The Central Civil Services (Leave) Rules, 1972, outline the comprehensive framework for managing leave for government servants. These rules detail various types of leave available, including earned leave, half pay leave, commuted leave, leave not due, extraordinary leave, maternity leave, paternity leave, child adoption leave, child care leave, work-related illness and injury leave, seamen’s sick leave, special leave for sexual harassment inquiries, departmental leave, and study leave. The document specifies conditions for granting leave, calculation of leave entitlements, procedures for application and sanction, and the implications of leave on pay and service. It also covers aspects like the combination of different types of leave, carry-forward of leave, encashment of leave, and the process for returning from leave. Furthermore, the rules address specific scenarios such as leave during foreign service, transfer to industrial establishments, and the impact of dismissal, removal, or resignation on leave credit. The document also includes provisions for special circumstances like disability and clarifies the roles and responsibilities of various authorities in granting and managing leave.

SOURCE PDF LINK :

Click to access updatedccsleaverulesN9ExV.pdf

Click to view full document content

CENTRAL CIVIL SERVICES

(LEAVE) RULES, 1972.

(UPDATED AS ON 24.09.2024)

TABLE OF CONTENT

- SHORT TITLE AND COMMENCEMENT.

- EXTENT OF APPLICATION.

- DEFINITIONS.

- GOVERNMENT SERVANTS ON TEMPORARY TRANSFER OR ON FOREIGN SERVICE.

- TRANSFER FROM SERVICES OR POSTS GOVERNED BY OTHER LEAVE RULES.

- TRANSFER TO INDUSTRIAL ESTABLISHMENT.

- RIGHT TO LEAVE.

- REGULATION OF CLAIM TO LEAVE.

- EFFECT OF DISMISSAL, REMOVAL OR RESIGNATION ON LEAVE AT CREDIT.

- COMMUTATION OF ONE KIND OF LEAVE INTO ANOTHER.

- COMBINATION OF DIFFERENT KINDS OF LEAVE.

- MAXIMUM AMOUNT OF CONTINUOUS LEAVE

- ACCEPTANCE OF SERVICE OR EMPLOYMENT WHILE ON LEAVE.

- APPLICATION FOR LEAVE.

- LEAVE ACCOUNT.

- VERIFICATION OF TITLE TO LEAVE.

- LEAVE NOT TO BE GRANTED IN CERTAIN CIRCUMSTANCES.

- GRANT OF LEAVE ON MEDICALCERTIFICATE TO GAZETTED AND NON- GAZETTED GOVERNMENT SERVANTS.

- LEAVE TO A GOVERNMENT SERVANT WHO IS UNLIKELY TO BE FIT TO RETURNTO DUTY.

- COMMENCEMENT AND TERMINATION OF LEAVE.

- COMBINATION OF HOLIDAYS WITH LEAVE.

- RECALL TO DUTY BEFORE EXPIRY OF LEAVE.

- RETURN FROM LEAVE.

- ABSENCE AFTER EXPIRY OF LEAVE.

- EARNED LEAVE FOR GOVERNMENT SERVANTS SERVING IN DEPARTMENTS OTHER THAN VACATION DEPARTMENTS.

- CALCULATION OF EARNED LEAVE.

- EARNED LEAVE FOR PERSONS SERVING IN VACATION DEPARTMENTS.

- HALF PAY LEAVE.

- COMMUTED LEAVE

- LEAVE NOT DUE

- EXTRAORDINARY LEAVE

- LEAVE TO PROBATIONER, A PERSON ON PROBATION AND AN APPRENTICE.

- PERSONS RE-EMPLOYED AFTER RETIREMENT.

- LEAVE PREPARATORY TO RETIREMENT.

- ENCASHMENT OF EARNED LEAVE ALONG WITH LEAVE TRAVEL CONCESSION WHILE IN SERVICE.

- LEAVE/CASH PAYMENT IN LIEU OF LEAVE BEYOND THE DATE OFRETIREMENT, COMPULSORY RETIREMENT OR QUITTING OF SERVICE.

- CASH EQUIVALENT OF LEAVE SALARY IN CASE OF DEATH IN SERVICE.

- CASH EQUIVALENT OF LEAVE SALARY IN CASE OF INVALIDATION FROM SERVICE.

- PAYMENT OF CASH EQUIVALENT OF LEAVE SALARY IN CASE OF DEATH, ETC., OF GOVERNMENT SERVANT.

- CASH EQUIVALENT OF LEAVE SALARY IN CASE OF PERMANENT ABSORPTION IN PUBLIC SECTOR UNDERTAKING/AUTONOMOUS BODY WHOLLY OR SUBSTANTIALLY OWNED OR CONTROLLED BY THE CENTRAL/STATE GOVERNMENT.

- LEAVE SALARY.

- DRAWAL OF LEAVE SALARY.

- ADVANCE OF LEAVE SALARY.

- MATERNITY LEAVE

- PATERNITY LEAVE

- PATERNITY LEAVE FOR CHILD ADOPTION

- CHILD ADOPTION LEAVE

- CHILD CARE LEAVE

- WORK Related ILLNESS AND INJURY LEAVE

- SEAMEN’S SICK LEAVE

- SPECIAL LEAVE CONNECTED TO INQUIRY OF SEXUAL HARASSMENT.

- DEPARTMENTAL LEAVE

- CONDITIONS FOR GRANT OF STUDY LEAVE

- MAXIMUM AMOUNT OF STUDY LEAVE

- APPLICATIONS FOR STUDY LEAVE

- SANCTION OF STUDY LEAVE

- ACCOUNTING OF STUDY LEAVE AND COMBINATION WITH LEAVE OF OTHER KINDS

- REGULAR OF STUDY LEAVE EXTENDING BEYOND COURSE OF STUDY.

- LEAVE SALARY DURING STUDY LEAVE

- ADMISSIBILITY OF ALLOWANCES IN ADDITION TO STUDY ALLOWANCE.

- TRAVELLING ALLOWANCE DURING STUDY LEAVE.

- COST OF FEES FOR STUDY.

- RESIGNATION OR RETIREMENT AFTER STUDY LEAVE OR NON-COMPLETION OF THE COURSE OF STUDY.

- INTERPRETATION

- POWER TO RELAX

- REPEAL AND SAVING

- SCHEDULE AND FORMS

CENTRAL CIVIL SERVICES

LEAVE RULES

CHAPTER I- Preliminary

1. Short title and commencement

(1) These rules may be called the Central Civil Services (Leave) Rules, 1972.

(2) They shall come into force on the $1^{\text {st }}$ day of June, 1972.

2. Extent of application

Save as otherwise provided in these rules, these rules shall apply to Government servants appointed to the civil services and posts in connection with the affairs of the Union, but shall not apply to-

(a) Railway servants;

(b) persons in casual or daily-rated or part-time employment;

(c) persons paid from contingencies;

(d) workmen employed in industrial establishments;

(e) persons employed in work-charged establishments;

(f) members of the All India Services;

(g) persons locally recruited for service in Diplomatic, Consular or other Indian establishments in foreign countries;

(h) persons employed on contract except when the contract provides otherwise;

(i) persons in respect of whom special provisions have been made by or under the provisions of the Constitution or any other law for the time being in force;

(j) persons governed, for purposes of leave, by the Fundamental Rules or the Civil Service Regulations;

(k) persons serving under a Central Government Department, on deputation from a State Government or any other source, for a limited duration.

3. Definitions

(1) In these rules, unless the context otherwise requires-

(a) Administrator means an Administrator of a Union Territory;

(b) Audit Officer means the Accounts and Audit Officer, whatever his official designation, in whose circle the office of the Government servant is situated;

(c) Authority competent to grant leave means the authority specified in Column (3) of the First Schedule to these rules, competent to grant the kind of leave specified in the corresponding entries in Column (2) of the said Schedule;

(d) Completed years of service or one year’s continuous service|| means continuous service of specified duration under the Central Government and includes the period spent on duty as well as on leave including extraordinary leave;

(e) Date of retirement or date of his retirement in relation to a Government servant, means the afternoon of the last day of the month in which the Government servant attains the age prescribed for retirement under the terms and conditions governing his services.

[MOF Notification No. 5(7)-EJV(A)/75 dated 02.12.1975]

(f) Department of the Central Government means a Ministry or aDepartment of the Central Government as notified from time to time and includes the Planning Commission, the Department of Parliamentary Affairs, the President’s Secretariat, the Vice-President’s Secretariat, the Cabinet Secretariat and the Prime Minister’s Secretariat;

(fa) “disability” means “specified disability”, “benchmark disability” and “disability having high support needs” as referred to in the Rights of Persons with Disabilities Act, 2016 (49 of 2016).

