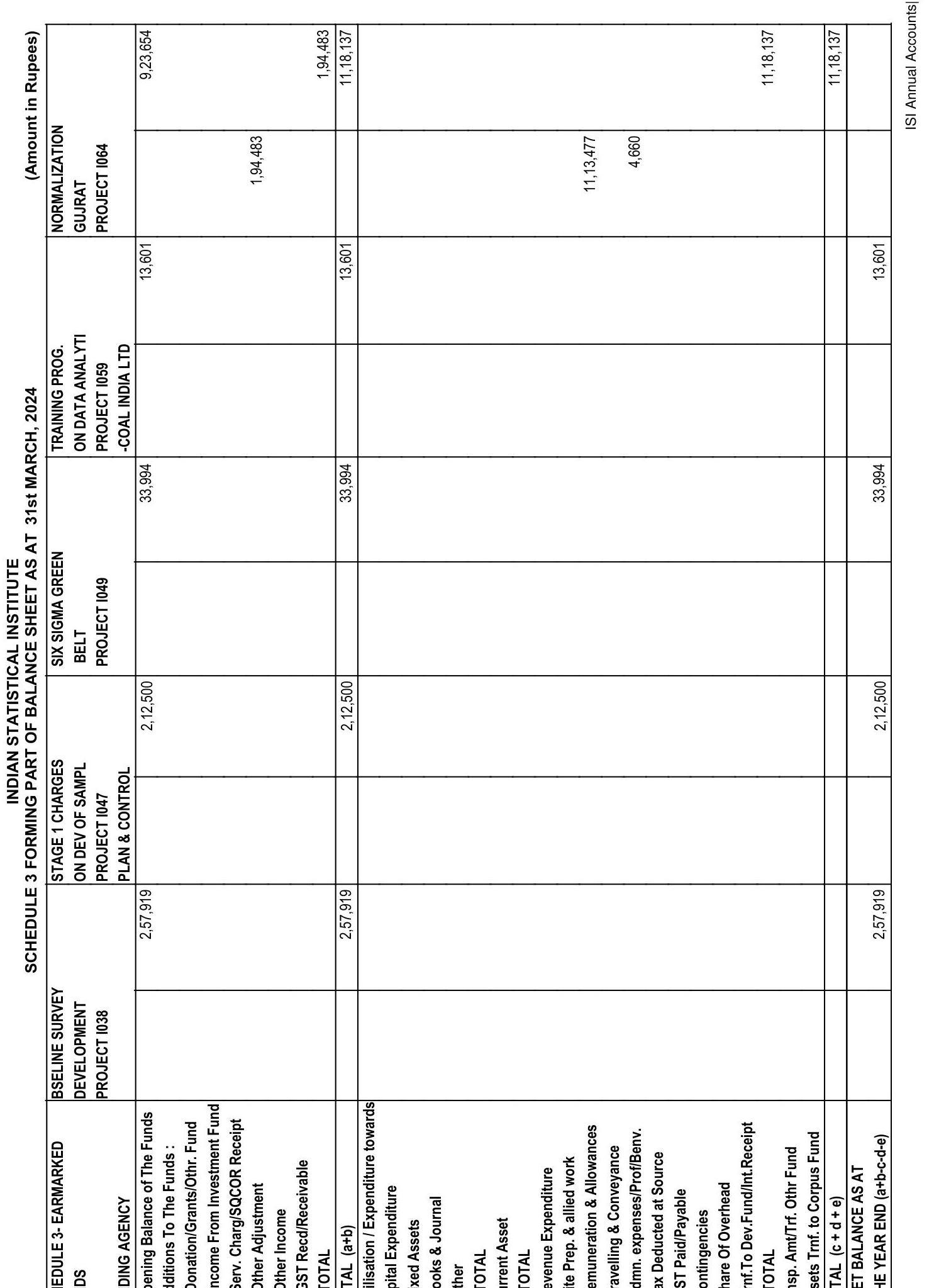

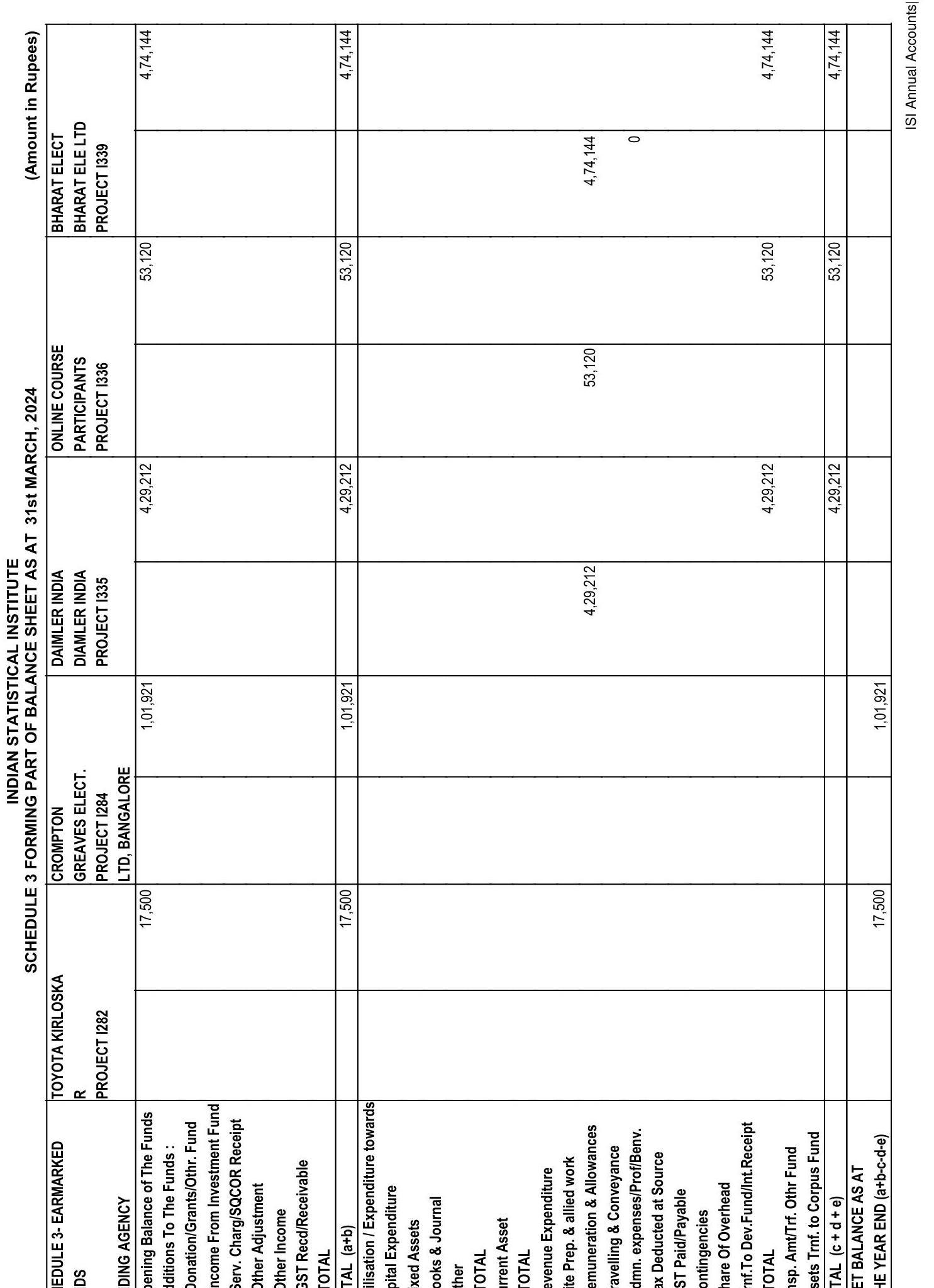

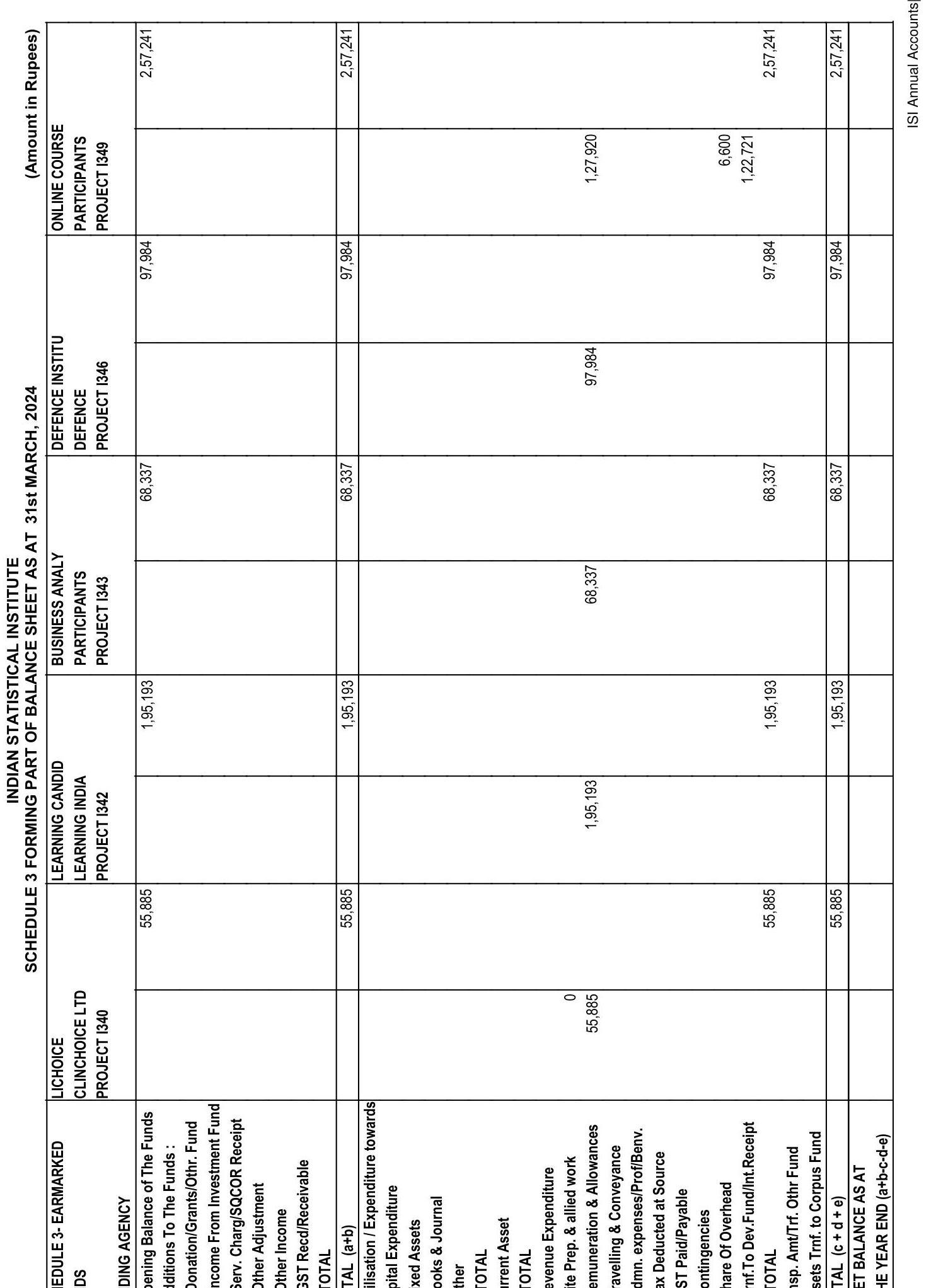

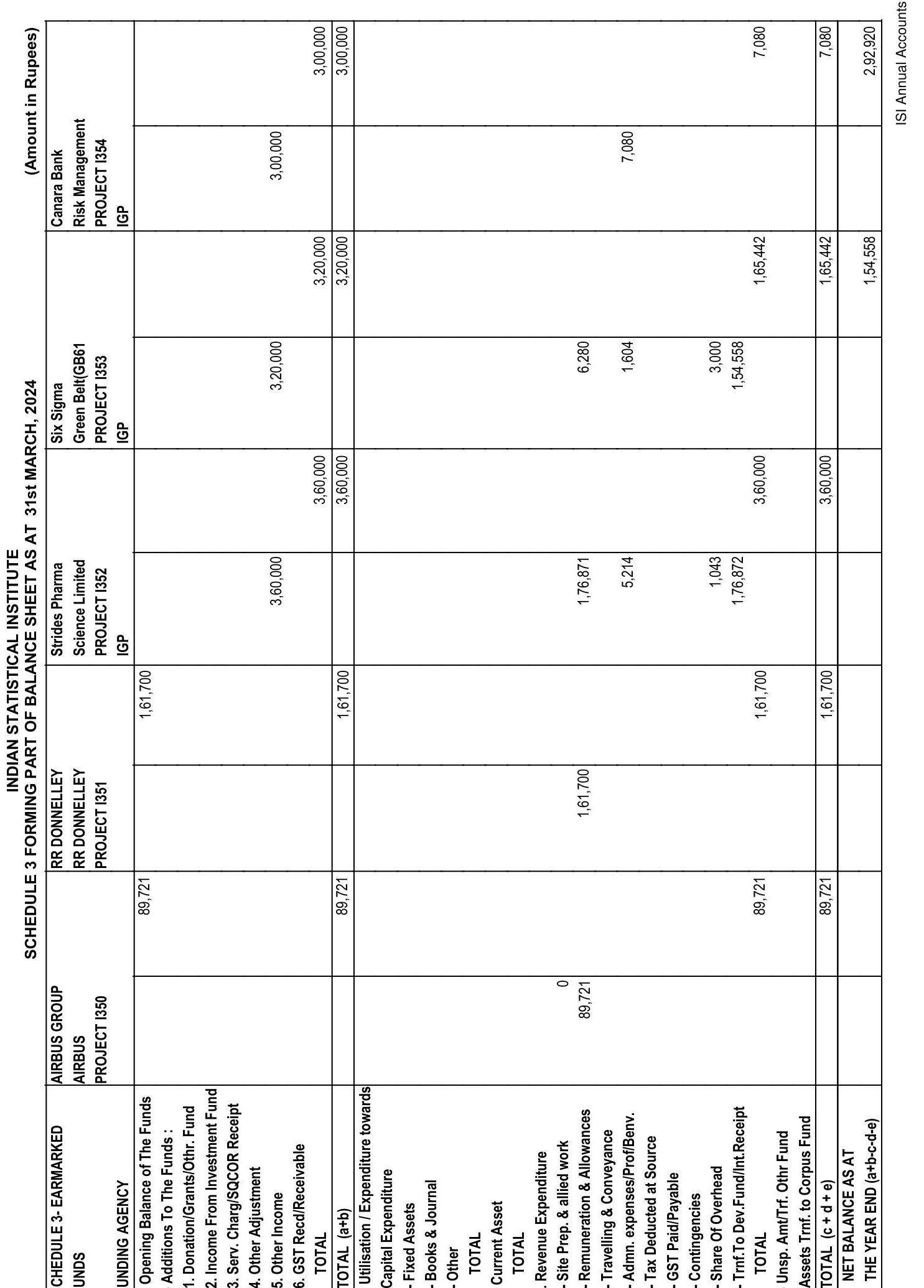

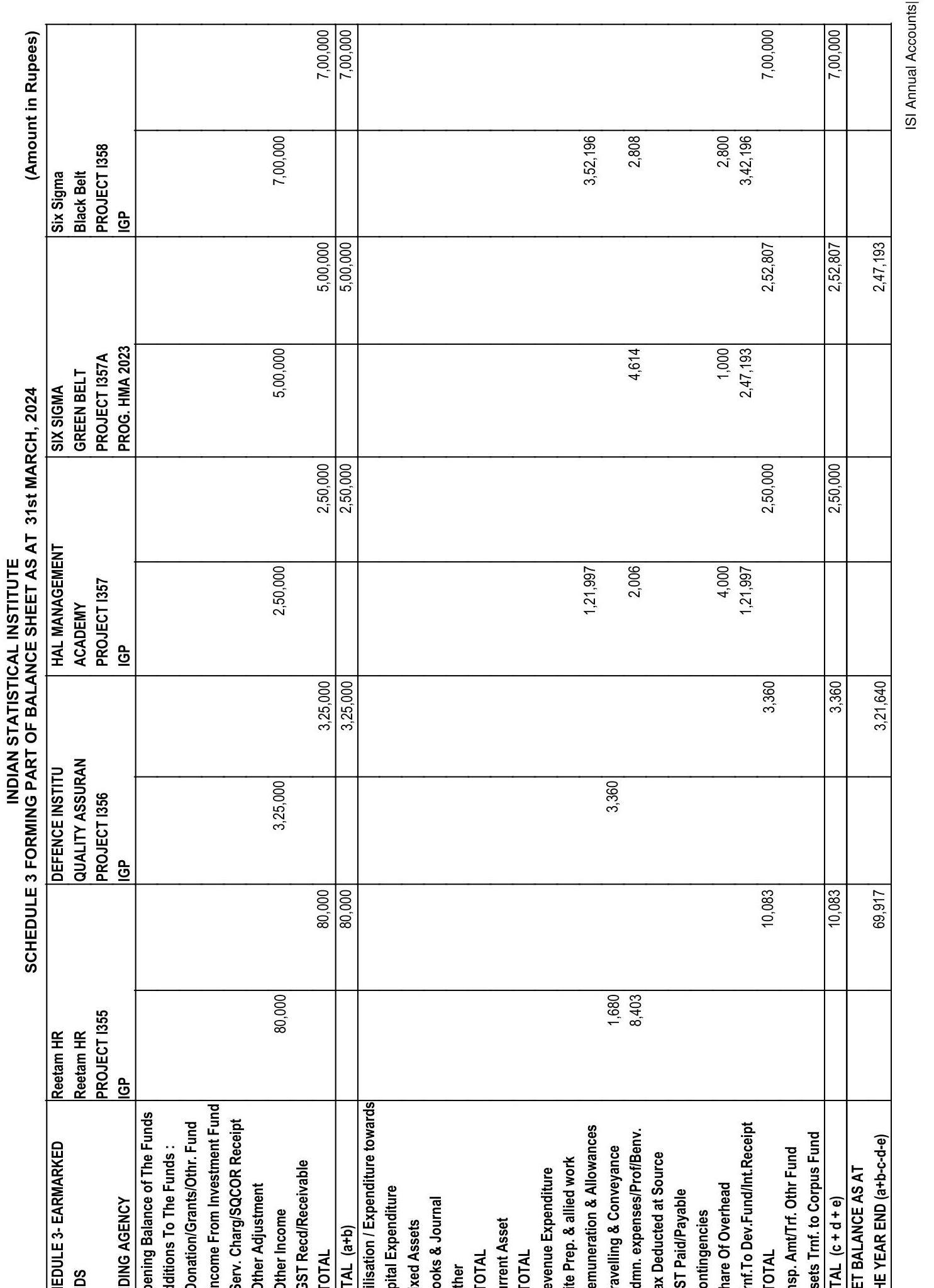

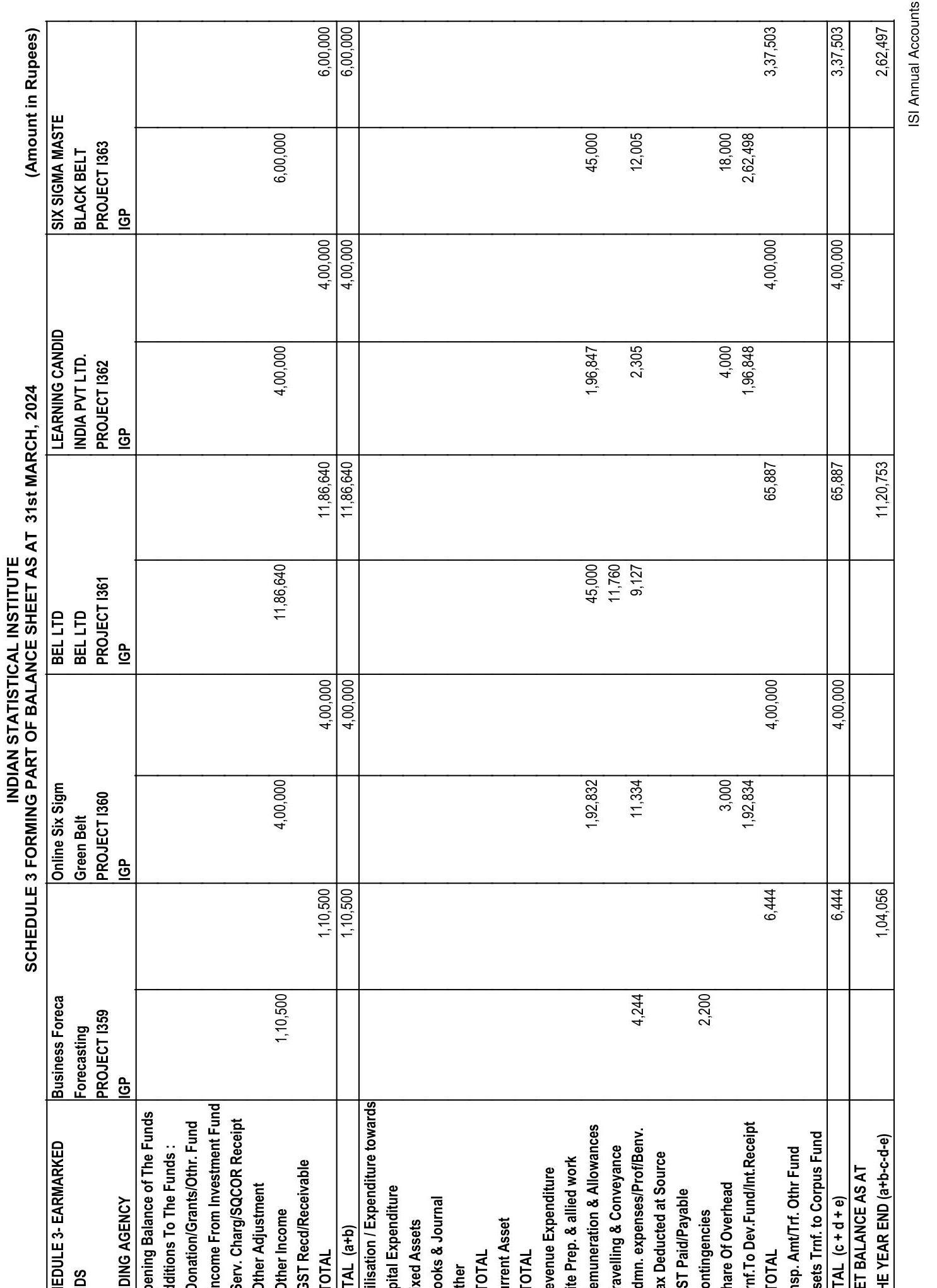

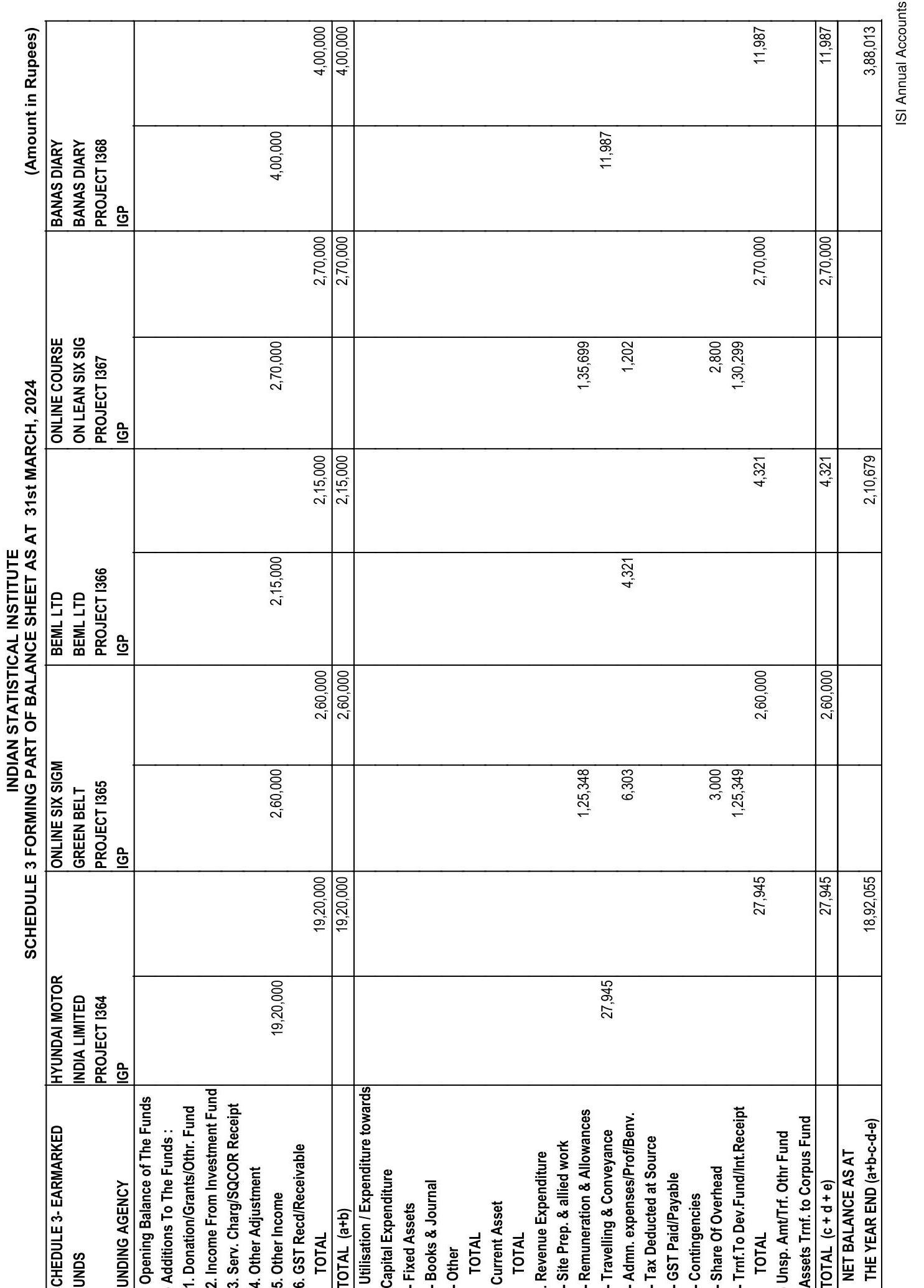

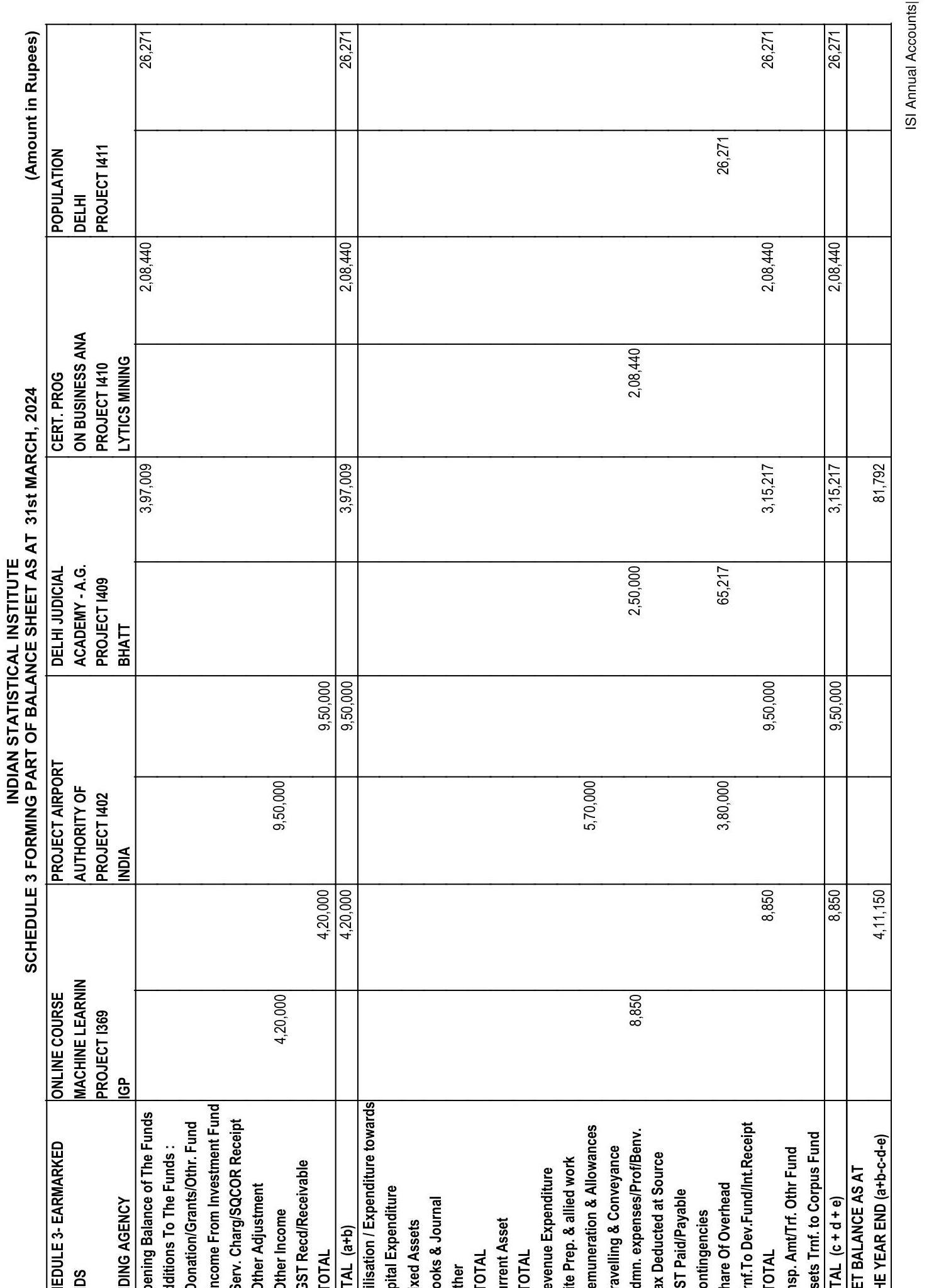

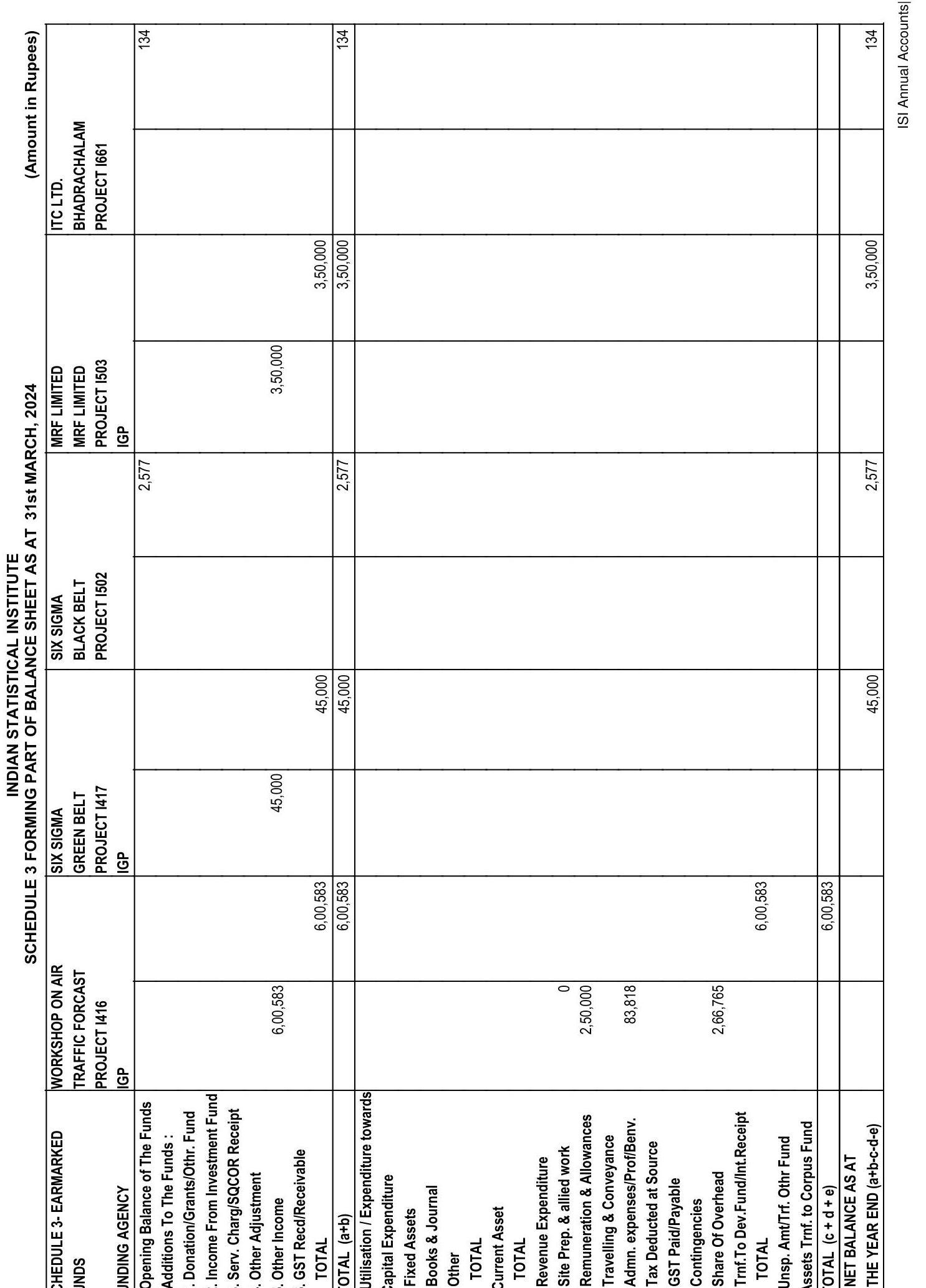

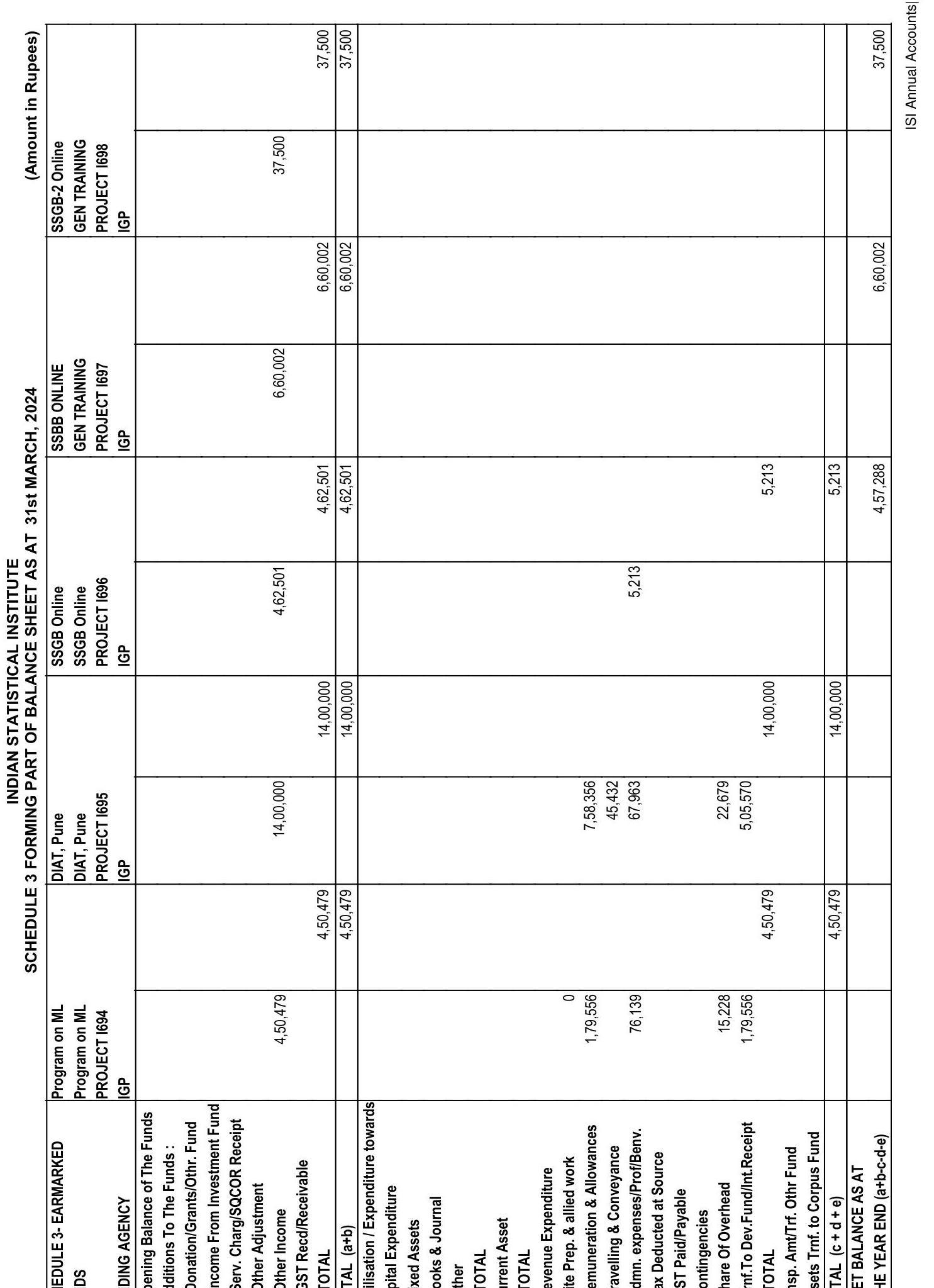

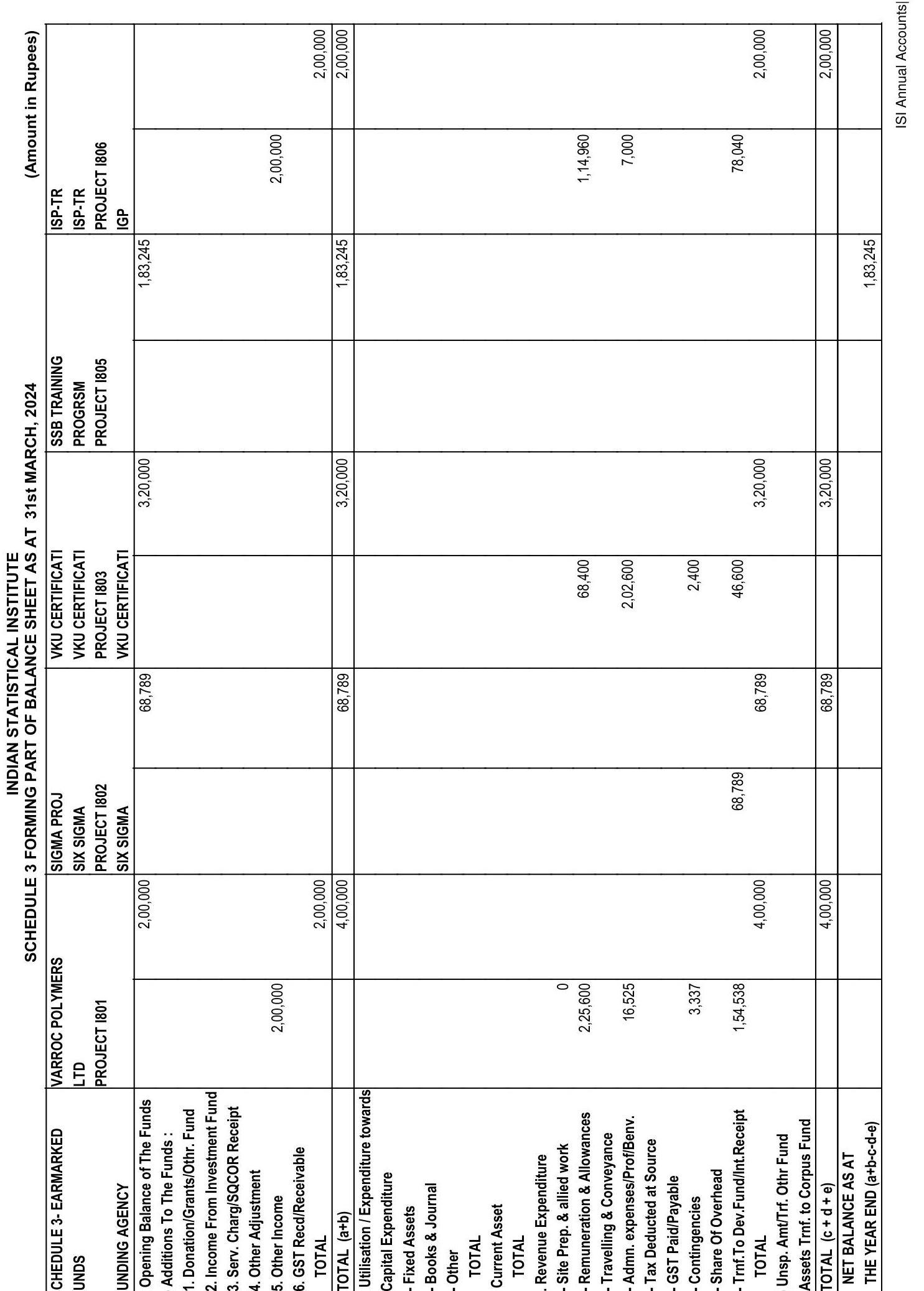

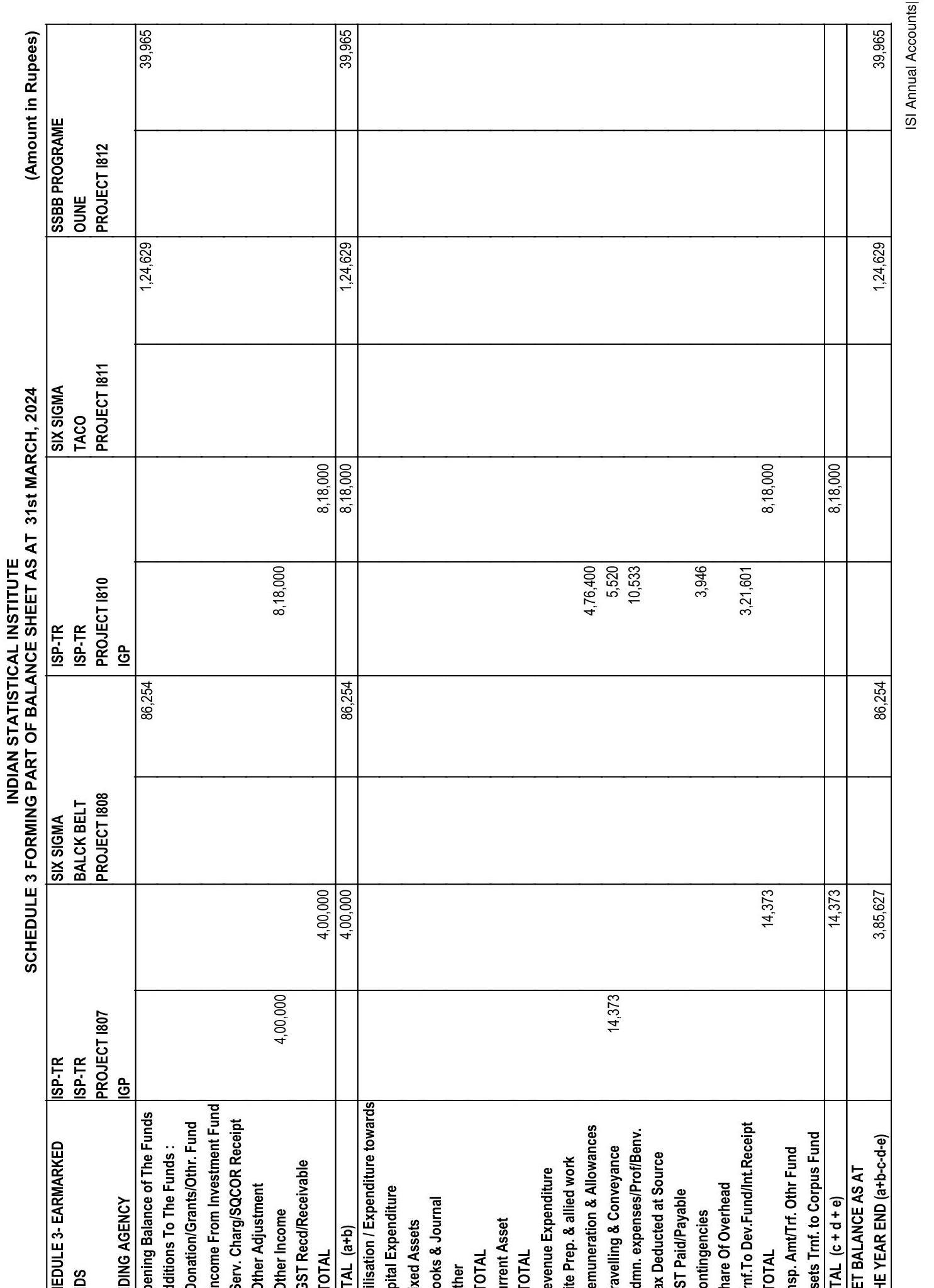

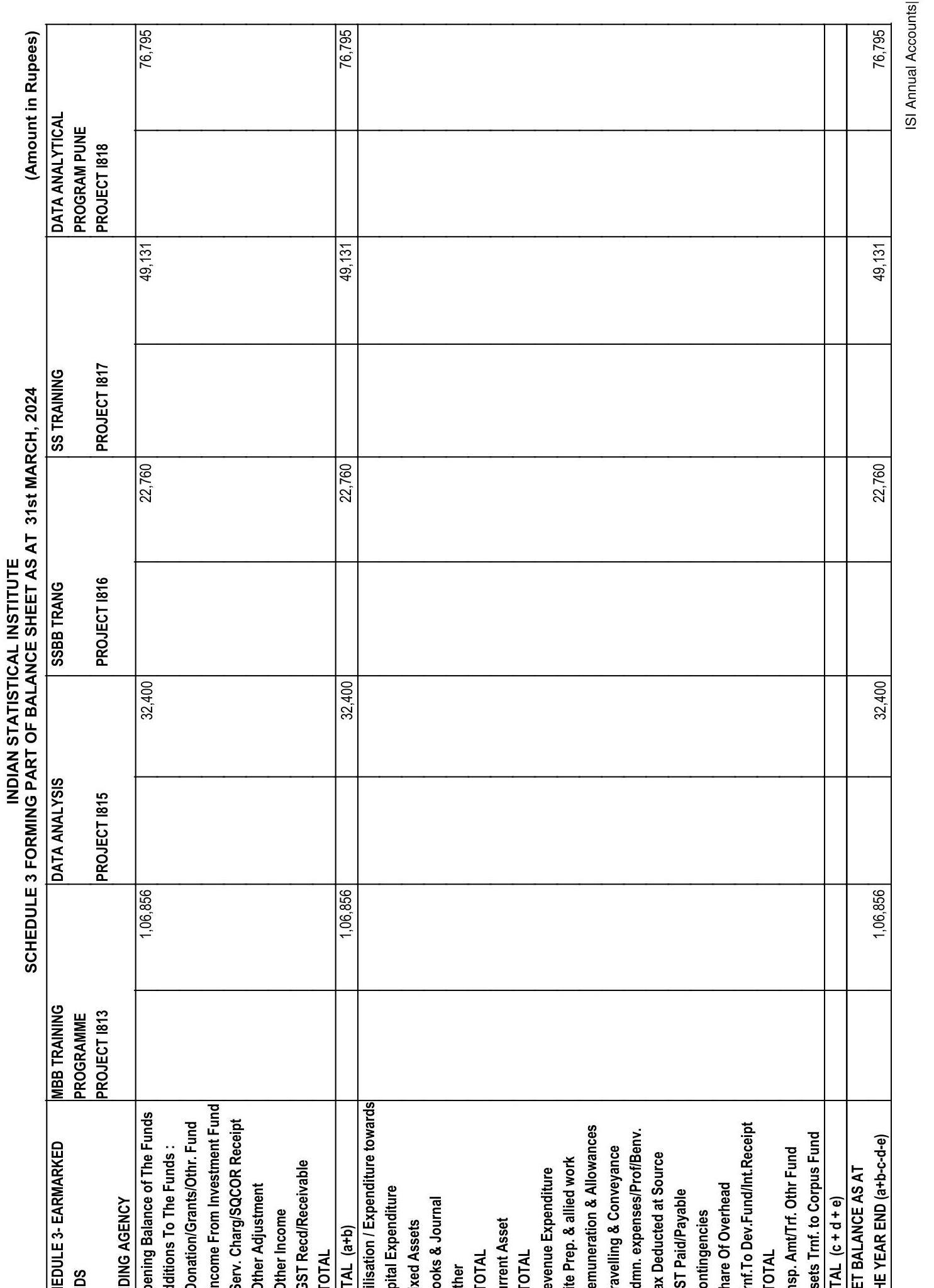

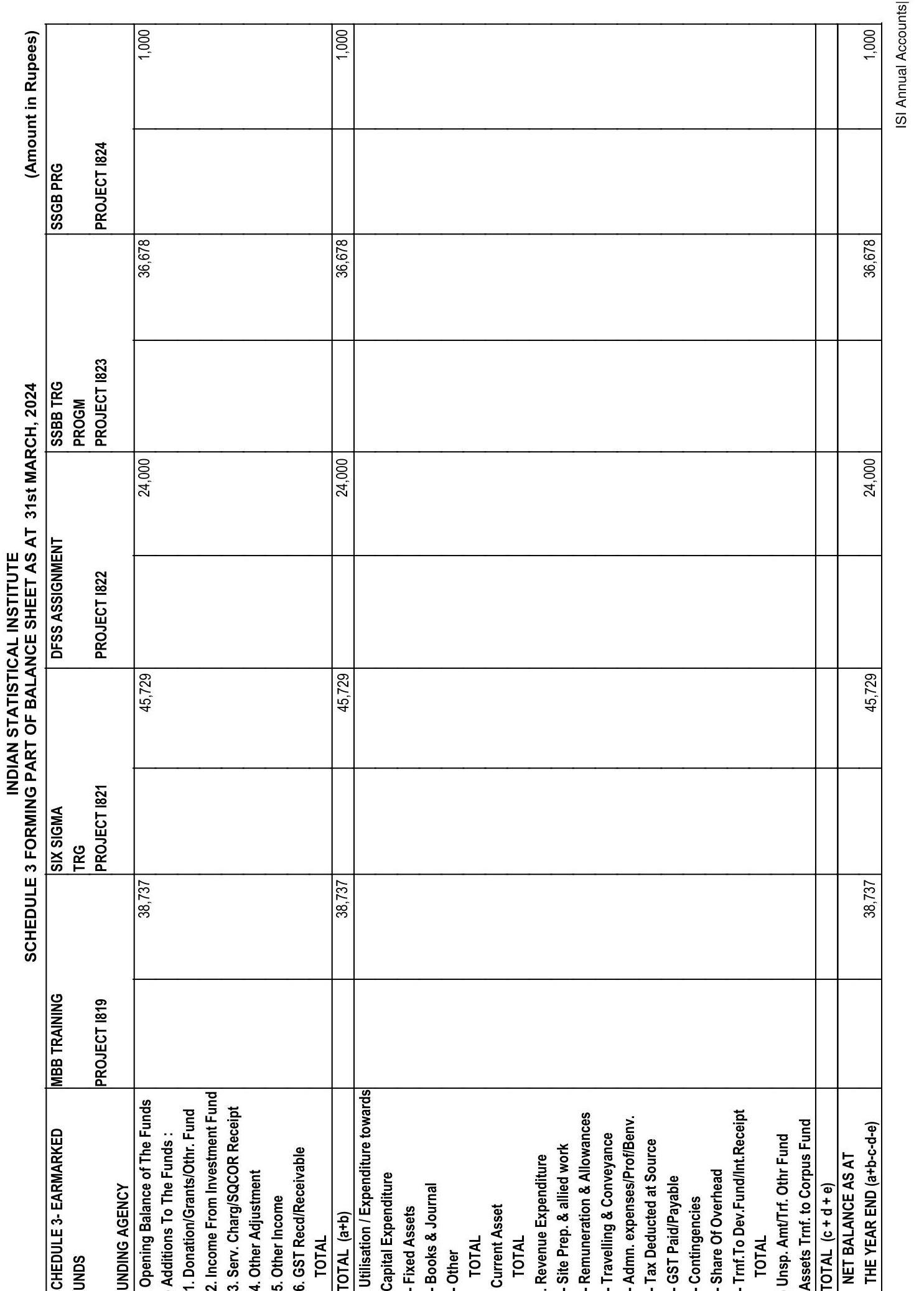

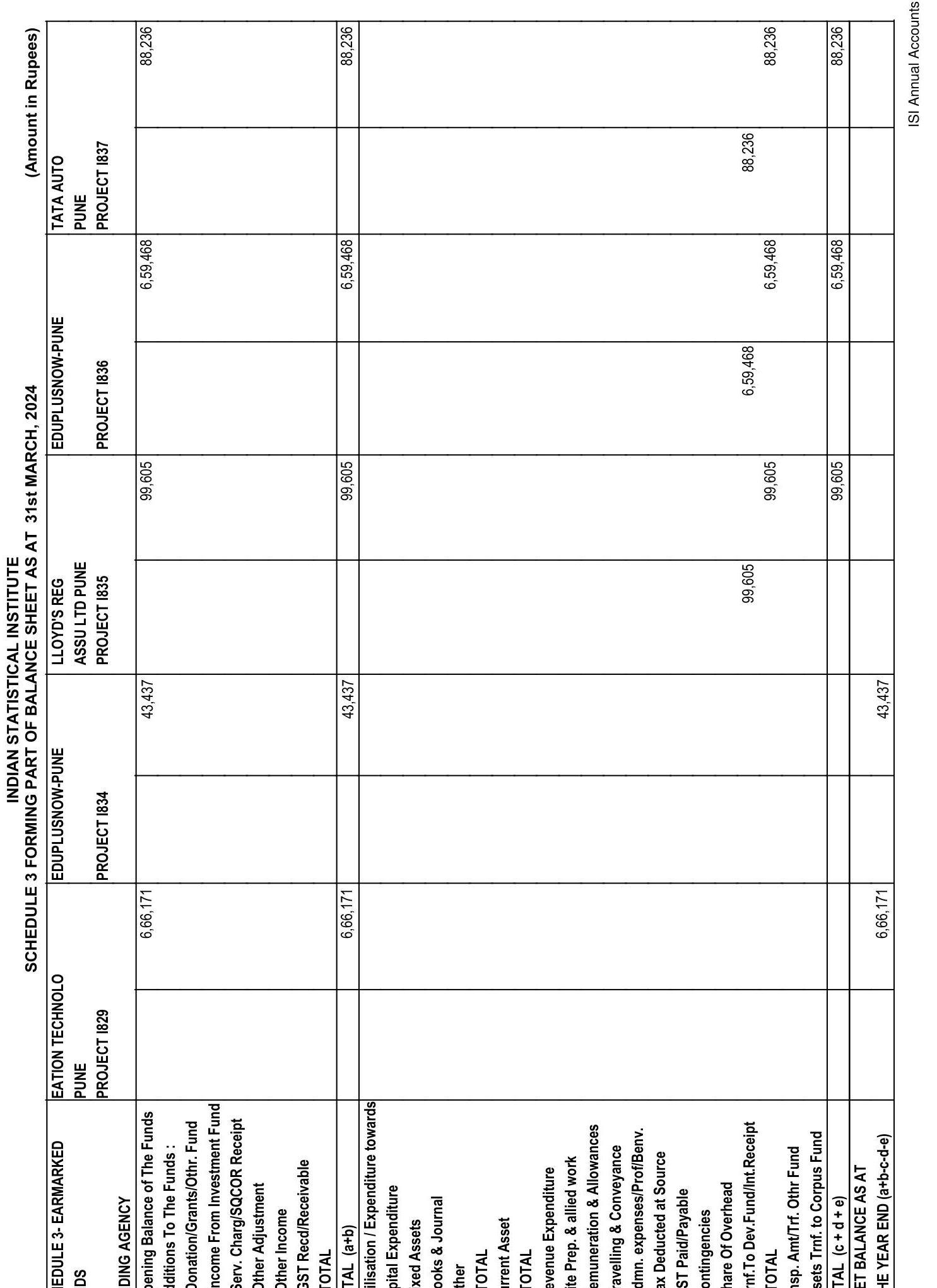

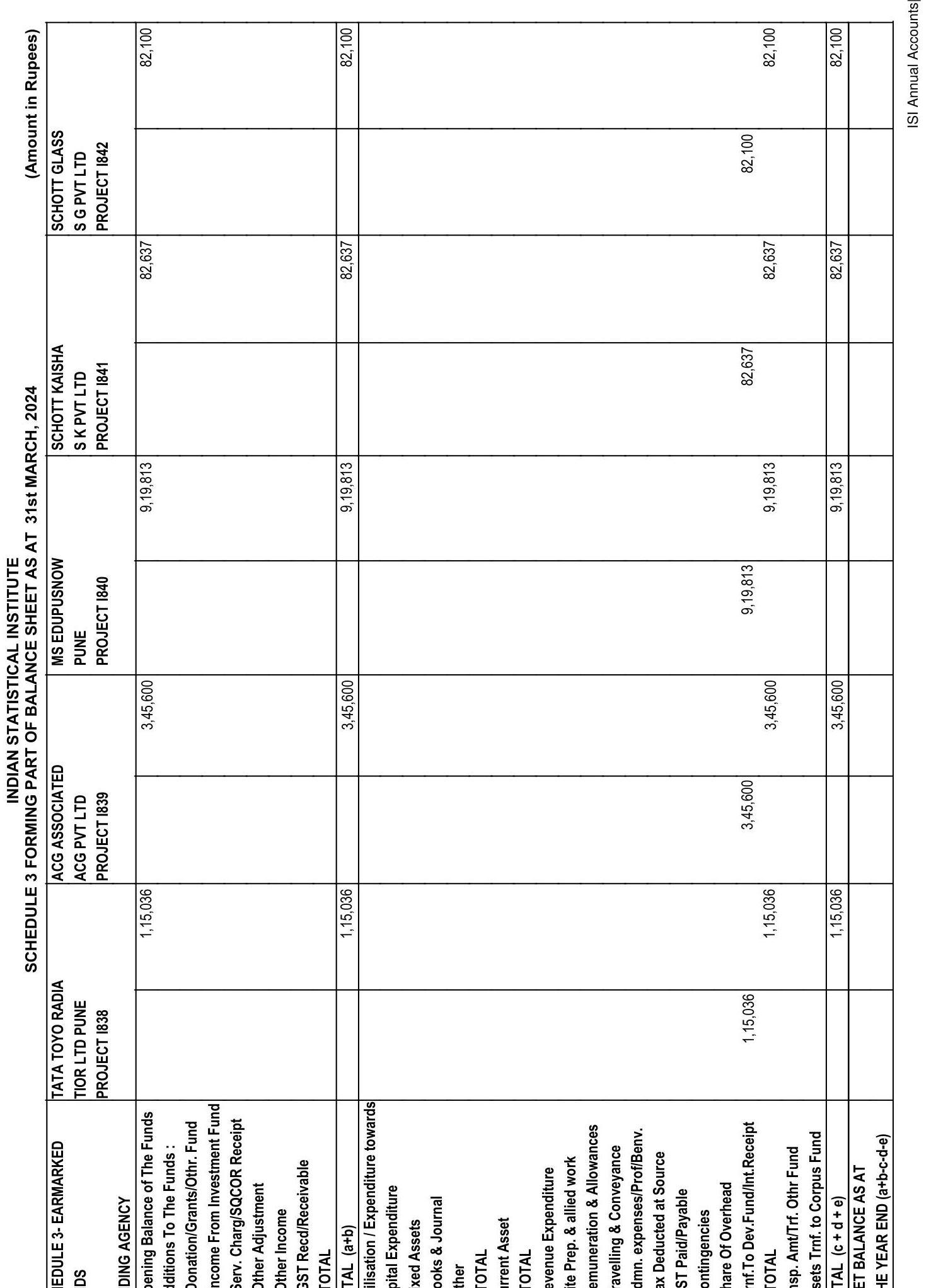

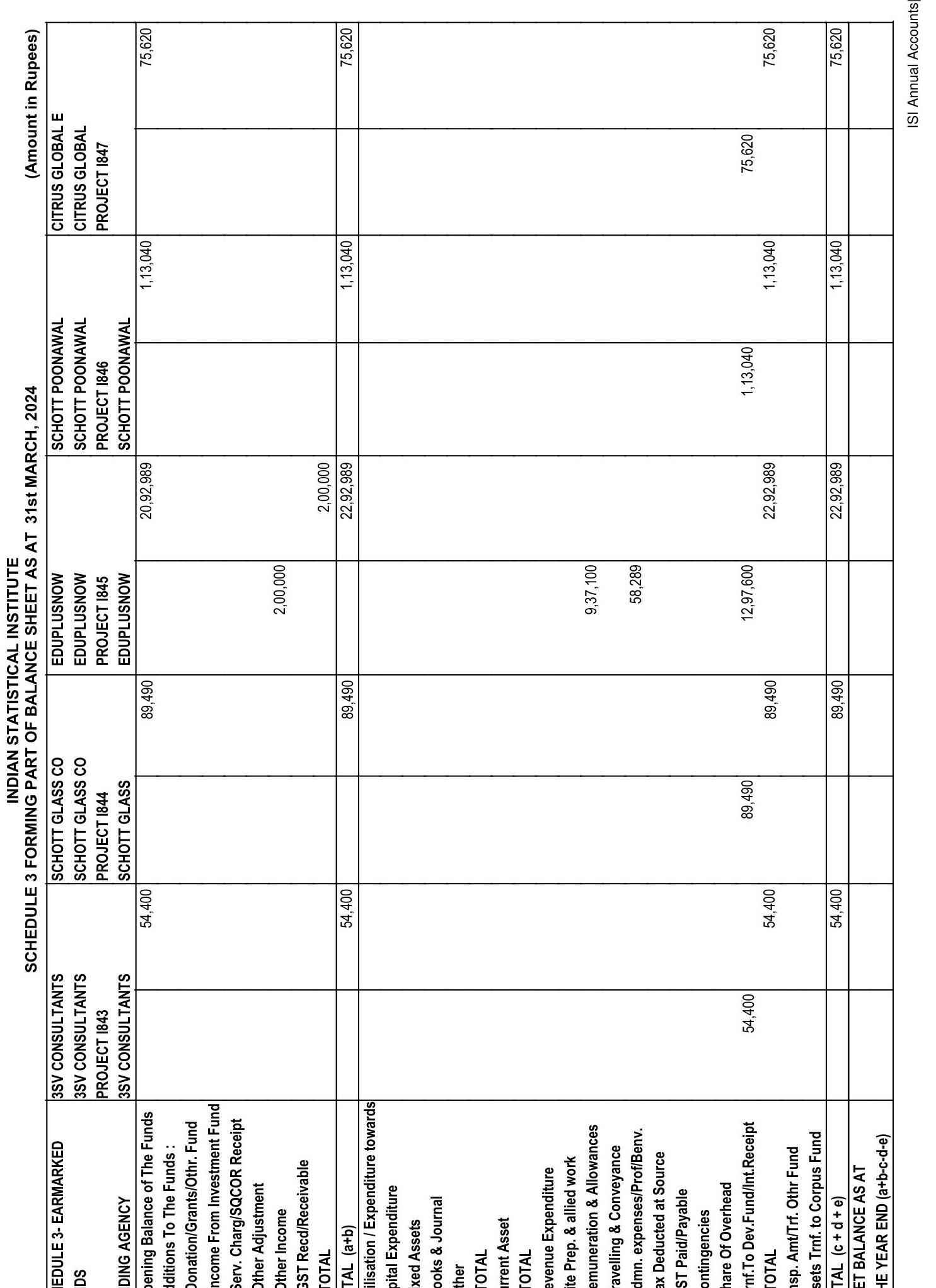

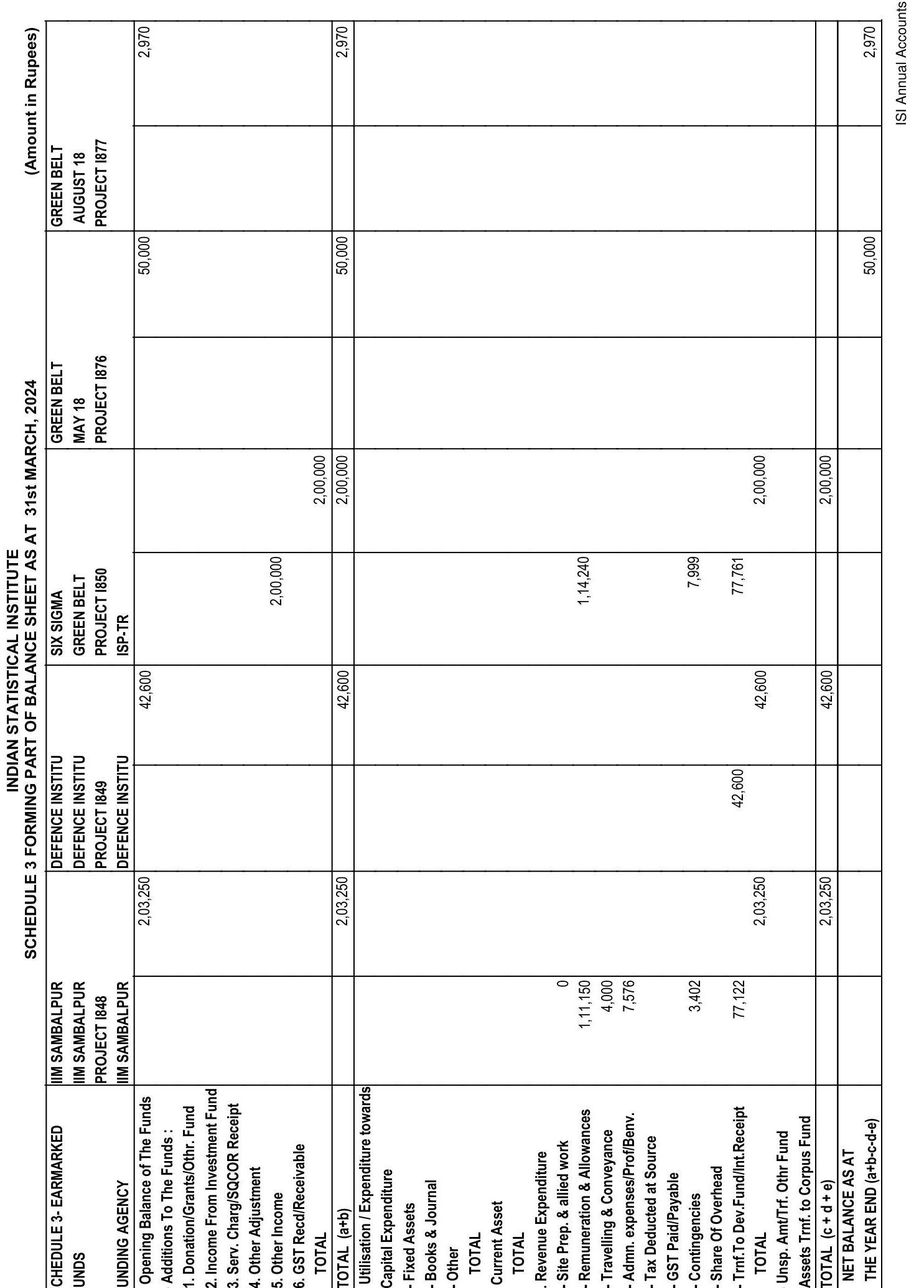

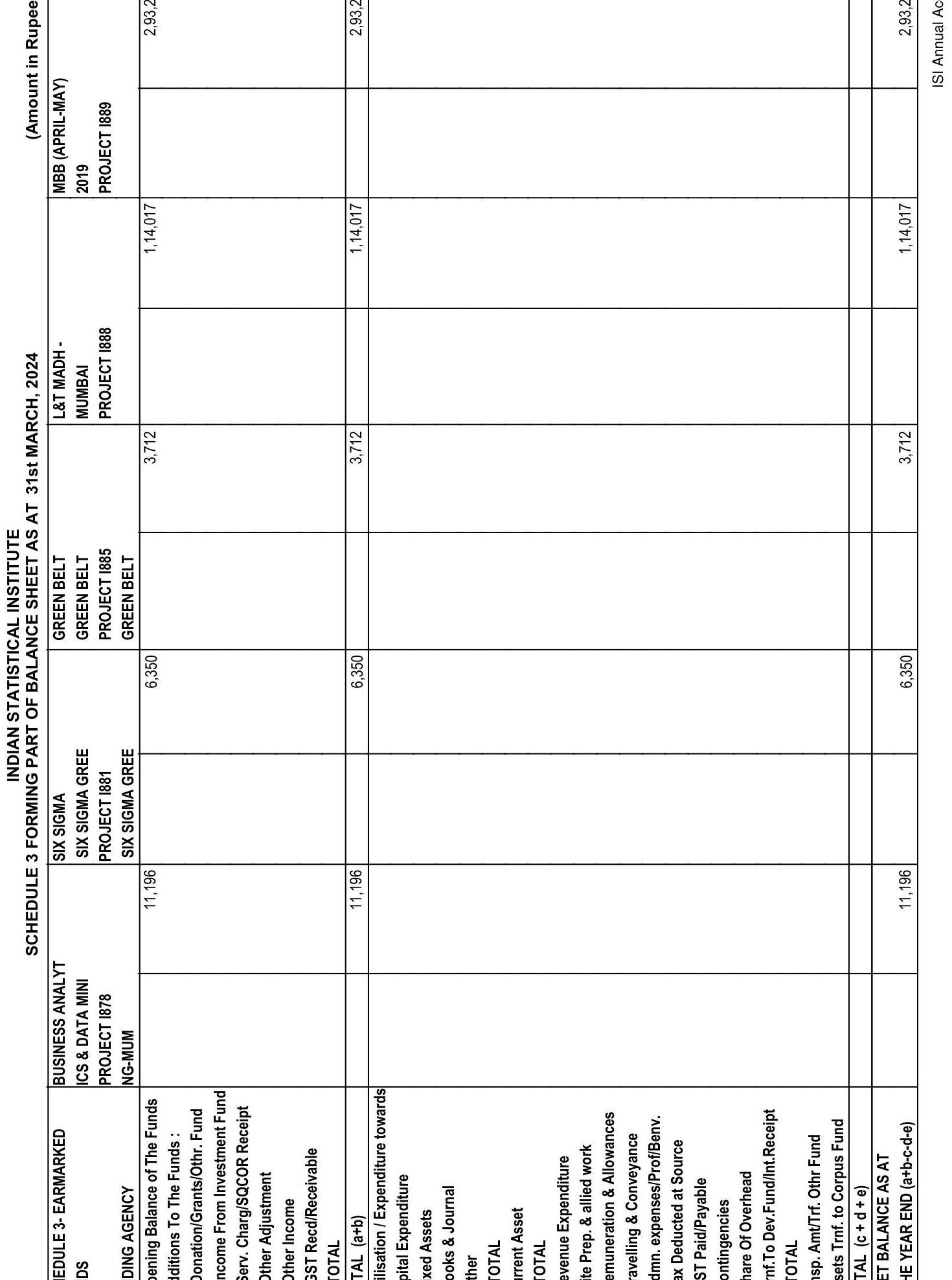

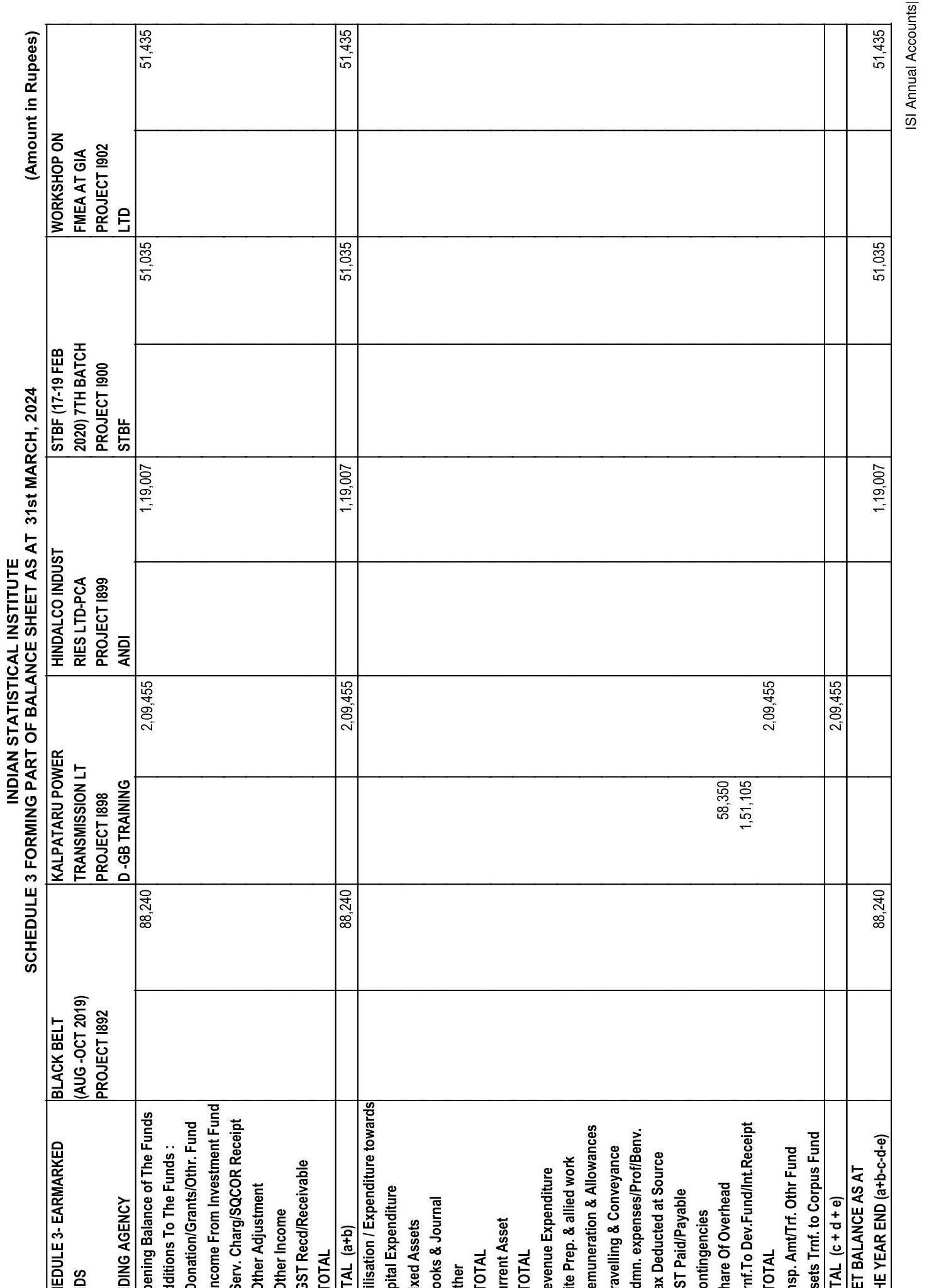

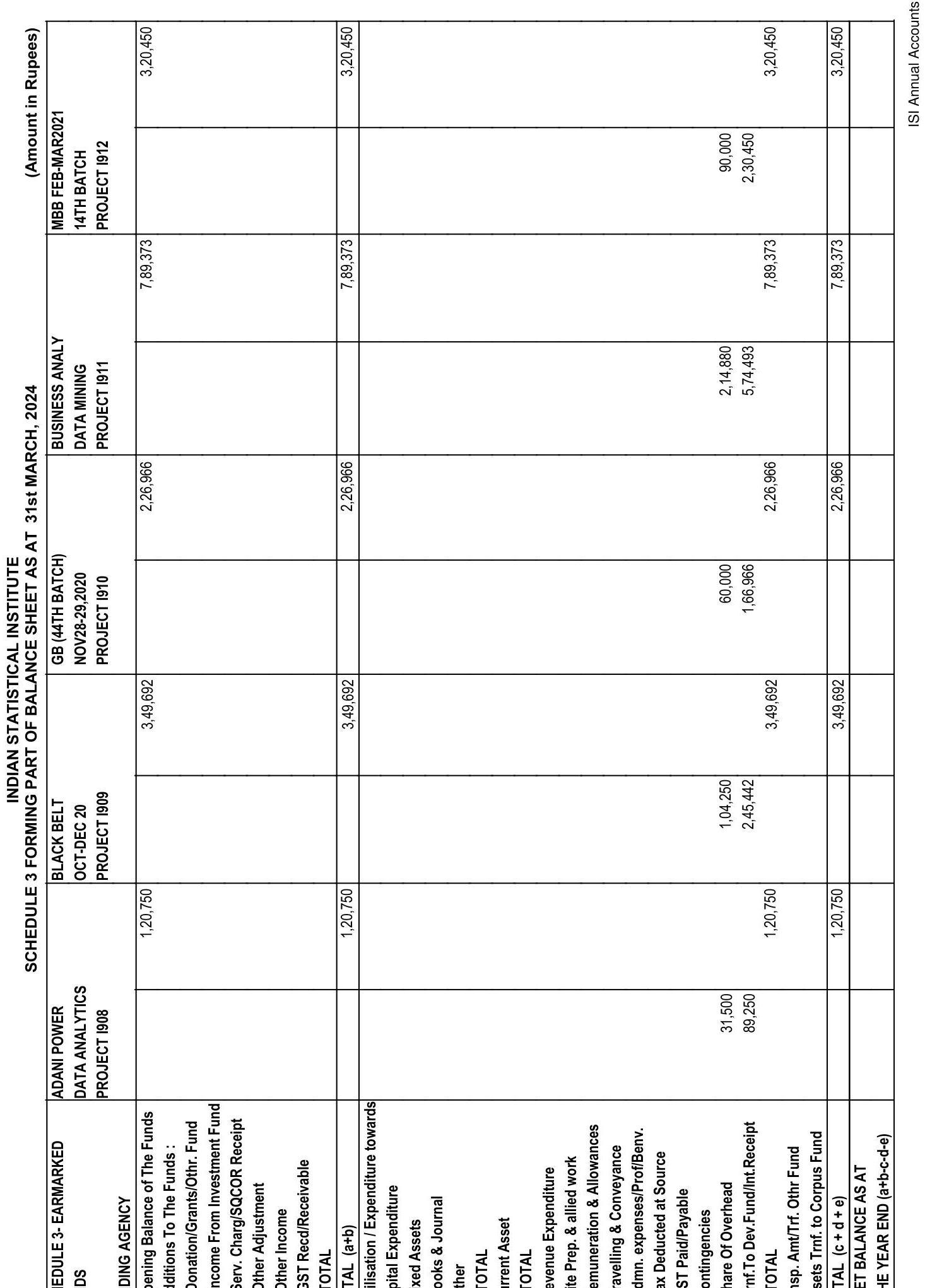

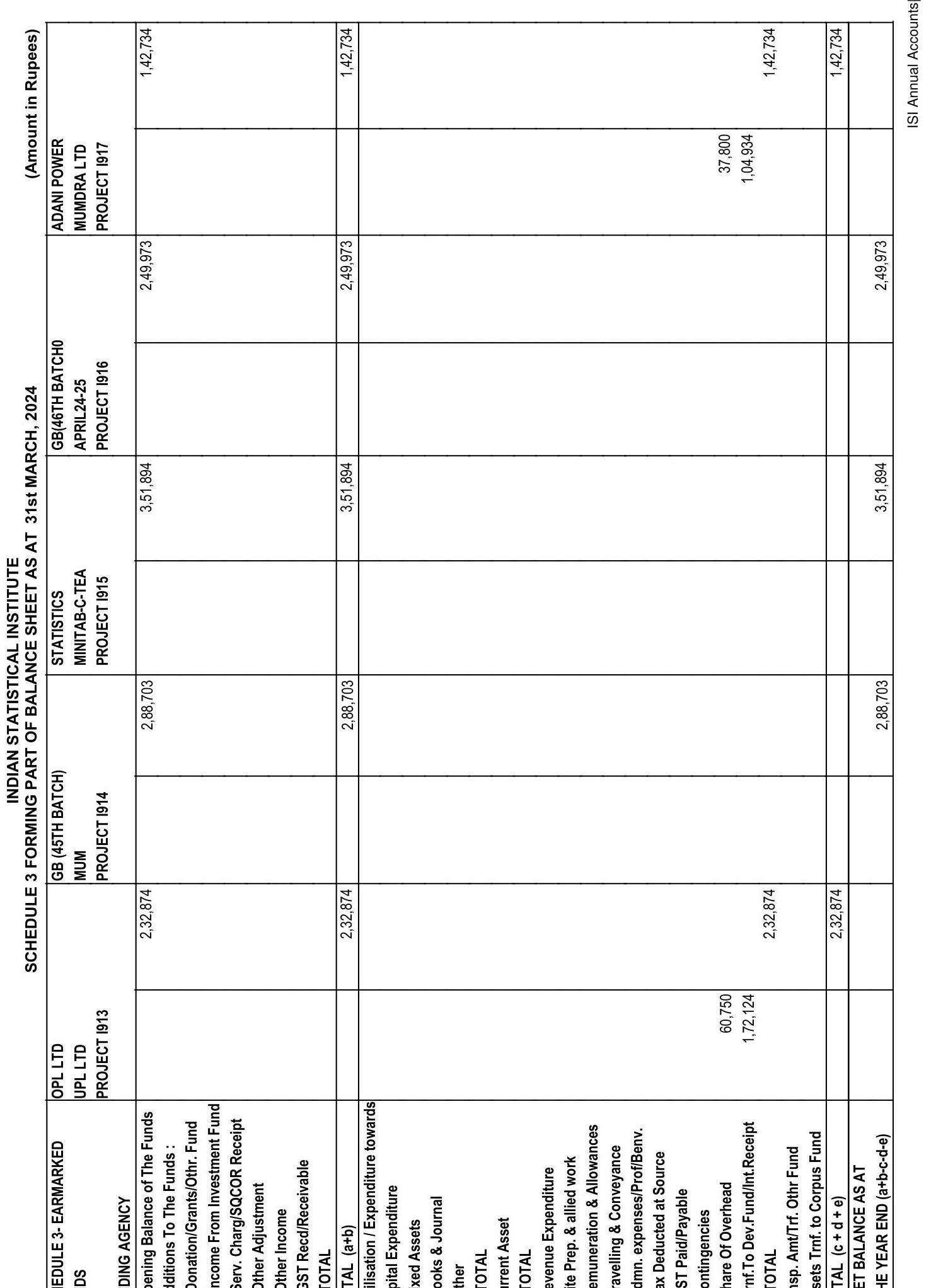

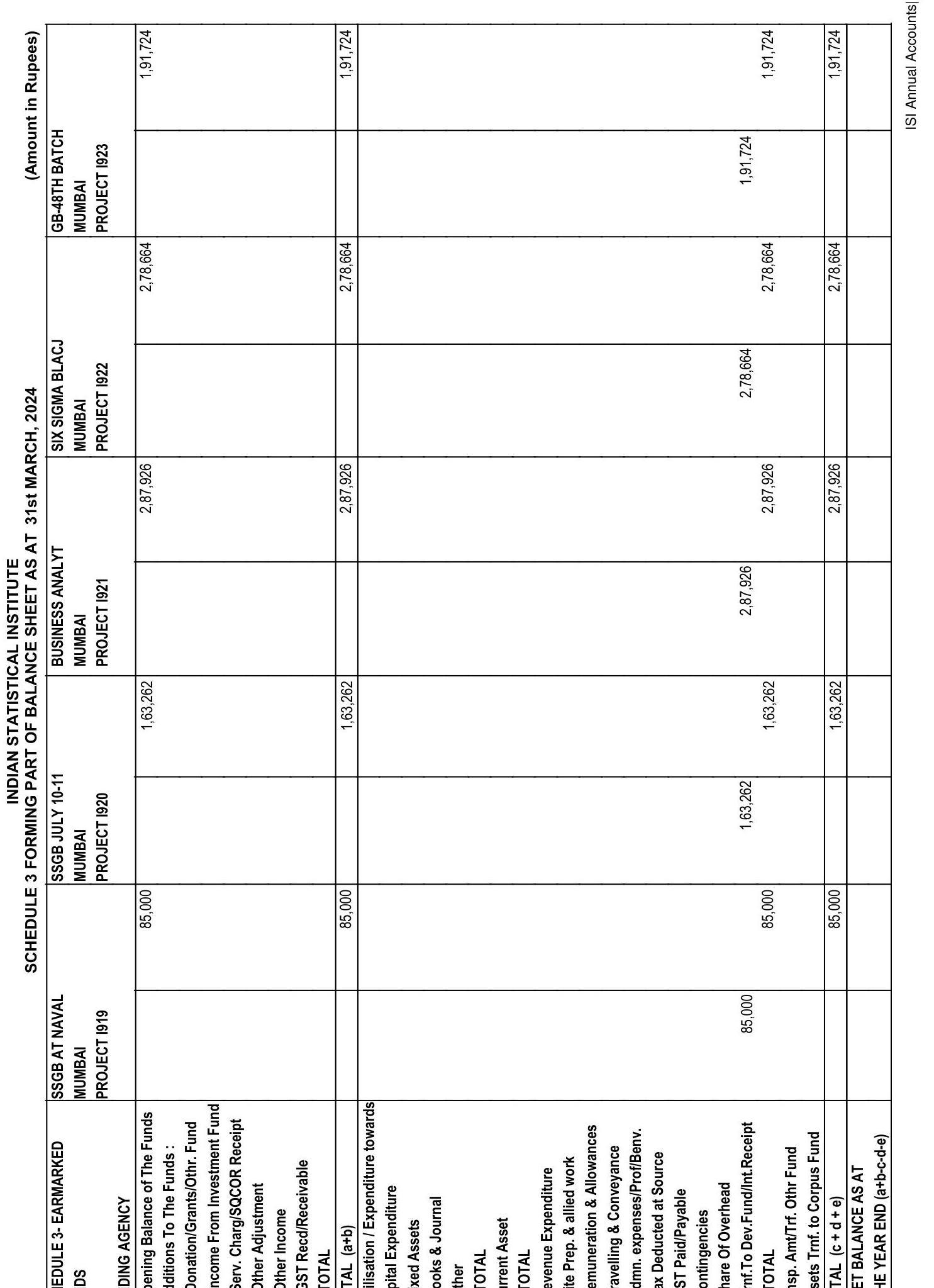

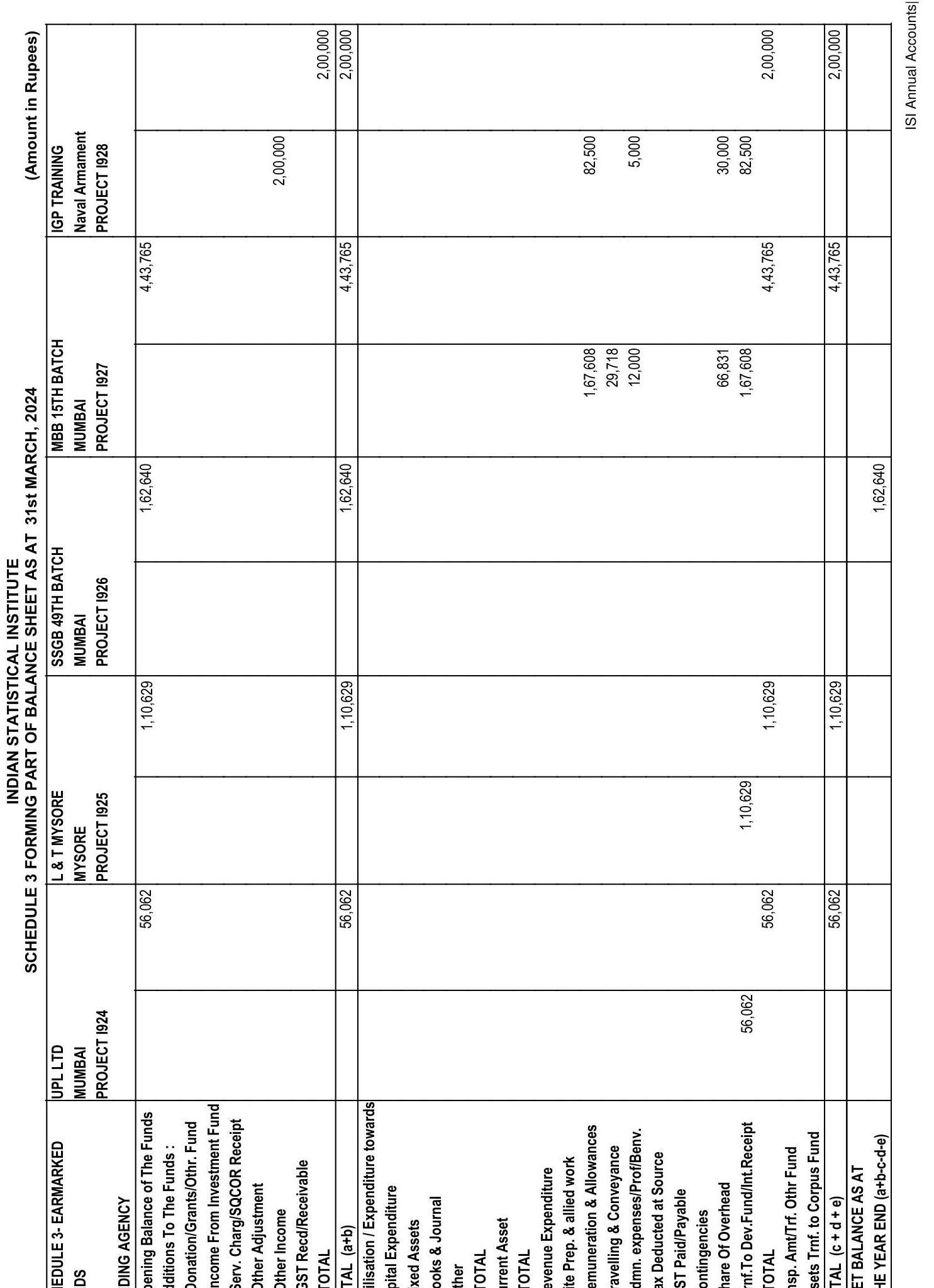

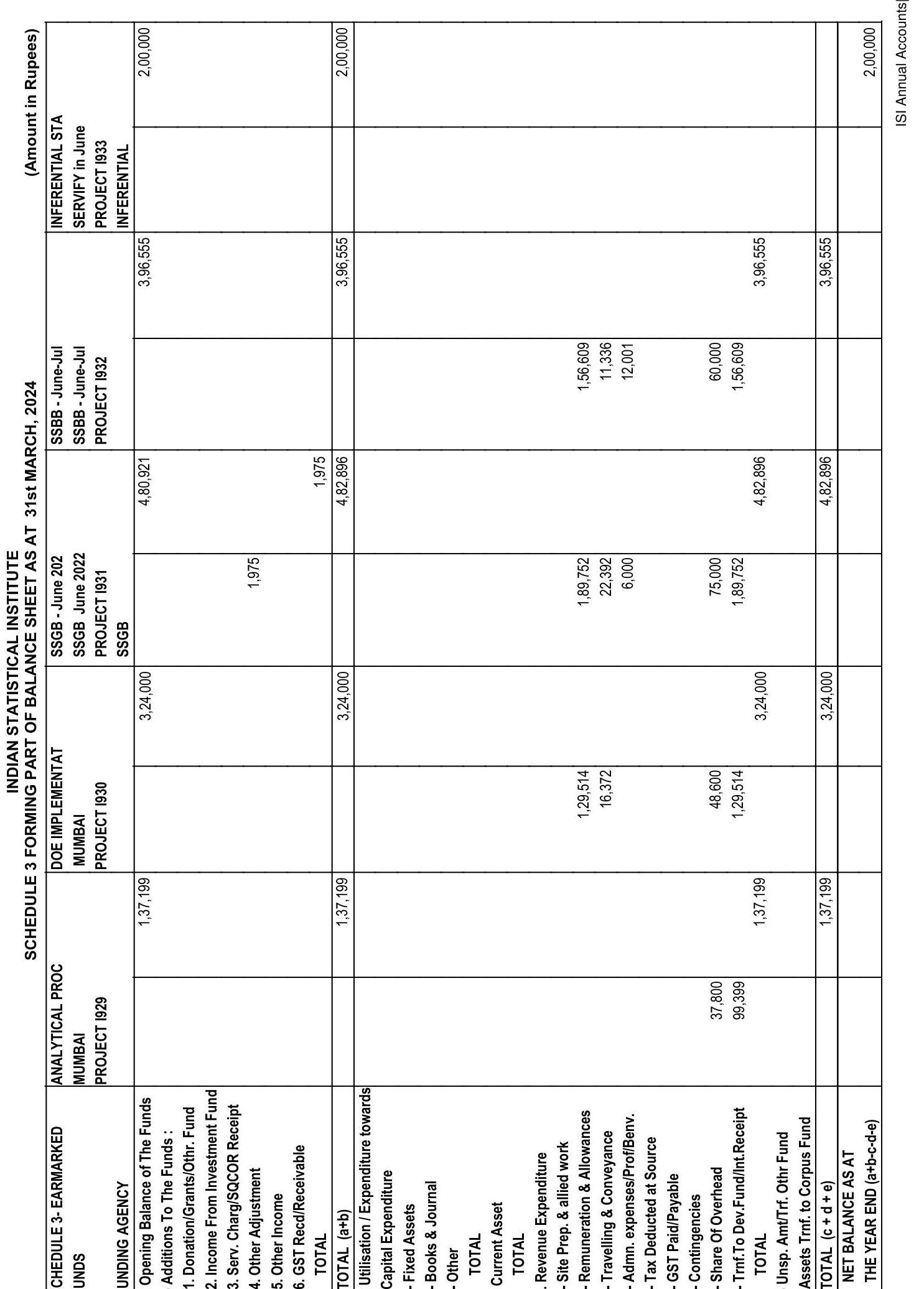

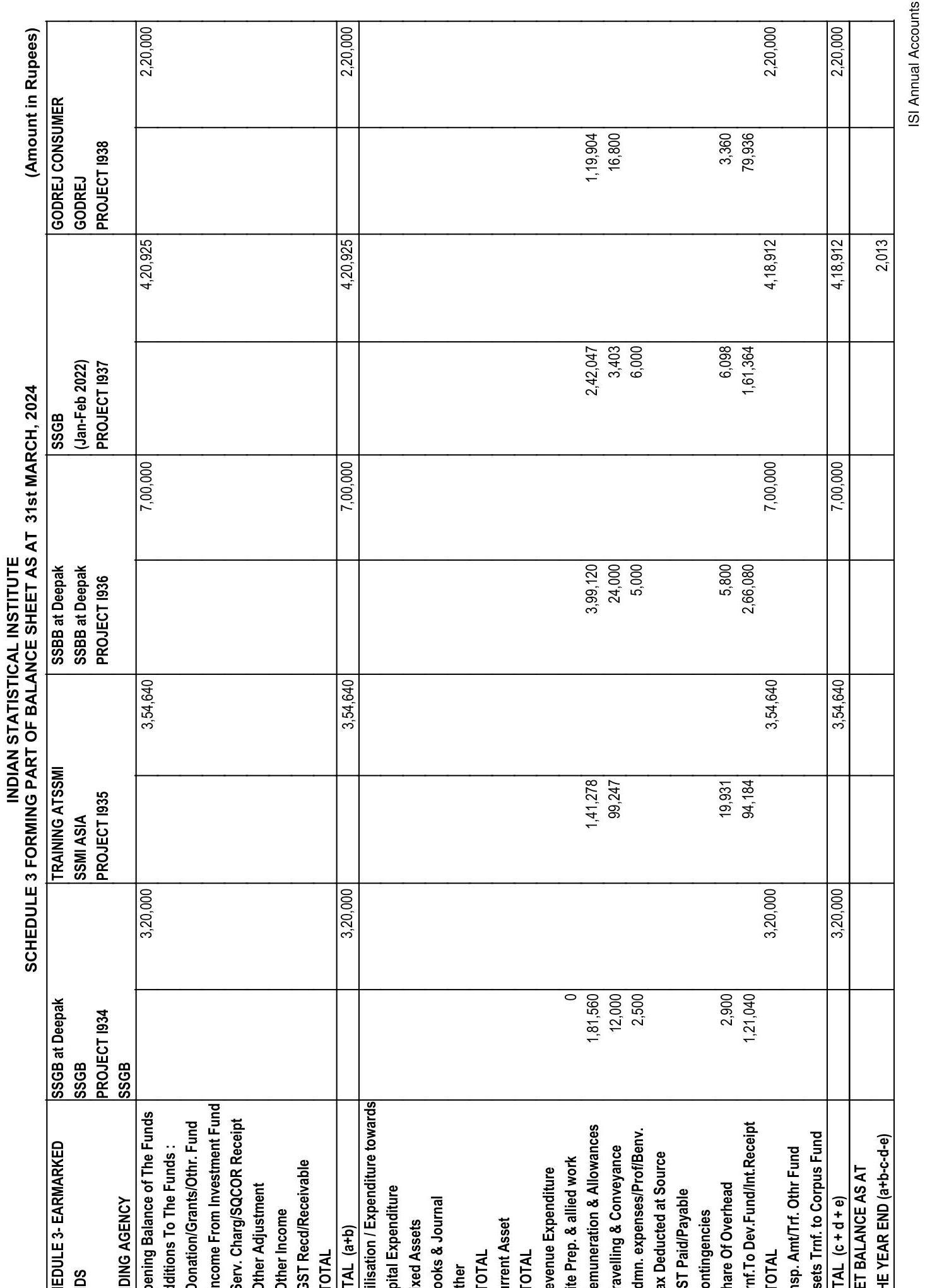

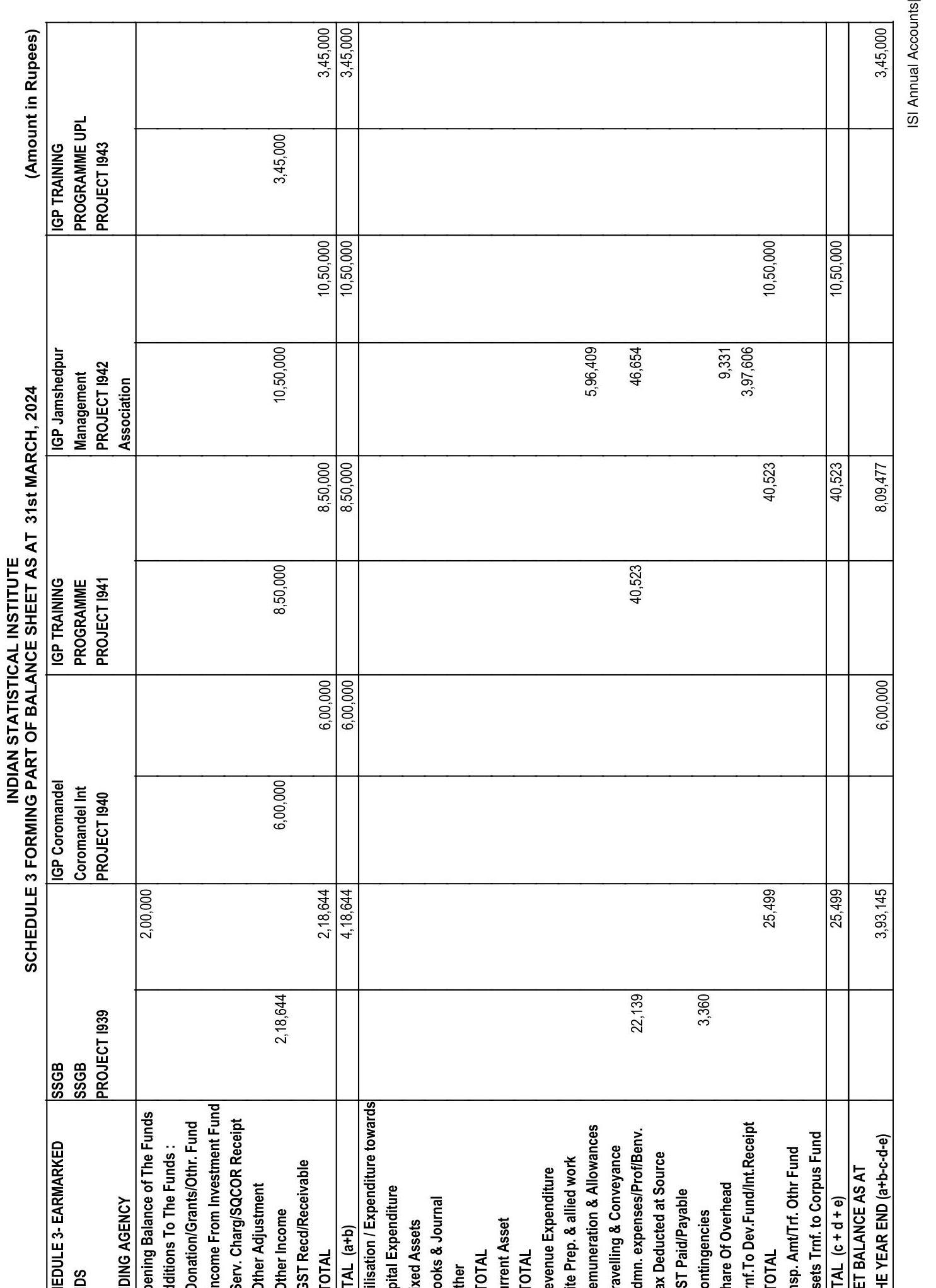

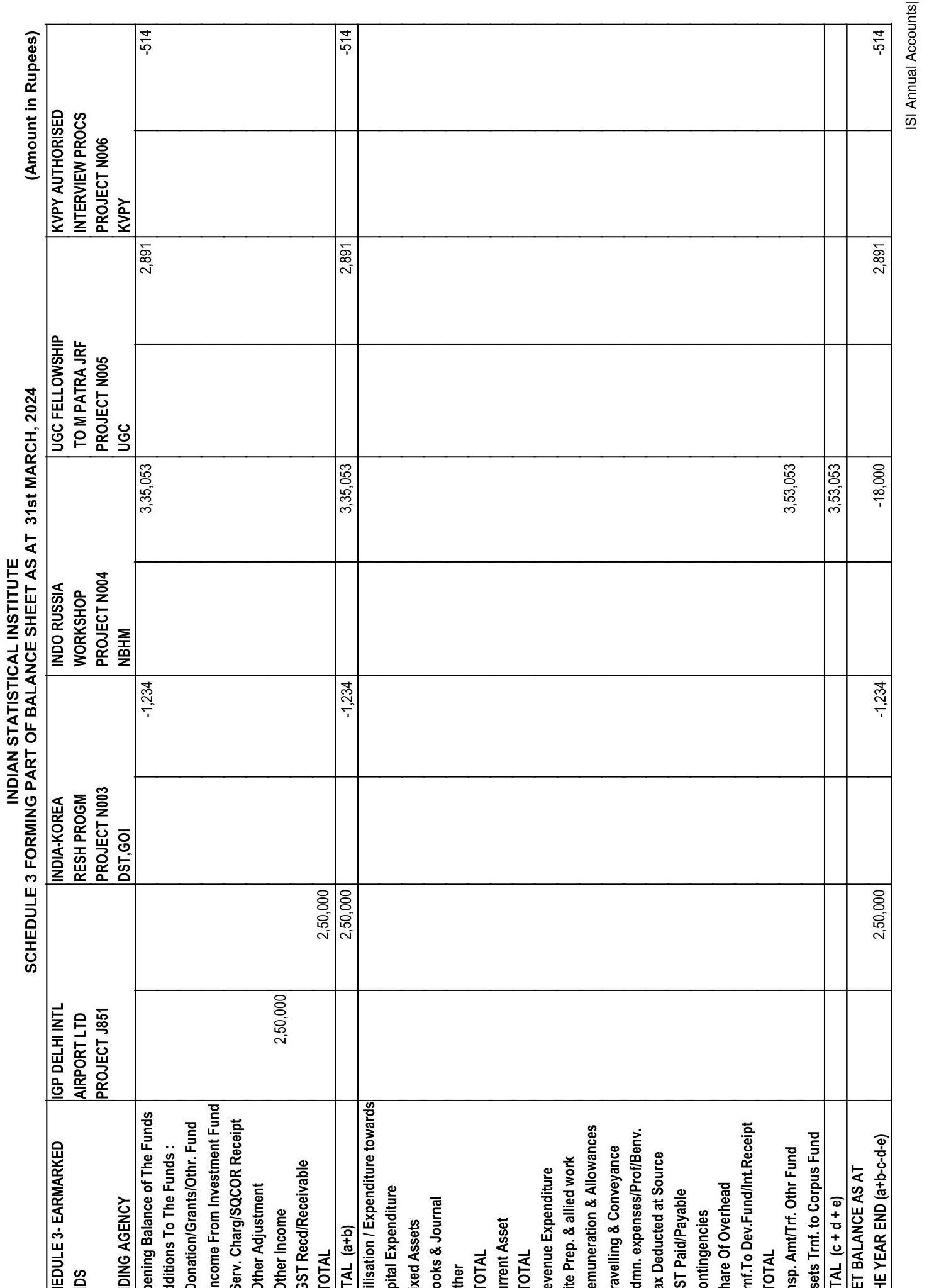

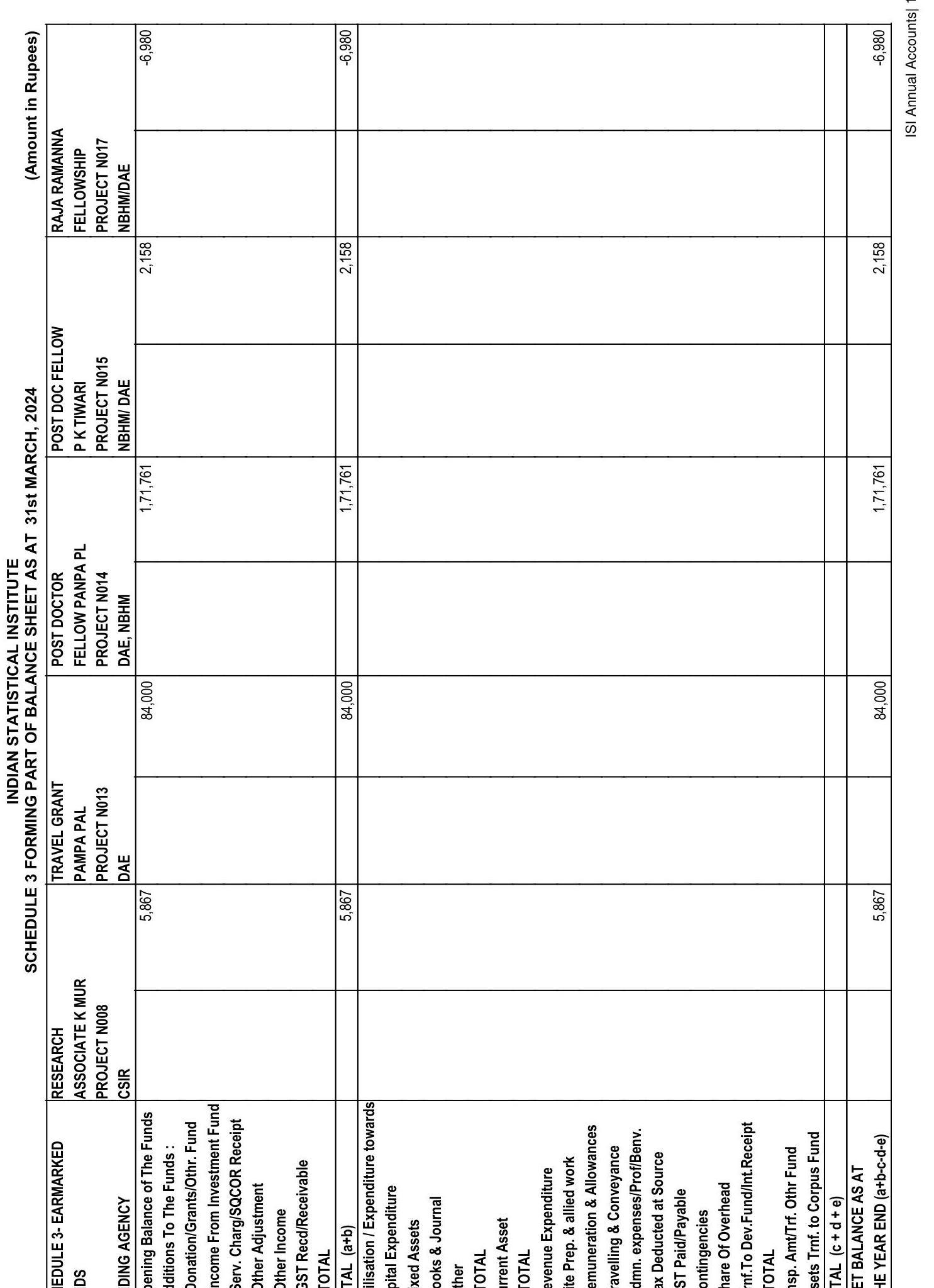

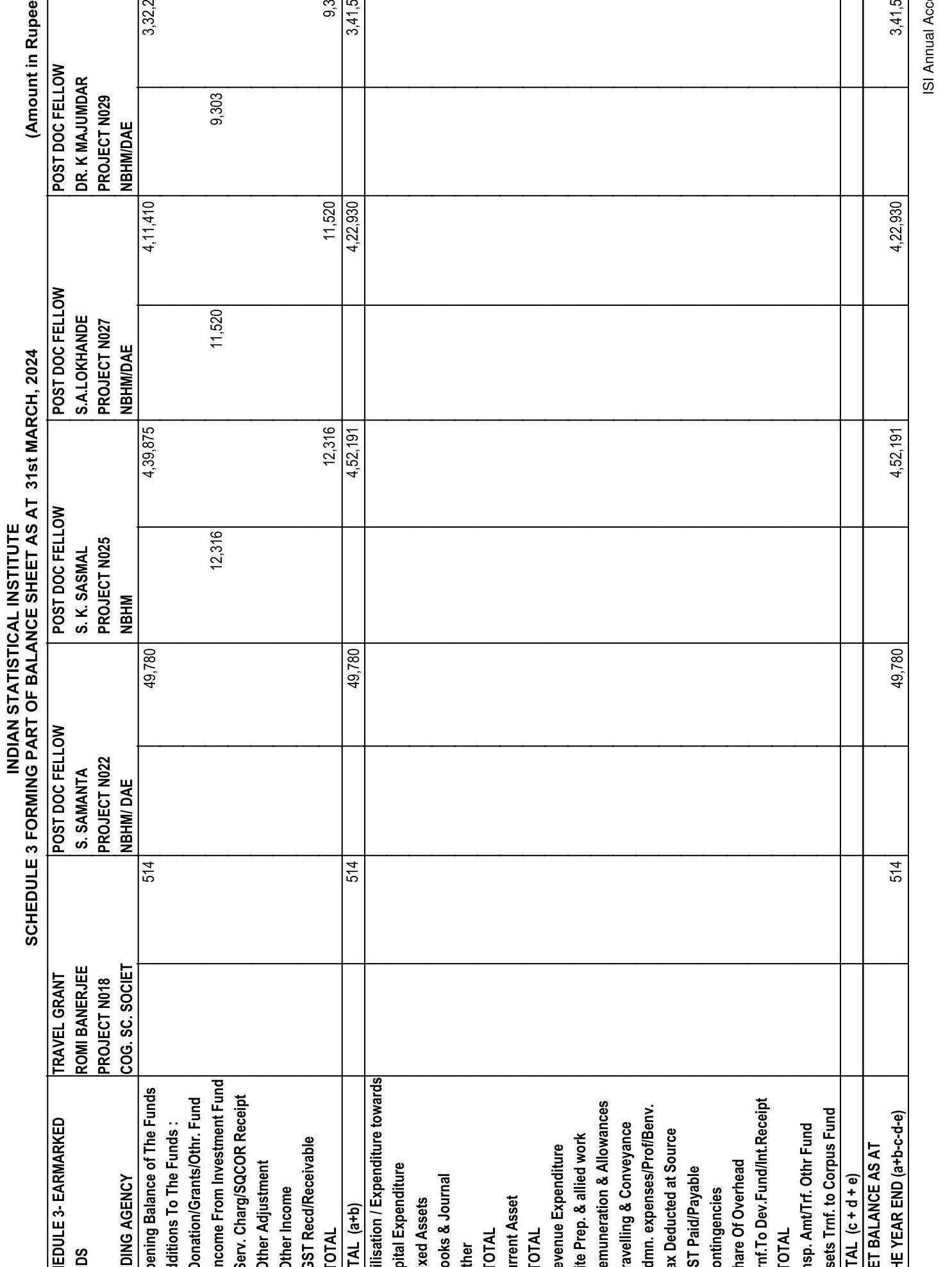

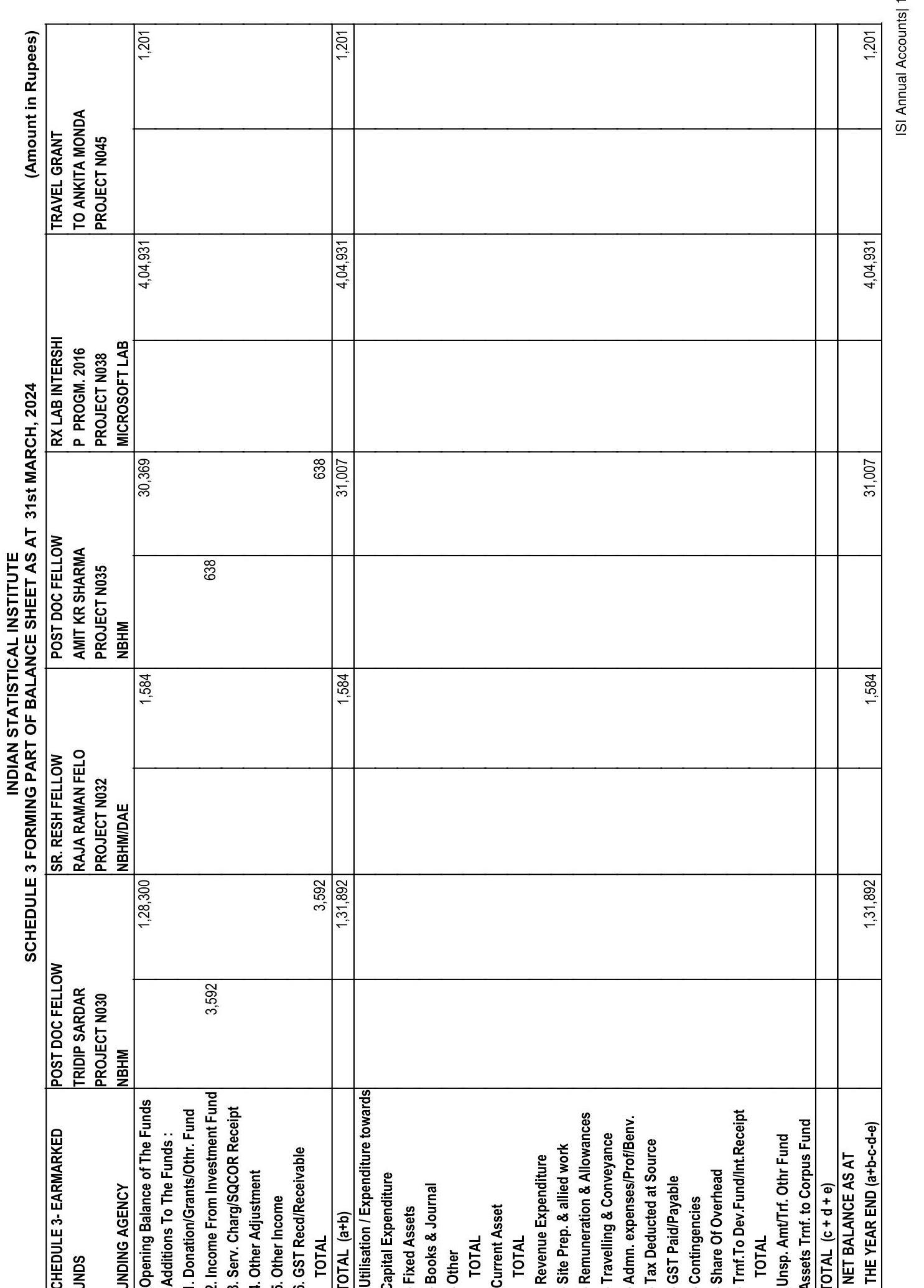