(DOPT Notification No. No. 18017/I/2014-Extt. (L), dated 03.04.2018)

(g) Foreign service means service in which a Government servant receiveshis pay with the sanction of Government from any source other than the Consolidated Fund of India or the Consolidated Fund of any State [or the Consolidated Fund of a Union Territory];

(h) Form means a Form appended to the Second Schedule to these rules;

(i) Government servant in quasi-permanent employ| means-

(A) an officer who, having been declared by the Union Public Service Commission to be eligible for appointment to the ministerial Services of the Government of India, has been appointed to a temporary or officiating vacancy on the understanding given to him in writing before he took up the appointment, that that vacancy is expected to become permanent but is not confirmed after completion of three years continuous service;

(B) an officer who may be declared as quasi-permanent under the Central Civil Services (Temporary Services) Rules, 1965.

(j) Government servant in permanent employ means an officer who holds substantively or provisionally substantively a permanent post or who holds a lien on a permanent post or who would have held a lien on permanent post had the lien not been suspended;

(k) Head of Mission means Ambassador, Charge d’ Affaires, Minister, ConsulGeneral, High Commissioner or any other authority declared as such by the Central Government, in the country in which the Government servant undergoes a course of study or training;

(1) Military Officer means an officer of the Armed Forces who is-

(i) a Commissioned Officer of the Army, the Navy or the Air Force, or

(ii) (a) a Junior Commissioned Officer (including an honorary commissioned officer), or an other rank’ of the Army, or

(b) a Branch List Officer or rating of the Navy, or

(c) an airman including a Master Warrant Officer of the Air Force;

(m) Vacation Department means a department or part of a department, to which regular vacations are allowed, during which Government servants serving in the department are permitted to be absent from duty.

(2) Words and expressions used herein and not defined but defined in the Fundamental Rules and Supplementary Rules shall have the meanings respectively assigned to them in the Fundamental Rules and Supplementary Rules.

4. Government servants on temporary transfer or on foreign service

(1) Government servants to whom these rules apply shall continue to be governed by these rules while on temporary transfer to the Indian Railways or to a State Government or while on foreign service within India.

(2) In the case of Government servants on foreign service outside India (including service with UN agencies within or outside India) or on temporary transfer to the Armed Forces of the Union, these rules shall apply only to the extent provided in the terms and conditions of foreign service or temporary transfer, as the case may be.

5. Transfer from services or posts governed by other leave rules

Unless it be otherwise provided in these rules, a permanent Government servant to whom these rules do not apply –

(a) when transferred temporarily to a service or post to which these rules apply, shall remain subject to the leave rules which were applicable to him before such transfer; and

Provided that where a Military Officer not in permanent civil employ has elected to draw civil rates of pay, his leave shall be regulated as per the provisions under these rules:

Provided further that in the event of his release/discharge from the Armed Forces, he shall carry forward the annual leave due to him with effect from the date of such release/discharge.

(DOPT Notification No. 11012/1/85-Extt.(L) dated 23.06.1987)

(b) when appointed substantively to a permanent post to which these rules apply, shall become subject to these rules from the date of such appointment, in which case the leave at his credit under the rules previously applicable to him shall be carried forward subject to the maximum limits of accumulation as laid down in Rule 26. The leave so carried forward shall first be exhausted before the leave earned under these rules is availed of. The leave salary in respect of the leave carried forward shall be borne by the (Department or the Government from which the Government servant proceeds on leave):

(DOPT Notification No. 14028/4/91-Extt.(L) dated 10.09.95)

Provided that in the case of Military Officer, half pay leave equal to the number of days of furlough shall also be carried forward in addition to the earned leave equal to the number of days of annual leave on the date he is so appointed, it would be permissible to grant him under the leave rules of the Armed Forces.

(DOPT Notification No. 11012/1/85-Extt.(L) dated 23.06.1987)

6. Transfer to industrial establishment

If a Government servant governed by these rules is appointed in an industrial establishment wherein his leave terms are governed by the Factories Act, 1948 (63 of 1948), the authority competent to grant leave shall, suo motu, issue an order granting cash equivalent of leave salary in respect of earned leave and half pay leave at his credit subject to a maximum of 300 days and the cash so granted shall be a sum equal to the leave salary as admissible for earned leave and leave salary as admissible for half pay leave plus dearness allowance admissible on that leave salary at the rate in force on the date the Government servant ceases to be governed by the provisions of the said rules:-

Provided that in the event of his return to a post or service to which the Central Civil Services (Leave) Rules, 1972 apply, the benefit of cash equivalent of leave salary payable under Rule 39 shall be modified as under-

(a) On superannuation.- encashment of leave shall be subject to the condition that the number of days of both earned leave and half pay leave for which encashment has already been allowed under this rule and the number of days of earned leave and half pay leave to be encashed on superannuation does not exceed 300 days;

(b) On premature retirement.- cash equivalent of unutilized earned leave and half pay leave should be subject to the condition that the number of days of earned leave and half pay leave for which encashment had already been allowed under this rule and the number of days of earned leave and half pay leave to be encashed on premature retirement shall not exceed 300 days.

(DOPT Notification No. 11012/1/2009-Extt.(L) dated 01.12.2009)

CHAPTER II- General Conditions

- Right to leave

(1) Leave cannot be claimed as of right.

(2) When the exigencies of public service so require, leave of any kind may be refused or revoked by the authority competent to grant it, but it shall not be open to that authority to alter the kind of leave due and applied for except at the written request of the Government servant.

Provided that leave applied under Rule 20, shall not be refused or revoked without reference to the Medical Authority, whose advice shall be binding.

[DOPT Notification No. No. 18017/1/2014-Extt. (L), dated 03.04.2018]

8. Regulation of claim to leave

A Government servant’s claim to leave is regulated by the rules in force at the time the leave is applied for and granted.

9. Effect of dismissal, removal or resignation on leave at credit

(1) Except as provided in Rule 39 and this rule, any claim to leave to the credit of a Government servant, who is dismissed or removed or who resigns from Government service, ceases from the date of such dismissal or removal or resignation.

(2) Where a Government servant applies for another post under the Government of India but outside his parent office or department and if such application is forwarded through proper channel and the applicant is required to resign his post before taking up the new one, such resignation shall not result in the lapse of the leave to his credit.

(3) A Government servant, who is dismissed or removed from service and is reinstated on appeal or revision, shall be entitled to count for leave his service prior to dismissal or removal, as the case may be.

(4) A Government servant, who having retired on compensation or invalid pension or gratuity is re-employed and allowed to count his past service for pension, shall be entitled to count his former service towards leave.

10. Commutation of one kind of leave into another

(1) At the request of a Government servant, the authority which granted him leave may commute it retrospectively into leave of a different kind which was due and admissible to him at the time the leave was granted, but the Government servant cannot claim such commutation as a matter of right.

Provided that no such request shall be considered unless received by such authority, or any other authority designated in this behalf, within a period of 30 days of the concerned Government servant joining his duty on the expiry of the relevant spell of leave availed of by him.

[DOPT Notification No. 140 15/2/97-Extt. (L), dated31.12.1997]

(2) The commutation of one kind of leave into another shall be subject to adjustment of leave salary on the basis of leave finally granted to the Government servant, that is to say, any amount paid to him in excess shall be recovered or any arrears due to him shall be paid.

NOTE.- Extraordinary leave granted on medical certificate or otherwise may be commuted retrospectively into leave not due subject to the provisions of Rule 31.

11. Combination of different kinds of leave

Except as otherwise provided in these rules, any kind of leave under these rules may be granted in combination with or in continuation of any other kind of leave.

EXPLANATION.- Casual leave which is not recognized as leave under these rules shall not be combined with any other kind of leave admissible under these rules.

12. Maximum amount of continuous leave

(DOPT Notification No. No. 13026/2/20 10- Extt. (L), dated 29.05.2012)

(1) No Government servant shall be granted leave of any kind for a continuous period exceeding five years

(2) Unless the President, in view of the exceptional circumstances of the case, otherwise determines, a Government servant who remains absent from duty for a continuous period exceeding five years other than on foreign service, with or without leave, shall be deemed to have resigned from the Government service:

Provided that a reasonable opportunity to explain the reasons for such absence shall be given to that Government servant before provisions of sub-rule (2) are invoked.

Provided that this rule shall not apply to a case where leave is applied on medical certificate, in connection with a disability.

(DOPT Notification No. 18017/1/2014-Extt. (L), dated 03.04.2018)

13. Acceptance of service or employment while on leave

(1) A Government servant (other than a Government servant who has been permitted a limited amount of private practice or who has been permitted to undertake casual literary work or service as an examiner or similar employment) while on leave, including leave preparatory to retirement shall not take up any service or employment elsewhere, including the setting up of a private professional practice as accountant, consultant or legal or medical practitioner, without obtaining the previous sanction of –

(a) the President, if the proposed services or employment lies elsewhere than in India; or

(b) the authority empowered to appoint him, if the proposed service or employment lies in India.

(2)(a) No Government servant while on leave, other than leave preparatory to retirement shall ordinarily be permitted to take up any other service or employment.

(b) If grant of such permission is considered desirable in any exceptional case, the Government servant may have his services transferred temporarily from his parent office to the office in which he is permitted to take up service or employment or may be required to resign his appointment before taking up any other service or employment.

(c) A Government servant while on leave preparatory to retirement shall not be permitted to take up private employment. He may, however, be permitted to take up employment with a Public Sector Undertaking or a body referred to in Clause (a) of sub-rule (2) of Rule 38 and in that event also leave salary payable for leave preparatory to retirement shall be the same as admissible under Rule 40.

(3)(a) In case a Government servant who has proceeded on leave preparatory to retirement is required, before the date of retirement for employment during such leave in any post under the Central Government in or outside India and is agreeable to return to duty, the unexpired portion of the leave from the date of rejoining shall be cancelled.

(b) The leave so cancelled under Clause (a) shall be allowed to be encashed in the manner provided in sub-rule (2) of Rule 39.

(c) Deleted.

(MOF Notification No. P-11012/1/77-E-IV(A) dated 21.11.1979)

(d) Deleted.

(DOPT Notification No. 14028/9/80-Estt.(L) dated 01.10.1981)

CHAPTER III- Grant of and return from leave

14. Application for leave

Any application for leave or for extension of leave shall be made in Form 1 to the authority competent to grant leave.

Provided that where a Government servant is unable to submit an application or medical certificate on account of a disability, such application or medical certificate may be signed and submitted by

(a) the spouse of the Government servant; or

(b) the parents in case of an unmarried Government servant; or

(c) the child including adopted child or brother or sister of the Government servant, who has attained the age of majority; or

(d) any person who has been assigned limited guardianship of the Government servant in terms of Section 14 of the Rights of Persons with Disabilities Act, 2016 (49 of 2016), and the same shall be deemed to have been made and submitted by the Government servant himself.

(DOPT Notification No. 18017/1/2014-Exit. (L), dated05.04.2018)

15. Leave account

Except as provided in the Note below, a leave account shall be maintained in Form 2 for each Government servant by the Audit Officer in the case of Gazetted Government servants and by the Head of Office or an officer authorized by him in the case of non-Gazetted Government servants.

NOTE.- In the case of Gazetted Government servants whose pay and allowances are drawn and disbursed by the Head of Office, the leave account shall be maintained by that Head of Office.

(MOF Notification No. 4(7)-E.IV(A)/72 dated 30.04.1973)

16. Verification of title to leave

(1) No leave shall be granted to a Government servant until a report regarding its admissibility has been obtained from the authority maintaining the leave account.

NOTE.- The order sanctioning leave shall indicate the balance of earned leave/half pay leave at the credit of the Government servant.

(GSR No. 1422, F.No. 11012/1/77-E.IV(A) dated 21.11.1979

(2)(a) Where there is reason to believe that the obtaining of admissibility report will be unduly delayed, the authority competent to grant leave may calculate, on the basis of available information, the amount of leave admissible to the Government servant and issue provisional sanction of leave for a period not exceeding sixty days.

(b) The grant of leave under this sub-rule shall be subject to verification by the authority maintaining the leave account and a modified sanction for the period of leave may be issued, where necessary.

(c) In the case of Gazetted Government servants, the Audit Officer may, at the request of the authority competent to grant leave, issue a provisional leave salary slip for a period not exceeding sixty days.

NOTE.- In the case of leave preparatory to retirement or where cash payment in lieu of leave at credit is granted under Rule 39, an undertaking for recovery of the leave salary, if any, paid in excess, shall be taken from the Government servant.

(DOPT Notification No. 14028/9/80-Estt.(L) dated 01.10.1981)

17. Leave not to be granted in certain circumstances

Leave shall not be granted to a Government servant whom a competent punishing authority has decided to dismiss, remove or compulsorily retire from Government service.

18. Deleted.

19. Grant of leave on medical certificate to Gazetted and non- Gazetted Government servants

(1) An application for leave on medical certificate made by-

(DOPT Notification No. 13026/1/2002-Estt. (L), dated15/16.01.2004)

(i) a Gazetted Government servant, shall be accompanied by a Medical Certificate in Form 3 given by a doctor in a Central Government Health Scheme Dispensary if such a Government servant is a Central Government Health Scheme beneficiary or by a Government Hospital or by an Authorized Medical Attendant if he is not a Central Government Health Scheme beneficiary and by an Authorized Doctor of the private hospital recognized under Central Government Health Scheme or Central Services (Medical Attendance) Rules, 1944, in case of hospitalization or indoor specialized treatment in respect of any particular kind of disease like heart disease, cancer, etc., for the treatment Of which the concerned hospital has been recognized by the Ministry of Health and Family Welfare:

Provided that the Gazetted Government servant who is a Central Government Health Scheme beneficiary, if at the time of illness, is away from Central Government Health Scheme area or proceeds on duty outside the Headquarters will produce Medical Certificate or Fitness Certificate in Form 3 and Form 5, as the case may be, given by an Authorized Medical Attendant;

(ii) a non-Gazetted Government servant, shall be accompanied by a Medical Certificate in Form 4 given by a Central Government Health Scheme Dispensary if such a Government servant is a Central Government Health Scheme beneficiary or by Government Hospital or by an Authorized Medical Attendant if he is not a Central Government Health Scheme beneficiary; and by an Authorized Doctor of the private hospital, recognized under Central Government Health Scheme or Central Services (Medical Attendance) Rules, 1944, in case of hospitalization or indoor specialized treatment duly approved by the Competent Authority in respect of particular kind of disease like heart disease, cancer, etc., for the treatment of which the concerned hospital has been recognized by the Ministry of Health and Family Welfare:

Provided that the non-Gazetted Government servant who is a CGHS beneficiary, if at the time of illness is away from Central Government Health Scheme area or proceeds on duty outside the Headquarters will produce Medical Certificate or Fitness Certificate in Form 4 or Form 5, as the case may be, given by an Authorized Medical Attendant or by Registered Medical Practitioner if there is no Authorized Medical Attendant available within a radius of eight kilometers from his residence or place of temporary stay outside his Headquarters and also in the circumstances when he finds it difficult to obtain Medical Certificate or Fitness Certificate from a Doctor in a Central Government Health Scheme Dispensary or an Authorized Medical Attendant; defining clearly the nature and probable duration of illness.

NOTE.- In the case of non-Gazetted Government servant, a certificate given by a registered Ayurvedic, Unani or Homoeopathic medical practitioner or by a registered Dentist in the case of dental ailments or by an honorary Medical Officer may also be accepted, provided such certificate is accepted for the same purpose in respect of its own employees by the Government of the State in which the Central Government servant falls ill or to which he proceeds for treatment.

(DOPT Notification No. 13015/11/82-Extt. (L), dated 25.05.1984)

(2) In case of a Government servant who has acquired disability, the Medical Authority shall certify, in Form 3-A,-

(DOPT Notification No. 18017/1/2014-Extt. (L), dated 03.04.2018)

(a) the nature and extent of the disability;

(b) the date from which such disability has occurred or manifested, to the extent it may be medically possible to indicate the same;

(c) whether there are reasonable prospects for the Government servant to be fit to resume duties, and if not, categorically state that such Government servant is completely and permanently incapacitated for further service.

(2-A) For the purposes of these rules, a doctor in Central Government Health Scheme or a Government Hospital, or a specialist in Government Hospital in cases requiring specialized treatment, or a Medical Board in a Government Hospital in the case of multiple disabilities shall, in addition to the authority certifying specified disability under the provisions contained in Chapter X of the Rights of Persons with Disabilities Act, 2016 (49 of 2016), be the Medical Authorities competent to issue certificate of disability in Form 3-A.

(2-B) Notwithstanding anything in these rules, no reference from the Head of Office or any other authority may be required for issue of medical certificate of disability.

(3) The authority competent to grant leave may, at its discretion, secure a second medical opinion by requesting a Government Medical Officer not below the rank of a Civil Surgeon or Staff Surgeon, to have the applicant medically examined on the earliest possible date.

(4) It shall be the duty of the Government Medical Officer referred to in subrule (3) to express an opinion both as regards the facts of the illness and as regards the necessity for the amount of leave recommended and for that purpose may either require the applicant to appear before himself or before a Medical Officer nominated by himself.

(5) The grant of medical certificate under this rule does not in itself confer upon the Government servant concerned any right to leave; the medical certificate shall be forwarded to the authority competent to grant leave and orders of that authority awaited.

(6) The authority competent to grant leave may, in its discretion, waive the production of a medical certificate in case of an application for leave for a period not exceeding three days at a time. Such leave shall not, however, be treated as leave on medical certificate and shall be debited against leave other than leave on medical grounds.

20. Leave to a Government servant who is unlikely to be fit to return to duty

(1)(a) When a Medical Authority has reported that there is no reasonable prospect that the Government servant will even be fit to return to duty, leave shall not necessarily be refused to such Government servant.