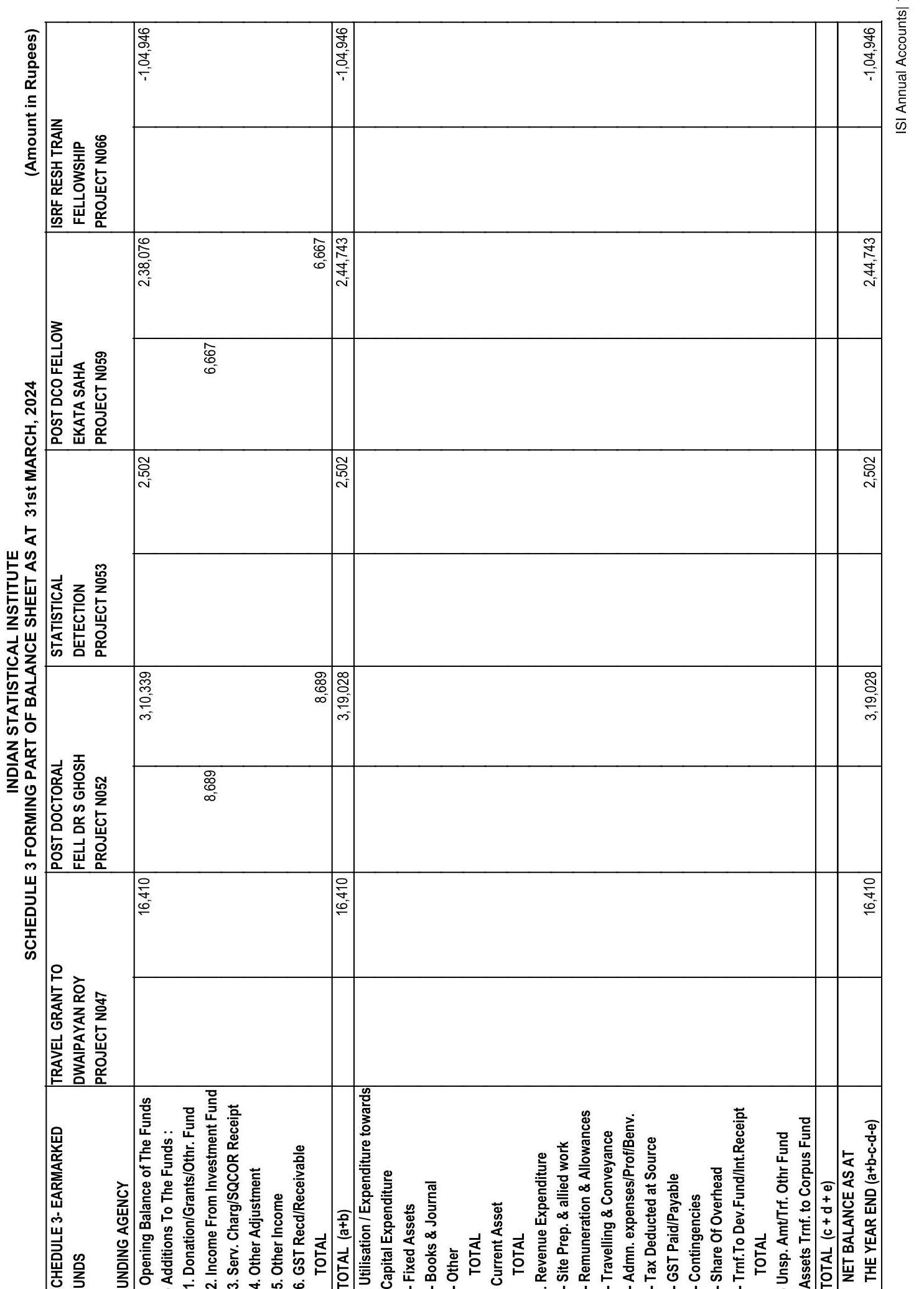

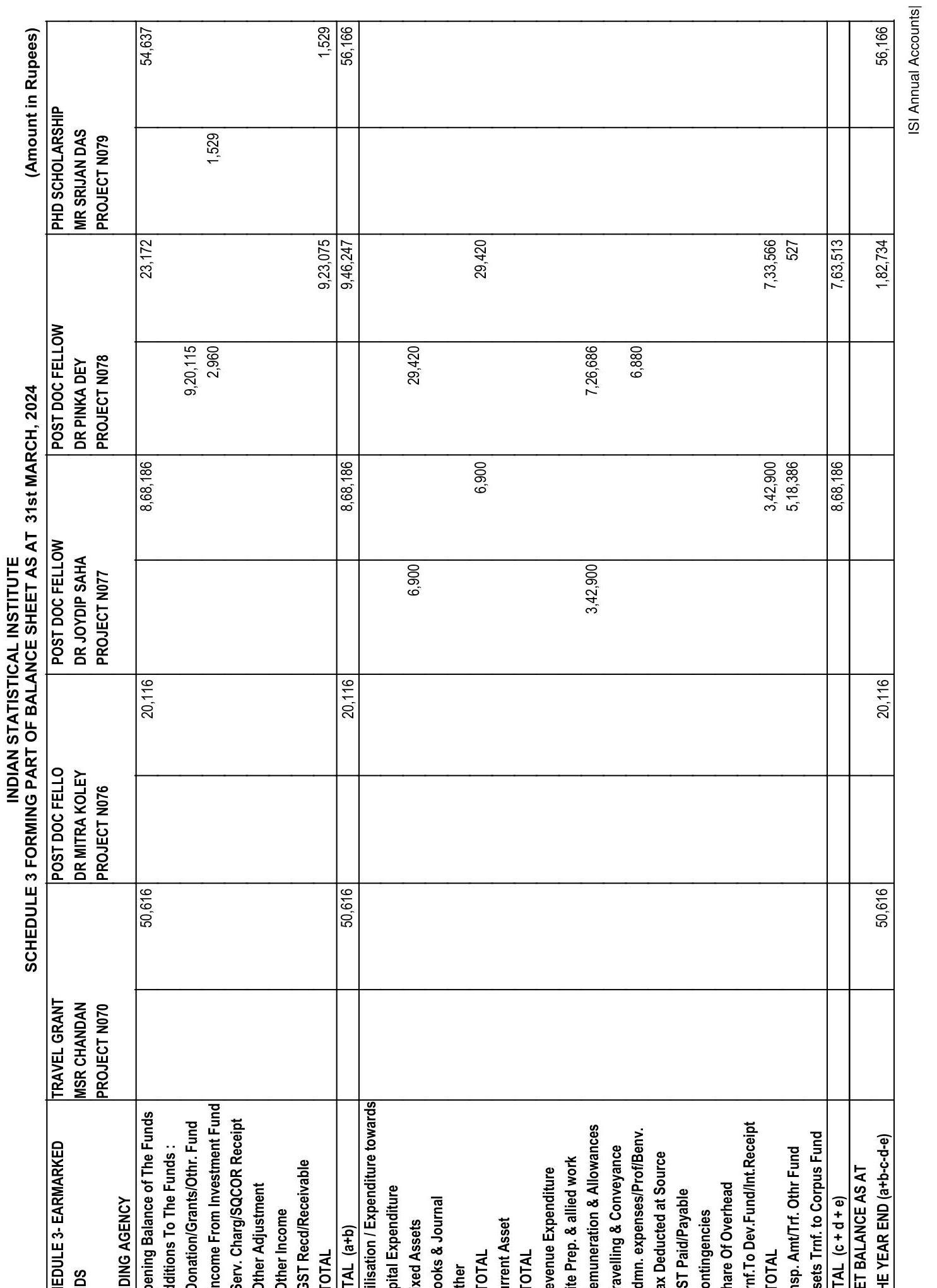

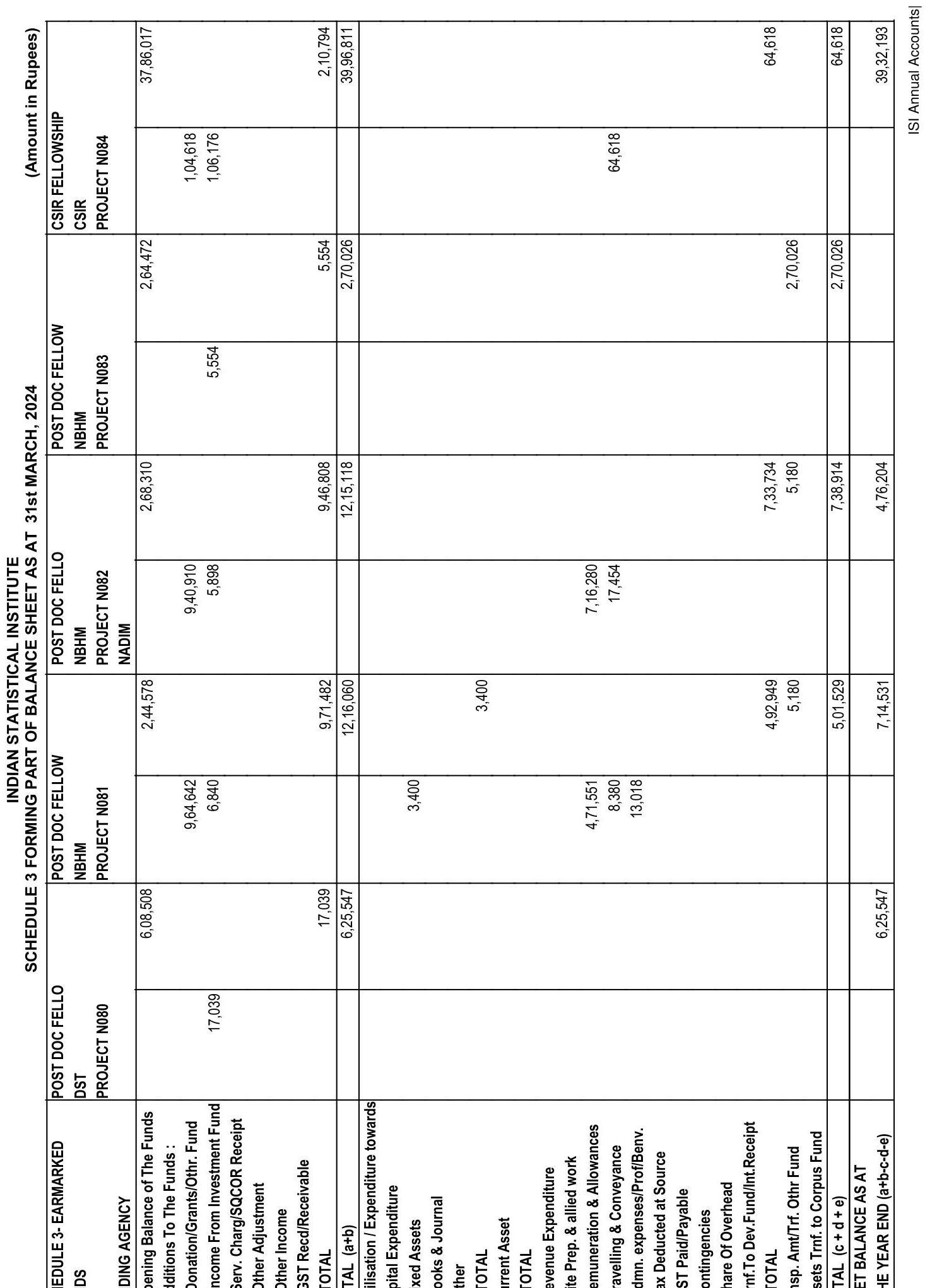

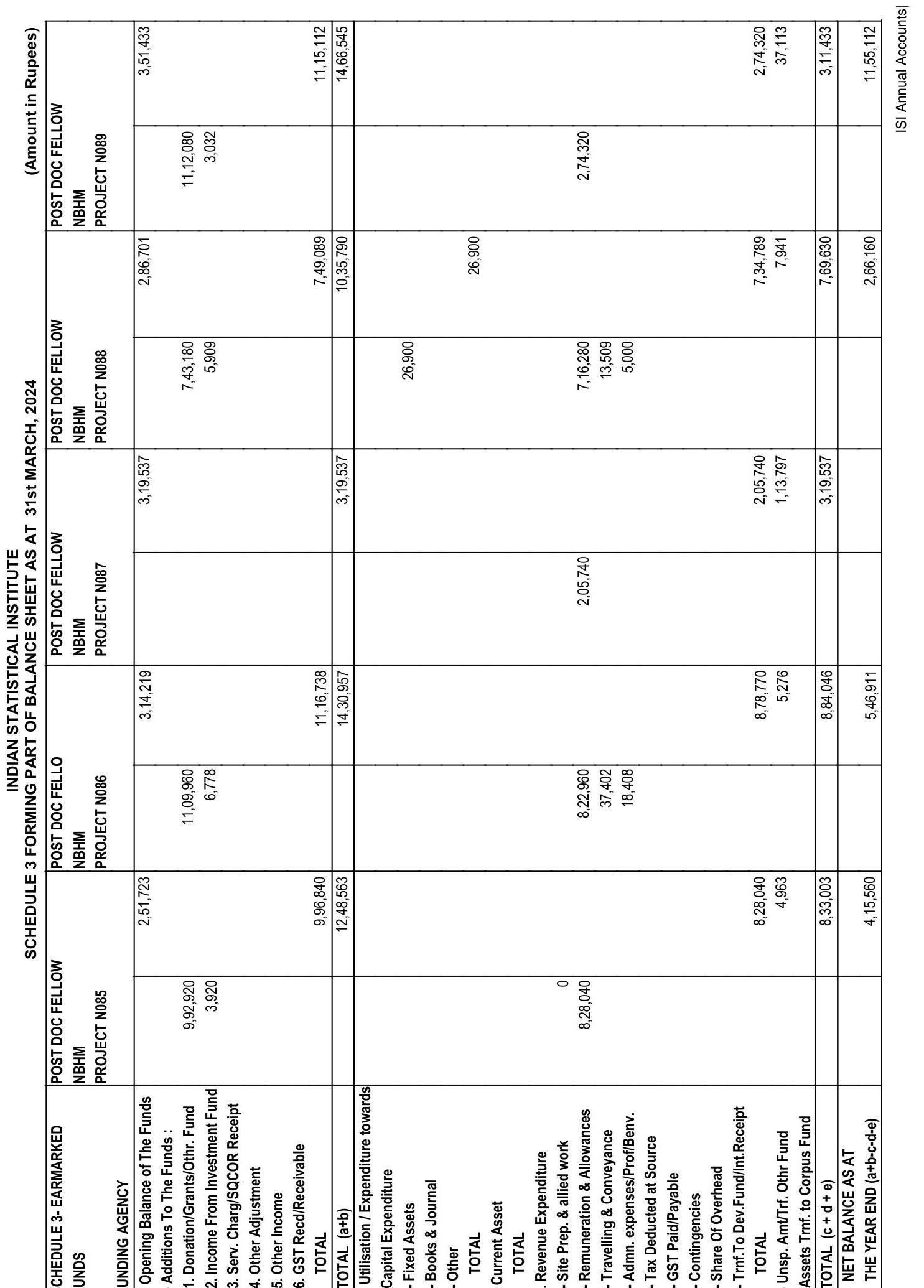

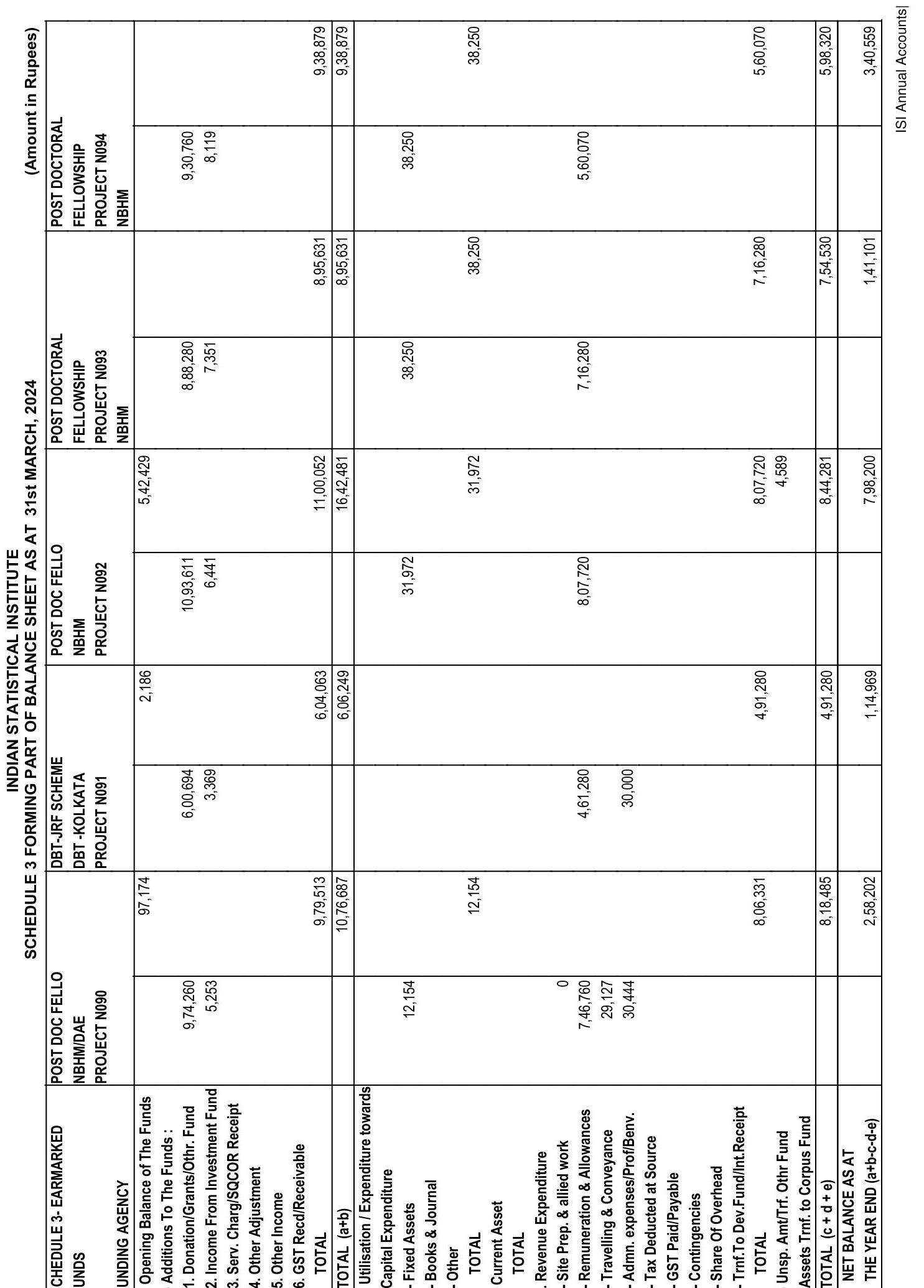

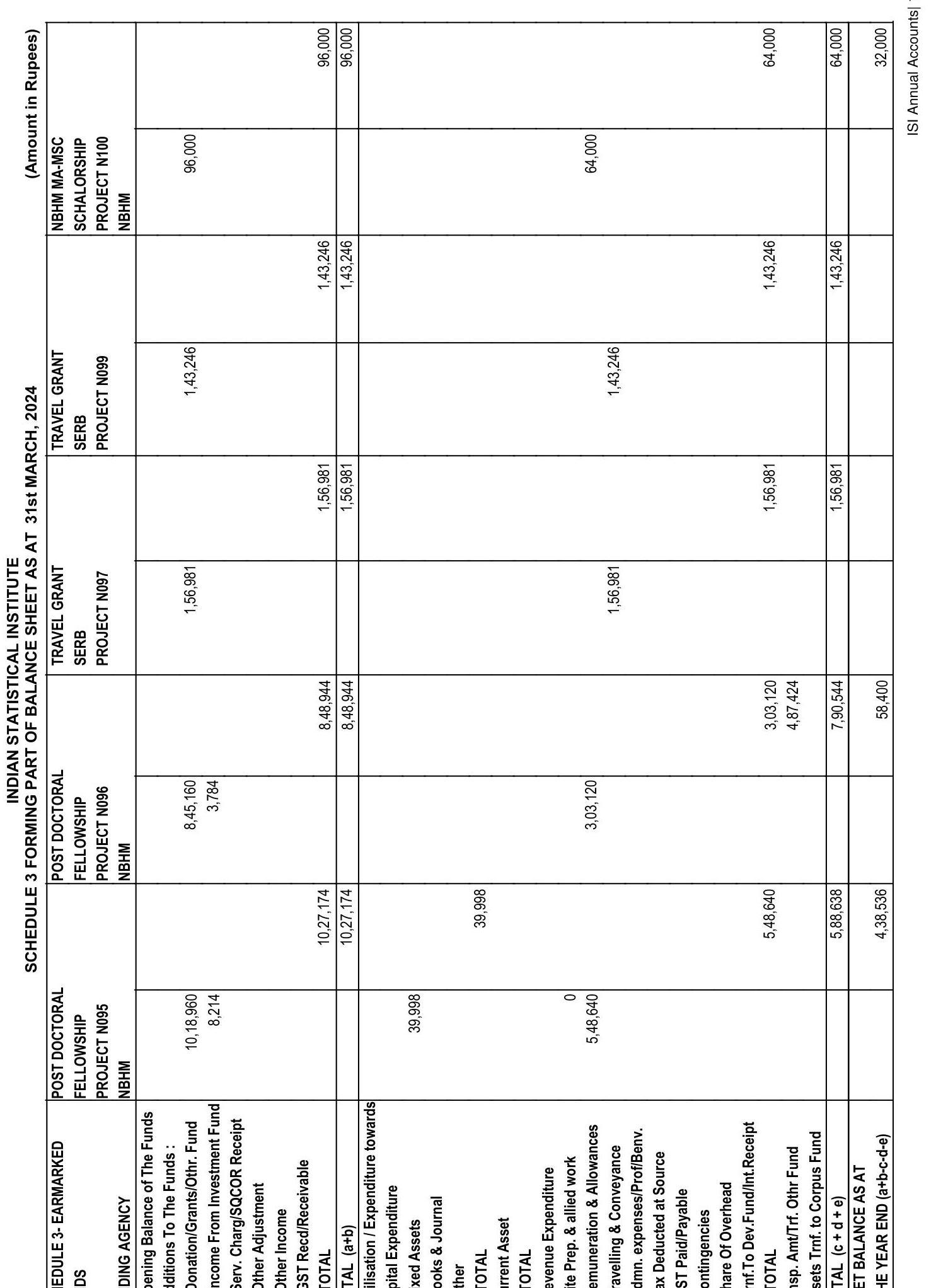

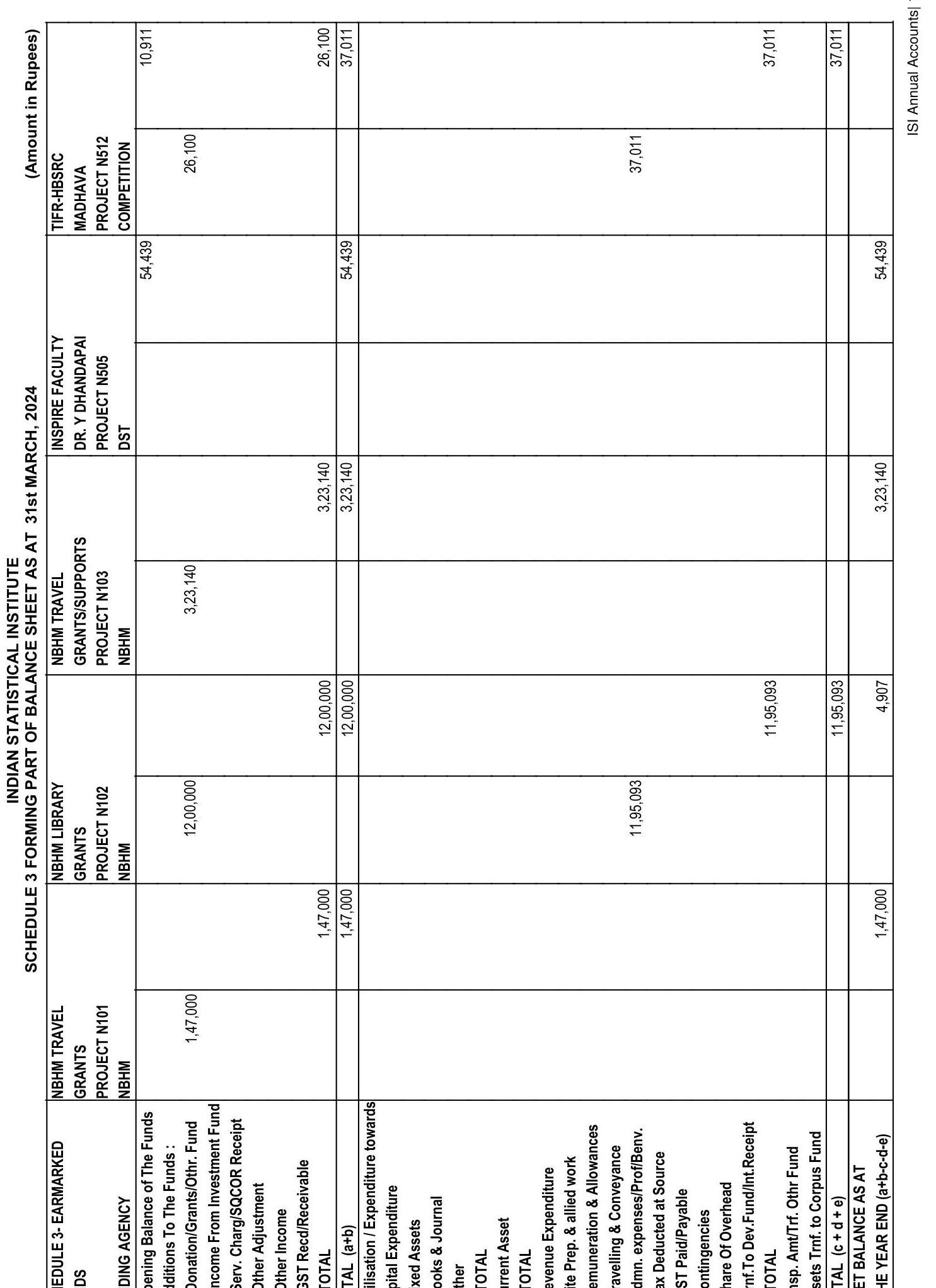

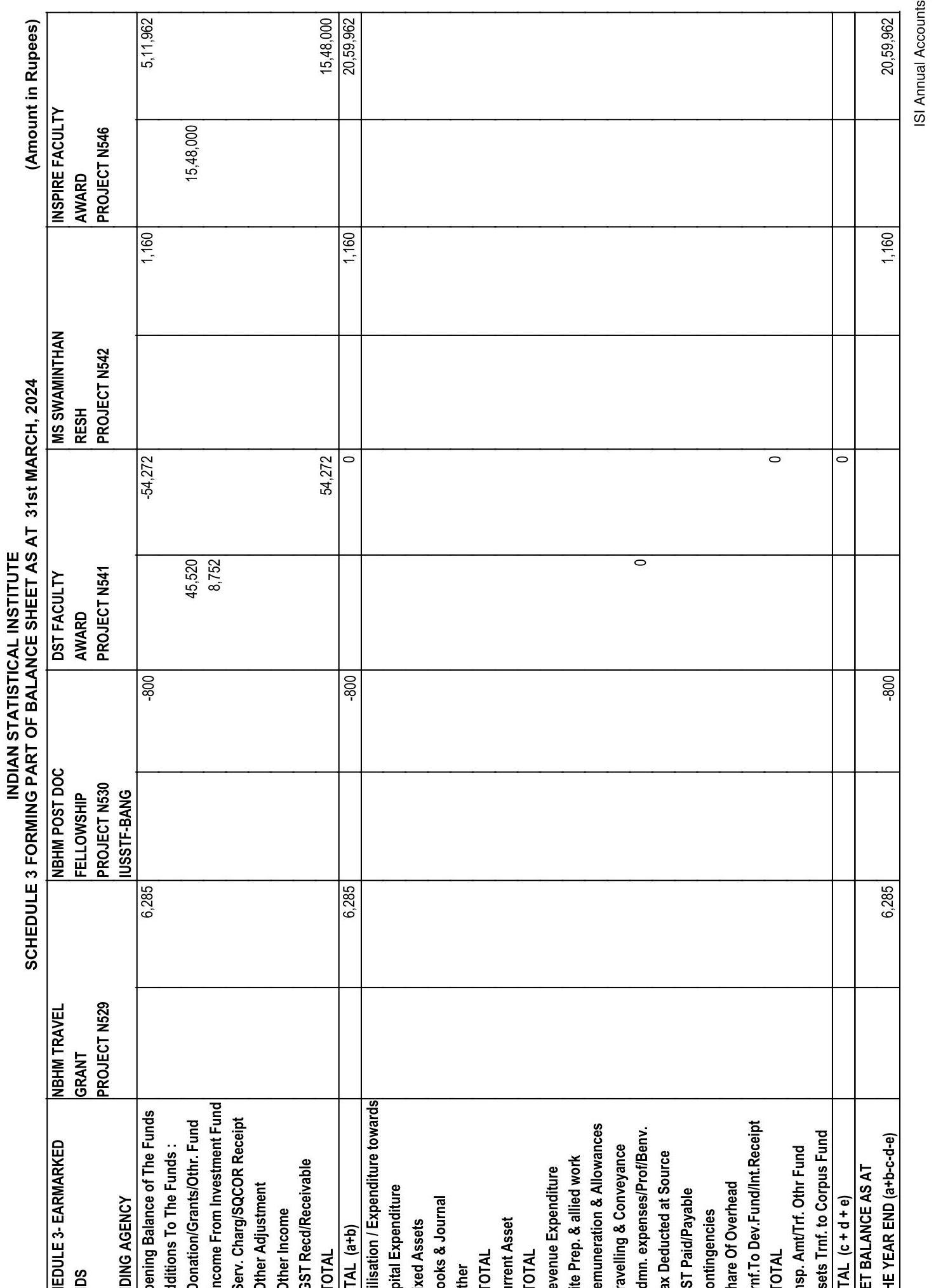

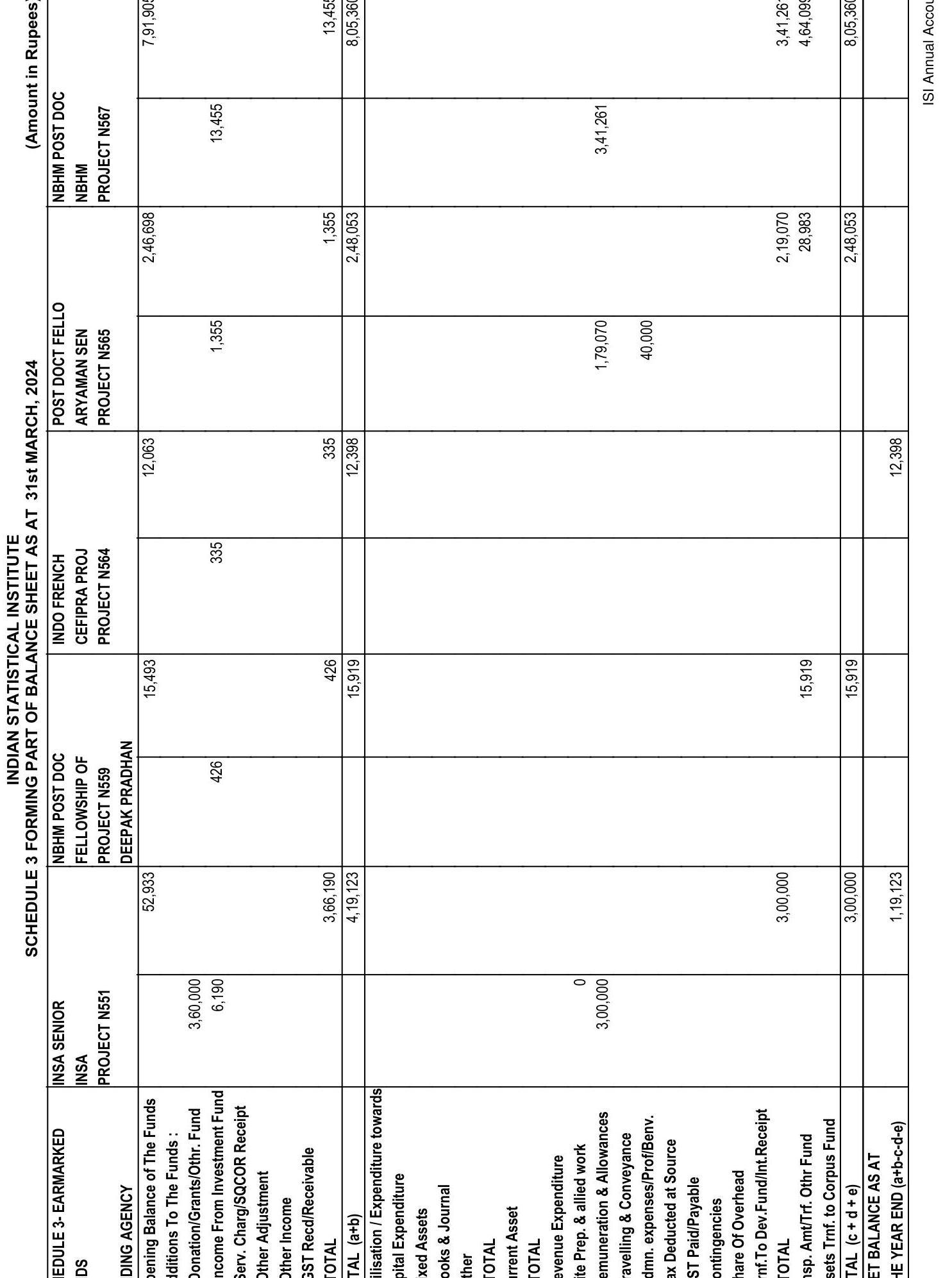

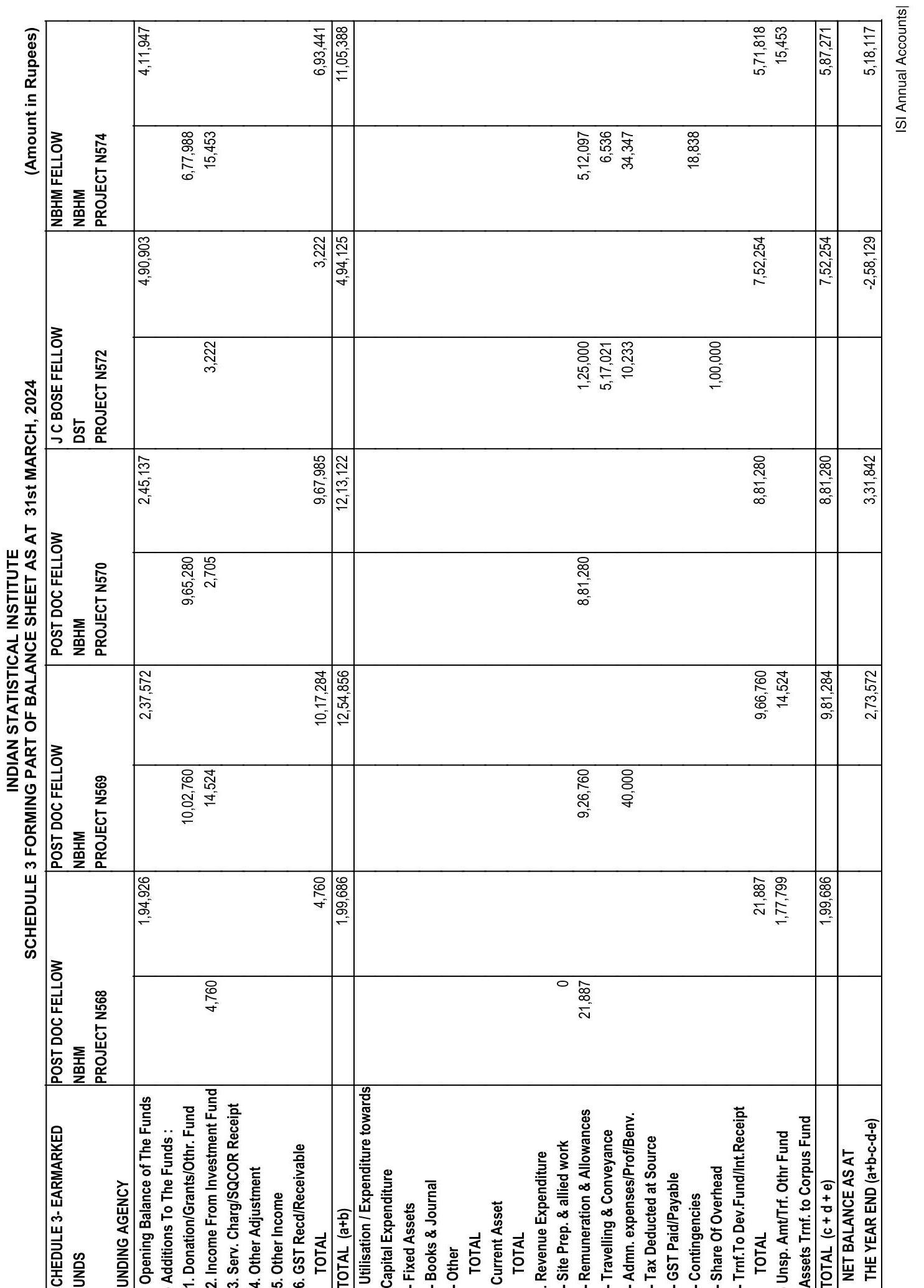

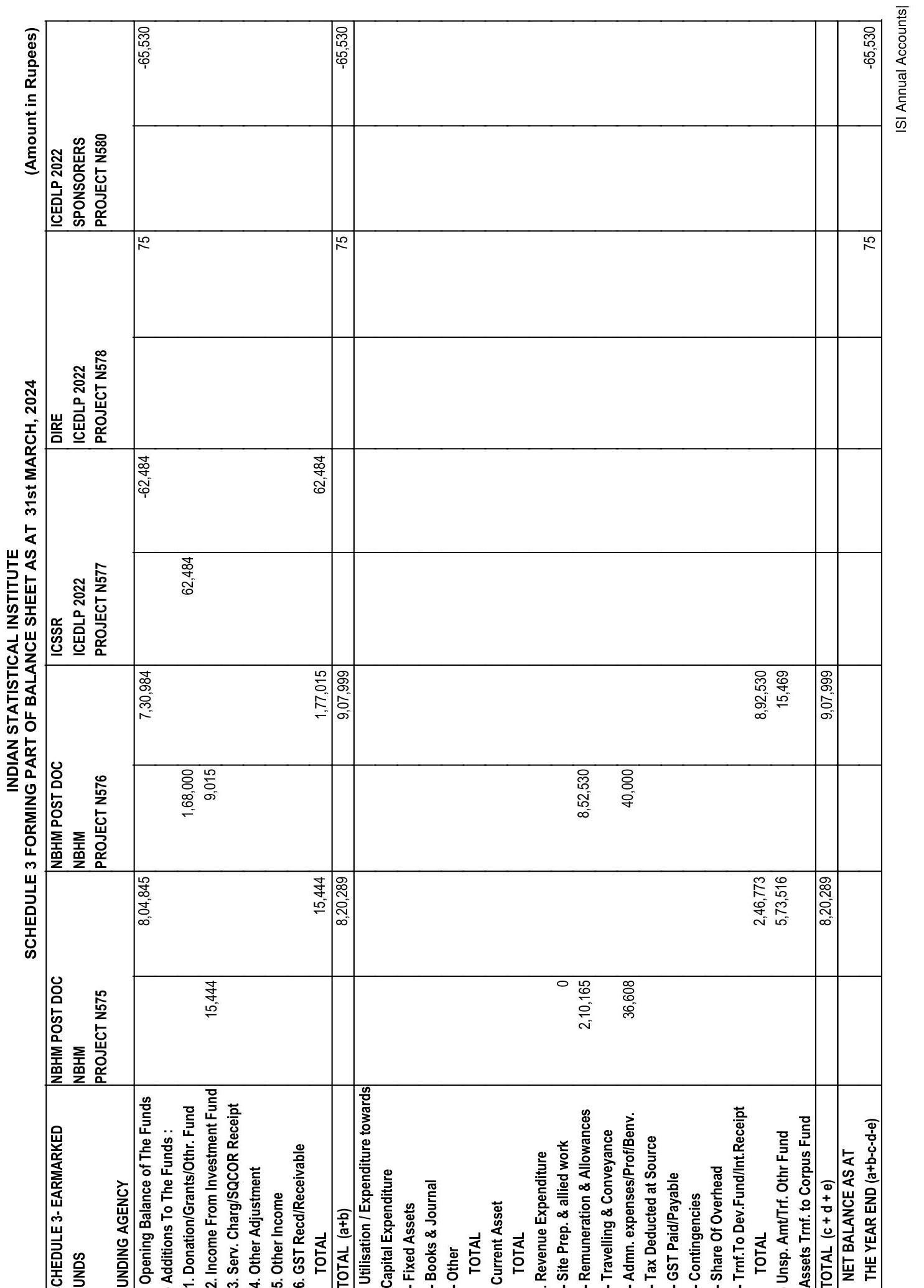

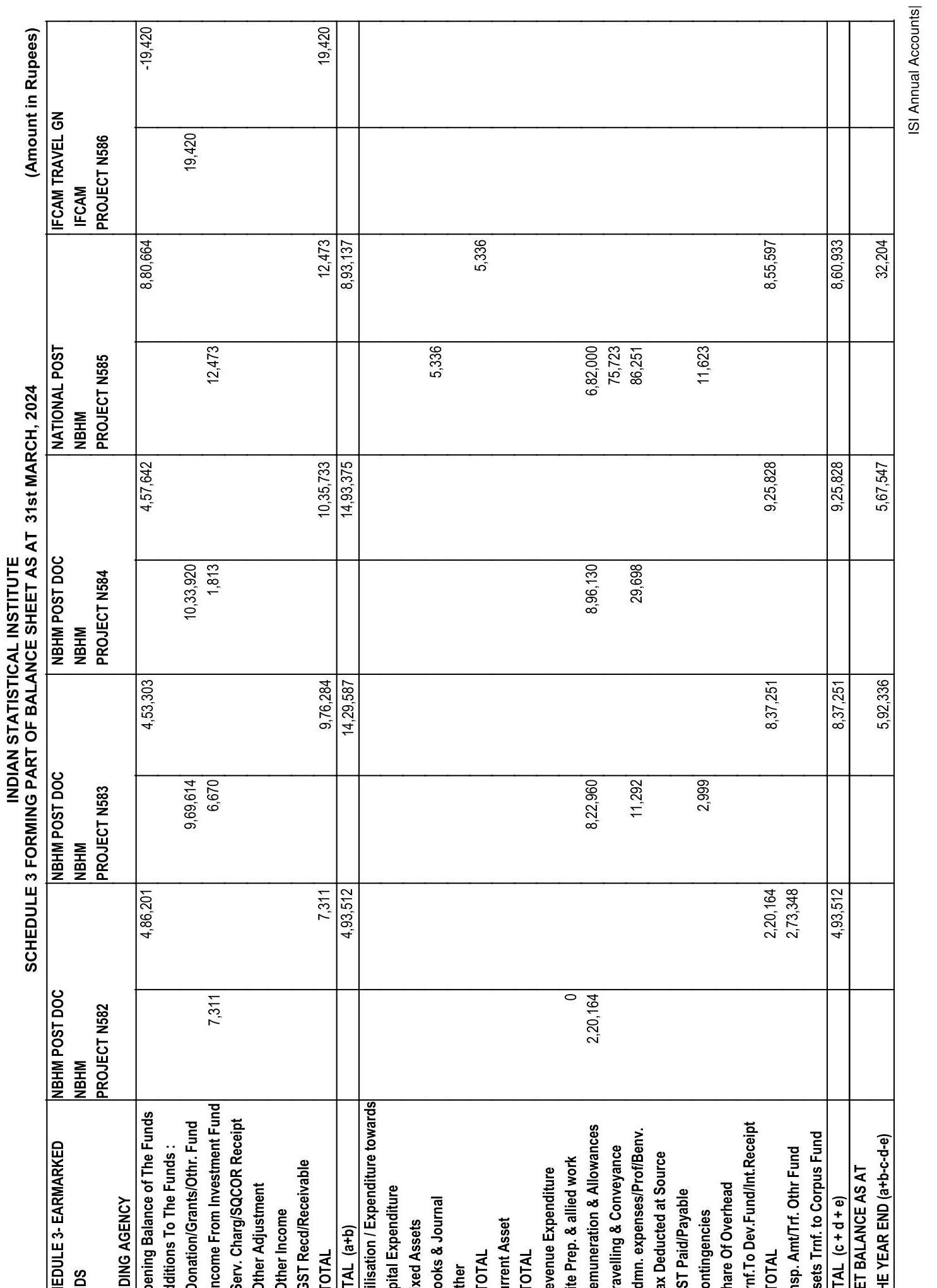

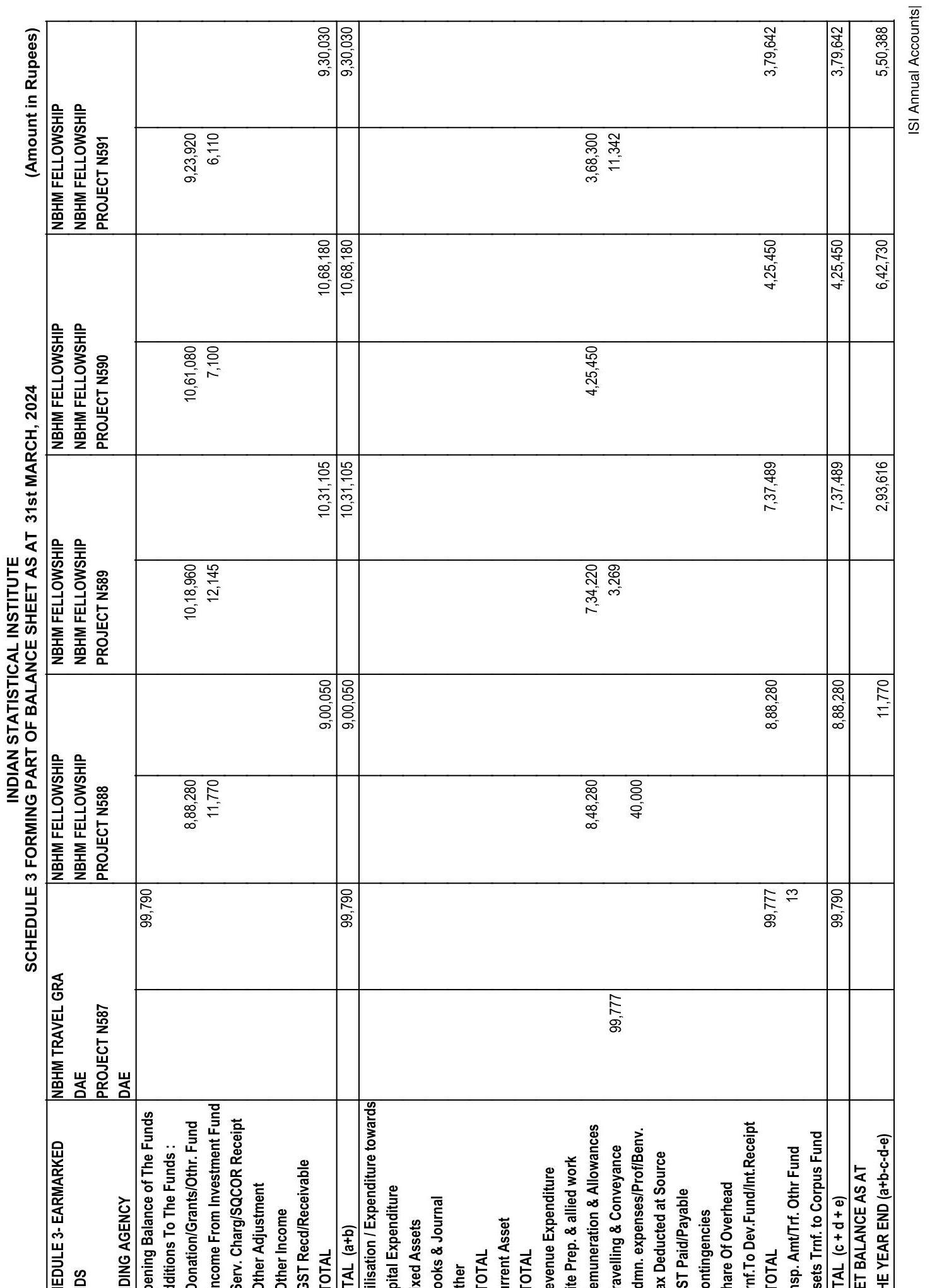

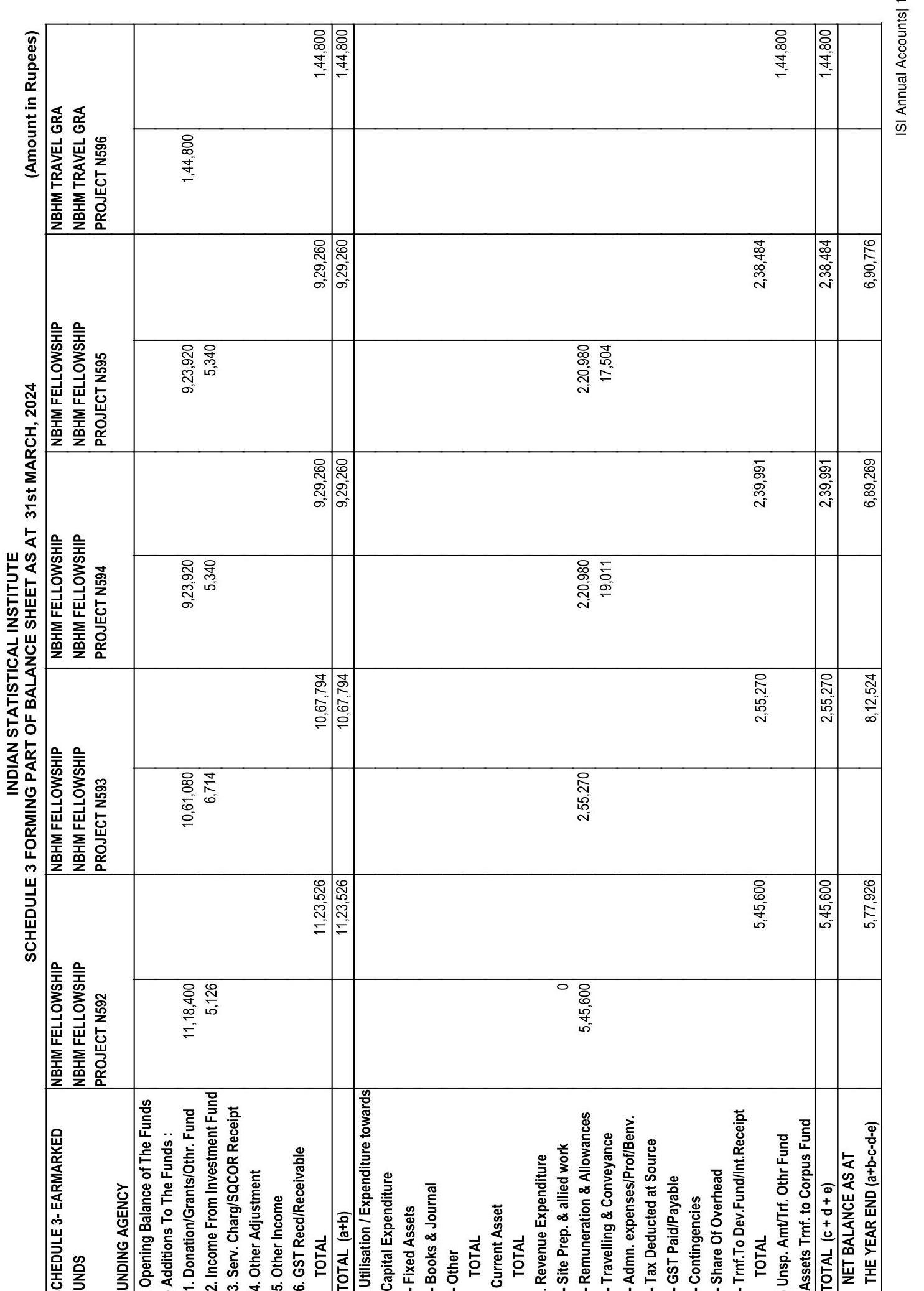

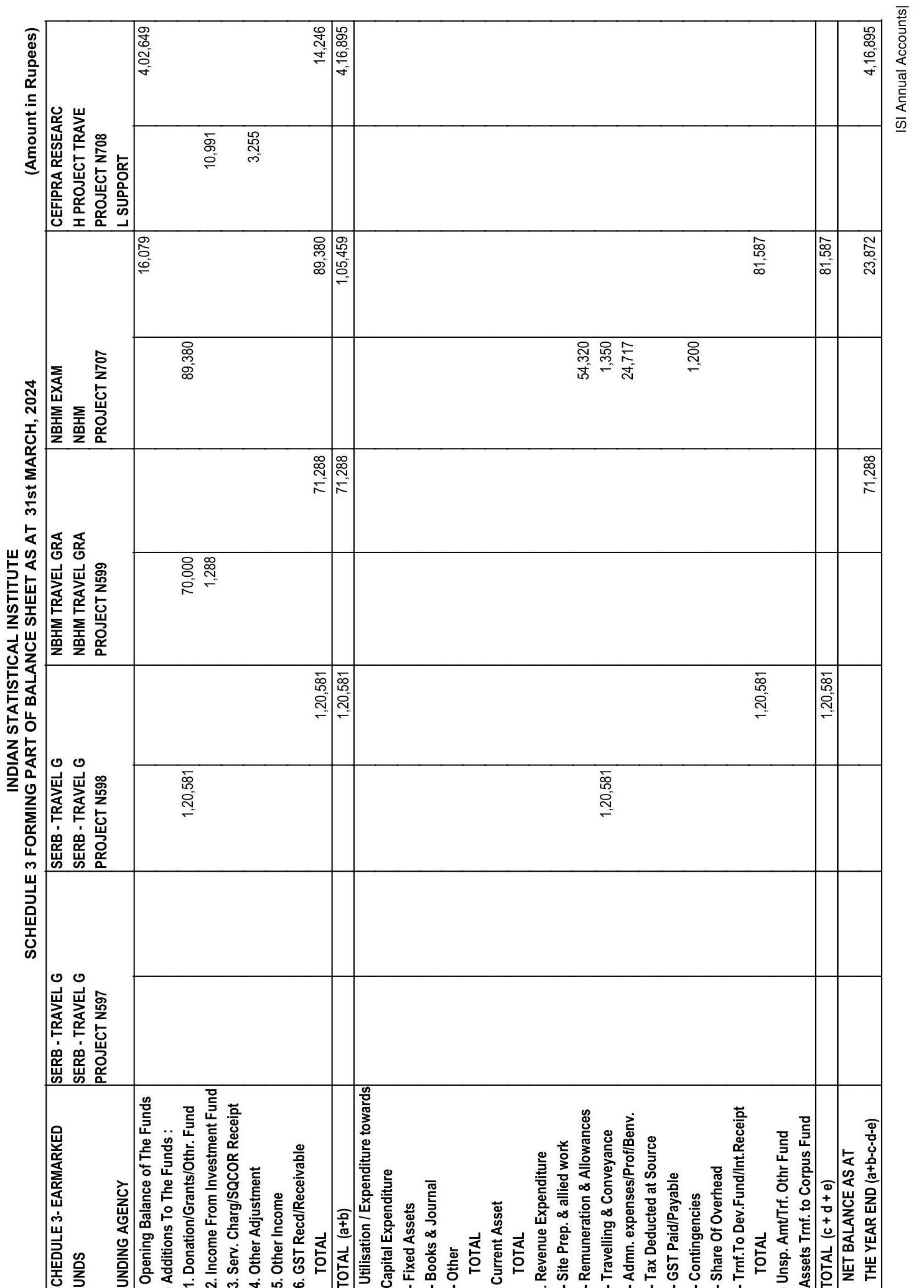

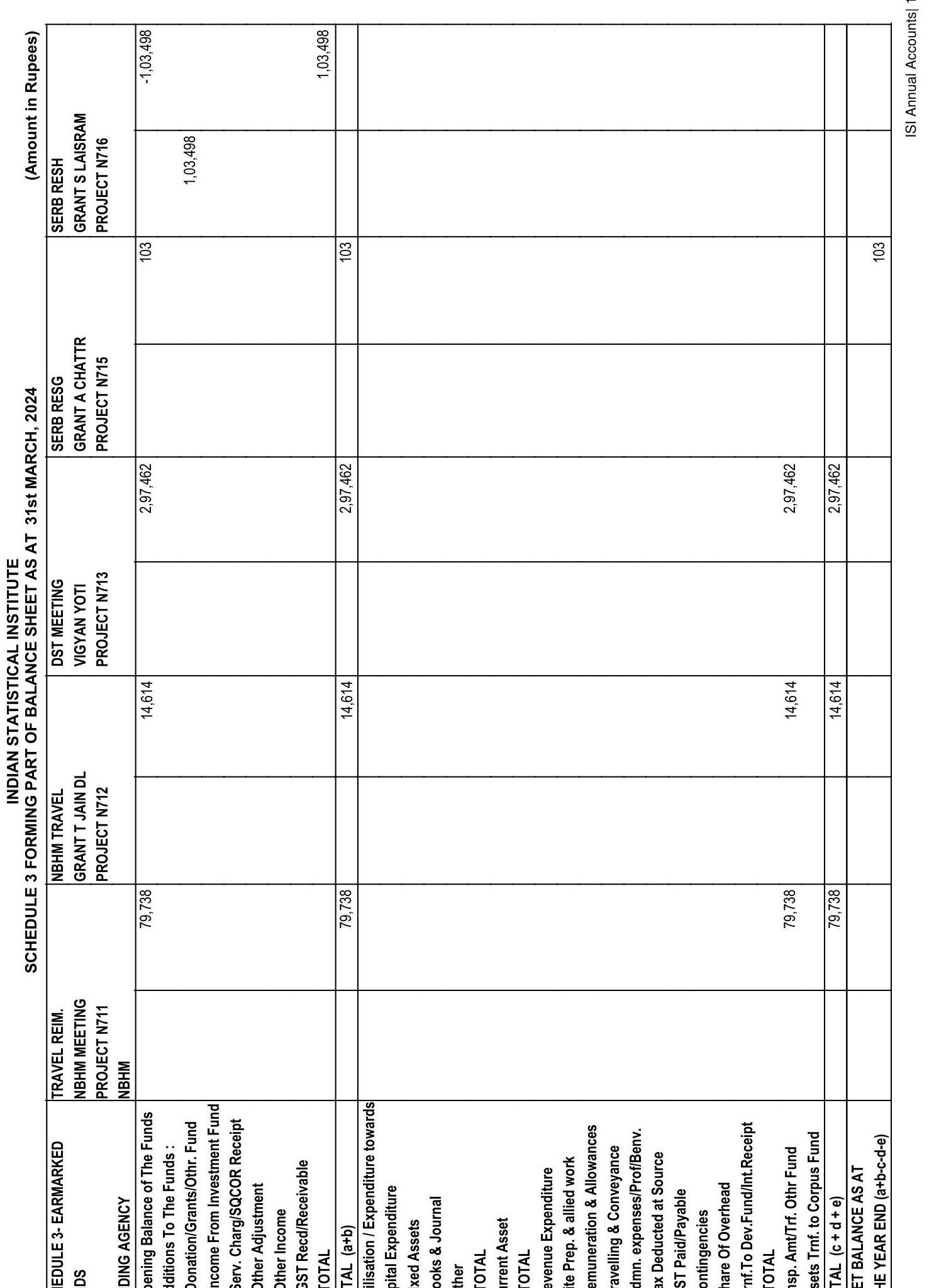

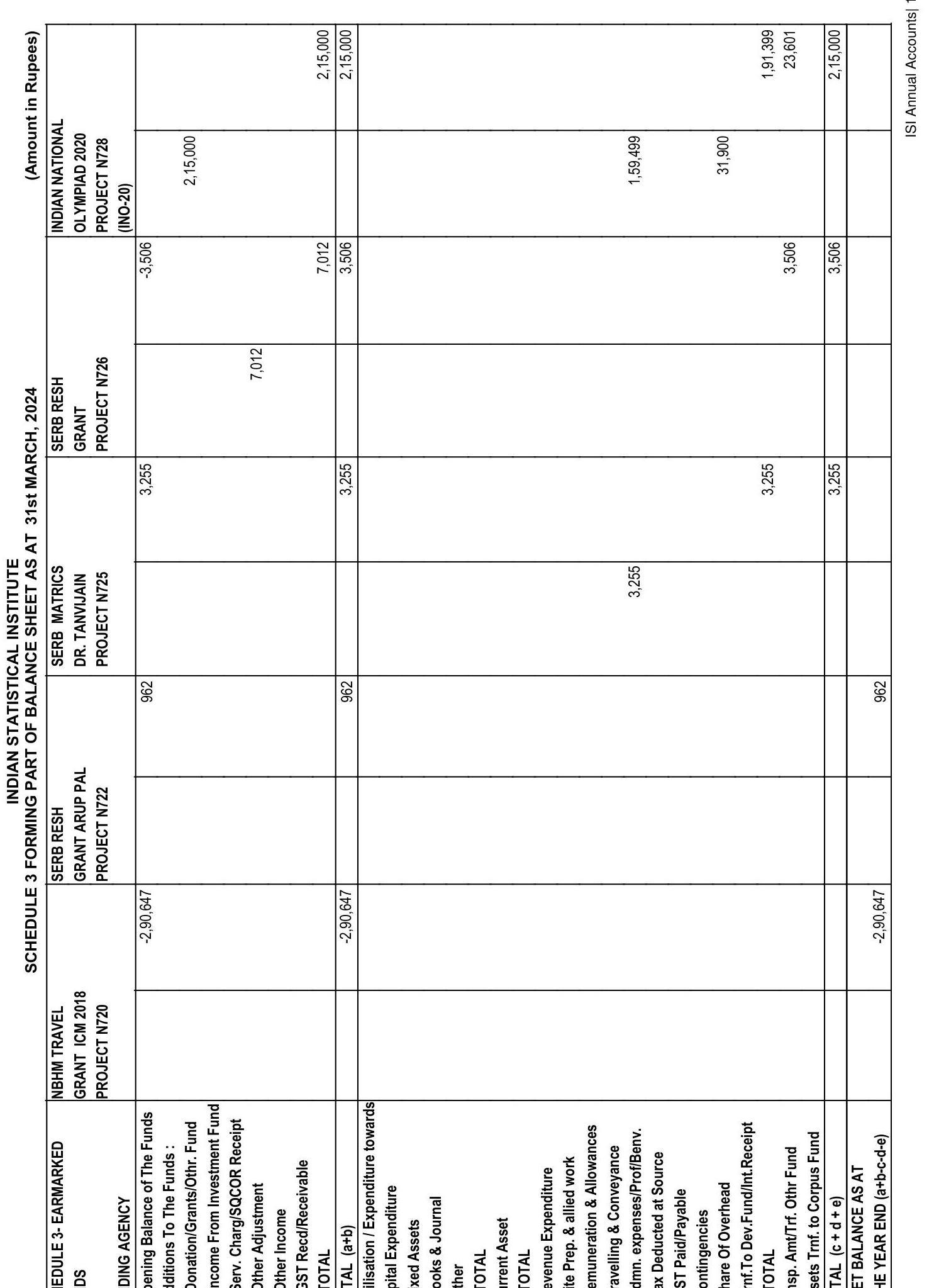

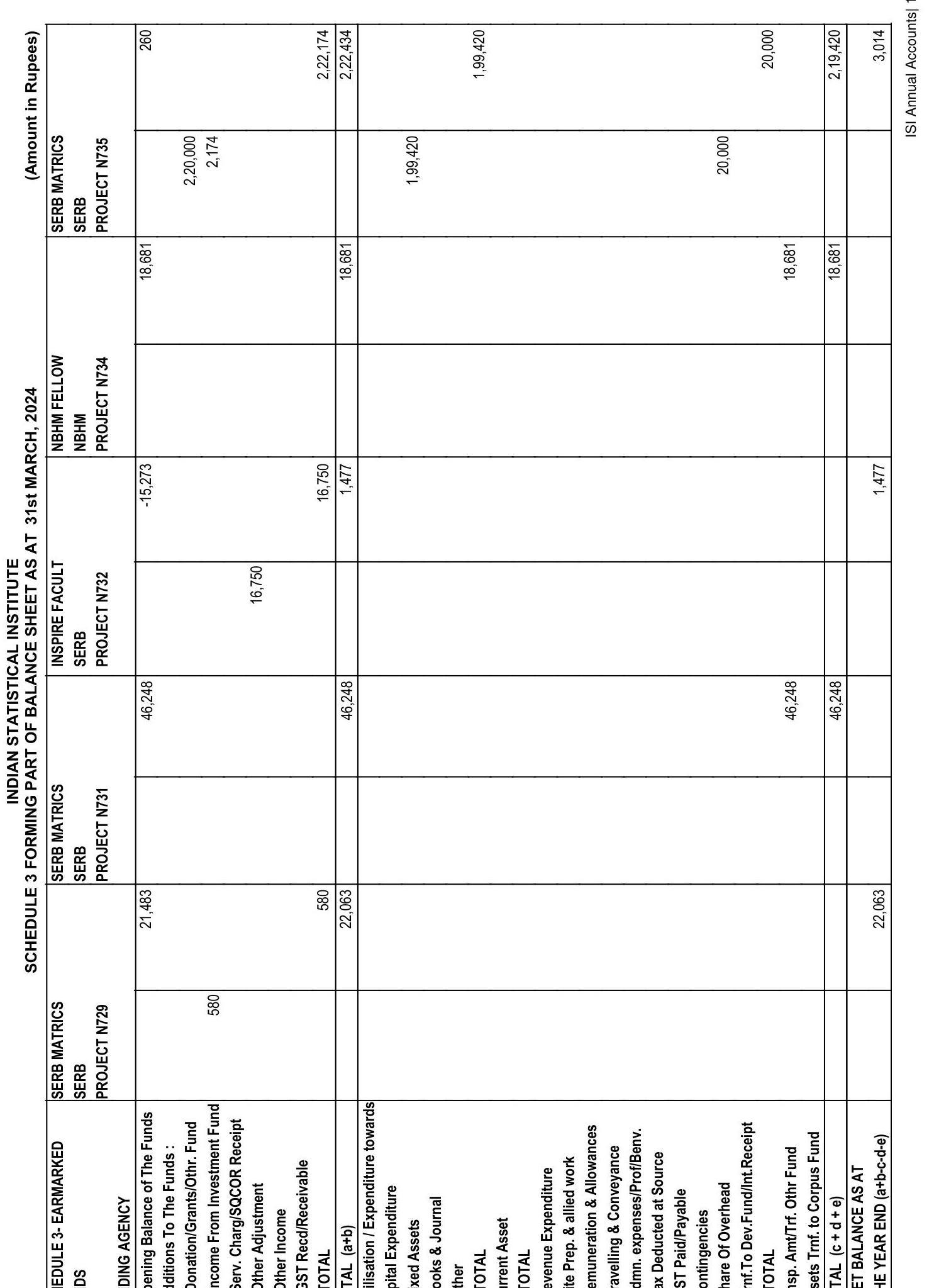

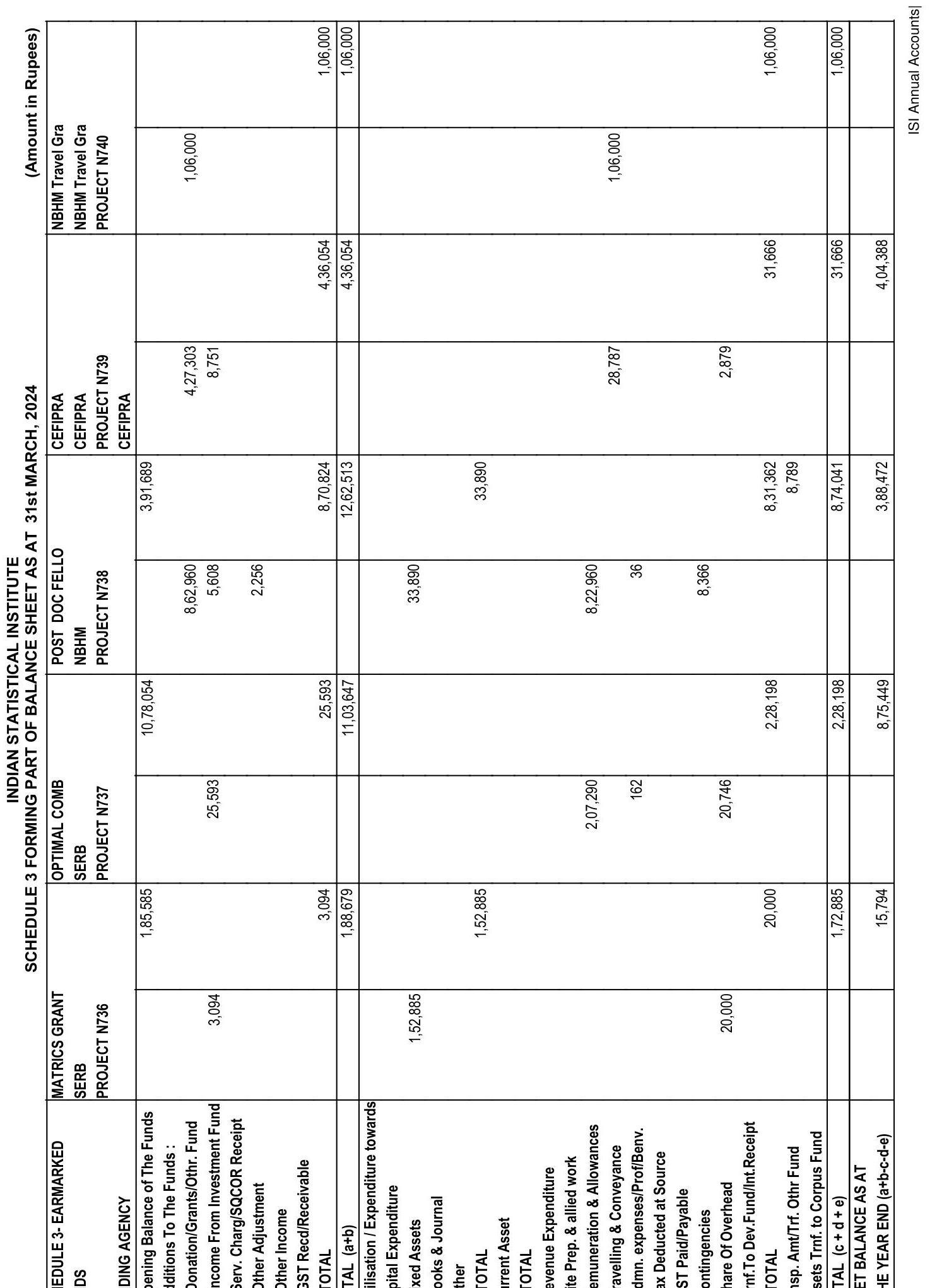

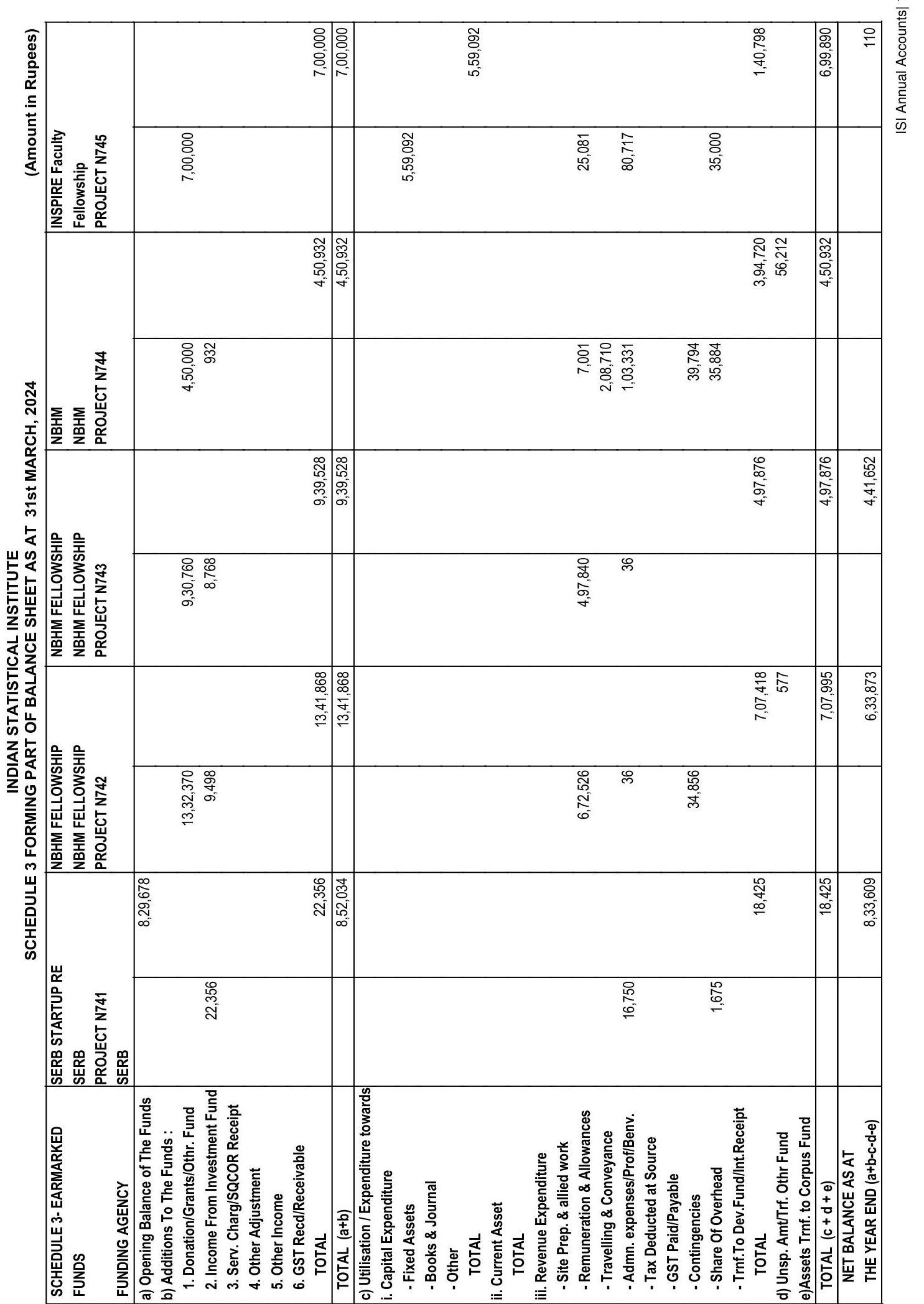

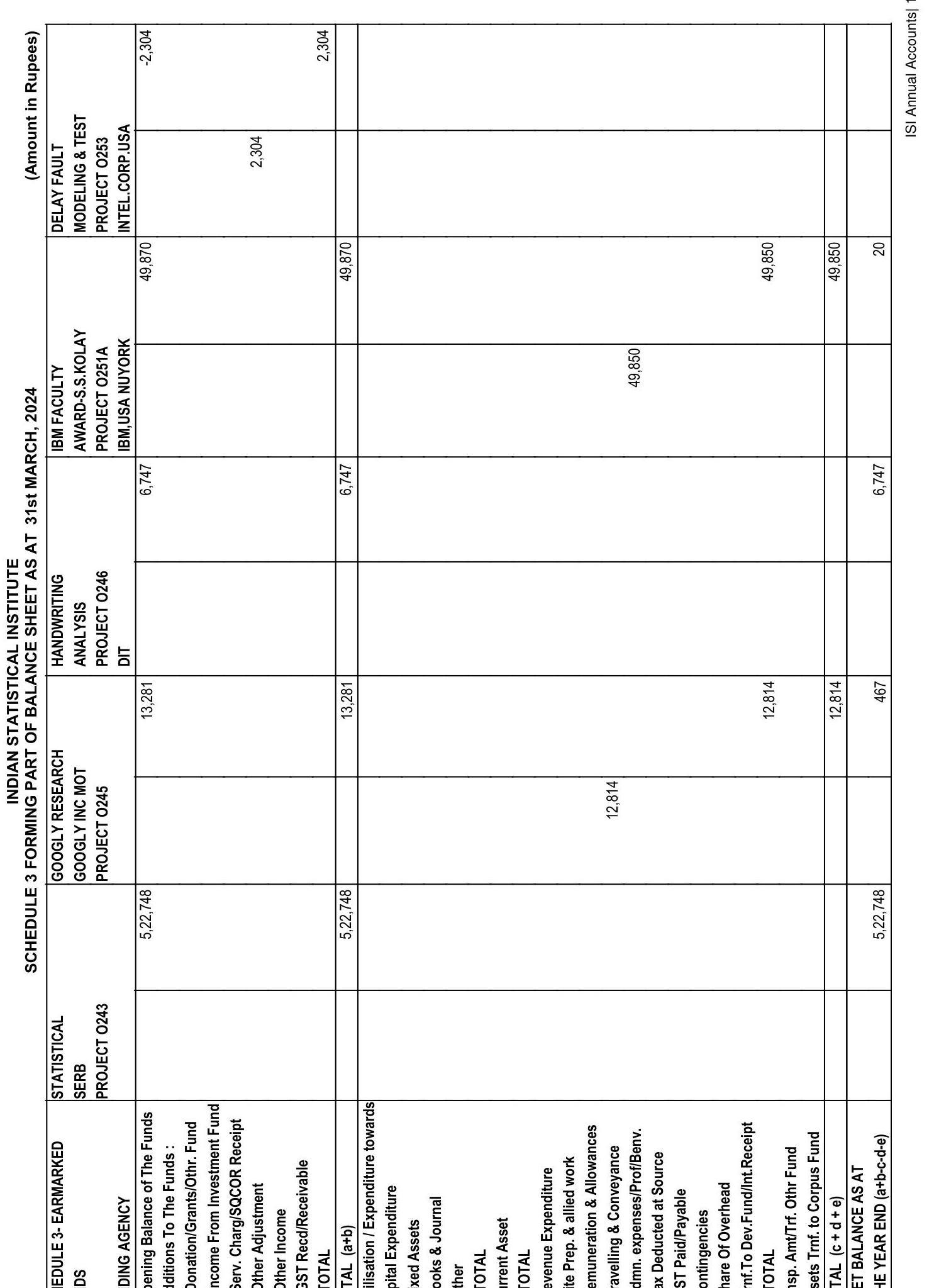

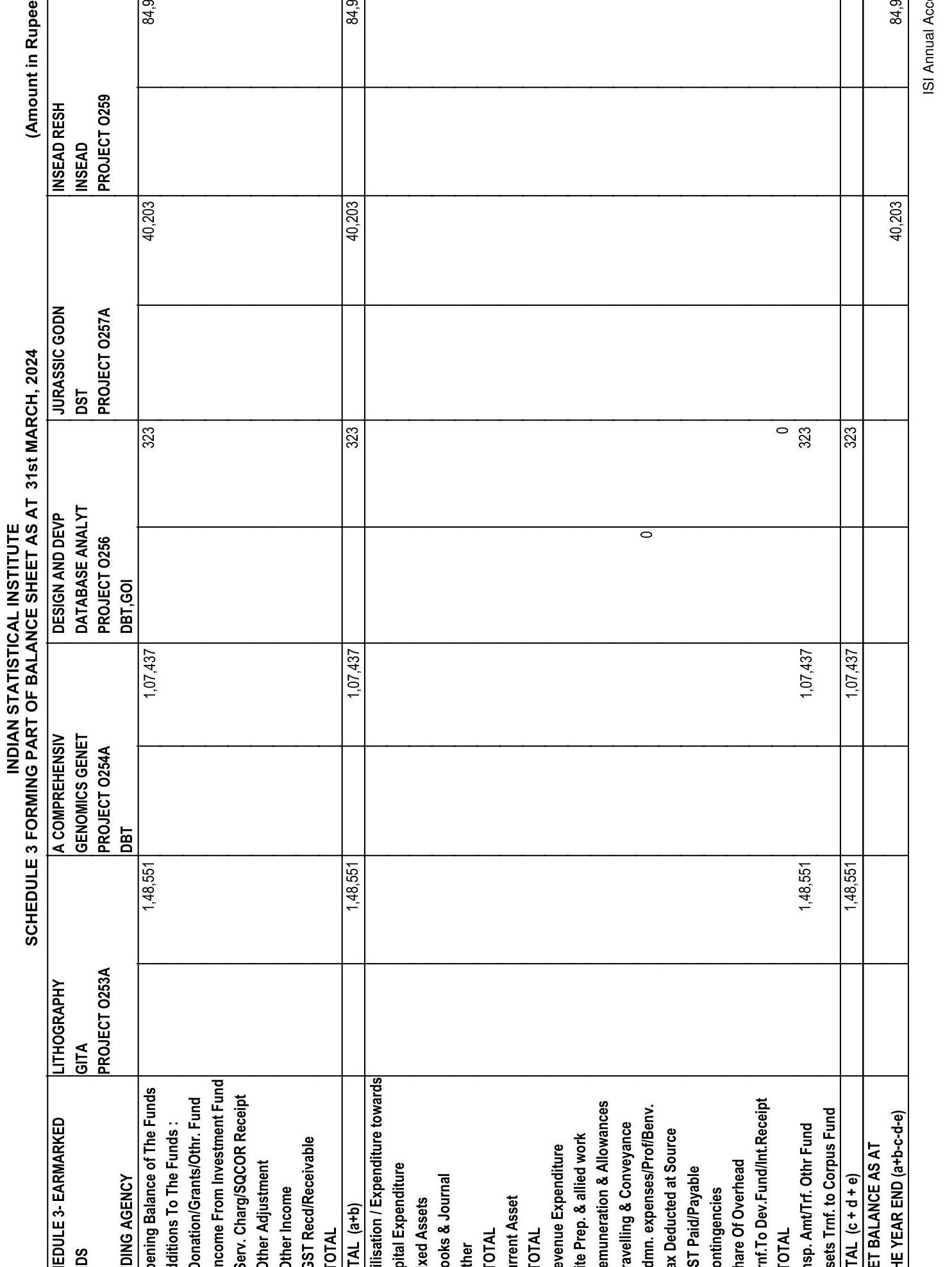

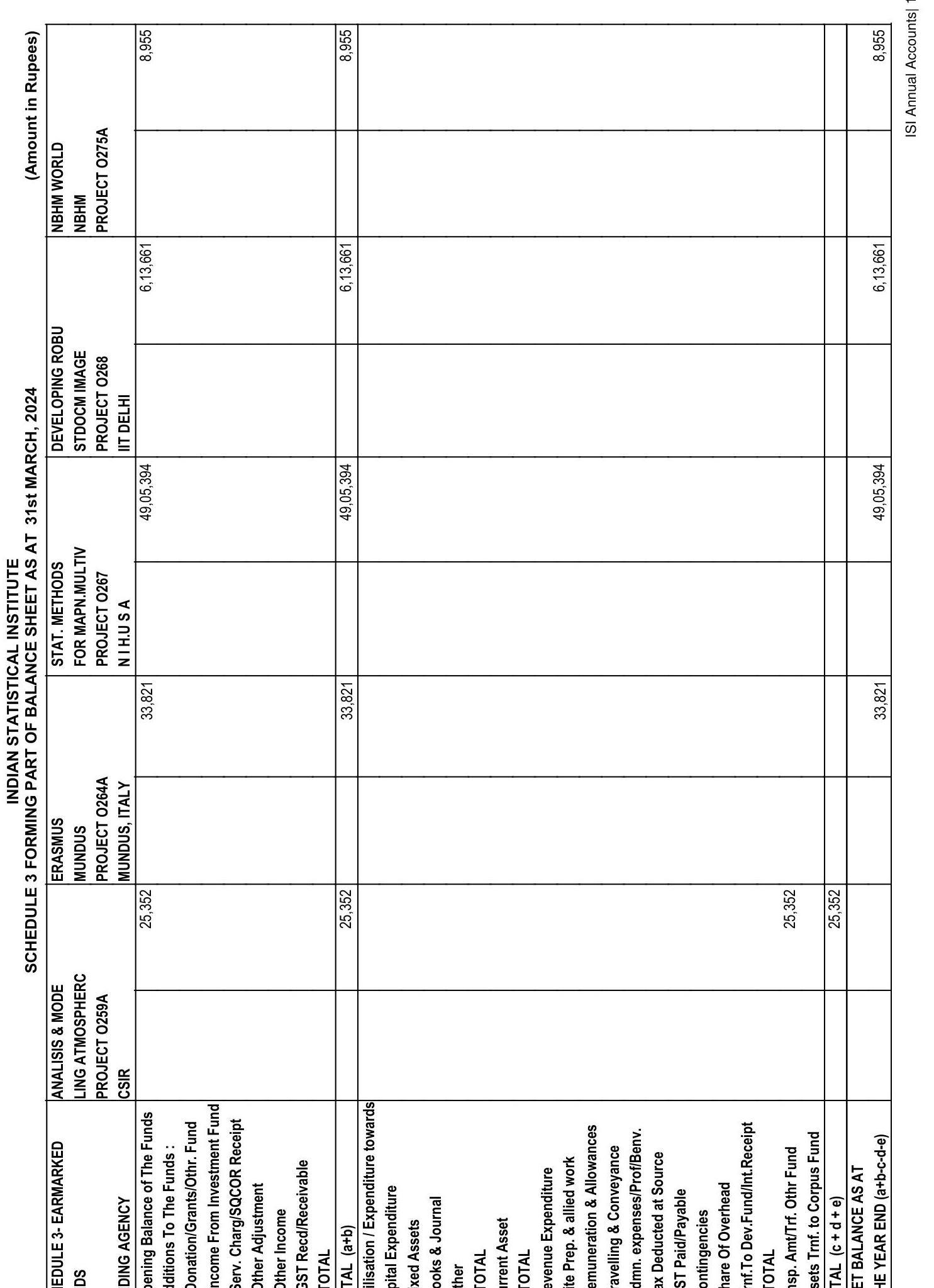

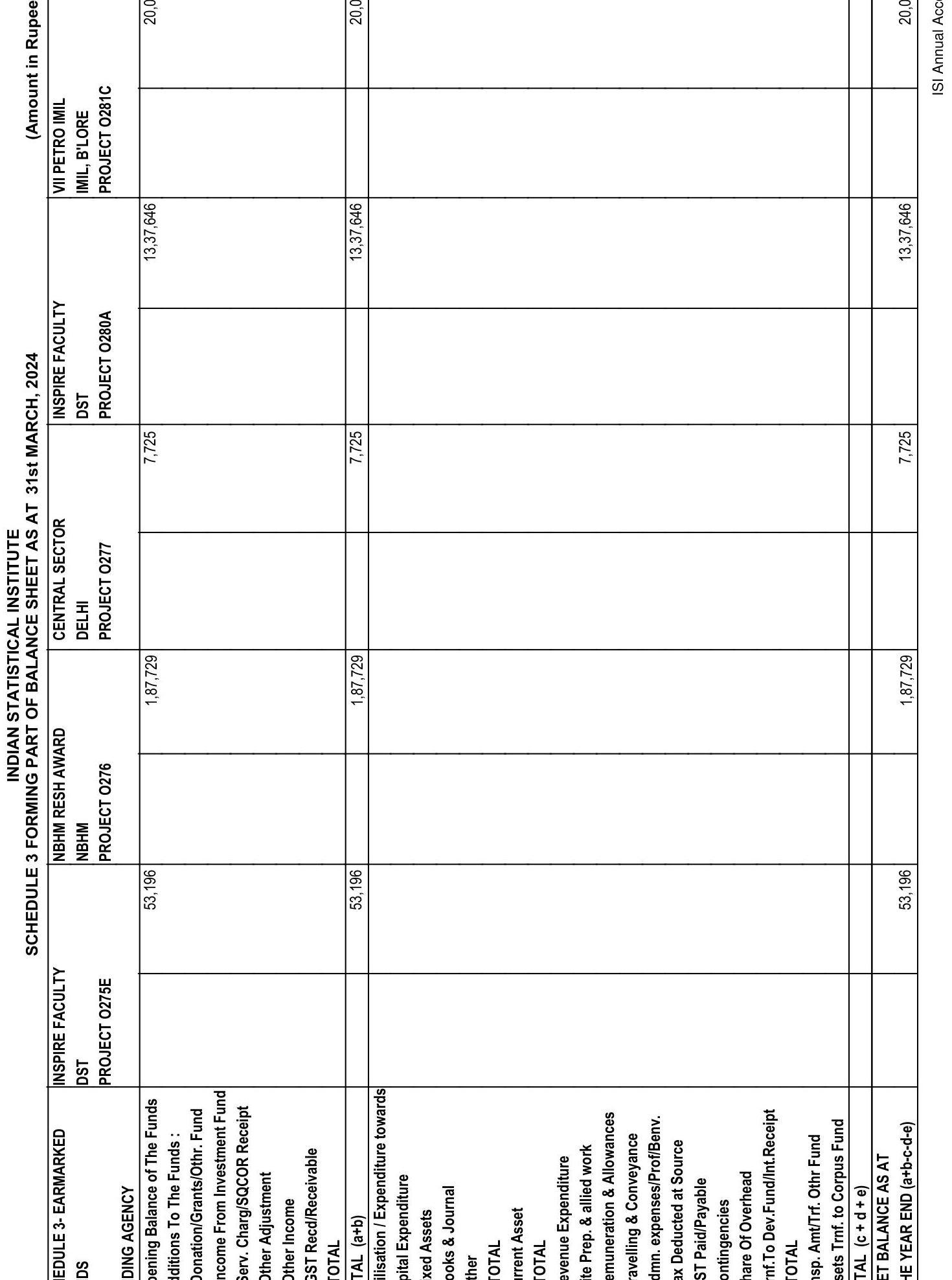

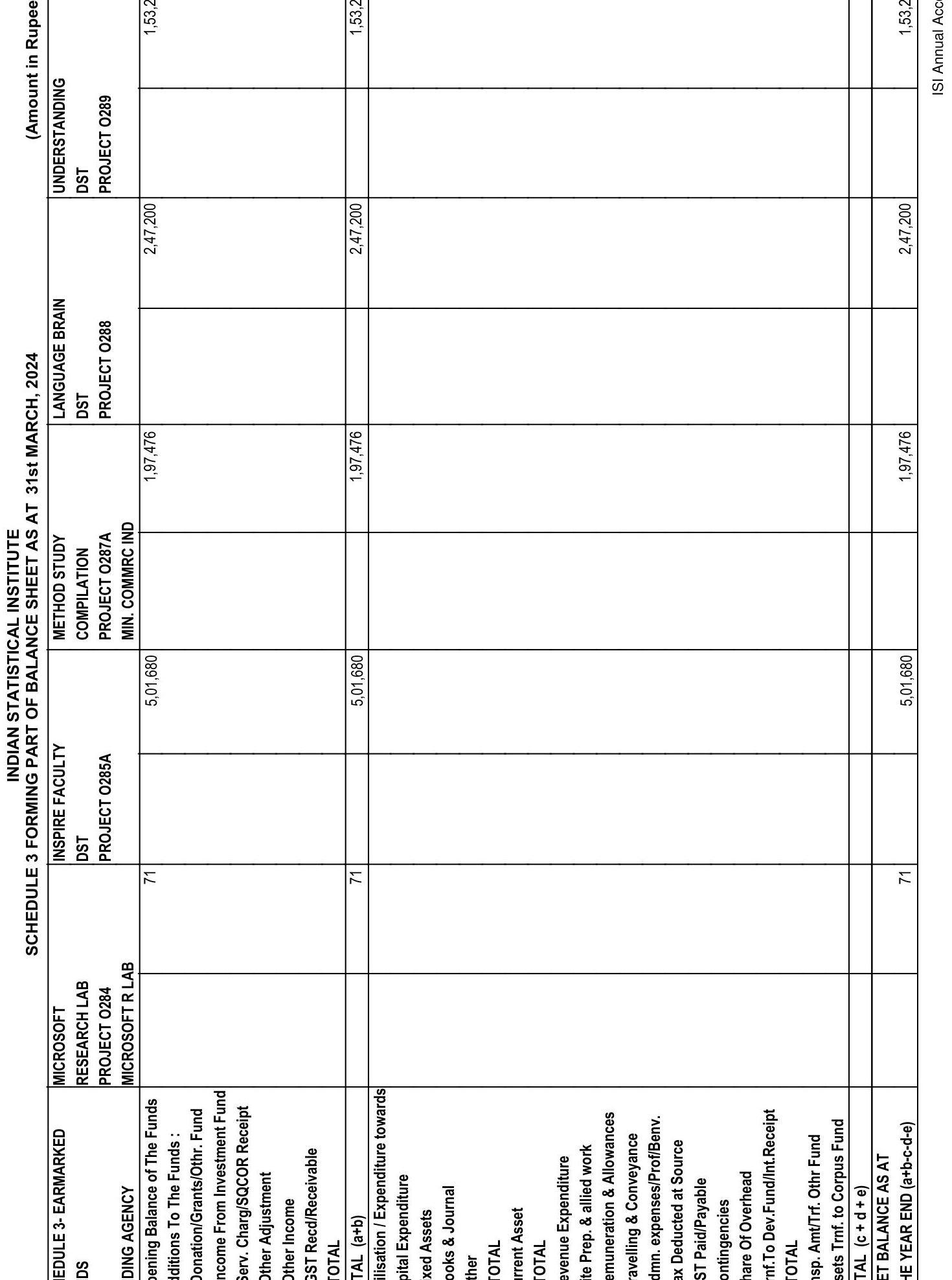

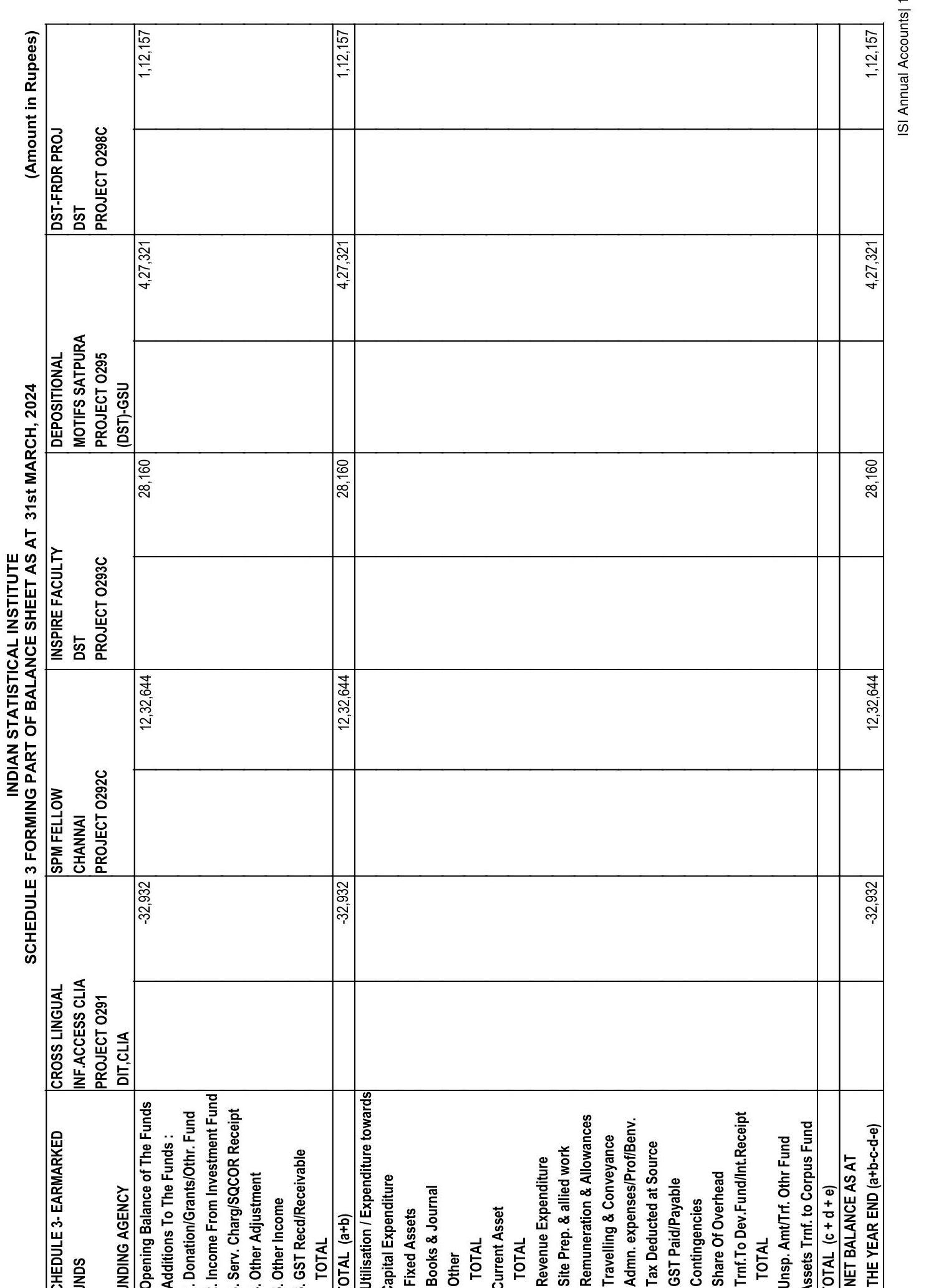

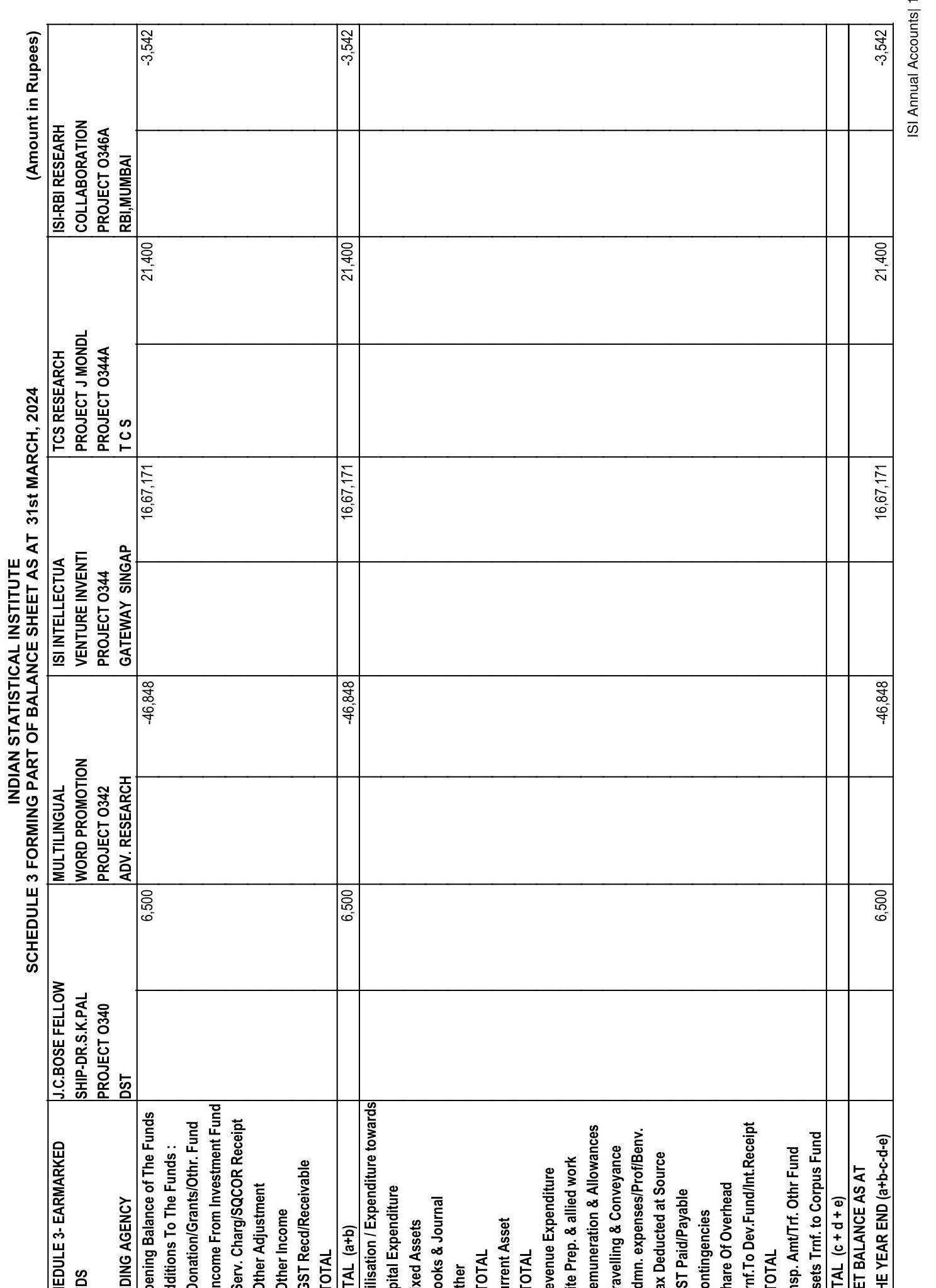

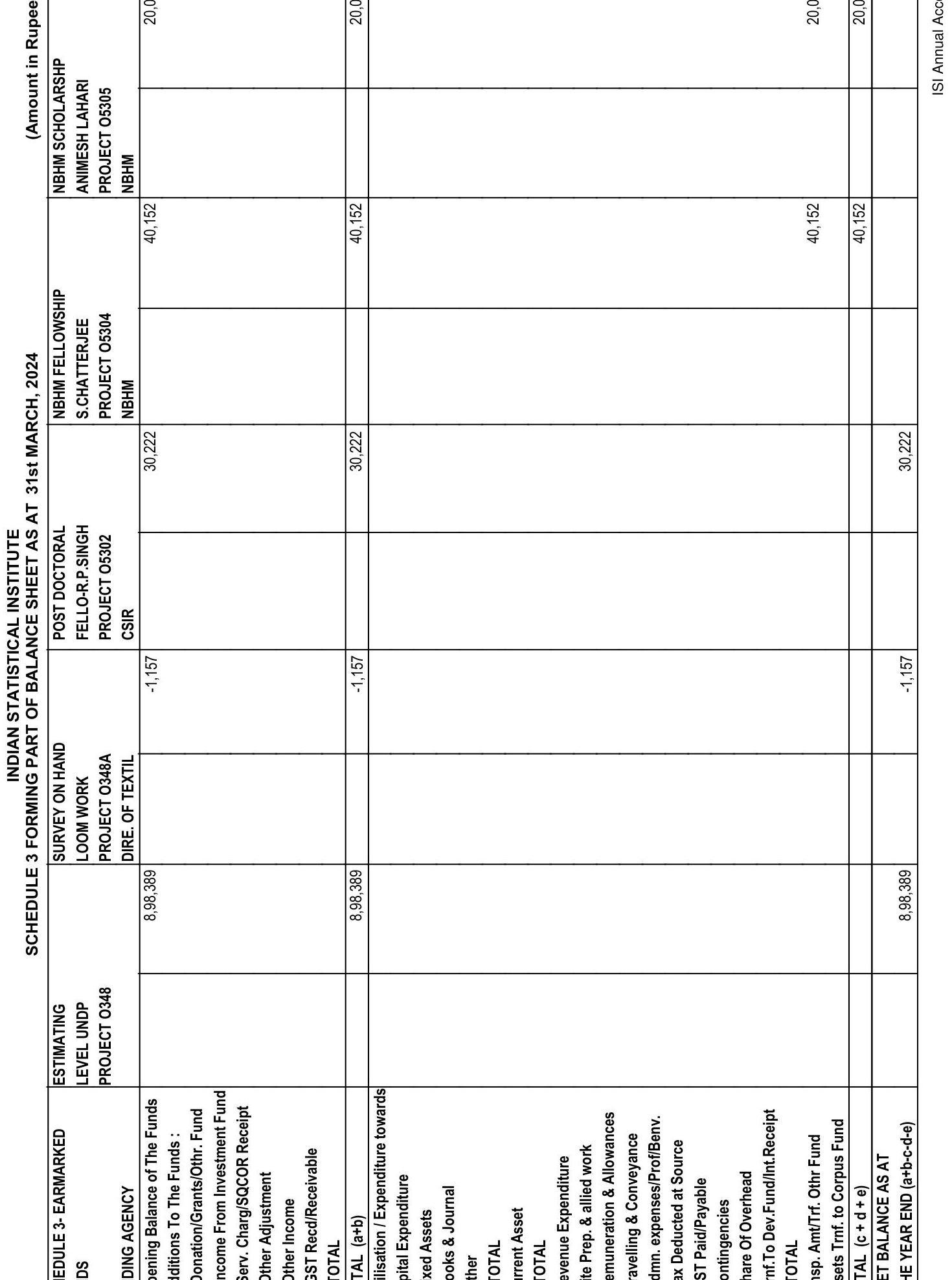

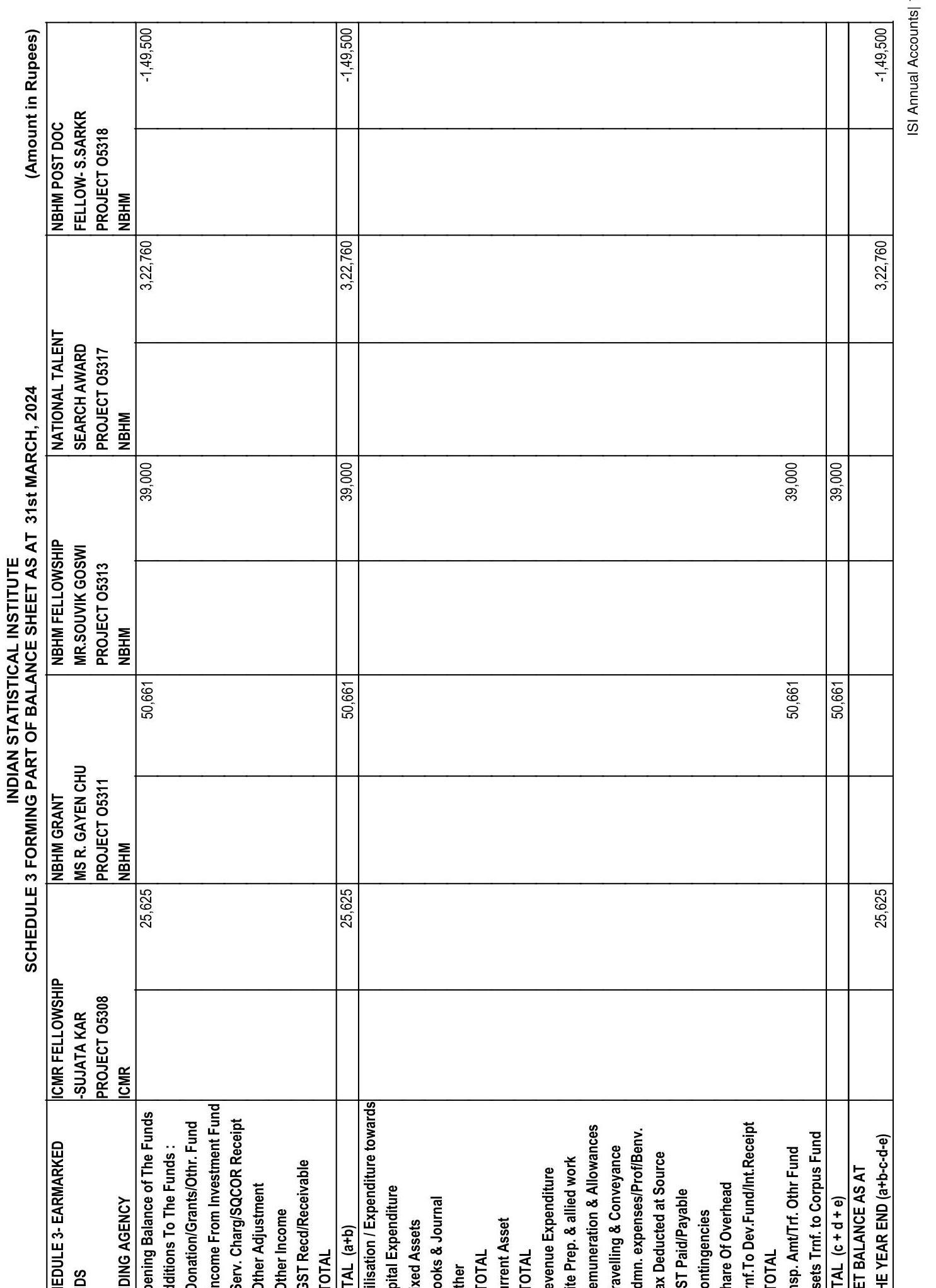

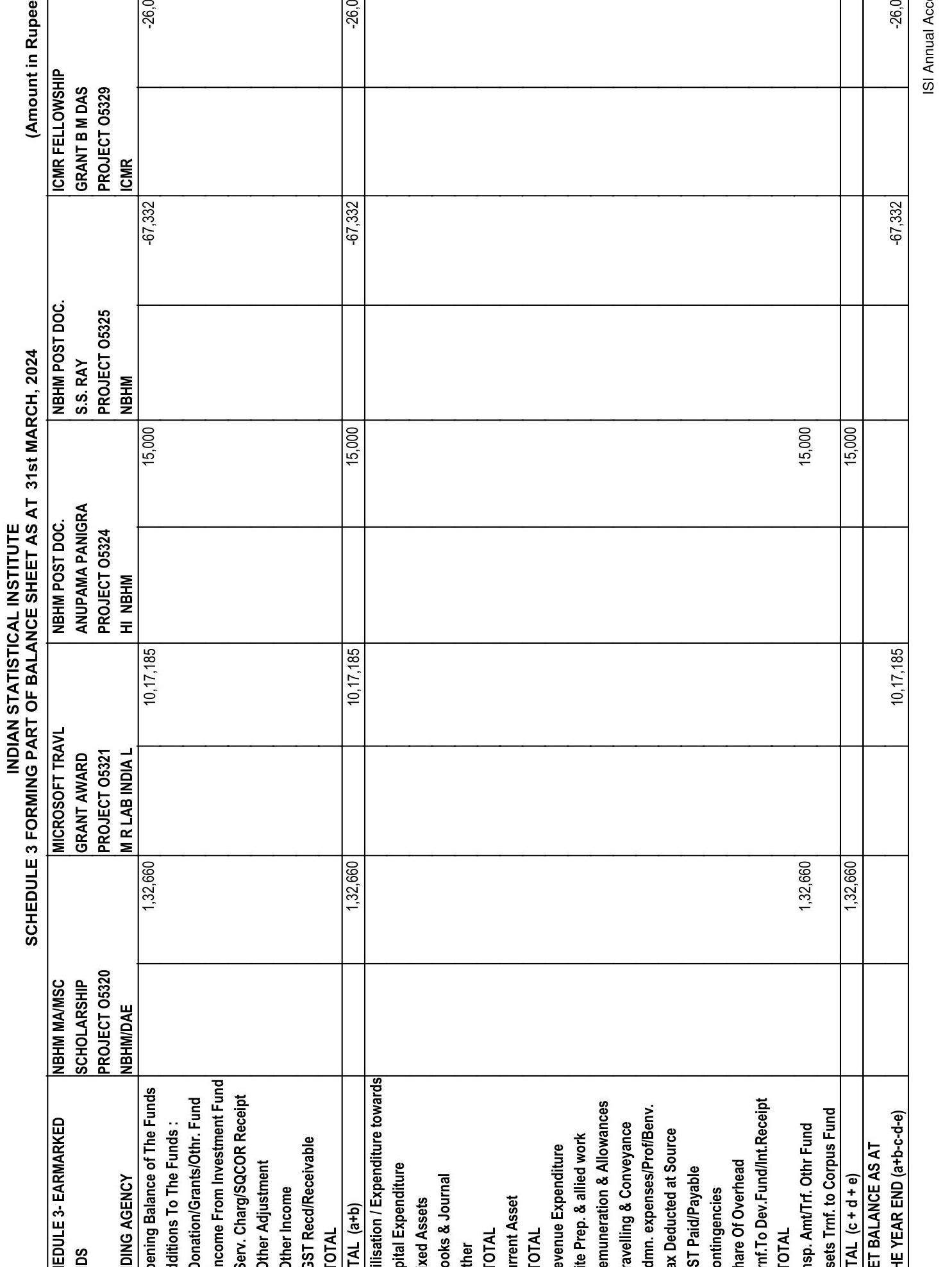

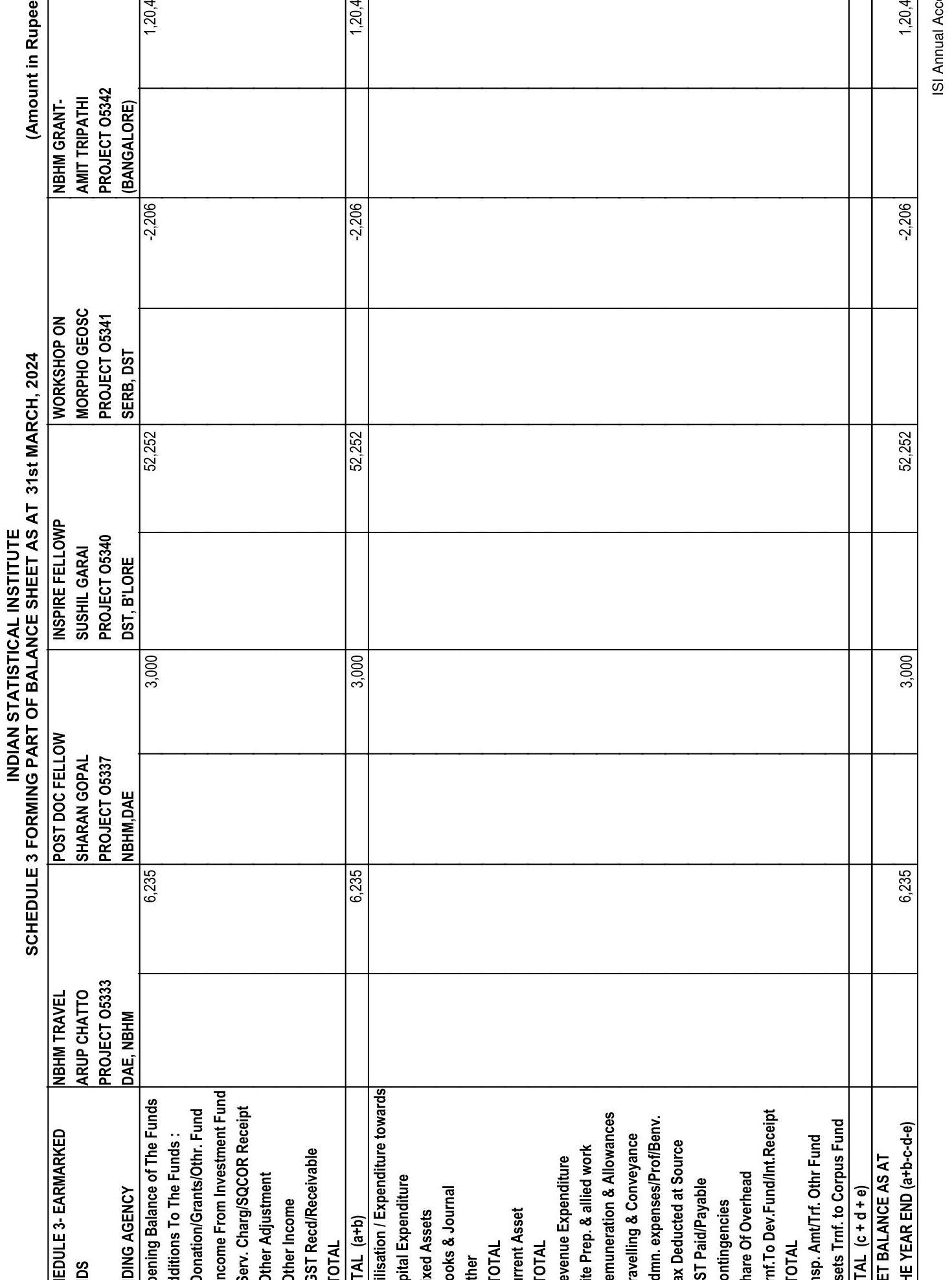