(b) The leave may be granted, if due, by the authority competent to grant leave on the following conditions:-

(i) if the Medical Authority is unable to say with certainty that the Government servant, who has acquired a disability, will never again be fit for service, leave not exceeding twelve months at a time may be granted and such leave shall not be extended without further reference to a Medical Authority;

(ii) if a Government servant is declared by the Medical Authority, as specified in Rule 19, as to have acquired such disability which may prevent him from discharging further service, leave or an extension of leave may be granted to him after the certificate of the Medical Authority has been received in Form 3-A:

Provided that any leave debited for the period(s) granted under subclause (i) of Clause (b), after receipt of the certificate of disability of the Medical Authority, shall be remitted back into the leave account of the Government servant:

Provided further that any leave granted to regulate the period of absence under sub-clause (ii) of Clause (b), after receipt of the certificate of the Medical Authority, shall not be debited to the leave account of the Government servant.

(2) In the case of a Government servant who is granted leave in accordance with the provisions of Clause (b) of sub-rule (1), the provisions of Section 20 of the Rights of Persons with Disabilities Act, 2016 (49 of 2016) shall, suo motu, apply.

(DOPT Notification No. 18017/1/2014-Extt. (L), dated 03.04.2018)

21. Commencement and termination of leave

Except as provided in Rule 22, leave ordinarily begins on the day on which the transfer of charge is effected and ends on the day preceding that on which the charge is resumed.

22. Combination of holidays with leave

(1)(i) When the day, immediately preceding the day on which a Government servant’s leave (other than leave on medical certificate) begins or immediately following the day on which his leave expires, is a holiday or one of series of holidays, the Government servant shall be deemed to have been permitted (except in cases where for administrative reasons permission for prefixing/suffixing holidays to leave specifically withheld) to leave his station at the close of the day before, or return to it on the day following such holiday or series of holidays, provided that-

(a) his transfer or assumption of charge does not involve the handling or taking over of securities or moneys other than a permanent advance;

(b) his early departure does not entail a correspondingly early transfer from another station of a Government servant to perform his duties; and

(c) the delay in his return does not involve a corresponding delay in the transfer to another station of the Government servant who was performing his duties during his absence or in the discharge from Government service of a person temporarily appointed to it.

(ii) In the case of leave on medical certificate(GSR No. 1422, F.No. 11012/1/77-EJV(A) dated 21.11.1979)

(a) When a Government servant is certified medically unwell to attend office, holiday(s), if any, immediately preceding the day he is so certified shall be allowed automatically to be prefixed to leave and the holiday(s) if any, immediately succeeding the day he is so certified (including that day) shall automatically be allowed to be suffixed to the leave, and holiday(s), if any, preceding the day he is so certified shall be treated as part of the leave; and

(b) When a Government servant is certified medically fit for joining duty, holiday(s) if any, succeeding the day he is so certified (including that day) shall automatically be allowed to be suffixed to the leave, and holiday(s), if any, preceding the day he is so certified shall be treated as part of the leave.

(DOPT Notification no. 11012/2/80-Estt.(L) dated 24.08.1981)

(2) On condition that the departing Government servant remains responsiblefor the moneys in this charge, the Head of Department may, in any particular case, waive the application of Clause (a) of the proviso to sub- rule (1).

(3) Unless the authority competent to grant leave in any case otherwise directs –

(a) if holidays are prefixed to leave, the leave and any consequent rearrangement of pay and allowances take effect from the day after the holidays; and

(b) if holidays are suffixed to leave, the leave is treated as having terminated and any consequent rearrangement of pay and allowances takes effect from the day on which the leave would have ended if holidays had not been suffixed.

NOTE.- A compensatory leave granted in lieu of duty performed by a Government servant on Sunday or a holiday for a full day may be treated as a holiday for the above purpose.

- Recall to duty before expiry of leave

(1) Deleted.

(2) Deleted.

(MOF Notification No. 11012/1/77-E.IV(A) dated 21.11.1979)

(3) In case a Government servant is recalled to duty before the expiry of his leave, such recall to duty shall be treated as compulsory in all cases and the Government servant shall be entitled-

(a) if the leave from which he is recalled is in India, to be treated as on duty from the date on which he starts for the station to which he is ordered, and to draw –

(i) travelling allowance under rules made in this behalf for the journey; and

(ii) leave salary, until he joins his post, at the same rate at which he would have drawn it but for recall to duty;

(b) if the leave from which he is recalled is out of India, to count the time spent on the voyage to India as duty for purposes of calculating leave, and to receive-

(i) leave salary, during the voyage to India and for the period from the date of landing in India to the date of joining his post, at the same rate at which he would have drawn it but for recall to duty;

(ii) a free passage to India;

(iii) refund of his passage from India if he has not completed half the period of his leave by the date of leaving for India on recall or three months, whichever is shorter;

(iv) travelling allowance, under the rules for the time being in force, for travel from the place of landing in India to the place of duty.

24. Return from leave

(1) A Government servant on leave shall not return to duty before the expiry of the period of leave granted to him unless he is permitted to do so by the authority which granted him leave.

(2) Notwithstanding anything contained in sub-rule (1), a Government servant on leave preparatory to retirement shall be precluded from returning to duty, save with the consent of the authority competent to appoint him to the post from which he proceeded on leave preparatory to retirement.

(3)(a) A Government servant who has taken leave on medical certificate may not return to duty until he has produced a medical certificate of fitness in Form 5.

(b) If the Government servant is a gazetted officer the certificate under clause (a) shall be obtained from a Medical Board, except in the following cases:-

(i) Cases in which the leave is for not more than three months;

(ii) Cases in which leave is for more than three months or leave for three months or less is extended beyond three months, and the medical Board states, at the time of granting the original certificate or the certificate for extension, that the Government servant need not appear before another Medical Board for obtaining the certificate of fitness.

(c) In cases falling under clause (b) the certificate may be obtained from the Chief Medical Officer, the District Medical Officer, a Civil Surgeon, a Staff Surgeon or a Medical Officer of equivalent status including a Medical Officer of the Central Government Health Scheme or in a case covered by sub-rule (6) of 18, from the Authorised Medical Attendant or the Medical Superintendent of the hospital concerned.

(d) In the case of a non-Gazetted Government servant, the authority under which the Government servant is employed on return from leave may, in its discretion, accept a certificate signed by a Registered Medical Practitioner.

(4)(a) A Government servant returning from leave is not entitled, in the absence of specific orders to that effect, to resume as a matter of course the post which he held before going on leave.

(b) Such Government servant shall report his return to duty to the authority which granted him leave or to the authority, if any, specified in the order granting him the leave and await orders.

NOTE.- A Government servant who had been suffering from Tuberculosis may be allowed to resume duty on the basis of fitness certificate which recommends light work for him.

25. Absence after expiry of leave

(1) Unless the authority competent to grant leave extends the leave, a Government servant who remains absent after the end of leave is entitled to no leave salary for the period of such absence and that period shall be debited against his leave account as though it were half pay leave, to the extent such leave is due, the period in excess of such leave due being treated as extraordinary leave.

(2) Wilful absence from duty after the expiry of leave renders a Government servant liable to disciplinary action.

CHAPTER IV – Kinds of leave due and Admissible

- Earned leave for Government servants serving in Departments other than Vacation Departments

(1)(a)(i) The leave account of every Government servant (other than a military officer) who is serving in a Department other than a Vacation Department, shall be credited with earned leave, in advance, in two installments of 15 days each on the first day of January and July of every calendar year.

(GSR No. 1422, F.No. 11012/1/77-E.IV(A) dated 21.11.1979)

(ii) When a Government servant joins a new post without availing full joining time by reasons that –

[GSR No. 198 vide DOPT Notification No. 13012/12/86-Estt.(L) dated 25.03.1989]

(a) he is ordered to join the new post at a new place of posting without availing of full joining time to which he is entitled,

or

(b) he proceeds alone to the new place of posting and joins the post without availing full joining time and takes his family later within the permissible period of time for claiming traveling allowance for the family,

the number of days of joining time as admissible under sub-rule (4) of Rule 5 of the Central Civil Services (Joining Time) Rules, 1979, subject to the maximum of 15 days reduced by the number of days actually availed of, shall be credited to his leave account as earned leave:

Provided that the earned leave at his credit together with the unavailed joining time allowed to be so credited shall not exceed 300days.

(“240 days substituted with 300 days” vide DOPT Notification No. 13026/1/89-Estt. (L), dated 18.04.2002)

(b) The leave at the credit of a Government servant at the close of the previous half-year shall be carried forward to the next half-year, subject to the condition that the leave so carried forward plus the credit for the halfyear do not exceed the maximum limit of 300 days.

Provided that where the earned leave at the credit of Government servant as on the last day of December of June is 300 days or less but more than 285 days, the advance credit of 15 days earned leave on first day of January or July to be afforded in the manner indicated under subrule (i) of Clause (a) of sub-rule (1) shall instead of being credited in leave accountbe kept separately and first adjusted against the earned leave that the Government servant takes during that half-year and the balance, if any, shall be credited to the leave account at the close of the half-year, subject to the condition that balance of such earned leave plus leave already at credit do not exceed the maximum limit of 300 days.

(225 days substituted with 285 days vide DOPT Notification No. 13026/1/99-Estt. (L), dated 18.04.2002)

(DOPT Notification No. 11012/1/2009-Estt.(L) dated 01.12.2009)

(DOPT Notification No. 13026/2/1990-Estt.(L) dated 22.10.1990)

(c)(i) Where a Government servant not in permanent employ or quasipermanent employ is appointed without interruption of service substantively to a permanent post or declared as quasi permanent, his leave account shall be credited with the earned leave which would have been admissible, if his previous duty had been rendered as a Government servant in permanent employ diminished by any earned leave already taken.

(ii) Where a Government servant had availed of extraordinary leave since the date of permanent appointment or quasi-permanent appointment, such leave may, subject to the provisions of rule 10, be converted into earned leave to the extent it is due and admissible as a result of recasting of his leave account.

(d) A period spent in foreign service shall count as duty for purposes of this rule, if contribution towards leave salary is paid on account of such period.

EXCEPTION.- The earned leave admissible to a Government servant of nonAsiatic domicile recruited in India, who is in continuous service from a date prior to the $1^{\text {st }}$ February, 1949 and is entitled to leave passage, is one-seventh of the period spent on duty and he ceases to earn such leave when the earned leave due amounts to 180 days.

(2) Subject to the provisions of Rules 7 and 39 and sub-rules (1) and (3) of the rule, the maximum earned leave that may be granted at a time shall be –

(i) 180 days in the case of any Government servant employed in India, or (DOPT Notification No. 11014/3/89-Estt.(L) dated 02.05.1991)

(ii) 150 days, in the case of any Government servant mentioned in the Exception to sub-rule (1)

(3) Earned leave may be granted to a Government servant in Class I of Class IIservice or to a Government servant mentioned in the Exception to sub-rule (1), for a period exceeding 180 days but not exceeding 300 days if the entire leave so granted or any portion thereof is spent outside India, Bangladesh, Bhutan, Burma, Sri Lanka, Nepal and Pakistan:

Provided that where earned leave for a period exceeding 180 days, is granted under this sub-rule, the period of such leave spent in India shall not in the aggregate exceed the aforesaid limits.

27. Calculation of Earned Leave

(1) Earned leave shall be credited to the leave account of Government servant at the rate of $21 / 2$ days for each completed calendar month of service which he is likely to render in a half-year of the calendar year in which he is appointed.

(2)(a) The credit for the half-year in which a Government servant is due to retire or resigns from the service shall be afforded only at the rate of $21 / 2$ days per completed calendar month up to the date of retirement or resignation. (MOF Notification No. 16(6)-E.IV(A)/74 dated 31.07.1976)

(b) When a Government servant is removed or dismissed from service, credit of earned leave shall be allowed at the rate of $21 / 2$ days per completed calendar month up to the end of the calendar month preceding the calendar month in which he is removed or dismissed from service;

(c) When a Government servant dies while in service, credit of earned leave shall be allowed at the rate of $21 / 2$ days per completed month of service up to the date of death of the Government servant.

(DOPT Notification No. F. No. 13026/1/2010-Estt. (L), dated 12.05.2011)

(3) If a Government servant has availed of extraordinary leave and/or some period of absence has been treated as dies non in a half-year, the credit to be afforded to his leave account at the commencement of the next halfyear shall be reduced by $1 / 10^{\text {th }}$ of the period of such leave and/or dies non subject to maximum of 15 days.

(MOF Notification No. 11012/1/77-E.IV(A) dated 21.11.1979)

(4) While affording credit of earned leave, fractions of a day shall be rounded off to the nearest day.

(DoE Notification No. 16(6)-E.IV(A)/74 dated 31.07.1976)

- Earned leave for persons serving in Vacation Departments (DOPT Notification. No. 11020/01/2017-ExIt. (L), dated 11.12.2018)

(1)(a) The leave account of every Government servant (other than a military officer) who is serving in a Vacation Department shall be credited with earned leave, in advance in two instalments of five days each on the first day of January and July of every calendar year.

(b) In respect of any year in which a Government servant avails a portion of the vacation, he shall be entitled to additional earned leave in such proportion of twenty days, as the number of days of vacation not taken bears to the full vacation, provided the total earned leave credited shall not exceed thirty days in a calendar year.

(c) If, in any year, the Government servant does not avail any vacation, earned leave will be as per Rule 26 instead of Clauses (a) and (b).

EXPLANATION.- For the purpose of this rule, the term “year” shall be construed not as meaning a calendar year in which duty is performed but as meaning twelve months of actual duty in a Vacation Department.

NoTE 1.- A Government servant entitled to vacation shall be considered to have availed a vacation or a portion of a vacation unless he has been required by general or special order of a higher authority to forgo such vacation or portion of a vacation:

Provided that if he has been prevented by such order from enjoying more than fifteen days of the vacation, he shall be considered to have availed himself of no portion of the vacation.

NOTE 2.- When a Government servant serving in a Vacation Department proceeds on leave before completing a full year of duty, the earned leave admissible to him shall be calculated not with reference to the vacations which fall during the period of actual duty rendered before proceeding on leave but with reference, to the vacation that falls during the year commencing from the date on which he completed the previous year of duty.

(2) Vacation may be taken in combination with or in continuation of any kind of leave under these rules:

Provided that the total duration of vacation and earned leave taken in conjunction, whether the earned leave is taken in combination with or in continuation of other leave or not, shall not exceed the amount of earned leave due and admissible to the Government at a time under Rule 26.

(3) The earned leave under this rule at the credit of a Government servant at the close of the previous half year shall be carried forward to the next half year, subject to the condition that the leave so carried forward plus the credit for the half year shall not exceed the maximum limit of 300 days.

NOTE.- The facility of crediting of unavailed portion of joining time shall be admissible to persons serving in Vacation Departments, in accordance with the provisions of sub-clause (ii) of Clause (a) of sub-rule (1) of Rule 26.

(DOPT Notification No. 13012/12/86-Estt.(L) dated 25.03.1989)

29. Half pay leave

(DOPT Notification No. 11020/01/2017-Estt (L), dated 11.12.2018)

(1) The half pay leave account of every Government servant (other than a military officer and a Government servant serving in a Vacation Department) shall be credited with half pay leave in advance, in two instalments of ten days each on the first day of January and July of every calendar year].

(2)(a) The leave shall be credited to the said leave account at the rate of $5 / 3$ days for each completed calendar month of service which he is likely to render in the half-year of the calendar year in which he is appointed.

(b) The credit for the half-year in which a Government servant is due to retire or resigns from the service shall be allowed at the rate of $5 / 3$ days per completed calendar month up to the date of retirement or resignation.

(c) When a Government servant is removed or dismissed from service, credit of half pay leave shall be allowed at the rate of $5 / 3$ days per completed calendar month up to the end of the calendar month preceding the calendar month in which he is removed or dismissed from service.

(DOPT Notification No. 13026/01/2010-Estt (L), dated 12.05.2011)

(ca) When a Government servant dies while in service, credit of half pay leave shall be allowed at the rate of $5 / 3$ days per completed month of service up to the date of death of the Government servant.

(DOPT Notification No.13026/1/2010-Estt. (L), dated 12.05.2011)

(d) Where a period of absence or suspension of a Government servant has been treated as dies non in a half-year, the credit to be afforded to his half pay leave account at the commencement of next half-year, shall be reduced by one-eighteenth of the period of dies non subject to a maximum of ten days.

(DOPT Notification No. 13014/1/87-Estt.(L) dated 16.06.1987)

(3) A Government servant who is eligible for Departmental leave under Rule 49, shall be entitled to half pay leave of twenty days on completion of twelve months of actual duty.

(4) The leave under this rule may be granted on medical certificate or on private affairs.

(DOPT Notification No. 13014/1/85-Estt.(L) dated 03.12.1985)

(5) While affording credit of half pay leave, fraction of a day shall be rounded off to the nearest day:

(DOPT Notification No. 13014/1/87-Estt.(L) dated 16.06.1987)

30. Commuted leave

(1) Commuted leave not exceeding half the amount of half pay leave due may be granted on medical certificate to a Government servant (other than a military officer), subject to the following conditions:-

(a) the authority competent to grant leave is satisfied that there is reasonable prospect of the Government servant returning to duty on its expiry:

(b) Deleted.

(c) Deleted.

(d) when commuted leave is granted, twice the amount of such leave shall be debited against the half pay leave due;

(e) Deleted.

(MOF Notification No. 16(5)-EIV(A)/74 dated 11.04.1975)

(1-A) Half pay leave up to a maximum of 180 days may be allowed to be commuted during the entire service (without production of medical certificate) where such leave is utilized for an approved course of study certified to be in the public interest by the leave sanctioning authority.