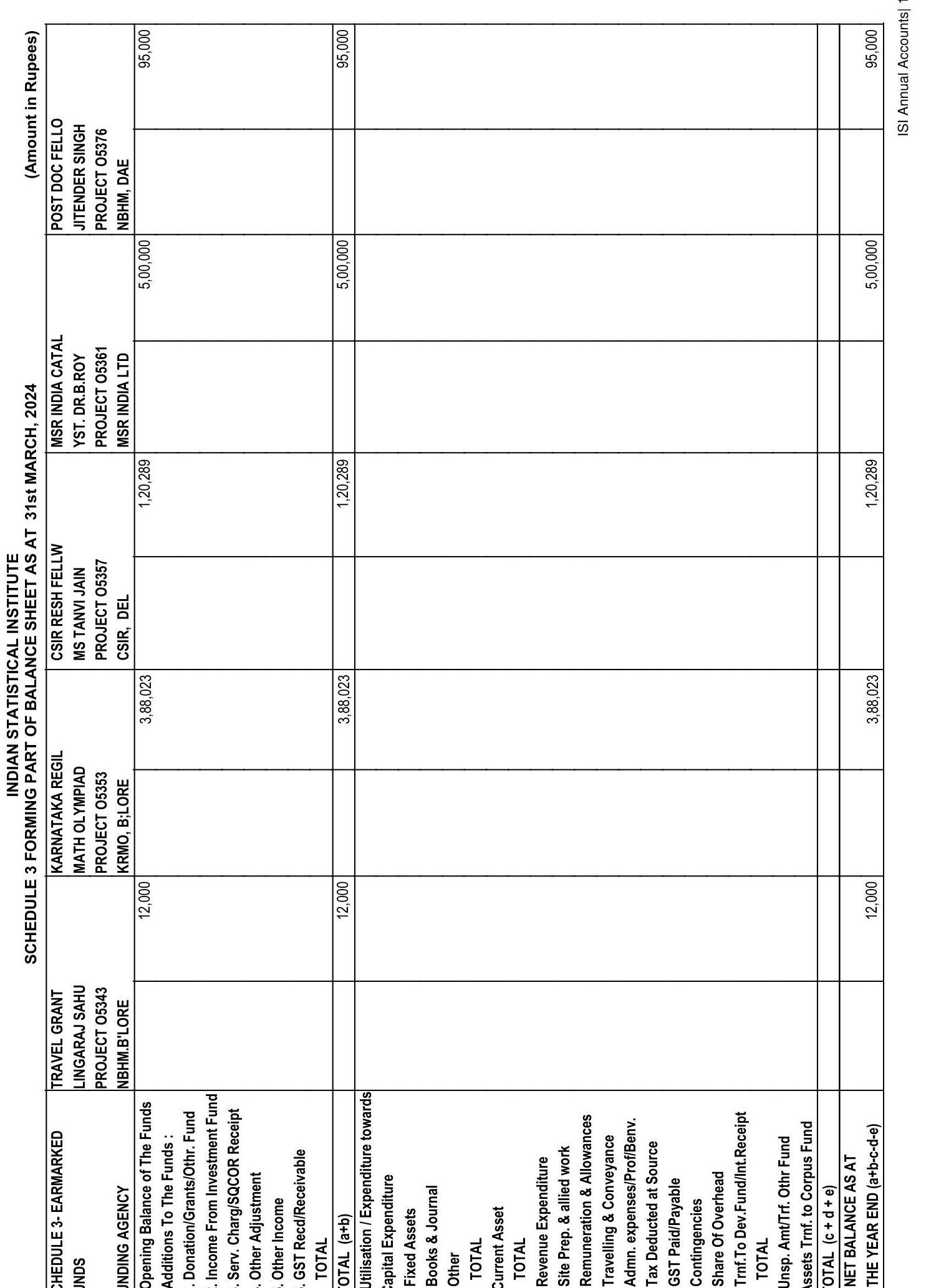

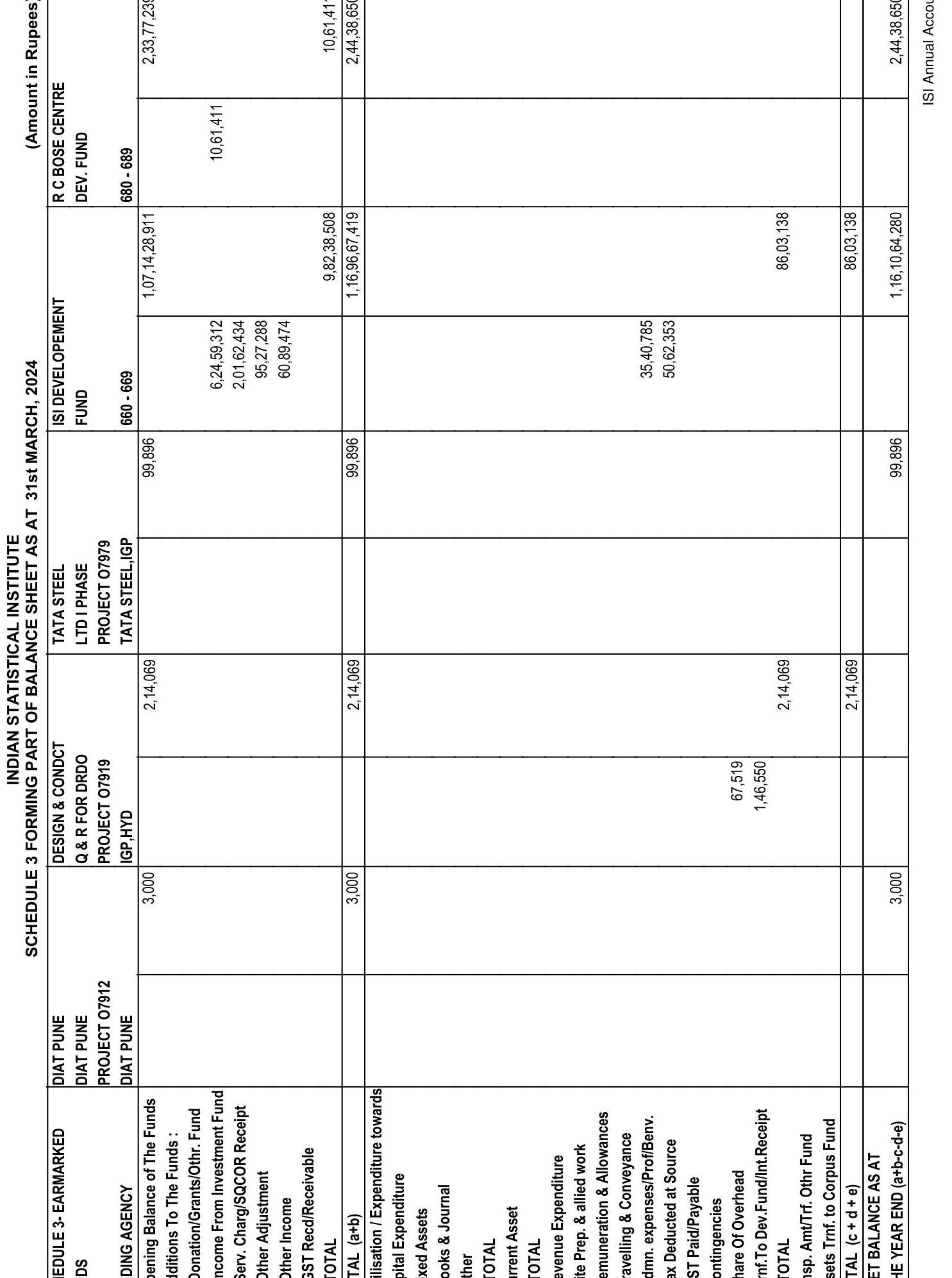

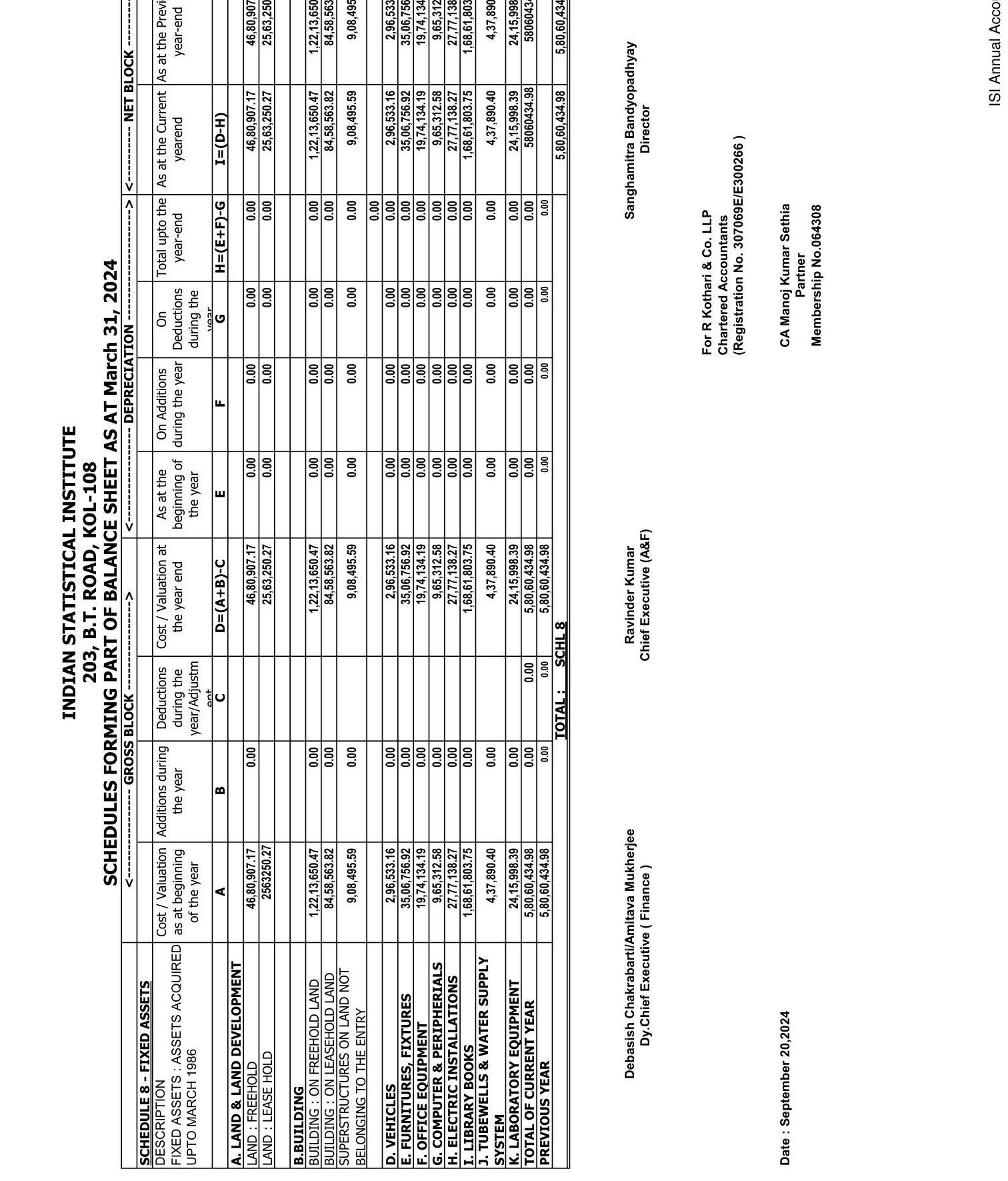

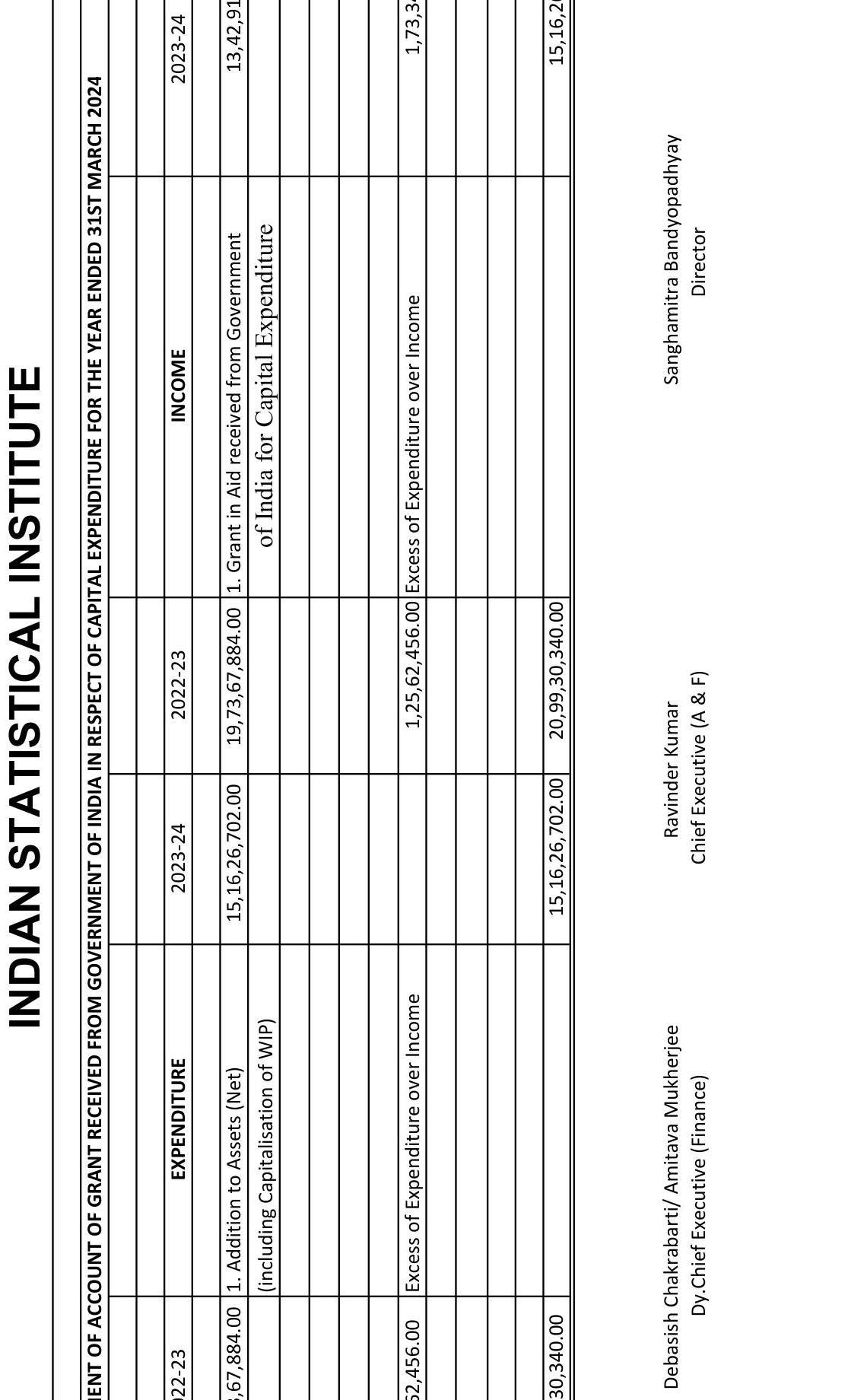

iii. Earmarked/Endowment Funds as per Schedule 3 includes Rs 18,14,995/- as on 31st March 2024,being excess of expenditure incurred over and above revenue in number of 30 projects. Out of the same there have been a few projects which has opening debit balance for the past two-three financial years.

iv. Internal audit for the year 2023-24 has been conducted in respect of Medical Welfare Unit, Sampling \& Official Statistics Unit, Transport Unit, Canteen, Guest House, and Library etc. of Kolkata Office and for Bangalore Centre it is conducted for the period from 2021 to 2023. We have reviewed the report and considered for statutory report for the year 2023-24. In our view, the scope \& coverage of activity area is not commensurate with the nature and size of activities and transactions of the institute. Further, there is no system of placing and approving the scope before the committee.

v. As per schedule 3 “Earmarked/Endowment Funds”, mentioned below funds are lying idle since long and no action is taken by the institute for utilization of the funds or refund of the same to GOI.

- Project code – Flood Relief loan from GOI Rs. 7,20,000/-