(2) Where a Government servant who has been granted commuted leave resigns from service or at his request permitted to retire voluntarily without returning to duty, the commuted leave shall be treated as half pay leave and the difference between the leave salary in respect of commuted leave and half pay leave shall be recovered:

Provided that no such recovery shall be made if the retirement is by reason of ill-health incapacitating the Government servant for further service or in the event of his death.

NOTE.- Commuted leave may granted at the request of the Government servant even when earned leave is due to him.

31. Leave not due

(1) Save in the case of leave preparatory to retirement, Leave Not Due may be granted to a Government servant in permanent employ or quasipermanent employ (other than a military officer) limited to a maximum of 360 days during the entire service on medical certificate subject to the following conditions:-

(a) The authority competent to grant leave is satisfied that there is reasonable prospect of the Government servant returning to duty on its expiry;

(b) Leave Not Due shall be limited to the half pay leave he is likely to earn thereafter;

(c) Leave Not Due shall be debited against the half pay leave the Government servant may earn subsequently.

(1-A) Leave Not Due may also be granted to such of the temporary Government servants as are suffering from TB, Leprosy, Cancer or Mental Illness, for a period not exceeding 360 days during entire service, subject to fulfillment of conditions in Clauses (a) to (c) of sub-rule (1) and subject to the following conditions, namely:-

(DOPT Notification No. 11012/1/05-Enti.(L) dated 06.06.1988)

(i) that the Government servant has put in a minimum of one year’s service;

(ii) that the post from which the Government servant proceeds on leave is likely to last till his return to duty; and

(iii) that the request for grant of such leave is supported by a medical certificate as envisaged in Clauses (c) and (d) of sub- rule (2) of Rule 32. (GSR No. 1422, F.No. 11012/1/77-EN(A) dated 21.11.1979)

(2)(a) Where a Government servant who has been granted Leave Not Due resigns form service or at his request permitted to retire voluntarily without returning to duty, the Leave Not Due shall be cancelled, his resignation or retirement taking effect from the date on which such leave had commenced, and the leave salary shall be recovered.

(b) Where a Government servant who having availed himself of Leave Not Due returns to duty but resigns or retires from service before he has earned such leave, he shall be liable to refund the leave salary to the extent the leave has not been earned subsequently:

Provided that no leave salary shall be recovered under Clause (a) or Clause (b) if the retirement is by reason of ill-health incapacitating the Government servant for further service or in the event of his death:

Provided further that no leave salary shall be recovered under Clause (a) or Clause (b), if the Government servant is compulsorily retired prematurely under Rule 48 (1) (b) of the Central Civil Services (Pension) Rules, 1972, or is retired under Fundamental Rule 56(j) or Fundamental Rule 56(l)

(NHA Notification No. 6(9)-EJV(A)/76 dated 31.12.1980)

32. Extraordinary leave

(1) Extraordinary leave may be granted to a Government servant (other than a military officer) in special circumstances-

(a) when no other leave is admissible:

(b) when other leave is admissible, but the Government servant applies in writing for the grant of extraordinary leave.

(2) Unless the President in view of the exceptional circumstances of the case otherwise determines, no Government servant, who is not in permanent employ or quasi-permanent employ, shall be granted extraordinary leave on any one occasion in excess of the following limits:-

(a) three months;

(b) six months where the Government servant has completed one year’s continuous service on the date of expiry of leave of the kind due and admissible under these rules, including three months’ extraordinary leave under Clause (a) and his request for such leave is supported by a medical certificate as required by these rules;

(c) Deleted.

(d) eighteen months, where the Government servant who has completed one year’s continuous service is undergoing treatment for –

(i) Pulmonary Tuberculosis or Pleurisy of tubercular origin, in a recognized sanatorium;

NOTE.- The concession of extraordinary leave up to eighteen months shall be admissible also to a Government servant suffering from Pulmonary Tuberculosis or Pleurisy of tubercular origin who receives treatment at his residence under a Tuberculosis Specialist recognized as such by the State Administrative Medical Officer concerned and produces a certificate signed by that Specialist to the effect that he is under his treatment and that he has reasonable chances of recovery on the expiry of the leave recommended.

(ii) Tuberculosis of any other part of the body by a qualified Tuberculosis Specialist or a Civil Surgeon or Staff Surgeon; or

(iii) Leprosy in a recognized leprosy institution or by a Civil Surgeon or Staff Surgeon or a Specialist in leprosy hospital recognized as such by the State Administrative Medical Officer concerned;

(iv) Cancer or for mental illness, in an institution recognized for the treatment of such disease.

[MOF Notification No. P-11012/1/77-E-IV(A) dated 21.11.1979]

(e) twenty-four months, where the leave is required for the purpose of prosecuting studies certified to be in the public interest, provided the Government servant concerned has completed three years’ continuous service on the date of expiry of leave of the kind due and admissible under these rules, including three months’ extraordinary leave under Clause (a).

(3)(a) Where a Government servant is granted extraordinary leave in relaxation of the provisions contained in Clause (e) of sub-rule(2), shall be required to execute a Bond in Form 6 undertaking to refund to the Government the actual amount of expenditure incurred by the Government during such leave plus that incurred by any other agency with interest thereon in the event of his not returning to duty on the expiry of such leave or quitting the service before a period of three years after return to duty.

(b) The Bond shall be supported by Sureties from two permanent Government servants having a status comparable to or higher than that of the Government servant.

(4) Government servants belonging to the Scheduled Castes or the Scheduled tribes may, for the purpose of attending the Pre-Examination Training Course at the centers notified by the Government from time to time, be granted extraordinary leave by Head of Department in relaxation of the provisions of subrule (2).

(5) Two spells of extraordinary leave, if intervened by any other kind of leave, shall be treated as one continuous spell of extraordinary leave for the purposes of sub-rule (2).

(6) The authority competent to grant leave may commute retrospectively periods of absence without leave into extraordinary leave.

33. Leave to probationer, a person on probation and an apprentice

(1)(a) A probationer shall be entitled to leave under these rules if he had held his post substantively otherwise than on probation.

(b) If, for any reason, it is proposed to terminate the services of a probationer, any leave which may be granted to him shall not extend –

(i) beyond the date on which the probationary period as already sanctioned or extended expires, or

(ii) beyond any earlier date on which his services are terminated by the orders of an authority competent to appoint him.

(2) A person appointed to a post on probation shall be entitled to leave under these rules as a temporary or a permanent Government servant according as his appointment is against a temporary or a permanent post:

Provided that where such person already holds a lien on a permanent post before such appointment, he shall be entitled to leave under these rules as a permanent Government servant.

(3) An apprentice shall be entitled to-

(a) leave, on medical certificate, on leave salary equivalent to half pay for a period not exceeding one month in any year of apprenticeship;

(b) extraordinary leave under Rule 32.

34. Persons re-employed after retirement

In the case of a person re-employed after retirement, the provisions of these rules shall apply as if he had entered Government service for the first time on the date of his re-employment.

35. Deleted.

(DOPT Notification No. 11012/1/85-Estt.(L) dated 23.06.1987)

36. Deleted.

(DOPT Notification No. 11012/1/85-Estt.(L) dated 23.06.1987)

37. Deleted.

(DOPT Notification No. 11012/1/85-Estt.(L) dated 23.06.1987)

38. Leave preparatory to retirement

(1) A Government servant may be permitted by the authority competent to grant leave to take leave preparatory to retirement to the extent of earned leave due, not exceeding 300 days together with half pay leave due, subject to the condition that such leave extends up to and includes the date of retirement.

(“240 days substituted with 300 days” vide DOPT Notification No. 13026/1/2002-Estt. (L), dated the 15/16.01.2004)

NOTE.- The leave granted as leave preparatory to retirement shall not include extraordinary leave.

(2)(a) Where a Government servant who is on foreign service in or under any Local Authority or a Corporation or Company wholly or substantially owned or controlled by the Government or a Body controlled or financed by the Government (hereinafter referred to as the local body) applies for leave preparatory to retirement, the decision to grant or refuse such leave shall be taken by foreign employer with the concurrence of the lending authority under Central Government.

(DOPT Notification No. 14028/9/80-Estt.(L) dated 01.10.1981)

(b) The Government servant on foreign service shall also be allowed to encash earned leave at his credit on the date of retirement in the manner provided in sub-rule (2) of Rule 39.

(c) Deleted. (DOPT Notification No. 14028/6/82 -Estt.(L) dated 31.05.1985)

(3) Where a Government servant is on foreign service in or under a local body other than the one mentioned in Clause (a) of sub-rule (2), leave preparatory to retirement shall be admissible to him only when he quits duty under the foreign employer:

Provided that where the Government servant continues in service under such foreign employer, the Government servant shall not be eligible for grant of cash payment in lieu of leave under Rule 39.

38-A. Encashment of Earned Leave along with Leave Travel Concession while in service.-

(DOPT Notification No. 14028/1/20 10- Estt. (L), dated 26.08.2011)

(1) A Government servant may be permitted to encash earned leave up to ten days at the time of availing of Leave Travel Concession while in service, subject to the conditions that-

(a) a balance of at least thirty days of earned leave is available to his credit after taking into account the period of encashment as well as leave being availed of:

(b) the total leave so encashed during the entire career does not exceed sixty days in the aggregate;

(2) The cash equivalent for encashment of leave under sub-rule (1) shall be calculated as follows, namely:-

(3) No House Rent Allowance shall be included in the cash equivalent calculated under sub-rule (2);

(4) The period of earned leave encashed shall not be deducted from the quantum of leave that can normally be encashed by the Government servant under Rules 6,39,39-A, 39-B, 39-C and 39-D.

(5) If the Government servant fails to avail the Leave Travel Concession within the time prescribed under the Central Civil Services (Leave Travel Concession) Rules, 1988, then he shall be required to refund the entire amount of leave so encashed along with interest at the rate of two per cent above the rate of interest allowed by the Government as applicable to Provident Fund balances and shall also be entitled for credit back of leave so debited for leave encashment.

39. Leave/Cash payment in lieu of leave beyond the date of retirement, compulsory retirement or quitting of service

(1) No leave shall be granted to a Government servant beyond-

(a) the date of his retirement, or

(b) the date of his final cessation of duties, or

(c) the date on which he retires by giving notice to Government or he is retired by Government by giving him notice or pay and allowances in lieu of such notice, in accordance with the terms and conditions of his service, or

(d) the date of his resignation from service.

(2)(a) Where a Government servant retires on attaining the normal age prescribed for retirement under the terms and conditions governing his service, the authority competent to grant leave shall, suo motu, issue an order granting cash equivalent of leave salary for both earned leave and half pay leave, if any, at the credit of the Government servant on the date of his retirement subject to a maximum of 300 days;

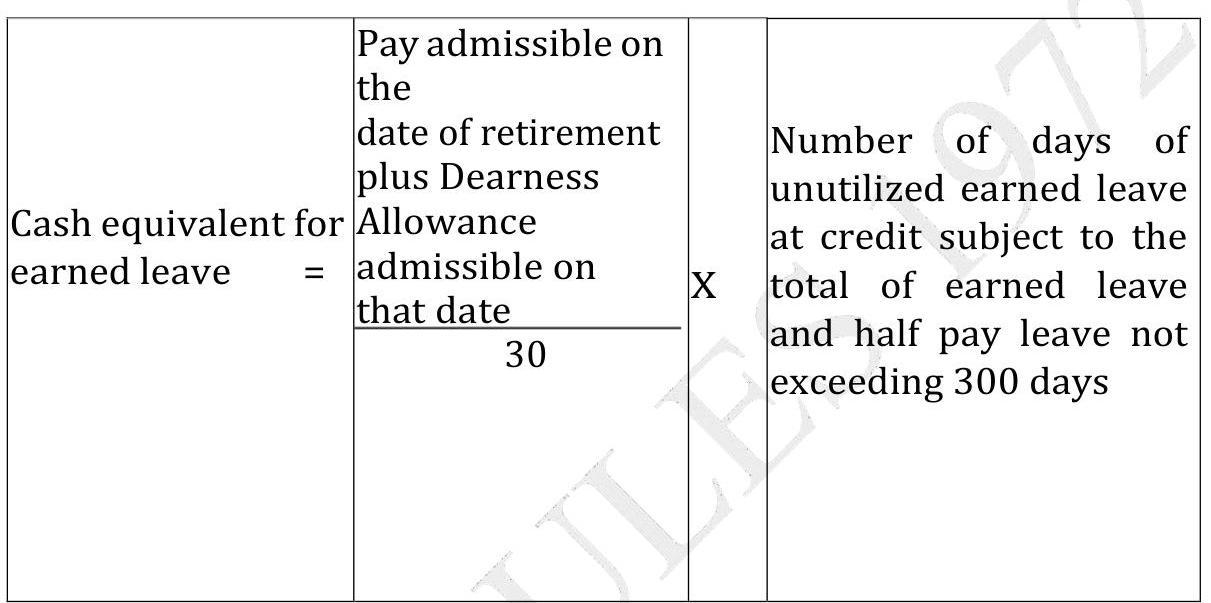

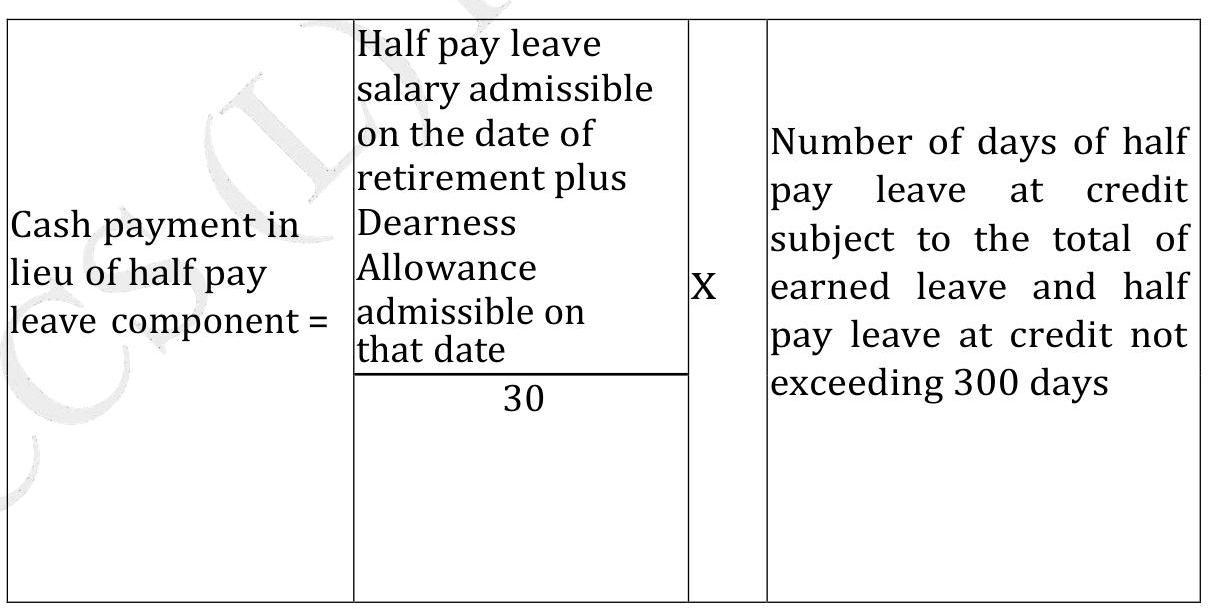

(b) The cash equivalent of leave salary under Clause (a) shall be calculated as follows and shall be payable in one lumpsum as a one- time settlement,-

(i)

(ii)

NOTE.- The overall limit for encashment of leave including both earned leave and half pay leave shall not exceed 300 days.

(c) To make up the shortfall in earned leave, no commutation of half pay leave shall be permissible.]

(DOPT Notification No. 11012/1/2009- Estt. (L), dated 01.12.2009)

(3) The authority competent to grant leave may withhold whole or part of cash equivalent of earned leave in the case of a Government servant who retires from service on attaining the age of retirement while under suspension or while disciplinary or criminal proceedings are pending against him, if in the view of such authority there is a possibility of some money becoming recoverable from him on conclusion of the proceedings against him on conclusion of the proceedings, he will become eligible to the amount so withheld after adjustment of Government dues, if any.

(DOPT Notification No. 14028/6/81 -Estt. (L), dated 17.10.1983)

(4)(a) Where the service of a Government servant has been extended, in the interest of public service beyond the date of his retirement, he may be granted-

(i) during the period of extension, any earned leave due in respect of the period of such extension plus the earned leave which was at his credit on the date of his retirement subject to a maximum of 180 days / 300 days as the case may be, as prescribed in Rule 26.

(DOPT Notification No. 14028/9/80 -Estt. (L), dated 01.10.1981)

(DOPT Notification No. 11014/3/89-Estt.(L) dated 02.05.1991)

(ii) after expiry of the period of extension, cash equivalent in the manner provided in Clause (b) of sub-rule (2) in respect of both earned leave and half pay leave at credit on the date of retirement, plus the earned leave and half pay leave earned during the period of extension reduced by the earned leave and half pay leave availed of during such period, subject to a maximum of 300 days.]

(DOPT Notification No. 11012/1/2009-Estt. (L), dated 01.12.2009)

(b) The cash equivalent payable under sub-clause (ii) of Clause (a) of this subrule shall be calculated in the manner indicated in Clause (b) of sub-rule (2) above

(5) A Government servant who retires or is retired from service in the manner mentioned in Clause (c) of sub-rule (1), may be granted suo motu, by the authority competent to grant leave, cash equivalent of the leave salary in respect of both earned leave and half pay leave at his credit subject to a maximum of 300 days. The cash equivalent payable shall be the same as in sub-rule (2) of Rule 39.]

(DOPT Notification No. 1101211/2009-Estt. (L), dated 01.12.2009)

(5-A) deleted.