- Project code – House Building Loan from GOI Rs. 2,60,50,238/-

- Project code – Grant for Conveyance Advance GOI Rs. 47,50,000/-

vi. CWIP as per Schedule 8A includes Rs 9725.95 lakhs [w.r.t. 16 locations as per Schedule 25(1.2)] is carried forward from previous year remain unadjusted and non moving. The institute has not carried out impairment assessment on opening CWIP, and effect of the same if any on account of impairment remain unascertained and not provided for in the financial statements of the institute for the year 2023-24.

Our Opinion on the financial statement of the Institute is not modified in these matters.

Responsibilities of Management and Those Charged with Governance for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with the accounting principles generally accepted in India including Accounting Standards as issued by ICAI, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the entity’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting.

The management of the Institute is responsible for overseeing the entity’s financial reporting process.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with SAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with SAs, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

- Identify and assess the risks of the material misstatement of the Financial Statement, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

- Obtain an understanding of internal controls relevant to the audit in order to design audit procedures that are appropriate in the circumstances.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the management.

- Conclude on the appropriateness of management’s use of the going concern basis of accounting and based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Institute’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the Financial Statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Company to cease to continue as a going concern.

- Evaluate the overall presentation, structure and content of the Financial Statements, including the disclosures, and whether the Financial Statements represent the underlying transactions and events in a manner that achieves fair presentation.

Materiality is the magnitude of misstatements in the Financial Statements that, individually or in aggregate, makes it probable that the economic decisions of a reasonably knowledgeable user of the Financial Statements may be influenced. We consider quantitative materiality and qualitative factors in (i) planning the scope of our audit work and in evaluating the results of our work; and (ii) to evaluate the effect of any identified misstatements in the Financial Statements.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

Report on Other Legal and Regulatory Requirements

a. We have sought and obtained all the information and explanations which to the best of our knowledge and beliefs were necessary for the purposes of our audit.

b. In our opinion, proper books of accounts as required by law have been kept by the Institute so far as it appears from our examination of those books.

c. The Balance Sheet, the Income \& Expenditure Account dealt with by this Report are in agreement with the books of account.

d. In our opinion, the aforesaid financial statements comply with the applicable Accounting Standards except as disclosed in the report otherwise.

For R KOTHARI \& CO LLP Chartered Accountants

FRN: 307069E/E300266

Place: Kolkata

Date: $20^{\text {th }}$ September, 2024

UDIN: 24064308BKCFFP3873

CA. Manoj Kumar Sethia Partner

Membership No. 064308

Note : Figures have been rearranged/regrouped wherever found necessary

| Debasish Chakrabarti/Amitava Mukherjee | Ravinder Kumar | Sanghamitra Bandyopadhyay |

|---|---|---|

| Dy. Chief Executive (Finance) | Chief Executive (A \& F) | Director |

In terms of our Report of even date.