(DOPT Notification no.14028/18/86-Estt.(L) dated 23.03.1988)

(DOPT Notification 14028/1/2004-Estt.(Leave) dated 13.02.2006)

(6)(a)(i) where the services of a Government servant are terminated by notice or by payment of pay and allowances in lieu of notice or otherwise in accordance with the terms and conditions of his appointment, he may be granted, suo motu, by the authority competent to grant leave, cash equivalent in respect of both earned leave and half pay leave at his credit on the date on which he ceases to be in service subject to a maximum of 300 days and the cash equivalent payable shall be the same as in sub-rule (2) of Rule 39].

(DOPT Notification No. 11012/I/2009-Extt. (L), dated 01.12.2009)

(ii) If a Government servant resigns or quits service, he may be granted, suo motu, by the authority competent to grant leave, cash equivalent in respect of earned leave at his credit on the date of cessation of service, to the extent of half of such leave at his credit, subject to a maximum of 150 days. (DOPT Notification No. 14028/9/80 -Estt. (L), dated 01.10.1981)

(“120 days substituted with 150 days” vide DOPT Notification No. 13026/1/99- Estt. (L), dated 18.04.2002)

(iii) A Government servant, who is re-employed after retirement may, on termination of his re-employment, be granted, suo motu, by an authority competent to grant leave, cash equivalent in respect of both earned leave and half pay leave at his credit on the date of termination of reemployment subject to a maximum of 300 days including the period for which encashment was allowed at the time of retirement and the cash equivalent payable shall be the same as in sub-rule (2) of Rule 39.

(DOPT Notification No. 11012/I/2009-Extt. (L), dated 01.12.2009)

(b) The cash equivalent payable under Clause (a) shall be calculated in the manner indicated in Clause (b) of sub-rule (2) and for the purpose of computation of cash equivalent under sub-clause (iii) of Clause (a), the pay on the date of the termination of re-employment shall be the pay fixed in the scale of post of re-employment before adjustment of pension and pension equivalent of other retirement benefits, and the Dearness Allowance appropriate to that pay.

(DOPT Notification No. 14028/6/02 -Estt.(L) dated 31.05.1985)

39-A. Cash equivalent of leave salary in case of death in service

In case a Government servant dies while in service, the cash equivalent of leave salary for both earned leave and half pay leave, if any, at the credit of the deceased Government servant on the date of his death, not exceeding 300 days shall be paid to his family in the manner specified in Rule 39-C and the cash equivalent payable shall be the same as in sub-rule (2) of Rule 39.

NOTE.- In addition to the cash equivalent of leave salary admissible under this rule, the family of the deceased Government servant shall also be entitled to payment of Dearness Allowance only as per orders issued in this behalf separately.

(Notification No. F. No. 11012/1/2009-Estt. (L), dated the 1st December, 2009)

39-B. Cash equivalent of leave salary in case of invalidation from service

completely and permanently incapacitated for further service may be granted, suo motu, by the authority competent to grant leave, cash equivalent of leave salary in respect of both earned leave and half pay leave, if any, at the credit of the Government servant on the date of invalidation from service, subject to a maximum of 300 days and the cash equivalent payable shall be the same as in sub-rule (2) of Rule 39.

(2) A Government servant not in permanent employ or quasi permanent employ shall not, however, be granted cash equivalent of leave salary in respect of half pay leave standing at his credit on the date of his invalidation from service.

[DOPT Notification No. 11012/1/2009-Extt. (L), dated 01.12.2009]

39-C. Payment of cash equivalent of leave salary in case of death, etc., of Government servant

In the event of the death of a Government servant while in service or after retirement or after final cessation of duties but before actual receipt of its cash equivalent of leave salary payable under Rules 39,39-A and 39-B, such amount shall be payable-

(DOPT Notification No. 14028/1/81-Extt.(L) dated 19.07.1984)

(i) to the widow, and if there are more widows than one, to the eldest surviving widow if the deceased was a male Government servant, or to the husband, if the deceased was a female Government servant;

EXPLANATION.- The expression -eldest surviving widow $|$ shall be construed with reference to the seniority according to the date of the marriage of the surviving widows and not with reference to their ages;

(ii) failing a widow or husband, as the case may be, to the eldest surviving son; or an adopted son;

(iii) failing (i) and (ii) above, to the eldest surviving unmarried daughter;

(iv) failing (i) to (iii) above, to the eldest surviving widowed daughter;

(v) failing (i) to (iv) above, to the father;

(vi) failing (i) to (v) above, to the mother;

(vii) failing (i) to (vi) above, to the eldest surviving married daughter; (DOPT Notification No. 11012/1/2009-Extt. (L), dated 01.12.2009)

(viii) failing (i) to (vii) above, to the eldest surviving brother below the age of eighteen years;

(ix) failing (i) to (viii) above, to the eldest surviving unmarried sister;

(x) failing (i) to (ix) above, to the eldest surviving widowed sister;

(xi) failing (i) to (x) above, to the eldest child of the eldest predeceased son.

39-D. Cash equivalent of leave salary in case of permanent absorption in Public Sector Undertaking/Autonomous Body wholly or substantially owned or controlled by the Central/State Government

(DOPT Notification No. 13026/2/90-Estt. (L), dated 22.10.1990)

A Government servant who has been permitted to be absorbed in a service or post in or under a Corporation or Company wholly or substantially owned or controlled by the Central Government or State Government or in or under a body controlled or financed by one or more than one such Government shall be granted suo motu by the authority competent to grant leave cash equivalent of leave salary in respect of earned leave at his credit on the date of absorption subject to a maximum of 300 days. This will be calculated in the same manner as indicated in Clause (b) of sub-rule (2) of Rule 39.

(DOPT Notification No. 13026/2/90-Estt.(L), dated 20.04.1993)

NOTE.- The expression ‘permanent absorption’ used in Rule 39-D shall mean the appointment of a Government servant in a Public Sector Undertaking or an Autonomous Body, for which he had applied through proper channel and resigns from the Government service to take up that appointment.

(DOPT Notification No. 13026/3/2011-Estt.(L), dated 28.03.2012)

40. Leave Salary

(1) Except as provided in sub-rule (7), a Government servant who proceeds on earned leave is entitled to leave salary equal to the pay drawn immediately before proceeding on earned leave.

(DOPT Notification No. 14028/9/80-Estt.(L) dated 01.10.1981)

NOTE :- In respect of any period spent on foreign service out of India, the pay which the Government servant would have drawn if on duty in India but for foreign service out of India shall be substituted for the pay actually drawn while calculating leave salary.

(2) deleted

(MoF Notification No. F. 6 (3)-E. IV (A)/75, dated the 07.10.1976)

(3) A Government servant on half pay leave or leave not due is entitled to leave salary equal to half the amount specified in sub-rule (1).

(4) A Government servant on commuted leave is entitled to leave salary equal to the amount admissible under (sub-rule (1).

(5) A Government servant on extraordinary leave is not entitled to any leave salary.

(6) Deleted.

(7) (a) Deleted.

(b) Deleted.

(DOPT Notification No. 14028/9/80 -Estt.(L) dated 1.10.1981)

(c). In the case of a Government servant who is granted leave earned by him during the period of re-employment, the leave salary shall be based on the pay drawn by him exclusive of the pension and pension equivalent of other retirement benefits.

(DOPT Notification No. 14028/6/82 -Estt.(L) dated 31.05.1985)

(8) In the case of a person to whom the Employees’ State Insurance Act, 1948 (34 of 1948) applies, leave salary payable during leave, other than earned leave, shall be reduced by the amount of benefit payable under the said Act for the corresponding period.

(9) (a) If, in the case of a Government servant who retires or resigns from the service, the leave already availed of is more than the credit so due to him, necessary adjustment shall be made in respect of leave salary, if any, overdrawn.

(b) Where the quantum of earned leave already availed of by a Government servant who is dismissed or removed from service or who die while in service is in excess of the leave credit under Clause (b) of sub-rule (2) of Rule 27, the over payment of leave salary shall be recovered in such cases. (MOF Notification No. 16(6)-E.IV(A)/74 dated 31.07.1976)

41. Drawal of leave salary

The leave salary payable under these rules shall be drawn in rupees in India.

42. Advance of Leave salary

A Government servant, including a Government servant on foreign service, proceeding on leave for a period not less than thirty days may be allowed an advance in lieu of leave salary up to a month’s pay and allowances admissible on that leave salary subject to deductions on account of Income Tax, Provident Fund, House Rent, Recovery of Advances, etc.

(MOF Notification No. P-11012/1/77-E-IV(A) dated 21.11.1979)

CHAPTER V – Special kinds of leave other than study leave

43. Maternity Leave

(1) A female Government servant (including an apprentice) with less than two surviving children may be granted maternity leave by an authority competent to grant leave for a period of ( 180 days) from the date of its commencement.

[MOF Notification No. P-11012/1/77-E-IV(A) dated 21.11.1979]