For R KOTHARI \& CO LLP

Chartered Accountants

(Firm Registration No . 307069E/E300266)

CA. Manoj Kumar Sethia

Partner

Membership No. 064308

ICAI UDIN : 24064308BKCFFP3873

Kolkata, September 20, 2024

INCOME \&

Miscellaneous Receipts

Grant-in-Aid From Govt. of India

TOTAL (A)

EXPENDITURE

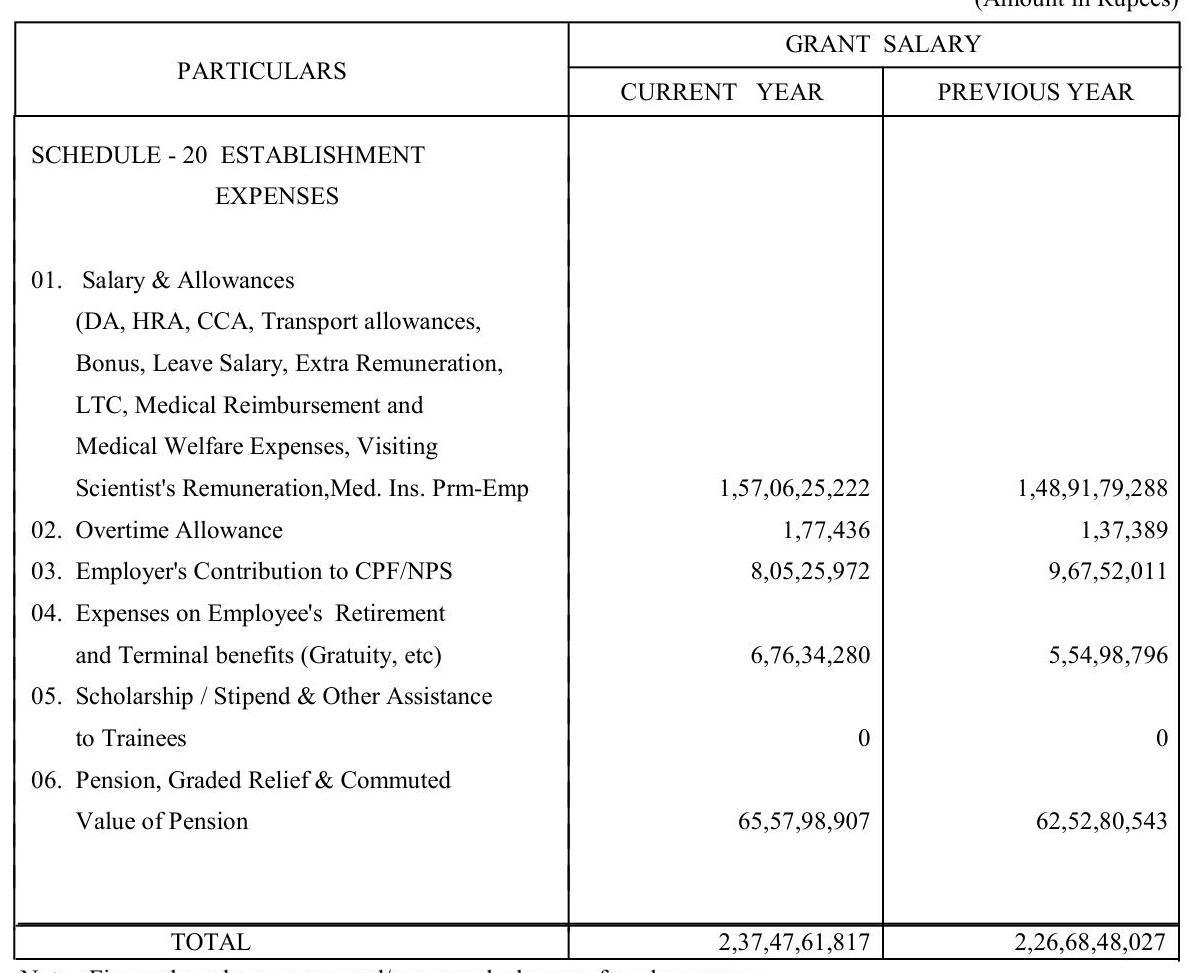

Establishment Expenses

Other Administrative Expenses

TOTAL (B)

BALANCE BEING SURPLUS /(DEFICIT) (A – B)

CARRIED TO CORPUS/CAPITAL

SIGNIFICANT ACCOUNTING POLICIES CONTINGENT LIABILITIES AND NOTES ON ACCOUNTS

| Ravi | |

|---|---|

| 24 | |

| 25 |

| Ravi | |

|---|---|

| 12 | 12,42,16,082 |

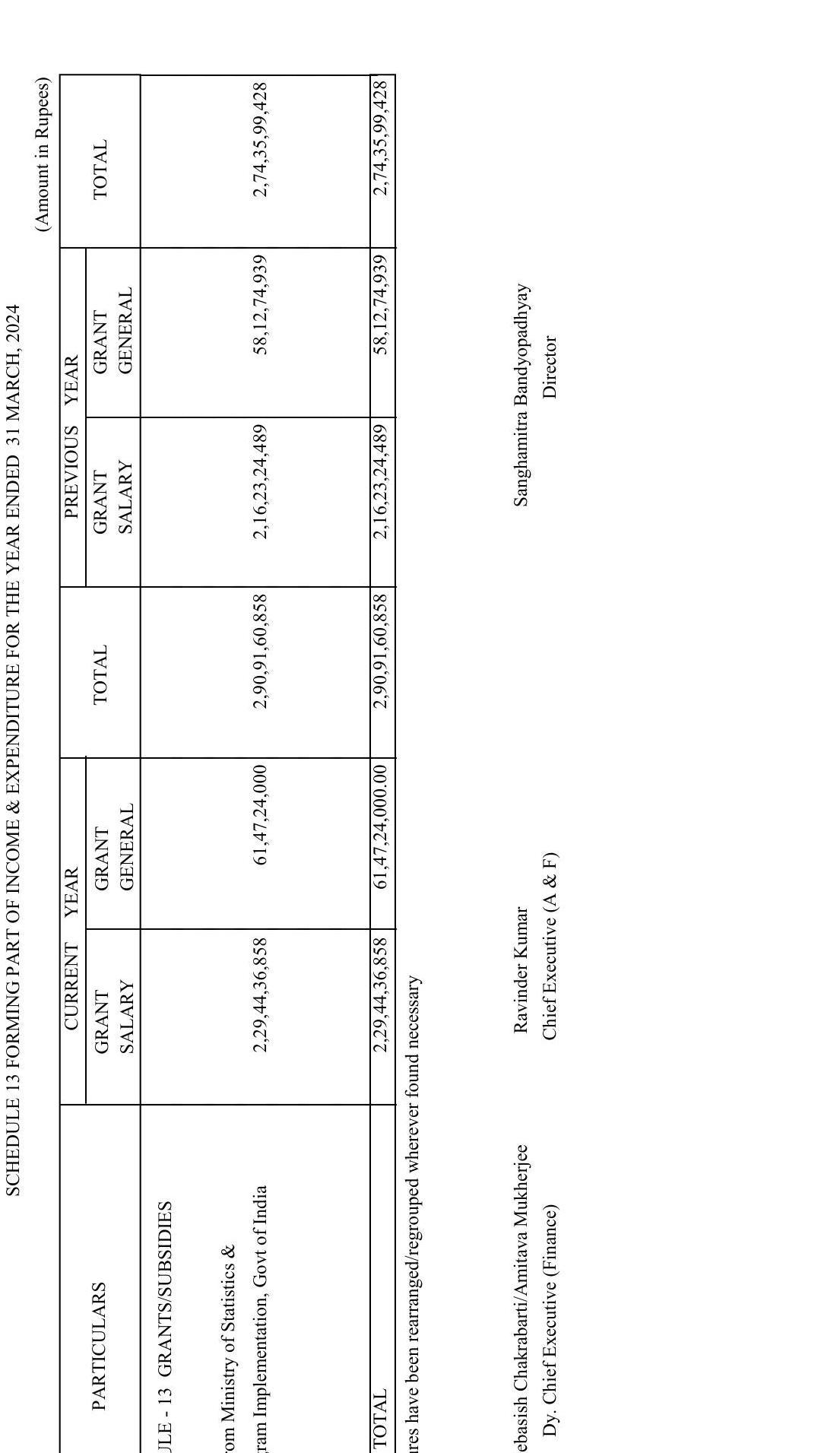

| 13 | 229,44,36,858 |

| 241,86,52,940 | |

| 20 | 237,47,61,817 |

| 21 | |

| 237,47,61,817 | |

| 4,38,91,123 | $-3,81,49,139$ |

| 57,41,984 | |

| Ravinder Kumar | |

| Chief Executive (A \& F) |

Sanghamitra Bandyopadhyay

Director

In terms of our Report of even date.

For R. KOTHARI \& CO LLP

Chartered Accountants

(Firm Registration No. 307069E/E300266)

CA. Manoj Kumar Sethia

Partner

Membership No. 064308

ICAI UDIN : 24064308BKCFFP3873

Kolkata, September 20, 2024

Debasish Chakrabarti/Amitava Mukherjee

Dy. Chief Executive (Finance)

Ravinder Kumar

Chief Executive (A \& F)

Sanghamitra Bandyopadhyay

Director

INDIAN STATISTICAL INSTITUTE

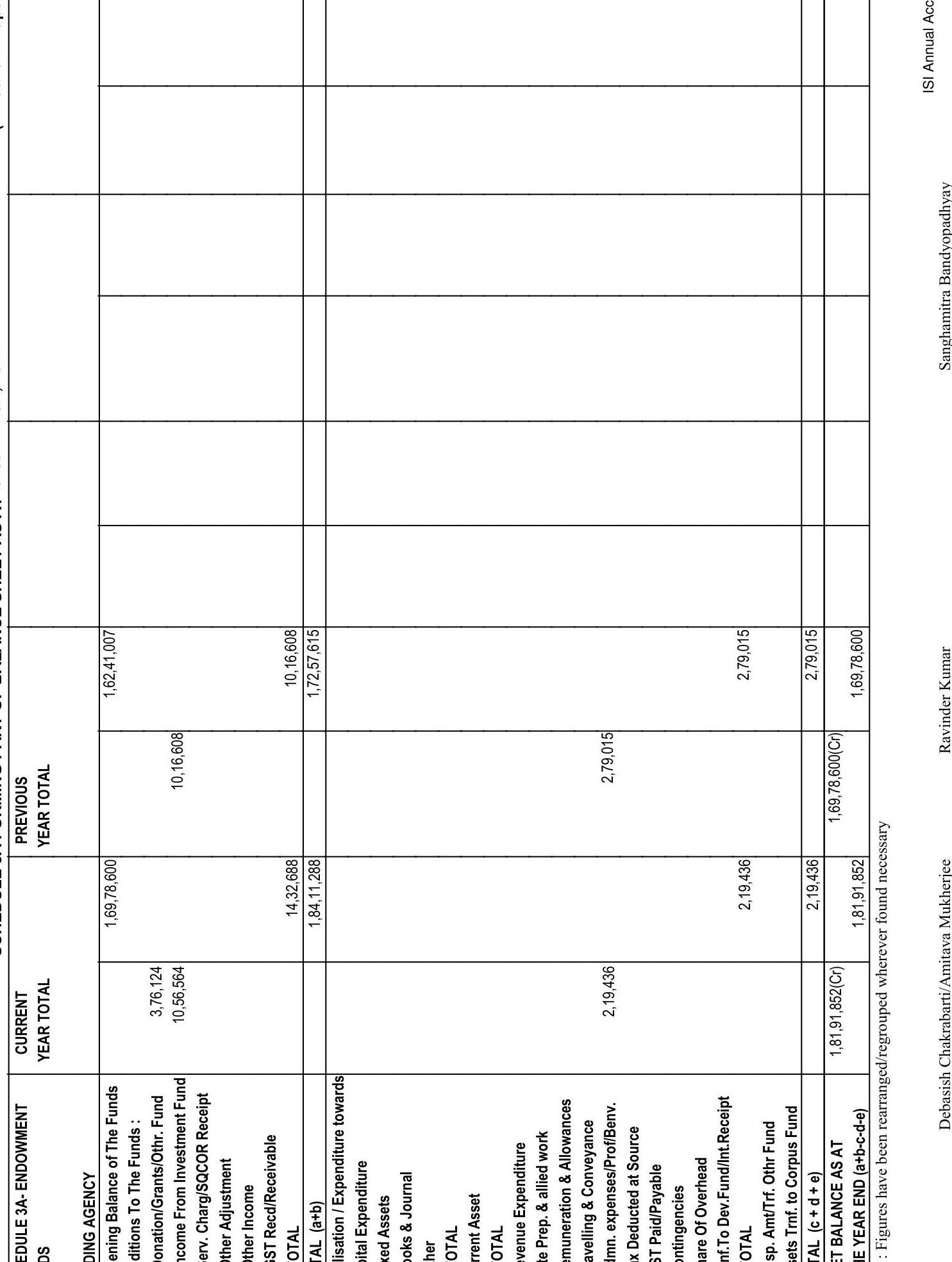

SCHEDULE 7 FORMING PART OF BALANCE SHEET AS AT 31 MARCH, 2024

Note : Figures have been rearranged/regrouped wherever found necessary

Debasish Chakrabarti/Amitava Mukherjee

Dy. Chief Executive (Finance)

Ravinder Kumar

Chief Executive (A \& F)

Sanghamitra Bandyopadhyay

Director

INDIAN STATISTICAL INSTITUTE

SUB SCHEDULE OF SCHEDULE 7 FORMING PART OF BALANCE SHEET 31 MARCH, 2024

(Amount in Rupees)

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| SUB SCHEDULE OF SCHEDULE 7 | ||

| A. CURRENT LIABILITIES | ||

| 1. STATUTORY LIABILITIES | ||

| Income Tax StaffPLP | 2,50,39,986.00 | 2,53,15,577.00 |

| Income Tax Contractor | 14,82,071.83 | 19,49,419.83 |

| Professional Tax | 2,29,257.00 | 2,44,902.00 |

| Service Tax | 77,702.30 | 77,702.30 |

| Cess on W.B. Cont. Worker Welfare | 33,272.00 | 19,281.00 |

| Output GST Payable – CGST | 6,81,805.99 | 37,98,304.83 |

| Output GST Payable – SGST | 7,39,415.93 | 38,41,515.83 |

| Output GST Payable – IGST | 16,69,266.97 | 5,65,755.82 |

| TDS GST Payable – CGST | 2,58,254.39 | 2,21,808.02 |

| TDS GST Payable – SGST | 2,58,253.39 | 2,21,810.02 |

| TDS GST Payable – IGST | 90,276.73 | 55,168.80 |

| Sub-Total (1) | 3,05,59,563.00 | 3,63,11,245.45 |

| 2. Other Current Liabilities | ||

| Deposit -Library | 1,22,08,405.00 | 1,12,88,404.84 |

| Deposit -Laboratory | 5,59,000.00 | 5,54,000.00 |

| Deposit-Hostel | 22,16,248.00 | 25,27,348.00 |

| Deposit-Electric Caution | 19,165.00 | 19,165.00 |

| Miscellaneous Deposit | 94,48,200.00 | 99,46,200.00 |

| Earnest Money Deposit | 13,41,536.16 | 22,93,236.16 |

| Security Deposit | 1,17,59,431.48 | 1,16,38,660.48 |

| Outstanding Liabilities Goods and Services | 7,44,11,589.38 | 5,63,40,361.06 |

| ISI Co-operative Credit Society Ltd-Kol | 3,618.00 | 2,63,440.00 |

| ISI Co-operative Credit Society Ltd-Giridih | 117.00 | 117.00 |

| ISEC ISI Fund | 71,89,115.19 | 1,14,81,283.15 |

| Group Insurance – Delhi and Giridih | 22,128.00 | 24,978.00 |

| Staff Insurance Premium Group Insurance | 3,03,009.00 | 3,73,552.00 |

| Staff Insurance Premium PPU | 60.00 | 60.00 |

| Staff Insurance Premium – Delhi \& Giridih | 20,990.00 | 20,990.00 |

| GLIC Claim From Insurance Company | 8,792.00 | 7,392.00 |

| ISI Salary Savings – LIC | 0.00 | 1,563.00 |

| Disposal Of Asset | 54,35,883.76 | 61,82,872.76 |

| Undisbursed Salary,Stipend and Pension | 44,75,580.22 | 43,91,121.22 |

| Stale Cheques | 13,19,820.00 | 13,19,820.00 |

| Intl.Conf-Premi (MIU) | 0.00 | 11,94,831.77 |

| INDO JAPAN Research Project-Dr.S.Ruj | 0.00 | 1,38,895.00 |

| Workshop Conf. Of Multivariate Stat Method | 0.00 | 16,69,438.50 |

| Study to Review the Existing System DGCIS | 0.00 | 2,29,677.00 |

| UNDP Project -Kanika Mahajan | 1,537.00 | 1,537.00 |

| International Conference on ICONQR -08 SQC | 0.00 | 81,682.00 |

| Robust Statistics 2015 ICORS 2015 Prof Ayan Basu | 0.00 | 1,29,612.43 |

| Indocrypt 2014 Microsoft Research Lab BLR | 0.00 | 3,00,000.00 |

| Fire Workshop of CVPR | 0.00 | 2,841.61 |

| International Workshop on Operator Theory | 0.00 | 210.00 |

| Planning Unit Conf (Einter School Delhi) | 0.00 | 21,909.14 |

INDIAN STATISTICAL INSTITUTE

SUB SCHEDULE OF SCHEDULE 7 FORMING PART OF BALANCE SHEET 31 MARCH, 2024

(Amount in Rupees)

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| Data Mining Workshop of S.S. Handa-Delhi | 0.00 | 2,73,051.00 |

| SMBI Workshop 08.01.15 To 09.01.15 – Chennai | 0.00 | 2,411.00 |

| DST-Workshop in Network Analysis. | 0.00 | 275.00 |

| Joint International Indo-AMA Meeting | 0.00 | $1,343.00$ |

| Workshop on R language ISI AERU | 0.00 | $3,124.00$ |

| IEEE Ants 2015 | 0.00 | 182.00 |

| Pre Regional Maths Olympiad 2015 | 0.00 | $1,59,107.00$ |

| Statistics For Officer of RBI | 0.00 | $16,120.00$ |

| School On Analysis \& Topology NorthEast | 0.00 | $56,765.05$ |

| Integration 2016 | 0.00 | $97,928.60$ |

| Raja Rammohan Roy Bangalore | 0.00 | 398.00 |

| Complex Geometry \& Operator Theory | 0.00 | 959.00 |

| State Level Workshop on Fin. Incl \& Rural | 0.00 | $1,61,082.00$ |

| Training Prog. On Reliability Engr. at SQC \& OR | 0.00 | $18,866.00$ |

| Encryption Workshop R C Bose | 0.00 | 2,00,708.00 |

| DST/PAC Meeting 16-09-16 | 0.00 | $11,195.00$ |

| DST-PAC Meeting SERB | 0.00 | 7,42,673.00 |

| Annual ISMS Meeting | 0.00 | $88,095.00$ |

| Workshop on species Distr. Model | 0.00 | 426.00 |

| Univ. of MAnchestor \& ISI Reaserch Collaboration | 0.00 | $7,867.00$ |

| Workshop on ACM Student Chapter on CVPR | 0.00 | $90,432.00$ |

| Workshop On High Performance on Comp. ACMU | 0.00 | $68,833.00$ |

| Symposium 2018(Countries in Econ Symposium) | 0.00 | $43,775.99$ |

| Training Prog. At RCBCCS For 2017 Japan | 0.00 | $49,669.00$ |

| Int. Conference on Cryptology- Indocrypt. | 0.00 | $18,730.00$ |

| Indocrypt 2016 for Registration | 0.00 | $1,11,122.94$ |

| R C Bose Conference | 0.00 | $1,29,000.00$ |

| National Symposium on Psychology in Diabetes | 0.00 | 451.00 |

| Expert Group Meet in MIU | 0.00 | $14,915.00$ |

| Workshop on Data Sc \& Machine Learning | 0.00 | $35,449.13$ |

| Recent Adv. in Operator Theory -Jaydeb Sarkar | 0.00 | 0.00 |

| OTOA Conference 2017 | 0.00 | $1,818.00$ |

| Electric charger recoverable from NSSO-ISI Giridih | 0.00 | $25,837.10$ |

| IEE CIS Summer School | 0.00 | $21,686.87$ |

| Statistical Theory and Application RBI | 0.00 | $6,08,782.31$ |

| Summer School Use and Appl SPSS Aug ‘2017 | 0.00 | $33,170.00$ |

| TRG Program RCBCCS 15-18.05.17 | 0.00 | $1,48,000.00$ |

| Workshop and Conf. Set theoretic and Topological met | 0.00 | $1,76,244.00$ |

| Indocrypt 2016-17 | 0.00 | $4,90,000.00$ |

| TRG Program Stat Theory and Applications RBI Officers | 0.00 | $15,05,432.47$ |

| 9th ICAPR 2017 Conference 125th PCM Birth | 0.00 | $4,72,694.66$ |

| Workshop on Interactive and Visual Approaches | 0.00 | $90,803.16$ |

| Regional Mathematical Olympiad 2017 | 0.00 | $1,19,374.81$ |

| Expert Group Meeting Soft Computing | 0.00 | $84,711.00$ |

| Lecture on Parallel Processing for large Network | 0.00 | $89,307.65$ |

| Lectures in Probability/Stochastic Process | 0.00 | $13,372.24$ |

| International Conference in Statistics and Probability | 0.00 | $1,07,398.00$ |

INDIAN STATISTICAL INSTITUTE

SUB SCHEDULE OF SCHEDULE 7 FORMING PART OF BALANCE SHEET 31 MARCH, 2024

(Amount in Rupees)

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| Scientific Framework for National Transformation | 0.00 | 8,394.00 |

| 42 Technology Innovations Pvt. Ltd | 0.00 | $40,000.00$ |

| Meeting Expert Committee on Engg. Sciences | 0.00 | $5,30,119.00$ |

| PAMC Meeting on Cluster roposals under ICPS | 0.00 | $5,34,845.24$ |

| Training Program on Predication Analytics | 0.00 | $71,121.00$ |

| Int. Conference on Future of Library | 0.00 | $1,75,618.30$ |

| Regional Mathematical Olympiad 2017 (KRMOU) | 0.00 | $1,28,055.00$ |

| EPU Conference | 0.00 | $3,53,701.44$ |

| Workshop On Reliability Theory \& Survival Analysis | 0.00 | $23,542.00$ |

| ATM Workshop on Cryptology ASU | 0.00 | $27,922.24$ |

| Lecture in TCS Facility Programme | 0.00 | $8,97,330.24$ |

| 16th Meeting of PAC-Elect, Electronics \& Computer | 0.00 | $4,98,440.24$ |

| MSR Training Programme 14/05/19 To 15/05/2019 -Prof. | 0.00 | $1,48,334.00$ |

| Workshop On Perceptual Orgn \& Roschah ink bolt test | 0.00 | $1,570.80$ |

| IWPAA 24/02/09 – 26/02/18 – CVPR | 0.00 | $61,059.54$ |

| Course in Cryptology \& Security For Defence | 0.00 | $8,46,788.00$ |

| Registration Fees Winter School | 0.00 | $84,745.60$ |

| LIA Examination For Asiatic Society, PRSU | 0.00 | $91,203.06$ |

| YSM Programme – 2019 BIRU | 0.00 | $85,502.21$ |

| Training Programme on ISO 5022 | 0.00 | $1,14,690.00$ |

| IWPAA Programme 2019 | 0.00 | $23,940.02$ |

| 6th India Bio Diversity Meet 2019 | 0.00 | $11,851.60$ |

| Workshop on Growth Curve Model 12-13. 02. 19 | 0.00 | $51,500.00$ |

| Workshop On DOWS 2018-19 SQC \& OR | 0.00 | $63,812.34$ |

| Workshop On Data Analytics | 0.00 | $1,49,152.92$ |

| Strengthening Capacity of FRI Mayanmar CFRI | 0.00 | $2,65,201.00$ |

| Workshop On Orientation Training on Data Visualization | 0.00 | $6,250.00$ |

| Workshop On Advance Tools \& Tech Software | 0.00 | $2,110.88$ |

| Scholl on Programming with Python | 0.00 | $1,428.10$ |

| 9th Workshop on Digital Pictorial Photography | 0.00 | $15,254.40$ |

| Contigency Grant BioTech Rise | 0.00 | $38,551.00$ |

| NBHM Grant For OTOA Conference | 0.00 | $4,522.00$ |

| APMO 2019 | 0.00 | $3,650.00$ |

| Workshop On Species Distribution Modelling | 0.00 | $1,35,000.00$ |

| Workshop On 6th Sigma Green Belt Giridih | 0.00 | $21,682.00$ |

| WS ON ORIENTATION TRG ON CTERG FROM | 0.00 | $11,000.00$ |

| 36TH FIELD TRIP DRY RUNS | 0.00 | $22,833.25$ |

| INDO FRENCH JOINT WORKSHOP 13-17.01.20 | 0.00 | $1,72,280.40$ |

| WORKSHOP ON SIX SIGMA GREEN BELT | 0.00 | $35,788.00$ |

| 4TH INTL CONFERENCE ON COMPUTER | 0.00 | $1,32,351.97$ |

| WORKSHOP ON DOEWS 2019 | 0.00 | $2,07,512.76$ |

| SYMPOSIUM AT PSYCHOLOGY RESEARCH UNIT | 0.00 | $3,539.92$ |

| INDO JAPAN JT WORKSHOP IN QUANTUM | 0.00 | $18,384.55$ |

| TRAINING ON DIGITAL CRYPTOGRAPHY | 0.00 | $6,91,895.00$ |

| E ITEC Course in ISEC | 0.00 | $2,15,565.00$ |

| Workshop on Data Analytics 26.07.21- 06.08.21 | 0.00 | $17,500.00$ |

| WEB Based Onlice Certification Cryptology | 0.00 | $11,56,405.00$ |

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| 9INTL Conf Premi 15-18.12.21 | 0.00 | $3,15,659.08$ |

| Trg Prog ITEC Course 30-08 To 24.09.21 | 0.00 | $3,43,500.00$ |

| Res Methodology and Stat Package For Social Science | 0.00 | $58,474.54$ |

| SPSS Workshop BAU | 0.00 | $35,869.44$ |

| Inter School On Deep Learning 21.01.22 To 12.03.22 | 0.00 | $2,79,833.46$ |

| Faculty Dev Prog On Manu Peer Review Process | 0.00 | $14,000.00$ |

| Computational Statistics and Data Analysis | 0.00 | $2,580.20$ |

| DST FIST 2021 Math Science Screening Meeting | 0.00 | $3,471.00$ |

| E Course On Smpling Methodology GIES | 0.00 | $4,57,112.00$ |

| MRF CORPORATION LTD CHENNAI | 0.00 | $60,000.00$ |

| TIMKEN ENGG RESEARCH INDIA | 0.00 | $1,48,283.00$ |

| ROYAL ENFIELD A UNIT OF EICHER MOTORS | 0.00 | $1,01,674.00$ |

| SYMPOSIUM ON FINANCIAL INCLUSION AND | 0.00 | $73,330.00$ |

| ISS Probationers 40th Batch 04-03-19 To 26-04-19 | 0.00 | $3,00,649.34$ |

| ISS PROBATIONERS TRAINING PROG | 0.00 | $44,37,147.30$ |

| TRAINING PROG ON OFFICIAL STATISTICS | 0.00 | $31,644.00$ |

| WORKSHOP ON RES METHOD SPSS MAR 21 | 0.00 | $44,491.50$ |

| WORKSHOP ON PROF BISWANATH DUTTA | 0.00 | $14,646.00$ |

| INMO BANGALORE | 0.00 | $52,500.00$ |

| MADHAVA MATH COMPETITION TIFR | 0.00 | $3,000.00$ |

| TRAINING PROG FOR OFFICIAL OF SIKKIM GOVT | 0.00 | $27,711.00$ |

| Workshop On Application Of STAT \& Mach Learn | 0.00 | $4,817.00$ |

| 6th Sigma Green Belt Training \& Project | 0.00 | $6,82,626.75$ |

| ISS Training 43-44 | 0.00 | $1,13,45,291.02$ |

| Center For Developement Studies | 0.00 | $14,400.00$ |

| Registration Fees SPSS | 0.00 | $25,817.34$ |

| Sanction For Cryptology | 0.00 | $10,69,618.58$ |

| WORKSHOP ON RATING SCALE DESIGN AND | 0.00 | $19,000.00$ |

| Winter School On Deep Learning | 0.00 | $19,07,198.42$ |

| Bayesian Inference \& Computation 2022-23 | 0.00 | $44,067.92$ |

| Workshop \& Conference | $3,54,26,672.80$ | 0.00 |

| PGDBA COURSE ISI+IIT+IIM [2023-2025) | 0.00 | 0.00 |

| DONATION FOR SCIENCTIFIC RESEARCH2 | $8,26,546.00$ | 0.00 |

| DONATION FOR SCIENTIFIC RESEARCH | 0.00 | $11,46,820.00$ |

| DONATION FOR SCIENTIFIC RESEARCH | 8.00 | 0.00 |

| Unpaid Account | 519.00 | 0.00 |

| Sub-Total (2) | $16,69,97,971.00$ | $16,01,05,962.01$ |

| GRAND TOTAL (1+2) | $19,75,57,535.00$ | $19,64,17,207.00$ |

INDIAN STATISTICAL INSTITUTE

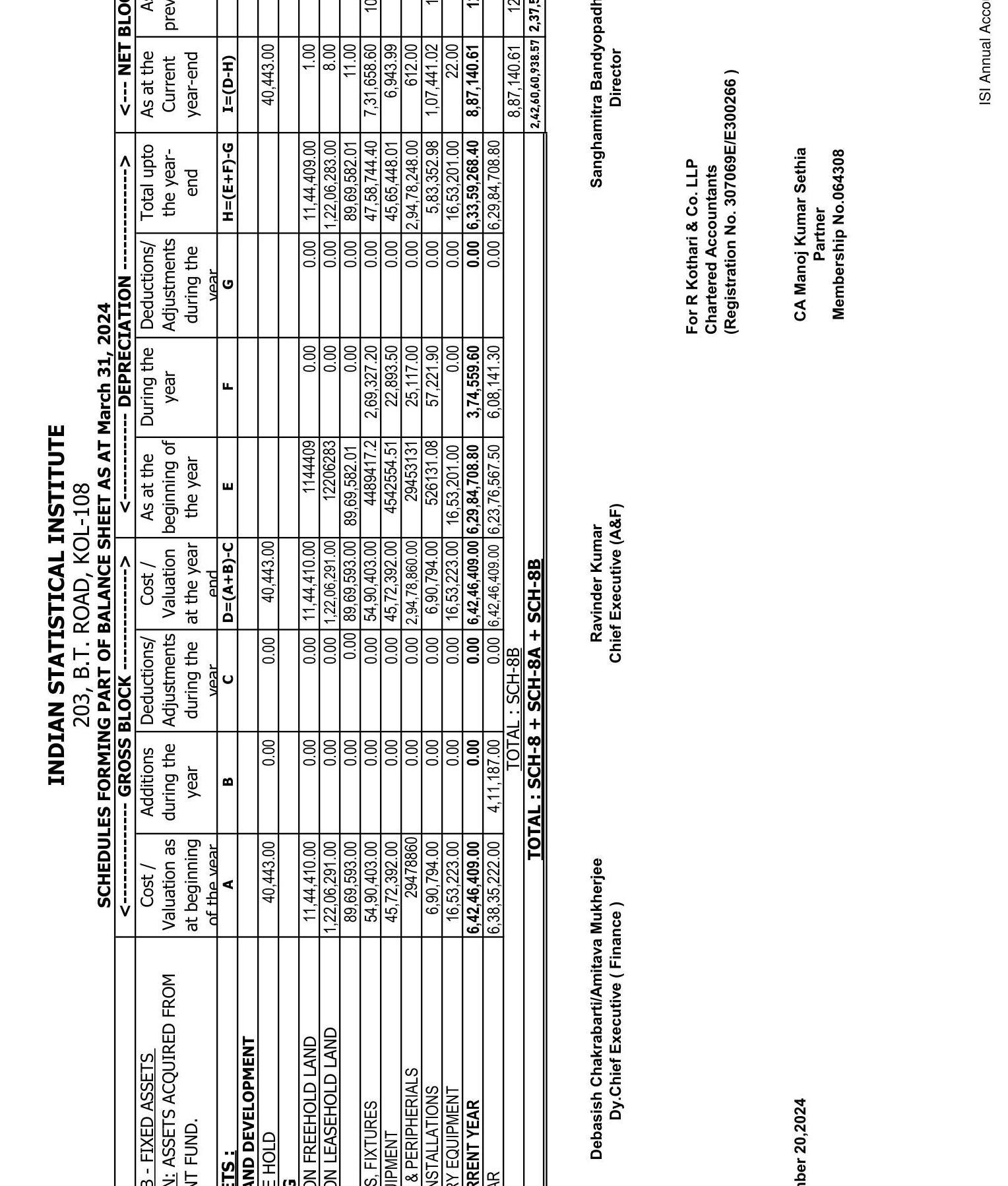

CAPITAL UTILISATION STATEMENT FOR THE YEAR ENDED 31/03/2024 (Amount in Rupees)

| PARTICULARS | GRANT CAPITAL | |

|---|---|---|

| CURRENT YEAR | PREVIOUS YEAR | |

| GRANT RECEIVED FOR CREATION OF CAPITAL ASSET (INCL C/F OF PREV. YEAR) | $13,42,91,795.00$ | $19,73,67,884$ |

| TOTAL (A) | $13,42,91,795.00$ | $19,73,67,884$ |

| CREATION OF CAPITAL ASSETS | $15,16,26,702.00$ | $20,99,30,340$ |

| TOTAL (B) | $15,16,26,702.00$ | $20,99,30,340$ |

| NET BALANCE | $-1,73,34,907$ | $-1,25,62,456$ |

Note : Figures have been rearranged/regrouped wherever found necessary

Debasish Chakrabarti/Amitava Mukherjee

Dy. Chief Executive (Finance)

Ravinder Kumar

Chief Executive (A \& F)

Sanghamitra Bandyopadhyay

Director

INDIAN STATISTICAL INSTITUTE

SUB-SCHEDULE OF SCHEDULE 9

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| SUB – SCHEDULE OF SCHEDULE 9 DETAILS OF INVESTMENT IN FIXED DEPOSIT IN BANK |

||

| EARMARKED FUNDS | ||

| 1. ISI General Fund | $3,80,21,719$ | $3,63,96,261$ |

| 2. ISI Developement Fund | $112,87,51,691$ | $98,31,48,745$ |

| 3. R.C.Bose Centre Development Fund | $2,22,50,000$ | $2,20,00,000$ |

| 4. General Fund UBI Overseas Branch | 0 | 0 |

| 5. CECFEE Investment | 0 | 0 |

| 6. CECFEE Sweep Investment | 0 | 0 |

| TOTAL (A) | $118,90,23,410$ | $104,15,45,006$ |

INDIAN STATISTICAL INSTITUTE

SUB-SCHEDULE OF SCHEDULE 9

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| ENDOWMENT FUNDS | ||

| 1. S.H. Arvind Endowment Fund | 89,000 | $1,03,000$ |

| 2. Suniti Pal Endowment Fund | $5,26,000$ | $2,26,000$ |

| 3.. Endowment Fund-Prof. J.M. Sengupta | $2,48,000$ | $2,42,000$ |

| 4.. Sabyasachi Roy Memorial Award Fund | $1,58,400$ | $1,71,400$ |

| 5. Mukul Choudhury Memorial Fund | $11,67,500$ | $11,99,166$ |

| 6. USRI Gangopadhyay Memorial Fund | $3,03,500$ | $2,71,500$ |

| 7. Nikhilesh Bhattacharya Memorial Fund | $1,62,800$ | $1,63,800$ |

| 8. Bimal K. Chakraborty Endowment Fund | $7,74,300$ | $7,47,300$ |

| 9 Lt. Sushil Banerji Endowment Fund | $7,59,500$ | $8,62,500$ |

| 10. D. Basu Memorial Gold Medal | $4,25,000$ | $4,22,000$ |

| 11. Golden Jubilee Alumnus Award Fund | $14,76,400$ | $14,32,400$ |

| 12. Dr. N.S. Iyengar Endowment Fund | $3,27,500$ | $3,27,500$ |

| 13. S P Das Endowment Fund | $3,25,000$ | $3,25,000$ |

| 14. Mahalonobis Int. Symposium | $3,02,000$ | $2,88,959$ |

| 15. Endowment Fund For Lecture in Economics | $1,98,800$ | $1,93,800$ |

| 16 Staff Benevolent Fund | $3,51,506$ | $3,39,290$ |

| 17. ISI Alumni Association Prize Fund | $1,60,000$ | $1,49,971$ |

| 18 Haldane Prize Fund | $5,23,502$ | $5,07,277$ |

| 19 Raja Rao Prize Fund | $4,16,507$ | $4,00,748$ |

| 20 P.C. Mahalonobis Fellowship Chair | $41,56,081$ | $42,46,452$ |

| 21. M.N. Murthy Memorial Prize Fund | $6,91,010$ | $6,60,115$ |

| 22. Ambar Nath Santi Ghosh Endowment Fund | $15,89,007$ | $15,47,279$ |

| 23. Asian Congress on Quality \& Reliability Fund | $25,55,046$ | $24,27,087$ |

| 24. Dr P.K. Menon Memorial Fund | $2,41,502$ | $2,29,380$ |

| TOTAL (B) | $1,79,27,861$ | $1,74,83,924$ |

| TOTAL (A + B) | $120,69,51,271$ | $105,90,28,930$ |

Note : Figures have been rearranged/regrouped wherever found necessary

Debasish Chakrabarti/Amitava Mukherjee

Dy. Chief Executive (Finance)

Ravinder Kumar

Chief Executive (A \& F)

Sanghamitra Bandyopadhyay

Director

INDIAN STATISTICAL INSTITUTE

SCHEDULE 11 FORMING PART OF BALANCE SHEET AS AT 31 MARCH, 2024

(Amount in Rupees)

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| (A) CURRENT ASSETS: 1. Inventories (a) (i) Stores And Spares (ii) Building Materials (b) Loose Tools (c ) Stock – in trade Finished Goods Work – in – progress |

$\begin{array}{r} 0.00 \ 0.00 \ 0.00 \ 0.00 \ 0.00 \ 0.00 \ 1,29,54,953.20 \ 1,02,60,781.21 \end{array}$ | $\begin{array}{r} 0.00 \ 0.00 \ 0.00 \ 0.00 \ 0.00 \ 1,30,83,135.66 \ 53,84,124.76 \end{array}$ |

INDIAN STATISTICAL INSTITUTE

SCHEDULE 11 FORMING PART OF BALANCE SHEET AS AT 31 MARCH, 2024

(Amount in Rupees)

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| 3. Cash in Hand | ||

| At Kolkata | $19,425.00$ | $19,425.00$ |

| At Kolkata-IMPREST | 0.00 | 0.00 |

| At Delhi | $1,29,815.00$ | $1,07,224.00$ |

| At Giridih | 0.00 | 0.00 |

| At Bangalore | $10,031.00$ | $10,031.00$ |

| At Hyderabad | 0.00 | 0.00 |

| At Coimbatore | 0.00 | 0.00 |

| At Mumbai | $15,313.00$ | $1,463.00$ |

| At Chennai | 0.00 | 0.00 |

| At Pune | $19,264.00$ | $7,562.00$ |

| At Tezpur | 0.00 | 0.00 |

| SUB TOTAL OF CASH | $1,93,848.00$ | $1,45,705$ |

INDIAN STATISTICAL INSTITUTE

SCHEDULE 11 FORMING PART OF BALANCE SHEET AS AT 31 MARCH, 2024

(Amount in Rupees)

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| 4. Bank Balances (a) With Scheduled Banks: On Current Accounts |

||

| Indian Bank | $10,81,33,502.50$ | $2,82,18,178.29$ |

| SBI -Shyambazar Branch | $4,76,959.81$ | $1,98,798.81$ |

| PNB-Dunlop Bridge Branch | $13,27,51,310.56$ | $16,20,51,428.44$ |

| Indian Bank New Delhi | $2,75,16,531.53$ | $1,57,17,218.73$ |

| Indian Bank (FCRA-A/C) New Delhi | $3,97,72,073.00$ | $2,59,10,982.46$ |

| PNB -Giridih | $1,69,255.47$ | $1,52,467.30$ |

| UCO Bank-Giridih | 5,933.06 | 5,933.06 |

| UCO Bank- Bangalore | 2,56,01,918.63 | 2,39,97,407.99 |

| Bank of Baroda-Bangalore | $35,38,455.62$ | $35,57,455.62$ |

| Union Bank Of India (Bangalore Center) | $2,71,681.28$ | $2,71,681.28$ |

| Union Bank R C Bose Centre For Cryptology And | $5,21,42,560.54$ | $4,96,20,824.05$ |

| Canara Bank- Coimbatore | 0.00 | 0.00 |

| SBI -Chennai | $10,99,905.91$ | $16,73,849.91$ |

| Canara Bank -Chennai | $10,28,627.99$ | $12,22,974.99$ |

| SBI- Mumbai | $24,84,121.63$ | $32,24,227.73$ |

| Bank of Baroda -Baroda | $10,593.97$ | $11,183.97$ |

| Canara Bank-Hyderabad | $45,59,056.60$ | $9,85,771.60$ |

| SBI -Pune | $55,07,242.71$ | $27,89,052.71$ |

| Indian Bank-(PPU)- ISI Extension Counter Kolkata | $1,27,84,446.90$ | $74,01,875.00$ |

| Punjab National Bank-Tezpur | $4,37,572.82$ | $6,21,939.43$ |

| Punjab National Bank-Savings A/C – Texpur | $5,67,862.00$ | 1.00 |

| IDBI Bank – RCB Center For Cryptology \& Security | 27,230.37 | 61,703.84 |

| SBI – Tezpur Branch | $6,10,945.00$ | $4,73,784.00$ |

| SBI – Ac No 35514239311 | $1,90,96,996.36$ | $29,48,669.36$ |

| PNB -Overseas Branch Ac | 0.00 | 0.00 |

| Indian Bank Savings Account | $3,22,51,181.34$ | $4,99,83,074.30$ |

| UCO Bank Savings A/c Bangalore Center | $1,30,36,614.59$ | $1,52,17,619.00$ |

| SBI GEM Pool AC | $1,06,000.00$ | $1,06,000.00$ |

| Canara Bank Savings A/c – Chennai | $32,02,419.00$ | $24,42,076.00$ |

| Indian Bank Savings A/C – Delhi Center | $1,96,90,314.20$ | $83,96,469.20$ |

| Union Bank Savings Account – Kol | $11,72,255.14$ | $11,41,614.44$ |

| State Bank of India (FCRA A/c) – New Delhi | $3,417.94$ | $1,84,539.92$ |

| State Bank of India – PBB Giridih Branch | $24,89,401.89$ | $27,74,980.05$ |

| Bank Of Maharashtra – Bangalore Center | 0.00 | 0.00 |

| SUB TOTAL OF AMOUNT WITH BANK | $51,05,46,388.36$ | $41,13,63,782.48$ |

| TOTAL OF CASH AND BANK :- | $51,07,40,236.00$ | $41,15,09,487$ |

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| 5. On Deposit Accounts (including margin money) | 0.00 | 0.00 |

| TOTAL (A) | $53,39,55,971.00$ | $42,99,76,748$ |

INDIAN STATISTICAL INSTITUTE

SCHEDULE 11 FORMING PART OF BALANCE SHEET AS AT 31 MARCH, 2024

(Amount in Rupees)

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| B. LOANS, ADVANCES AND OTHER ASSETS | ||

| 1. Loans: (a) Staff |

||

| Travel Advance | $6,76,528.00$ | $54,873.00$ |

| LTC Advance | $1,05,304.00$ | $36,257.00$ |

| Cycle Advance | 830.00 | 830.00 |

| General Advance | $11,65,823.00$ | $10,01,493.00$ |

| Festival Advance | $11,000.00$ | $11,000.00$ |

| Medical Advance | 0.00 | 0.00 |

| Scooter Advance | 0.00 | 0.00 |

| House Building Advance | $16,76,137.00$ | $19,62,937.00$ |

| Motor Car Advance | 0.00 | 0.00 |

| Computer Advance | $1,22,500.00$ | $2,21,500.00$ |

| Flood \& Drought Relief Loan | 0.00 | 0.00 |

| Medical Insurance Premium Paid for Students | $12,40,502.00$ | $12,84,261.00$ |

| (b) Deptt. Imprest | 0.00 | 0.00 |

| Loan to /from Fund | 0.00 | 0.00 |

INDIAN STATISTICAL INSTITUTE

SCHEDULE 11 FORMING PART OF BALANCE SHEET AS AT 31 MARCH, 2024

(Amount in Rupees)

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| 2. Advances and other amounts recoverable on cash or in kind | ||

| (a) Prepaid Expenses | 0.00 | $13,16,191.00$ |

| (b) Others | ||

| Security Deposit | $2,18,89,588.00$ | 2,08,62,212.00 |

| Suppliers Advance | $1,07,80,278.09$ | $1,01,35,379.59$ |

| Loan To/From Fun | 35,001.00 | 32,160.00 |

| Income Tax deducted -Other than Dev.Fund | $1,74,61,924.20$ | 2,14,43,988.00 |

| TCS Recovered by Supplier | 11,935.00 | 11,935.00 |

| Service Tax Receivable-Ober Construction | $47,56,336.00$ | $47,56,336.00$ |

| Cenvat Credit | 0.00 | 0.00 |

| Amount Receivable By ISI From RC Bose Center For | 0.00 | 0.00 |

| 3. Income Accrued: | ||

| (a) On Investments form Earmarked/Endowment Funds | $62,33,636.00$ | $54,58,186.00$ |

| 4. Claims Receivable | ||

| 5. Conference/Seminar | ||

| NBHM Math Olympiad | 0.00 | $1,36,603.00$ |

| TRG Program on Career Profile Similarity | 0.00 | $8,234.00$ |

| Grant From ICCSR For Int Con On Fut Of ICFL 2017 | 0.00 | $38,007.00$ |

| Conference IWPAA 2018 | 0.00 | $3,969.00$ |

| Workshop under ICPS Programme | 0.00 | 2,600.00 |

| Decentralised Computation Net to SWARMS | 0.00 | 197.50 |

| Microsoft Research Lab Pvt Ltd. | 0.00 | $9,973.50$ |

| 39th Batch Trainning Prog Sample Survey Methodology NS | 0.00 | 535.00 |

| Summer School On USE \& Application Of SBSS at BAU | 0.00 | $6,116.74$ |

| IBM Meet 2017-18 | 0.00 | $49,632.00$ |

| Workshop on Analytic Number Theory | 0.00 | 16,234.00 |

| Workshop On Mental Health Dataanalytics PRSU | 0.00 | 74,224.72 |

| AICRP Nimatod | 0.00 | 11,145.00 |

| Workshop On Gross Domestic Knowledge Product | 0.00 | 1,285.00 |

| Grant From ICCSR For DRTC International Conference | 0.00 | 19,735.00 |

| R Workshop | 0.00 | $1,36,552.32$ |

| Internship TRG Program Xavier School of Economics | 0.00 | $46,572.00$ |

| AIS Homotopy Theory EMU | 0.00 | $2,91,287.00$ |

| ISS Probationers 41st Batch 24-06-19 To 16-08-19 | 0.00 | 0.00 |

| ISI CTP Summer School | 0.00 | 32,495.00 |

| ISI UTS Workshop | 0.00 | 17,611.00 |

| Workshop on 7th IBM 2019 AERU | 0.00 | $38,427.12$ |

| Six Sigma Green Belt Training and Project | 0.00 | 0.00 |

INDIAN STATISTICAL INSTITUTE

SCHEDULE 11 FORMING PART OF BALANCE SHEET AS AT 31 MARCH, 2024

(Amount in Rupees)

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| Grant from RRLF 2019-20 For DRTC Conference | 0.00 | $8,848.00$ |

| Workshop on Morphometry \& Its OPP | 0.00 | 652.50 |

| WAIS Conf. 04-08/12/17 | 0.00 | 400.00 |

| Finantial Support For Geo Science \& Tech | 0.00 | $38,833.00$ |

| Advance Training in Stat School | 0.00 | $96,543.00$ |

| Specialised Training on Stat Process | 0.00 | $1,25,430.00$ |

| Electric charger recoverable from NSSO-ISI Giridih | $1,24,051.90$ | 0.00 |

| 6. Remittance in Transit | $1,19,64,956.00$ | $1,20,14,994.00$ |

| 7. Accrued Income | $46,87,120.00$ | $37,08,042.87$ |

| Accrued Interest RC Bose Center Developement Fund | $2,81,465.64$ | 0.00 |

| 8. ISEC ISI Fund-Capital. | $11,67,659.00$ | $11,67,659.00$ |

| 9. GST Input Tax Credit | ||

| Input Tax Credit CGST | $40,65,918.60$ | $38,89,060.42$ |

| Input Tax Credit SGST | $24,80,615.79$ | $23,03,757.19$ |

| Input Tax Credit IGST | $8,70,901.65$ | $6,22,807.53$ |

| Advance Receipts – CGST | $49,770.00$ | $1,60,541.00$ |

| Advance Receipts – SGST | $49,770.00$ | $1,60,541.00$ |

| Advance Receipts – IGST | 0.00 | $7,16,280.23$ |

| CGST TDS Sales Bill | $94,226.00$ | $66,275.00$ |

| SGST TDS Sales Bill | $94,226.00$ | $66,275.00$ |

| IGST TDS Sales Bill | $2,03,531.00$ | $20,373.00$ |

| ECL CGST | $27,000.00$ | $27,000.00$ |

| ECL SGST | $27,000.00$ | $27,000.00$ |

| ECL IGST | $1,19,880.00$ | $1,19,880.00$ |

| 0.00 | 0.00 | |

| TOTAL (B) | $9,24,75,414.00$ | $9,48,72,167.00$ |

| TOTAL (A + B) | $62,64,31,385$ | $52,48,48,915$ |

Note : Figures have been rearranged/regrouped wherever found necessary

Debasish Chakrabarti/Amitava Mukherjee

Dy. Chief Executive (Finance)

Ravinder Kumar

Chief Executive (A \& F)

Sanghamitra Bandyopadhyay

Director

INDIAN STATISTICAL INSTITUTE

SCHEDULE 12 FORMING PART OF INCOME \& EXPENDITURE FOR THE YEAR ENDED 31 MARCH, 2024

(Amount in Rupees)

| PARTICULARS | GRANT GENERAL \& SALARY | T O T A L | ||

|---|---|---|---|---|

| CURRENT YEAR | PREVIOUS YEAR | CURRENT YEAR | PREVIOUS YEAR | |

| SCHEDULE – 12 MISC. RECEIPTS. | ||||

| 1) Share of Income from SQCOR Consultancy Services |

$6,05,23,130$ | $3,05,17,878$ | $6,05,23,130$ | $3,05,17,878$ |

| 2 ) Membership Fees | $1,08,625$ | $1,14,405$ | $1,08,625$ | $1,14,405$ |

| 3) Fees for Training Course and | ||||

| Sale of Prospectus,Bye Laws etc. | $2,73,86,350$ | $1,23,16,250$ | $2,73,86,350$ | $1,23,16,250$ |

| 4) Receipt from Sale of Farm Products | ||||

| at Giridih | 0 | 0 | 0 | 0 |

| 5) Misc. Receipt, Examination Fees and Other Receipts | $59,52,592$ | $50,54,975$ | $59,52,592$ | $50,54,975$ |

| 6) Interest on Short Term Deposit | $66,78,101$ | $35,17,321$ | $66,78,101$ | $35,17,321$ |

| 7 ) Sale of Sankhya Publication | 2,433 | 5,100 | 2,433 | 5,100 |

| 8) Hostel Seat Rent | $32,34,254$ | $26,99,870$ | $32,34,254$ | $26,99,870$ |

| 9) Rent Realised -Premises | $52,72,685$ | $43,98,286$ | $52,72,685$ | $43,98,286$ |

| 10) Rent Realised – Guest House | $19,98,493$ | $23,46,925$ | $19,98,493$ | $23,46,925$ |

| 11) License Fees From Workers -Quarters | $8,87,900$ | $9,06,074$ | $8,87,900$ | $9,06,074$ |

| 12) Interest on Motor Car Advance | 0 | 90,699 | 0 | 90,699 |

| 13) Interest on Scooter Advance | 3,274 | 40,966 | 3,274 | 40,966 |

| 14) Interest on Computer Advance | $1,36,330$ | 90,012 | $1,36,330$ | 90,012 |

| 15) Share of Overhead from Externally | ||||

| Funded Project | $60,89,474$ | $44,24,583$ | $60,89,474$ | $44,24,583$ |

| 16) Interest on Marginal Deposit | 0 | 0 | 0 | 0 |

| 17) Interest on House Building Advance | $51,91,443$ | $3,38,983$ | $51,91,443$ | $3,38,983$ |

| 18) NPS Refund NSDL For Deceased Employees | 0 | 0 | 0 | 0 |

| 19) Profit/Loss On Sale Of Fixed Assets \& Scraps | $7,50,999$ | 0 | $7,50,999$ | 0 |

| GRAND TOTAL | $12,42,16,082$ | $6,68,62,327$ | $12,42,16,082$ | $6,68,62,327$ |

Note : Figures have been rearranged/regrouped wherever found necessary

Debasish Chakrabarti/Amitava Mukherjee

Dy. Chief Executive (Finance)

Ravinder Kumar

Chief Executive (A \& F)

Sanghamitra Bandyopadhyay

Director

Note : Figures have been rearranged/regrouped wherever found necessary

Debasish Chakrabarti/Amitava Mukherjee

Dy. Chief Executive (Finance)

Ravinder Kumar

Chief Executive (A \& F)

Sanghamitra Bandyopadhyay

Director

INDIAN STATISTICAL INSTITUTE

SCHEDULE 21 FORMING PART OF INCOME \& EXPENDITURE FOR THE YEAR ENDED 31 MARCH, 2024

(Amount in Rupees)

| PARTICULARS | GRANT GENERAL | |

|---|---|---|

| CURRENT YEAR | PREVIOUS YEAR | |

| SCHEDULE – 21 OTHER ADMIN. EXPENSES | ||

| 01. Purchase \& Expenses on Giridih Agricultural | 10,01,690 | $6,44,095$ |

| 02. Electricity Expenses | $3,99,85,951$ | $4,13,04,358$ |

| 03. Repairs, Replacement and Maintenance of Office Equipment, Computers and Accessories etc | 2,17,19,113 | $1,96,31,627$ |

| 04. Rent,Rates,Taxes and Water Charges | $1,05,44,720$ | $1,01,56,561$ |

| 05. Transport Expenses-Vehicles Running and Maintenance. | 38,15,274 | $38,63,536$ |

| 06. Postage, Telephone and Communication | $30,04,722$ | $38,55,291$ |

| 07. Stationeries, Liveries and Consumable Stores for Electrical \& Building | $1,20,96,508$ | $80,03,333$ |

| 08. Travelling \& Conveyance Expenses | $1,76,58,209$ | $1,71,77,136$ |

| 09. Society Type Activities, Seminar and | $5,69,245$ | $22,90,914$ |

| 10. Statutory Audit Fees \& Expenses | $3,79,665$ | $3,79,665$ |

| 11. Freight and Forwarding Expenses, Insurance, Advertisement, Examination Expenses | 2,01,22,938 | $1,45,10,087$ |

| 12. Books \& Journals | $15,19,69,257$ | $13,03,65,031$ |

| 13. Printing \& Publication | $4,27,515$ | $5,58,666$ |

| 14. Interest \& Bank charges | 44,842 | 72,028 |

| 15. Repairs, Maintenance of Building \& Petty Constructions | $1,30,11,043$ | $1,25,37,267$ |

| 16. Workers \& Student’s Walfare \& Amenities (Excluding Medical Expenses) | $51,80,353$ | $47,83,520$ |

| 17. Lab. \& Reprography Stores, Consumbles, Tools \& Minor Accessories | 26,78,852 | 27,27,972 |

| 18. Out Sourcing Services/Ext Expert Remuneration | $15,29,20,872$ | $14,80,85,586$ |

| 19. Scholarship/Stipend \& oth asstance to Trainees | $19,57,42,370$ | $19,46,75,197$ |

| TOTAL | $65,28,73,139$ | $61,56,21,870$ |

Note : Figures have been rearranged/regrouped wherever found necessary

Debasish Chakrabarti/Amitava Mukherjee

Dy. Chief Executive (Finance)

Ravinder Kumar

Chief Executive (A \& F)

Sanghamitra Bandyopadhyay

Director

INDIAN STATISTICAL INSTITUTE 203, B.T. Road, Kolkata – 700108

SCHEDULE FORMING PART OF THE ACCOUNTS FOR THE YEAR ENDED $31^{\text {ST }}$ MARCH 2024

Schedule 24 – Significant Accounting Policies

1. Accounting Convention

1.1. The Indian Statistical Institute is an Institute of National Importance by an Act of Parliament. It is fully funded by Govt. of India. The Financial Statements are prepared on the basis of historical cost convention and on the accrual method of accounting (unless otherwise stated).

1.2. All Income / Receipts and Expenditure are maintained on accrual basis excepting in following cases: –

(a) Receipts on Interest on HB Loan are accounted on recovery basis.

(b) Ad hoc Bonus and portion of D.A. to employees are accounted for in the year government orders are received.

(c) Expenditure on disbursement of Share of Faculty members in respect of income sharing externally funded SQCOR consultancy project is accounted for on Cash basis.

(d) Prepaid expenses are charged off in the year these are incurred other than subscription of Journals.

1.3. In absence of prior period adjustment account, all transactions pertaining to the past year are accounted for in the regular head of accounts.

2. Depreciation

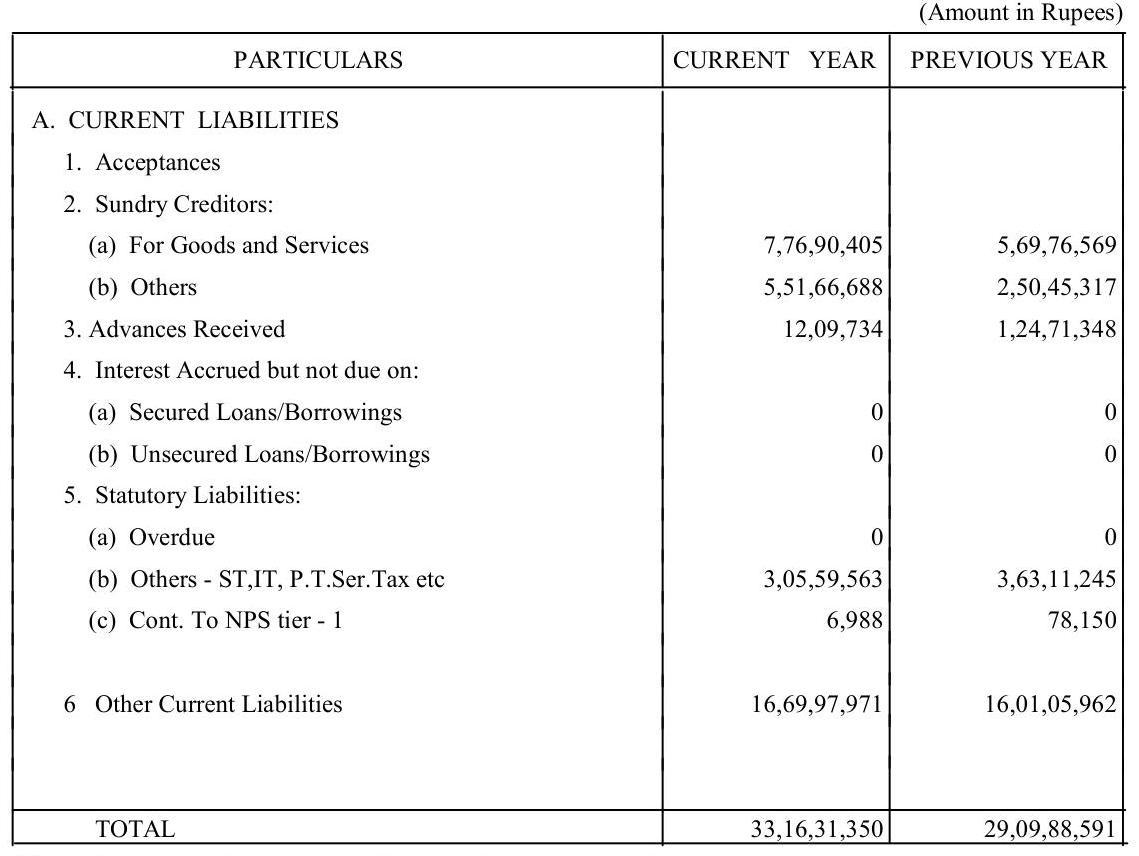

2.1. Depreciation on assets acquired up to accounting year 1985 – 1986 have been charged up to 1985 – 1986 as per Income Tax Rules and thereafter no depreciation has been charged on those assets and the same have been kept in fixed assets Schedule-8 separately.

2.2. The system of charging depreciation has been reintroduced from the Financial year 2003-2004 on assets acquired from 01.04.1986 and depreciation is charged on opening balances covered under Schedules 8A and 8B as per rates specified in the Income Tax Rules 1962 on Straight Line Method.

2.3. Depreciation on assets acquired after $30^{\text {th }}$ September has been charged @50\% of applicable rates. Assets which are fully depreciated have been retained at Re.1/-

2.4. Depreciation on fixed assets for the year is deducted / reduced from the Capital Fund.

3. Fixed Assets

3.1. Fixed Assets are stated at cost of acquisition inclusive of inward freight, duties and taxes and incidental and direct expenses related to acquisition.

3.2. All assets which are put to use during the year are capitalized.

3.3. Sale or disposal of fixed assets are recognized on realization basis and credited to Miscellaneous Receipt as Income. The written down value of such asset are deducted from fixed assets as well as from Capital Fund.

4. Retirement Benefits

Provision for the accrued liabilities for Retirement Benefits are not made in the accounts except unpaid liability of retired employee because those expenses are paid out of grant received from Government.

5. Earmarked / Endowment Fund

All externally / internally funded earmarked / endowment fund are accounted for under distinctive heads. Closing Balances of externally / internally funded earmarked / endowment fund are depicted in the Balance Sheet.

6. Foreign Currency Transaction

Transactions in foreign currencies are recorded at exchange rate at the time of settlement.

7. Investments

7.1. Investments against General Fund and other Funds stands in the name of Indian Statistical Institute, the disclosure of such investments, in Schedule- 9 forming part of the Balance Sheet as at 31.03.2024, under different fund heads are based on internal records.

7.2. Interest received on Investment on General and other Funds are accounted for directly in the fund account itself.

8. Books and Journals

All the cost of books and journals are charged to Income \& Expenditure Account in the year of Purchase. However, $95 \%$ of such cost is capitalized by crediting the Capital/Corpus Fund and disclosed in the Balance Sheet.

9. Government Grant:

Government Grant is given under three heads namely Grant in aid -General, Grant in aid for creation of Assets and Grant in aid for salaries from financial year 2017-18 onwards.

10. Inventories:

In case of laboratory stores, minor accessories, stationary items including computer stationeries, medicine are charged off to Income and Expenditure Account in the year of purchase. Year end stock under these heads not being material, are not taken back to the accounts.

Debasish Chakrabarti/Amitava Mukherjee

Dy.Chief Executive (Finance)

Ravinder Kumar

Chief Executive ( A \& F)

Sanghamitra Bandyopadhyay

Director

INDIAN STATISTICAL INSTITUTE 203, B. T. Road, Kolkata-700108

SCHEDULE FORMING PART OF THE ACCOUNTS

FOR THE YEAR ENDED $31^{\text {ST }}$ MARCH 2024

Schedule – 25: Notes on Accounts

1. Fixed Assets

1.1 Depreciation on fixed assets for the current year has been charged in the accounts on assets acquired on and after 01.04.1986 and depreciation on fixed assets acquired up to $31^{\text {st }}$ March 1986 except Lease hold Land and Development could not be charged although process of incorporation of data in the revised software have been made as on date.

1.2 Work-in-Progress in Schedule ‘ 8 A ‘ represent E-Governance project in Kolkata, Baruipur Land, Construction of new Academic Building at Kolkata, Construction of new Students’ Hostel at Kolkata, Augmentation \& distribution of electrical power, Repairing of overhead RCC water reservoir and Development of surrounding area at ISI campus Kolkata, Repair/Retrofitting of M.Tech. Hostel (Meghnad Saha Hall), Construction of new campus for R C Bose Centre for Cryptology and Security at Gupta Niwas, Kolkata, Design, delivery, installation. commission and trial run of 2 nos 13 Passenger Lift at S N Bose Bhavan (Kolkata), SITC of Solar PV System in ISI campus at Delhi Centre, Mess Building at Delhi Centre, Consultancy for rehabilitation of P J Hostel at ISI Delhi,SITC of 500 KVA Transformer at ISI Delhi Centre, Filling of low lying areas of Karapakkam Road at Chennai, Construction work of first floor of Gymnasium at Bangalore, Construction of rain water harvesting structures at Bangalore, Construction of $2^{\text {nd }}$ floor Guest House and Construction of new Academic Block at Bangalore and Construction of Tezpur Campus, Construction of boundary wall of upper Farm house at Giridih, Vertical extension of existing Office Building on the west side of first floor at Hyderabad, Construction of Seminar Hall on the $1^{\text {st }}$ floor at Hyderabad,Guest House renovation civil works at Delhi, Lift work civil works at Delhi, Upliftment of Residential Quarters at Delhi (Exterior paint etc.), Repairing and Reconstruction of Roads at Delhi,Repair and Renovation of Neils Bohr Hall(ISEC and RS Hostel) at ISI campus Kolkata.

1.3 Verification of assets of Kolkata facilities have been completed and Fixed Asset Register have been updated up to 31.03 .2019 by M/s Sarkar Gurumurthy \& Associates, Chartered Accountants .During the visit of Government Auditors to the Institute for auditing the accounts for 2019-20 a meeting was held in March 2021 between the Institute, M/s Sarkar Gurumurthy \& Associates, Chartered Accountants and Government Auditors .In that meeting the representatives of M/s Sarkar Gurumurthy \& Associates briefed the process of physical verification before the Government Auditors. It was intimated by the C\&AG Audit team that the issue needs to be discussed with their seniors at Government Audit Office and accordingly they will inform us. The matter was once again

discussed with the Government Auditors during their visit (from 03.01.2023 to 01.03.2023) to the Institute for audit of accounts of Indian Statistical Institute for the year 2021-22. Records relating to Physical Verification of Assets (done up to 31.03.2019) were presented before the Government Auditors. As per as the process of Physical Verification of Assets as done by M/s Sarkar Gurumurthy \& Associates (done up to 31.03.2019), the Government Auditors informed that it is a technical matter and they had no issue on the same. They advised that the Institute needs to do Physical Verification of Assets on regular basis. Accordingly the work of the physical verification of all assets of the Institutes (head quarters and outline centres) has been awarded to M/s Sarkar Gurumurthy \& Associates, Chartered Accountants and the said firm has started the physical verification work from July 2024 onwards.

1.4 Insurance Coverage of Fixed Assets excepting vehicle has not been taken in view of the communication received from Government that there is no provision under rule for insuring Government Building, library books, equipment and computers etc.

1.5 Assets under Schedule 8A include a computer system (fixed value: ₹ 7.00 lakhs approx.) which was stolen in 1992 – 1993. A letter (No. CAF/14-1/13/17 dt.12/12/2011) was written to the officer-in-charge, Baranagar Police Station to provide status of the case but reply is still awaited. As per decision of the Council meeting held on 30/10/2012, approval request was sent to parent Ministry and as per its direction, requisite information for preparation of a loss statement was also forwarded to that end followed by reminder. No adjustment has been made since the requisite approval from the Ministry is still pending.

1.6 Current Liabilities includes ₹ 54,35,883.76 (Previous Year ₹ 61,82,872.76) being sale proceeds of fixed assets disposed off. An amount of Rs. 7,51,010/towards sale of Scrap Vehicles has been identified and removed the same from the Asset Register. During the visit of Government Auditors to the Institute for auditing the accounts for 2019-20 a meeting was held in March 2021 between the Institute, M/s Sarkar Gurumurthy \& Associates, Chartered Accountants and Government Auditors .In that meeting the representatives of M/s Sarkar Gurumurthy \& Associates briefed the process of physical verification before the Government Auditors. It was intimated by the C\&AG Audit team that the issue needs to be discussed with their seniors at Government Audit Office and accordingly they will inform us. The matter was discussed with the Government Auditors during their visit (from 03.01.2023 to 01.03 .2023 ) to the Institute for audit of accounts of Indian Statistical Institute for the year 2021-22. Records relating to Physical Verification of Assets (done up to 31.03.2019) were presented before the Government Auditors. As per as the process of Physical Verification of Assets as done by M/s Sarkar Gurumurthy \& Associates (done up to 31.03.2019), the Government Auditors informed that it is a technical matter and they had no issue on the same. They advised that the Institute needs to do Physical Verification of Assets on regular basis. Accordingly the work of the physical verification of all assets of the Institutes (head quarters and outline centres) has been awarded to M/s Sarkar Gurumurthy \& Associates, Chartered Accountants and the said firm has started the physical verification work from July 2024 onwards.

1.7 Assets acquired from the externally funded projects have been shown in the Asset side and Liability side of the balance sheet in historical values. No depreciation has been charged on the same.

1.8 Contingent Liabilities not provided for in respect of Interest levied on property tax from 2004-2005 to 2012-2013 amounting to ₹ $34,43,388.00$ for Delhi Centre. Appeal for the same has been filed in the High Court of Delhi vide W.P( C) No.4027/2013 Dated.22/04/2014. The High Court of Delhi had given the judgement in favour of Indian Statistical Institute, Delhi Centre clearly stating that we need not to pay any property tax and we need to pay only the service charges. However, the judgement of the High Court has been challenged by South Delhi Municipal Corporation by filing a LPA (Letter Patent Appeal) in the High Court of Delhi. The matter is still pending in the High Court of Delhi.

1.9 Land to the extent of 8.00 acres was allotted to ISI by the Government of Tamil Nadu at free of cost. Due to the PIL filed by an NGO, recently the High Court of Madras has ordered the Government of Tamil Nadu to cancel the land allotment to ISI. Also there is a mention in the Order that ISI may approach the Government of Tamil Nadu for alternate allotment. As per the decision of the Council, ISI have approached the Government of Tamil Nadu for alternative land allotment and claimed for compensation of the expenditure incurred to the tune of Rs 11.02 Crs. for the site development.

2 Current Assets, Loans \& Advances (Schedule – 11)

2.1 T.A. advance under Loans \& Advances for ₹ 6,26,528.00 as on 31.03.2024 and all the outstanding advance pertaining to the current financial year only. Action has been taken to identify and adjust the same.

2.2 There are old balances of ₹ 91,33,127.13 (over 2 years) shown as advance to Suppliers which includes ₹ 29,09,388.58 paid to erstwhile Statistical Publishing Society in the year 1994-1995. Action is being taken to adjust these balances after proper scrutiny.

2.3 Advances to Staff \& Others, include ₹ 66,563.00 old / unreconciled debit balances (over two years). Action is being taken to identify and adjust these balances.

2.4 Sundry Debtors from SQC consultancy / other services amounting to ₹ $2,32,15,734.41$ represent value of professional services rendered including ₹ $1,13,33,755.20$ due for more than 2 years.

2.5 GST Input balance of ₹ 74,17,436.04 (Previous Year ₹ 68,15,625.14) appearing in the accounts is subject to reconciliation with the figures uploaded in the GST Portal by the vendors.

3. Income and Expenditure Account:

3.1 Expenditures on account of Visiting Professor Remuneration and Expenditure on Medical Reimbursement \& Medical Welfare, LTC have been included under the head of expenditure under Salary and Allowances as recommended by Section 8(1) Committee of the Institute.

3.2 Out of net receipts on Statistical Quality Control Services a sum of ₹ 1,29,604.73 (being $25 \%$ of net receipts on SQC \& OR Services, with effect from F.Y. 2005 – 2006) is shown in the Income Expenditure Account of the Institute and the balance amount has been retained with the Development Fund.

4 Development Fund:

Closing balance of Development fund is net of TDS [TDS amount: ₹ 38,32,705.24/- (Previous Year figure: ₹ 29,97,423.30/-)].

5. Capital Commitments:

Contracts remaining to be executed on Capital Account amount to ₹ 5141.82 lakhs (Previous year ₹ 6405.10 lakhs).

6. Gratuity Liabilities:

The Gratuity Liability as per Payment of Gratuity Act, 1972 estimated as on 31.03.2024 is ₹ 73.18 Crores (Previous year ₹ 66.67 Crores) and not provided for in Books of Accounts.

7. Current Liabilities:

7.1 Other current liabilities include ₹ 1,05,08,325.64 on account of Earnest Money/ Security Deposits and ₹ 46,35,914.84 on account of Library / Laboratory/ Hostel Caution Money Deposit which are outstanding for more than three years and five years respectively. Action has been taken to scrutinize and make appropriate adjustment in the accounts for these balances. Current liabilities include stale cheques of ₹ $13,19,820.00$ and the same is under scrutiny.

7.2 GST Output balance of ₹ 30,90,488.89 (Previous Year ₹ 82,05,576.48) appearing in the accounts is subject to confirmation with GST records.

8. General:

8.1 As per decision of the Council, the Institute recovered overhead charges on fund received from externally funded projects and such recoveries are credited to the Miscellaneous Receipt Account and the Development Fund Account in equal proportion.

8.2. Assets acquired out of fund of Externally Funded Projects, during the year under audit, have been shown in the Schedule 3 – Earmarked Funds.

8.3. The Institute has been approved by the Central Government of India, Ministry of Finance (Department of Revenue) for the purpose of clause (ii) of sub-section (1) of Section 35 of the Income Tax Act, 1961, read with Rule 6 of the Income Tax Rules, 1962 from the Assessment year 2004 onwards. This approval has further been granted with effect from Assessment Year 2022-23 to Assessment Year 2026-27 vide Registration No.AAAAI0345RN20181 (through e-mail communication dated 07/04/2023).

8.4. Uniform format of Account recommended by the Government of India has been implemented to the extent it is applicable and suitable to the Institute.

Schedules of Accounts forming part of Balance sheet and Income \& Expenditure are drawn which are relevant to the Institute. Schedules No. 2, 4, $5,6,10,14,15,16,17,18,19,22 \& 23$ are not applicable to the Institute.

8.5. House Building Advances are made to the employees out of Specific Fund granted by the Government of India. Interests are recovered after recovery of the principal amounts and credited to Income and Expenditure Account. On recovery, principal amount is credited to the House Building Advance Account and thereby gets funded for payment of fresh House Building Advance. Interest on house building advances amounting to Rs.48,47,081.14 upto 2002-03 were wrongly credited to the House building advance fund (ACCODE:803) that has been identified and transferred to the proper account head of interest on HBA (ACCODE:087).

8.6 The balances of Sundry Debtors, Sundry Creditors, Advances, Deposits and Other Libilities (including Goods \& Service Tax, Professional Tax) as on 31.03.2024 are subject to confirmation and subsequent adjustment, if any, on reconciliation.

8.7 Break-up of Audit Fees \& Expenses – Audit Fee ₹ 2,90,000.00 (Previous Year₹ 2,90,000.00), Provident Fund Audit – ₹ 31,750.00 (Previous Year – ₹ 31,750.00) (exclusive of GST).

8.8 The Institute has been granted registration by the Income Tax Department as Charitable / Religious Trust / Institution under Section 12AA of the Income Tax Act, 1961.Certificate granted on 10.11.2010 by the Office of the Director of I.T. (Exemption) with effect from 01.04.2010. This approval has further been granted with effect from Assessment Year 2022-23 to Assessment Year 202627 vide Registration No.AAAAI0345RE20165.

8.9 The Management is of the opinion that, all assets other than Tangible Fixed Assets and Non-Current Investments have a value in realization in the ordinary course of business at least equal to the amounts at which they are stated in the Balance Sheet. Hence, none of the assets of the Institute has been considered as impaired during the year as per Accounting Standard (AS)-28 ‘Impairment of Assets’ as issued by the Institute of Chartered Accountants of India.

8.10 An amount of ₹ 59,21,727.95 yet to be realized from Indian Bank (Erstwhile Allahabad Bank) towards Arrear License Fees for the period from June,2008 to July 2018 and considering the contingency for realization of the same \& following the conservatism concept of accounting the same will be recognized as income of the Institute on actual realization.

8.11 Previous year’s figures have been regrouped / rearranged, wherever considered necessary in order to make them comparable with those of the current year. In current year Schedule $3 \& 3 A$ has been shown separately as Earmarked Funds and Endowment Funds respectively.

Debasish Chakrabarti/Rmitava Mukherjee Ravinder Kumar Sanghamitra Bandyopadhyay

Dy.Chief Executive (Finance) Chief Executive (R\&F) Director

INDEPENDENT AUDITOR’S REPORT

Report on the Audit of the Financial Statements

Opinion

We have audited the Financial Statements of Plan and Policy Research Fund (PPRF) of INDIAN STATISTICAL INSTITUTE (hereinafter referred to as “the Institute”), which comprise the Balance Sheet as at 31st March, 2024, and the Income \& Expenditure Account, and Notes to the Financial Statements, including a summary of significant accounting policies and other explanatory information.

In our opinion and to the best of our information and according to the explanations given to us the aforesaid Financial Statements give a true and fair view in conformity with the accounting principles generally accepted in India, of the state of affairs of PPRF of the institute as at 31st March, 2024 and Surplus for the year ended on that date.

Basis for Opinion

We conducted our audit in accordance with Standards on Auditing (SAs) as prescribed by the Institute of Chartered Accountants of India. Our responsibilities under those Standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Institute in accordance with the Code of Ethics issued by the Institute of Chartered Accountants of India together with the ethical requirements that are relevant to our audit of the Financial Statements under the provisions of the relevant act and the rules thereunder, and we have fulfilled our other ethical responsibilities in accordance with these requirements and the Code of Ethics. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Responsibilities of Management and Those Charged with Governance for the Financial Statements

The Management of the Institute is responsible for the matters with respect to the preparation of these financial statements that give a true and fair view of the financial position, financial performance of the Institute in accordance with the accounting principles generally accepted in India including the accounting standards as issued by the Institute of Chartered Accountants of India. This responsibility also includes maintenance of adequate accounting records for safeguarding of the assets of the Institute and for preventing and detecting frauds and other irregularities; selection and application of appropriate implementation and maintenance of accounting policies; making judgments and estimates that are reasonable and prudent; and design, implementation and maintenance of adequate internal financial controls that were operating effectively for ensuring the accuracy and completeness of the accounting records, relevant to the

preparation and presentation of the financial statement that give a true and fair view and are free from material misstatement, whether due to fraud or error.

In preparing the financial statements the Management of the Institute is responsible for assessing the Institutes’ ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting.

The Management of the institute is also responsible for overseeing the Institute’s financial reporting process.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objective is to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with SAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with SAs. We exercise professional judgment and maintain professional scepticism throughout the audit. We also :

- Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion. forgery, intentional omissions, misrepresentations, or the override of internal control.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the Management.

- Evaluate the overall presentation, structure and content of the financial statements, including the disclosures and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

Materiality is the magnitude of misstatements in the financial statements that, individually or in aggregate, makes it probable that the economic decisions of a reasonably knowledgeable user of the financial statements may be influenced. We consider quantitative materiality and qualitative factors in (i) planning the scope of our audit work and in evaluating the results of our work; and (ii) to evaluate the effect of any identified misstatements in the financial statements.

We communicate with, those charged with governance regarding, among other matters. the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

Report on Other Legal and Regulatory Requirements

Based on our audit, we report that:

- We have sought and obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purposes of our audit.

- In our opinion, proper books of account as required by law have been kept by the Institute so far as it appears from our examination of those books.

- The Balance Sheet, the Income \& Expenditure Account dealt with by this Report are in agreement with the books of account.

- In our opinion, the aforesaid financial statements comply with the applicable Accounting Standards.

Place: Kolkata

Date: $20^{\text {th }}$ September, 2024

UDIN: 24064308BKCFFQ3006

C.A Manoj Kumar Sethia Partner

Membership No. 064308

INDIAN STATISTICAL INSTITUTE

PLAN AND POLICY RESEARCH UNIT, FUNDED BY PLANNING COMMISSION

BALANCE SHEET AS AT 31st MARCH, 2024

(Amount in Rupees)

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| ENDOWMENT FUND | ||

| As per Last Account | 5,31,55,918.19 | 5,27,63,827.19 |

| Add : Excess / (Defecit) Of Income over Expenditure | 21,60,190.00 | 3,92,091.00 |

| 5,53,16,108.19 | 5,31,55,918.19 | |

| GENERAL FUND | ||

| Amount Transferred from Endowment Fund (As per Last | 19,83,257.00 | 19,83,257.00 |

| CURRENT LIABILITIES | ||

| Outstanding Liabilitis | 2,16,397.00 | $1,52,808.00$ |

| TOTAL | 5,75,15,762.19 | 5,52,91,983.19 |

| ASSETS | ||

| Fixed Assets | 1,15,77,038.00 | 1,14,23,443.00 |

| Investment | 4,02,00,000.00 | 4,02,00,000.00 |

| Tax Deducted At Source | 17,54,213.10 | 14,63,131.10 |

| Books \& Journals | 19,83,257.00 | 19,83,257.00 |

| CURRENT ASSETS | ||

| Interest accrued but not due on Fixed Deposit | 19,57,990.00 | 71,845.00 |

| Advance \& Prepaid Expenditure | 15,500.00 | 15,500.00 |

| Cash \& Bank Balance With Indian Bank | 27,764.09 | 1,34,807.09 |

| TOTAL | 5,75,15,762.19 | 5,52,91,983.19 |

Debasish Chakrabarti/Amitava Mukherjee

Dy. Chief Executive (Finance)

Ravinder Kumar

Chief Executive (A \& F)

Sanghamitra Bandyopadhyay

Director

In terms of our Report of even date.

For R. KOTHARI \& CO LLP

Chartered Accountants

(Firm Registration No. 307069E/E300266)

CA. Manoj Kumar Sethia

Partner

Membership No. 064308

ICAI UDIN : 24064308BKCFFQ3006

Kolkata, September 20, 2024

INDIAN STATISTICAL INSTITUTE

PLAN AND POLICY RESEARCH UNIT, FUNDED BY PLANNING COMMISSION

INCOME \& EXPENDITURE ACCOUNT FOR THE YEAR ENDED 31st MARCH, 2024

(Amount in Rupees)

| PARTICULARS | CURRENT YEAR | PREVIOUS YEAR |

|---|---|---|

| INCOME | ||

| Interest on Investment | 28,44,235.00 | 19,24,584.00 |

| Interest on Saving Bank A/c | 6,888.00 | 93,838.00 |

| Misc. Income(Sundry Balance Written Off) | 20,839.00 | |

| TOTAL (A) | 28,51,123.00 | 20,39,261.00 |

| EXPENDITURE | ||

| Salary, Honorarium | $5,48,545.00$ | 7,92,929.00 |

| Travelling,conveyance etc. | 3,860.00 | 23,888.00 |

| Misc. Expenditure(Pre Closure of FDR) | 4,85,517.00 | |

| Repair \& Maintenance of Equipment \& Computer and | 74,939.00 | 2,69,807.00 |

| Stores \& Stationeries and General Charges | 203.00 | |

| Postage,Telephone \& Electricity Charges | 18,198.00 | |

| Overhead Charges to ISI | 63,589.00 | 56,628.00 |

| TOTAL (B) | $6,90,933.00$ | $16,47,170.00$ |

| Excess / (Deficit) of Income over Expenditure | 21,60,190.00 | 3,92,091.00 |

Debasish Chakrabarti/Amitava Mukherjee

Dy. Chief Executive (Finance)

In terms of our Report of even date.

For R. KOTHARI \& CO LLP

Chartered Accountants

(Firm Registration No. 307069E/E300266)

CA. Manoj Kumar Sethia

Partner

Membership No. 064308

ICAI UDIN : 24064308BKCFFQ3006

Kolkata, September 20, 2024